Texas Uniform Plan And Motion For Valuation of Collateral (Chapter 13)

Description

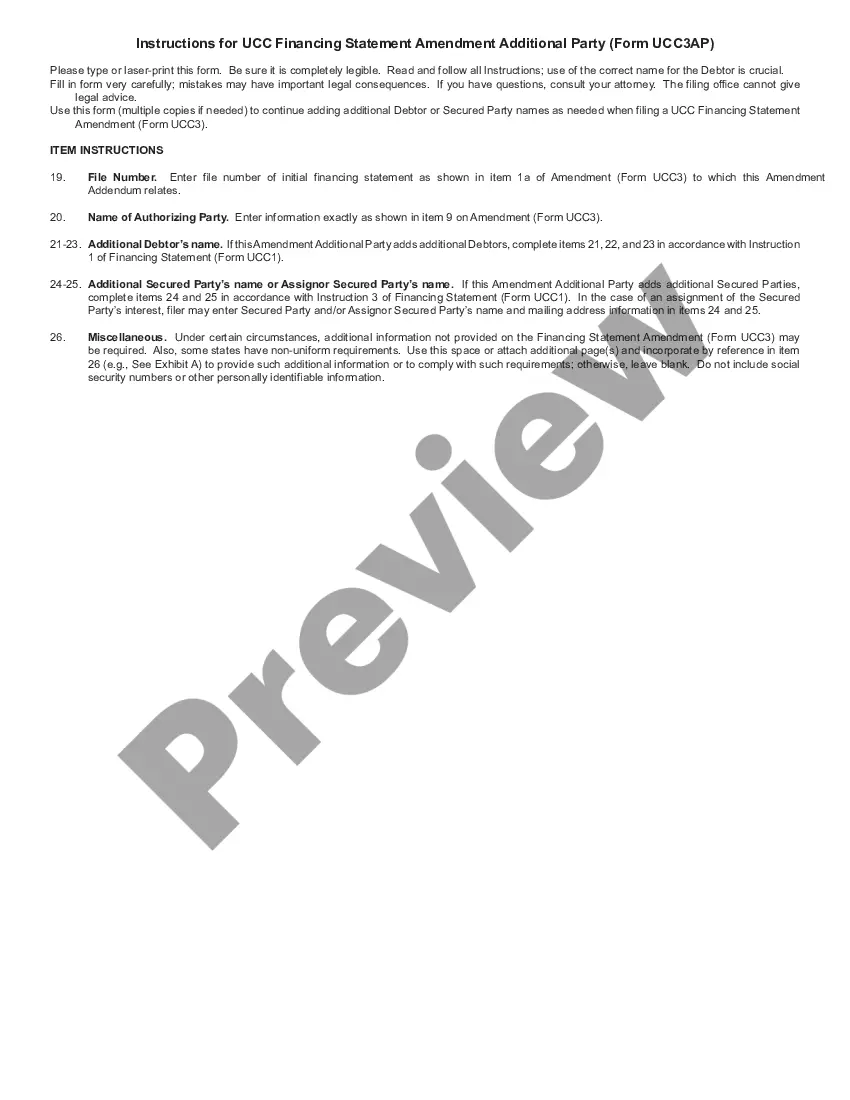

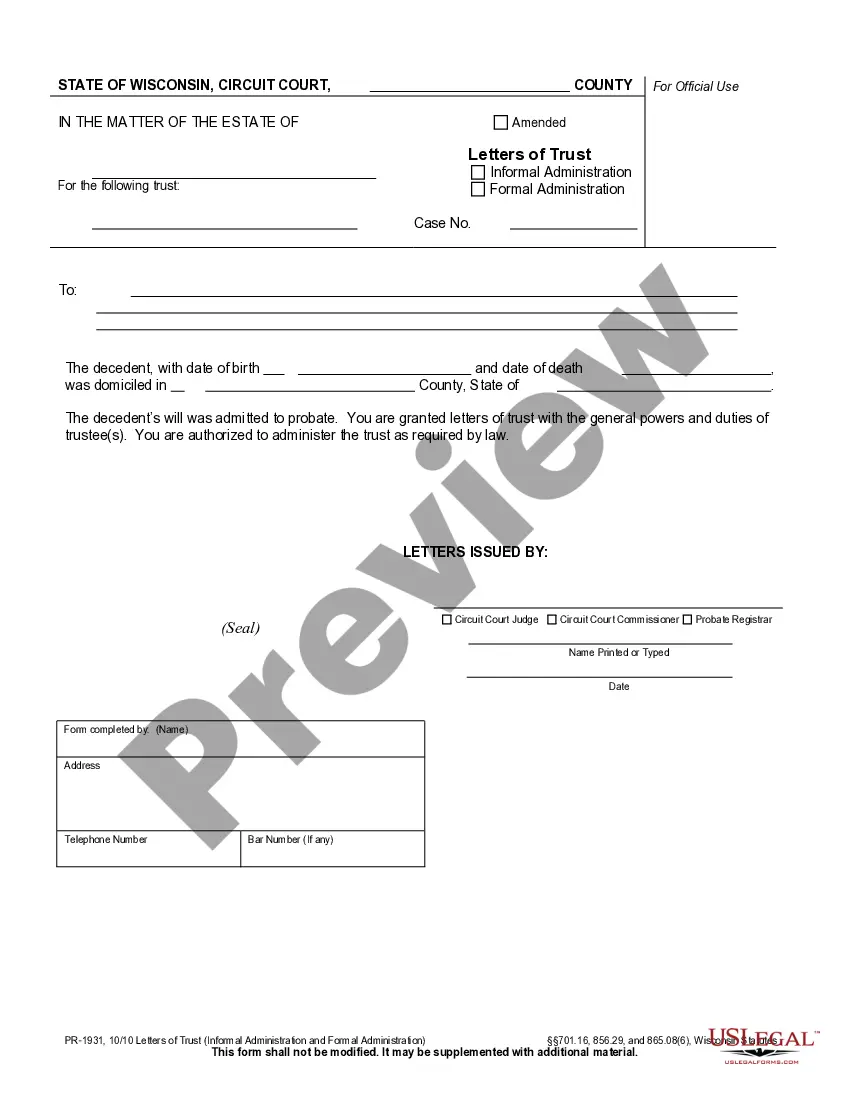

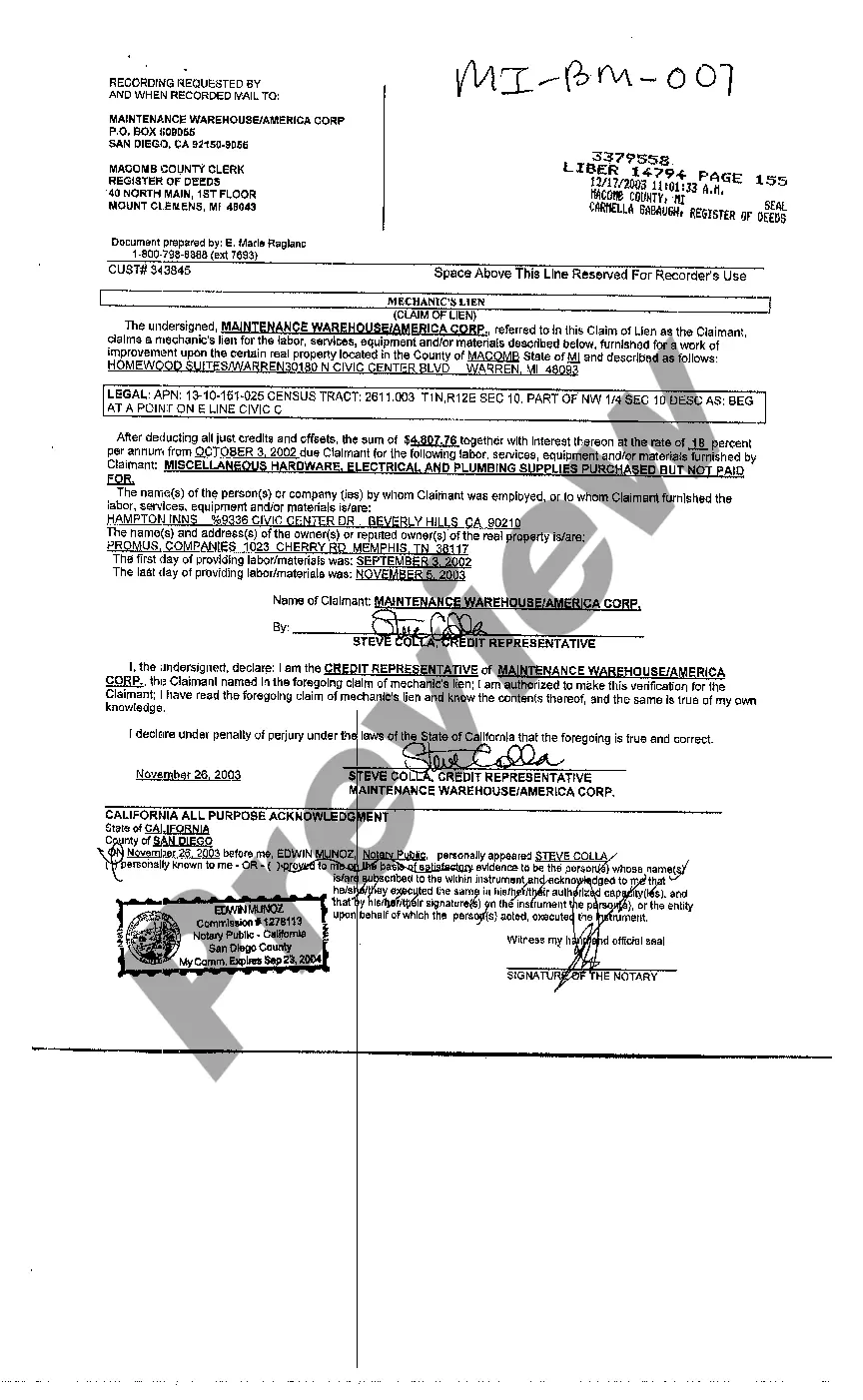

How to fill out Texas Uniform Plan And Motion For Valuation Of Collateral (Chapter 13)?

US Legal Forms is the most easy and cost-effective way to locate appropriate formal templates. It’s the most extensive web-based library of business and individual legal documentation drafted and verified by legal professionals. Here, you can find printable and fillable blanks that comply with national and local laws - just like your Texas Uniform Plan And Motion For Valuation of Collateral (Chapter 13).

Obtaining your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Texas Uniform Plan And Motion For Valuation of Collateral (Chapter 13) if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make certain you’ve found the one meeting your demands, or find another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and select the subscription plan you prefer most.

- Create an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Texas Uniform Plan And Motion For Valuation of Collateral (Chapter 13) and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the corresponding official documentation. Try it out!

Form popularity

FAQ

This chapter of the Bankruptcy Code provides for adjustment of debts of an individual with regular income. Chapter 13 allows a debtor to keep property and pay debts over time, usually three to five years.

The repayment plan must provide for a fixed payment to the trustee on a regular basis. If the court approves the plan, the trustee will distribute your payments to the creditors ing to the terms laid out in the plan.

Unlike chapter 7, creditors do not have standing to object to the discharge of a chapter 12 or chapter 13 debtor. Creditors can object to confirmation of the repayment plan, but cannot object to the discharge if the debtor has completed making plan payments.

Advantages Offered in Chapter 13 but Not Chapter 7 You Can Catch Up on a Mortgage or Car Loan.You Can Force a Creditor Into a Payment Plan.You Can Protect a Codebtor on a Personal Debt.You Can Keep Property You'd Lose in Chapter 7.

The appointed trustee will collect and take control of a debtor's non-exempt assets, liquidate them, and distribute the proceeds to creditors.

If your Chapter 13 plan payment is too high, you can sometimes get it lowered if you encounter a reduction in household income. If your income reduces, you are many times also allowed to reduce your plan payment. This is accomplished usually by filing a Motion to Modify your Chapter 13 plan.

The Chapter 13 Plan must: provide for payments of fixed amounts to the trustee on a regular basis, typically monthly. provide for the full payment of all claims entitled to priority under section 507 such as taxes and child support (unless the holder of a particular claim agrees to different treatment of a claim)

Unlike chapter 7, creditors do not have standing to object to the discharge of a chapter 12 or chapter 13 debtor. Creditors can object to confirmation of the repayment plan, but cannot object to the discharge if the debtor has completed making plan payments.