Accounts Receivable - Guaranty

Description Receivable Form Pdf

How to fill out Accounts Form Application?

Aren't you sick and tired of choosing from countless samples every time you require to create a Accounts Receivable - Guaranty? US Legal Forms eliminates the wasted time numerous Americans spend browsing the internet for perfect tax and legal forms. Our expert team of attorneys is constantly upgrading the state-specific Templates library, so it always provides the proper documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Users who don't have a subscription need to complete a few simple actions before having the ability to get access to their Accounts Receivable - Guaranty:

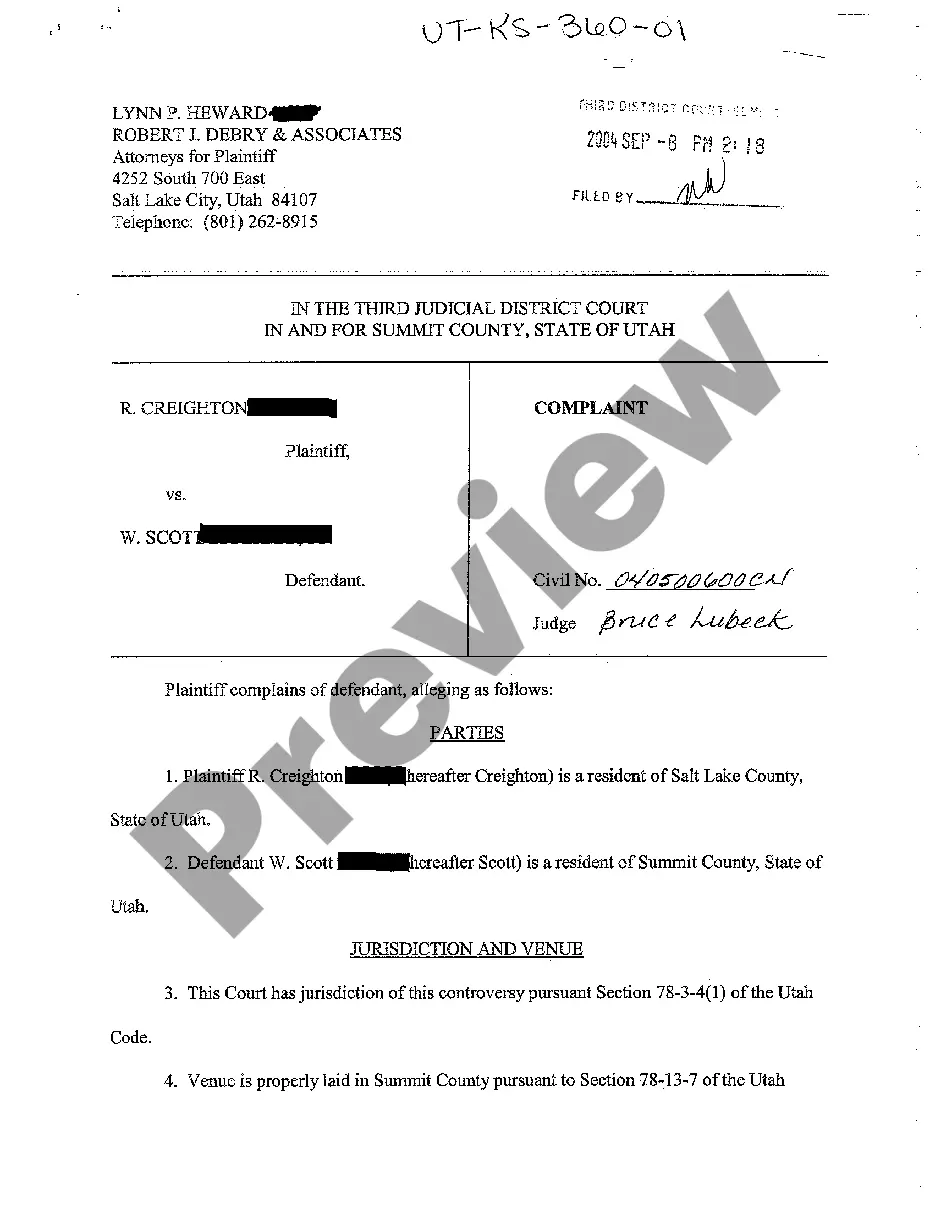

- Use the Preview function and read the form description (if available) to ensure that it is the proper document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the correct example for the state and situation.

- Use the Search field on top of the site if you need to look for another document.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your sample in a required format to complete, create a hard copy, and sign the document.

After you’ve followed the step-by-step recommendations above, you'll always have the ability to sign in and download whatever file you want for whatever state you want it in. With US Legal Forms, completing Accounts Receivable - Guaranty templates or any other legal paperwork is simple. Get started now, and don't forget to examine your samples with certified lawyers!

Receivable Form Document Form popularity

Receivable Form Statement Other Form Names

Accounts Receivable Guaranty FAQ

Protect their accounts receivable against default risks. Extend competitive payment terms without worry. Allow extended market share by moving business deals abroad.

Since the accounts receivable job description can be very stressful at times, not many people can handle the responsibilities without a certain number of skills and personal qualities. These can range from skills picked up in grade school to talents that have always been with the interested employee.

One common option is to use your accounts receivables as collateral for a short term or long term loan, or a line of credit. Using accounts receivables as collateral shows lenders that a business has sufficient incoming cash flow to repay a loan.

THE FIVE WORST PERSONALITY TRAITS FOR ACCOUNTS RECEIVABLE. Collecting on outstanding invoices is probably the least fun part of any job. It is an uncomfortable and, often times, frustrating task.Often times, it will make the job much more difficult and even unenjoyable.

Payment in advance. Delegation of payment. Bank guarantees. Parent company guarantee. Documentary credit of Letter of Credit Standby.

Secured debts are those for which the borrower puts up some asset as surety or collateral for the loan. A secured debt instrument simply means that in the event of default, the lender can use the asset to repay the funds it has advanced the borrower.

Step 1: Determine if credit should be extended to a client. Step 2: Put payment terms in writing and document your agreement. Step 3: Send an itemized, professional invoice. Step 4: Follow-up with an automated invoice reminder. Step 5: Step up collection efforts.

Overstatement of revenue: When revenue is overstated, more receivables are recorded than what customers actually owe. Unenforced cutoffs: Cutoffs ensure that financial transactions are accurate and accounted for in the correct accounting period.