This is one of the official workers' compensation forms for the state of Texas.

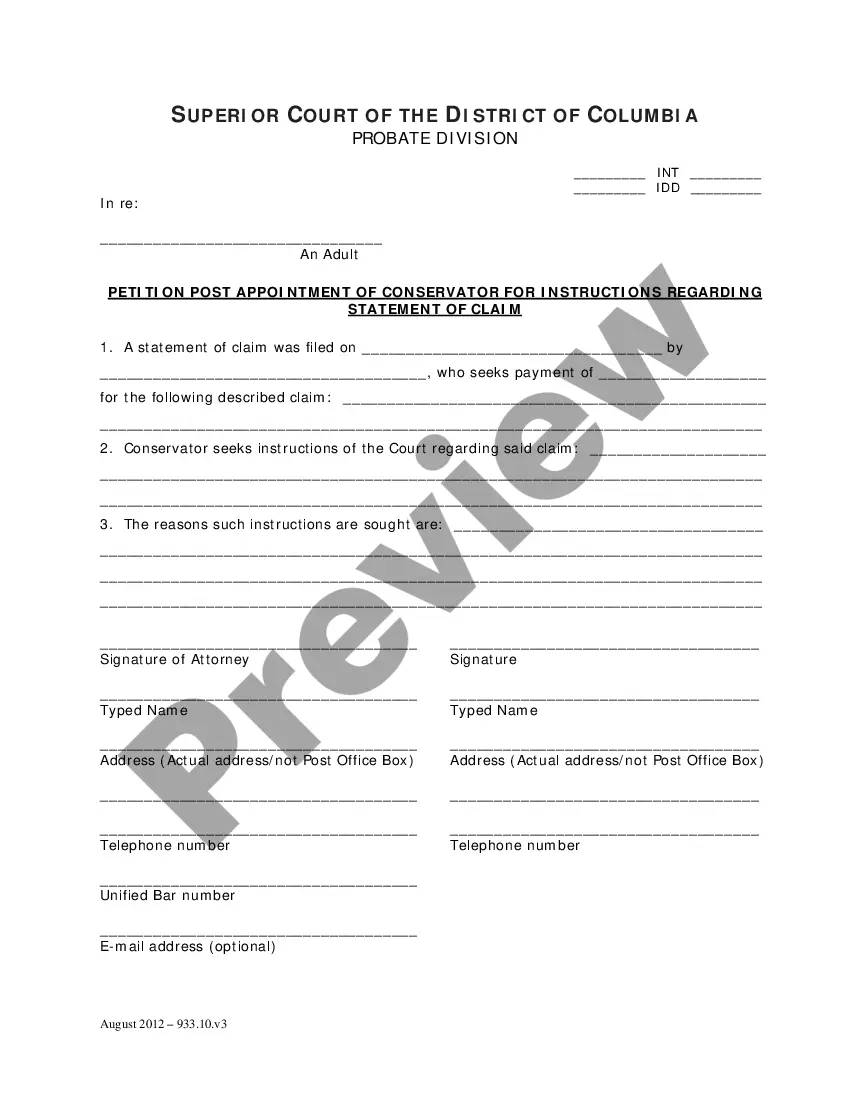

Texas Employers Report For Reimbursement of Voluntary Payment

Description

How to fill out Texas Employers Report For Reimbursement Of Voluntary Payment?

Get access to top quality Texas Employer's Report For Reimbursement for Workers' Compensation samples online with US Legal Forms. Steer clear of hours of wasted time browsing the internet and lost money on files that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Get above 85,000 state-specific legal and tax templates that you can save and fill out in clicks within the Forms library.

To receive the sample, log in to your account and click on Download button. The document is going to be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

- See if the Texas Employer's Report For Reimbursement for Workers' Compensation you’re considering is appropriate for your state.

- Look at the form using the Preview function and browse its description.

- Visit the subscription page by clicking on Buy Now button.

- Choose the subscription plan to keep on to register.

- Pay by credit card or PayPal to finish making an account.

- Pick a favored format to save the file (.pdf or .docx).

Now you can open the Texas Employer's Report For Reimbursement for Workers' Compensation example and fill it out online or print it and get it done yourself. Take into account sending the document to your legal counsel to be certain everything is filled in appropriately. If you make a error, print out and complete sample once again (once you’ve made an account every document you download is reusable). Create your US Legal Forms account now and get access to much more forms.

Form popularity

FAQ

Reimbursement is the compensation paid out by an organisation for the expenses made by an employee from his or her own pocket.Reimbursement of business expenses, overpaid taxes, and insurance costs are the most common examples. One should note that reimbursement is not subject to taxation.

Workers' compensation provides limited reimbursement for medical expenses and lost wages for employees injured at work or who become ill because of work-related conditions.

Yes you can post what you are calling reimbursable expense to one general expense account account, if you wish. And the income to another income account. You do not net income and expense in one account.

Employers Should NOT Refuse to Issue Reimbursements Neglecting to pay employees the proper compensation for all hours worked, including overtime, is not the only way employers can deprive workers of their proper compensation.

Some employees may not be aware that they are entitled to reimbursement, or may ask, Can an employer refuse to reimburse expenses? Unfortunately, some employers may not sufficiently reimburse employees, or may refuse to reimburse expenses altogether. This is unlawful, but may occur nonetheless.

Personal entertainment expenses including in-flight movies, headsets, books, magazines, newspapers, health club fees, hotel pay-per-view movies, in-theater movies, greens fees, ski passes, social activities, honor / mini bar charges, etc. Babysitting, house-sitting, pet-sitting and kennel fees.

Expense reimbursements aren't employee income, so they don't need to be reported as such. Although the check or deposit is made out to your employee, it doesn't count as a paycheck or payroll deposit.

A reimbursable expense is an expense that a business incurs on behalf of the customer while conducting their business. These expenses may include travel, delivery fees, currency conversion fees, office expenses, and business phone calls.

Reimbursement is money paid to an employee or customer, or another party, as repayment for a business expense, insurance, taxes, or other costs. Business expense reimbursements include out-of-pocket expenses, such as those for travel and food.