This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

Aren't you sick and tired of choosing from countless samples every time you want to create a Application for Release of Right to Redeem Property from IRS After Foreclosure? US Legal Forms eliminates the lost time an incredible number of American citizens spend surfing around the internet for ideal tax and legal forms. Our professional group of lawyers is constantly changing the state-specific Forms collection, so it always has the appropriate files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have an active subscription need to complete simple steps before being able to get access to their Application for Release of Right to Redeem Property from IRS After Foreclosure:

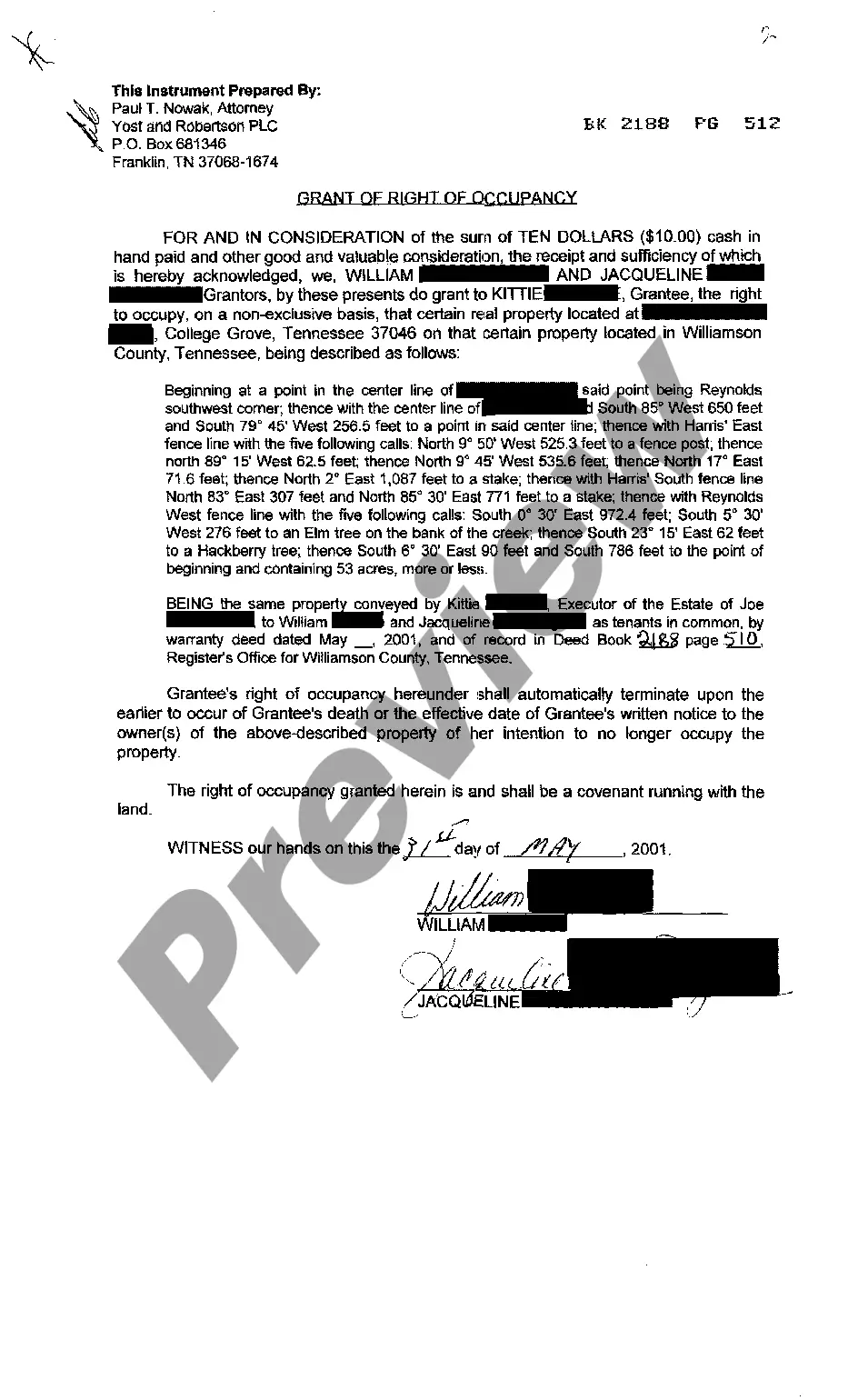

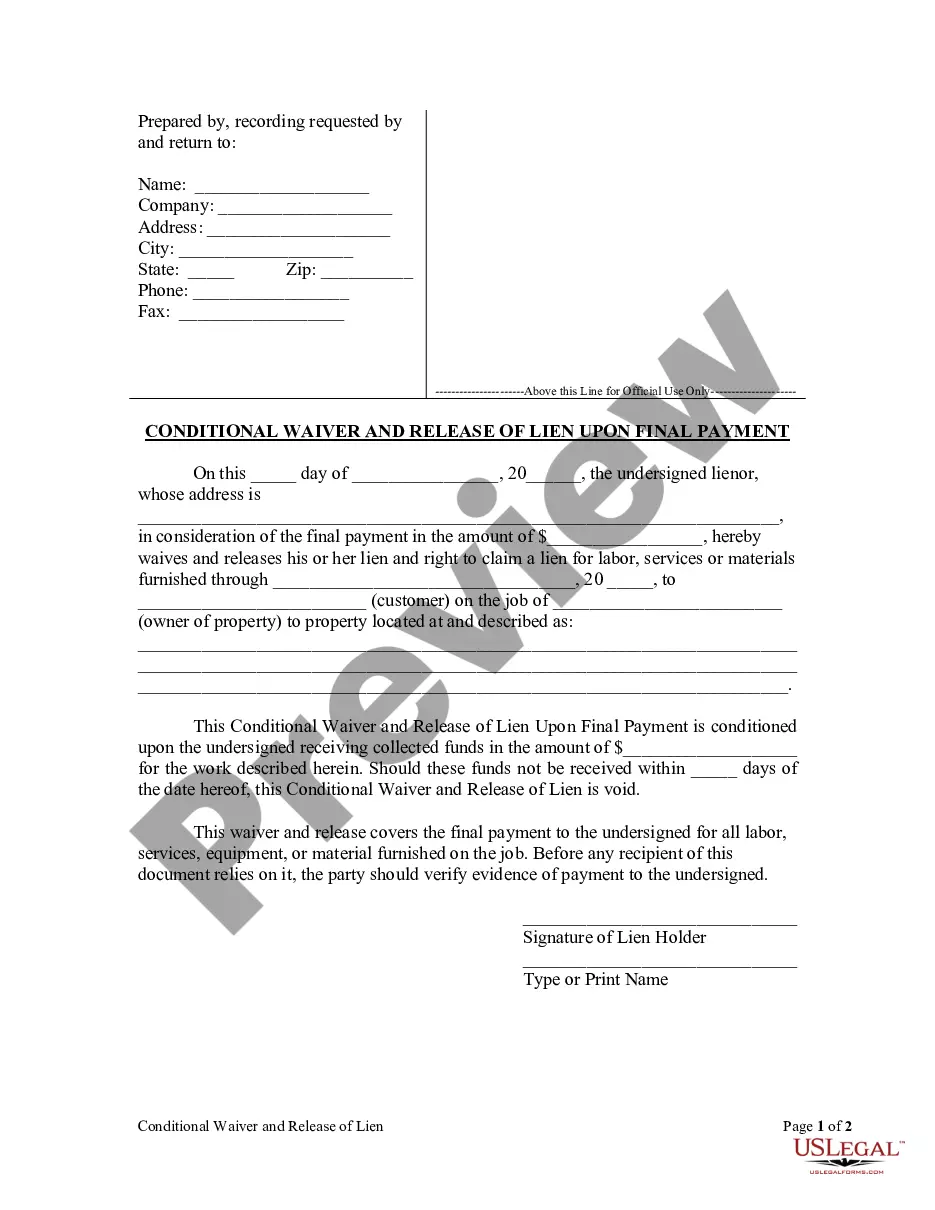

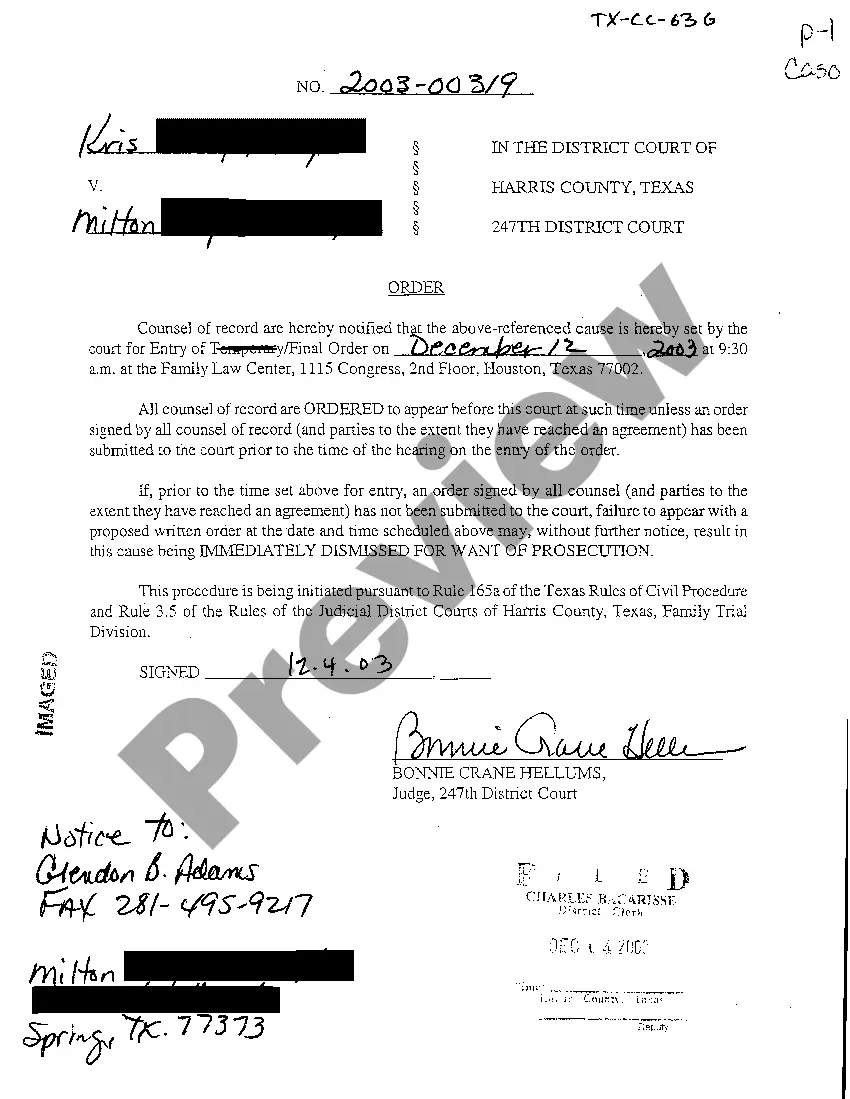

- Utilize the Preview function and look at the form description (if available) to make sure that it is the right document for what you’re looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate sample for your state and situation.

- Use the Search field at the top of the page if you have to look for another file.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your document in a convenient format to complete, print, and sign the document.

As soon as you’ve followed the step-by-step guidelines above, you'll always have the capacity to log in and download whatever document you require for whatever state you require it in. With US Legal Forms, completing Application for Release of Right to Redeem Property from IRS After Foreclosure templates or any other official files is not hard. Get started now, and don't forget to double-check your examples with certified lawyers!

Form popularity

FAQ

The seller can request a release from the IRS and your purchase proceeds. If the purchase price is high enough to pay off the lien amount and satisfy the existing mortgage, you will be able to buy the property using standard methods.

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home.Taxpayers or lenders also can ask that a federal tax lien be made secondary to the lending institution's lien to allow for the refinancing or restructuring of a mortgage.

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

Foreclosure Eliminates Liens, Not Debt Following a first-mortgage foreclosure, all junior liens (including a second mortgage and any junior judgment liens) are extinguished and the liens are removed from the property title.

In cases where the mortgage lender recorded its lien (the mortgage) before the IRS records a Notice of Federal Tax Lien, the mortgage has priority. This means that if the lender forecloses, the federal tax lien on the homebut not the debt itselfwill be wiped out in the foreclosure.

An IRS tax lien lasts for 10 years, or until the statute of limitations on your tax debt expires.

You need to submit form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien at least 45 days before the sale or settlement meeting. Publication 783 provides the instructions for completing form 14135. You will need to describe the property, its appraised value, and other information.

In a mortgage foreclosure, any judgment liens that were recorded after the mortgage will be wiped out by the foreclosure. Any surplus funds after the foreclosing lender's debt has been paid off will be distributed to other creditors holding junior liens, like second mortgages and judgment lienholders.