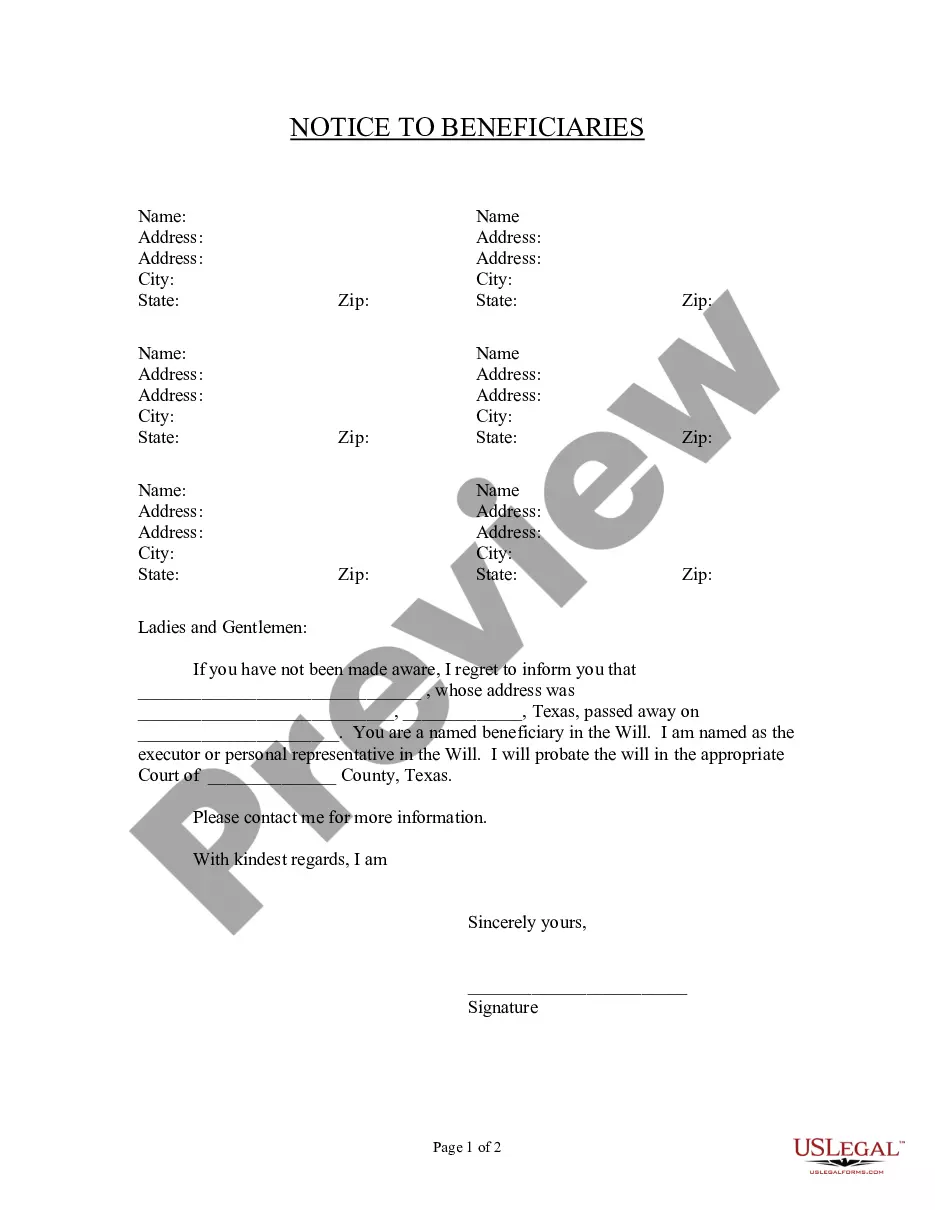

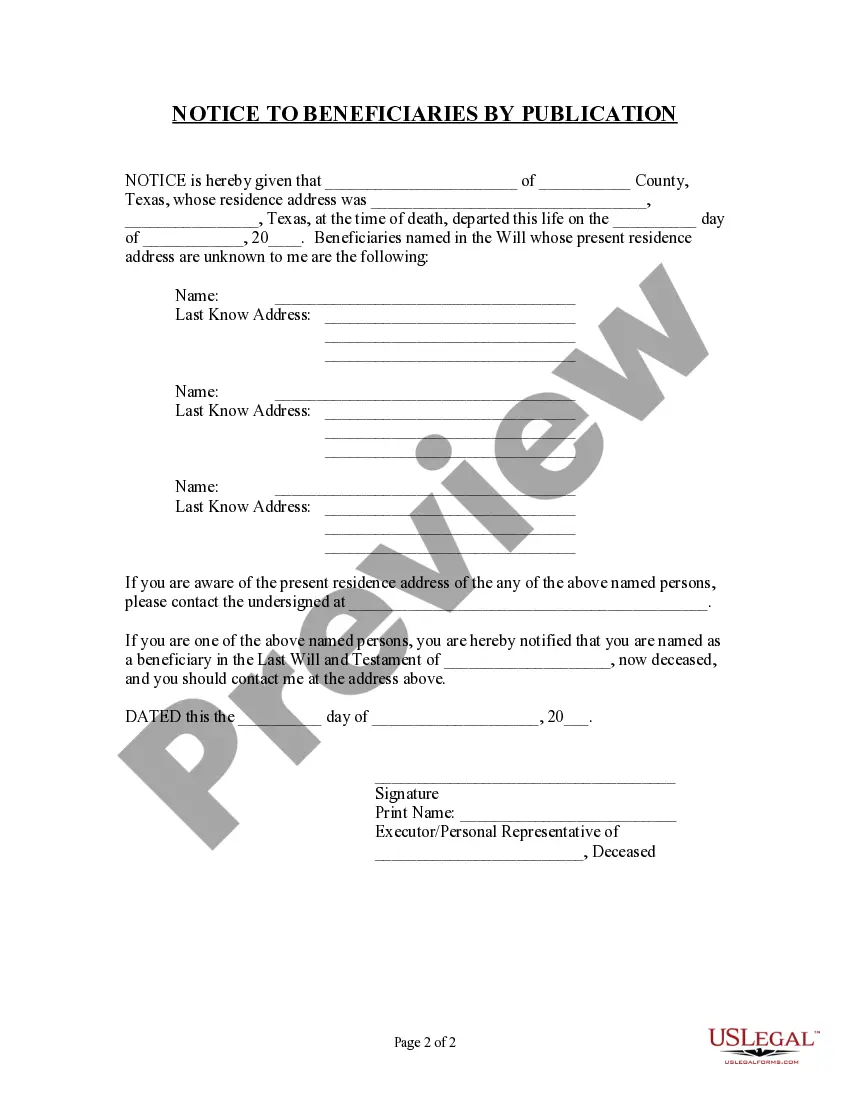

This Notice to Beneficiaries form is for the executor/executrix or personal representative to provide notice to the beneficiaries named in the will of the deceased. A second notice is also provided for publication where the location of the beneficiaries is unknown.

Texas Notice to Beneficiaries of being Named in Will

Description Beneficiaries Being Named

How to fill out Texas Notice Beneficiaries Being?

Get access to high quality Texas Notice to Beneficiaries of being Named in Will forms online with US Legal Forms. Prevent hours of lost time searching the internet and dropped money on files that aren’t updated. US Legal Forms offers you a solution to exactly that. Get around 85,000 state-specific legal and tax forms that you could download and complete in clicks within the Forms library.

To get the sample, log in to your account and then click Download. The file will be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- See if the Texas Notice to Beneficiaries of being Named in Will you’re considering is suitable for your state.

- Look at the form using the Preview option and read its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to keep on to register.

- Pay by card or PayPal to finish making an account.

- Choose a favored file format to save the file (.pdf or .docx).

Now you can open the Texas Notice to Beneficiaries of being Named in Will sample and fill it out online or print it out and do it yourself. Take into account mailing the document to your legal counsel to be certain everything is completed properly. If you make a error, print and complete sample once again (once you’ve created an account every document you save is reusable). Make your US Legal Forms account now and access a lot more samples.

Texas Beneficiaries Form popularity

Notice To Beneficiaries Texas Other Form Names

Beneficiaries Will Form FAQ

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

The executor can sell property without getting all of the beneficiaries to approve.If the executor can sell the property for more than 90 percent of its appraised value then they do not need to get the permission of the beneficiaries or of the court.

If you fail to probate a will within the 4 year time period, then the decedent's estate will be treated as though they died intestate without a will. There are specific laws in Texas that govern which heirs are entitled to the estate's assets when a person dies intestate.

According to estate planning attorney Adam Ansari, it is legal for an executor to purchase the home instead of selling it, as long as the executor purchases the property for fair market value and all of the beneficiaries agree with the terms of the sale.

Texas has a probate process similar to many other states, but before we go any further, let's ask an important question: Do you even need to probate the estate? Not all assets go through probate. Assets that automatically transfer to another person without a court order will avoid probate.

Generally the heirs don't decide if the house is sold unless somehow it is titled in all their names. If is a specific gift and the will requires it be transferred to all six, and one does not want to sell, that person can buy out the other 5. There of course is always a partition Acton.

An executor can sell a property without the approval of all beneficiaries. The will doesn't have specific provisions that require beneficiaries to approve how the assets will be administered. However, they should consult with beneficiaries about how to share the estate.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.