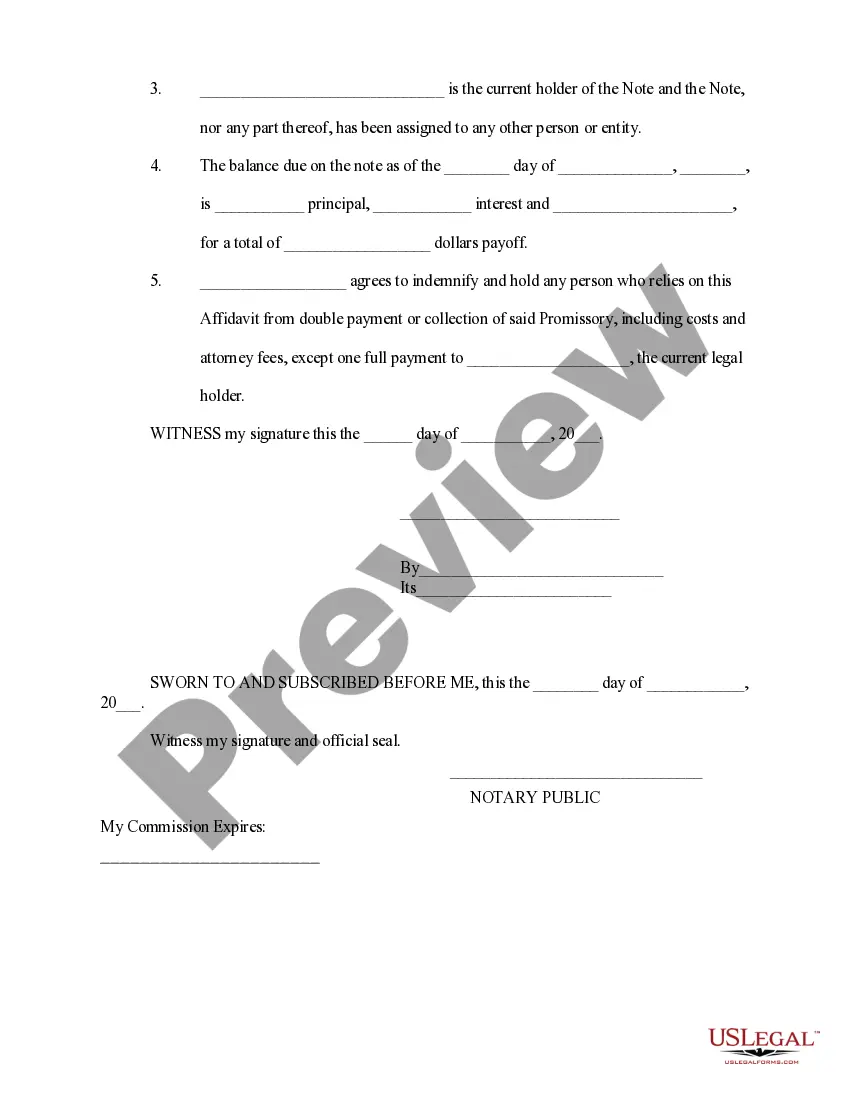

Affidavit of Lost Promissory Note

Description Promissory Note Release

How to fill out Freddie Mac Lost Note Affidavit Form?

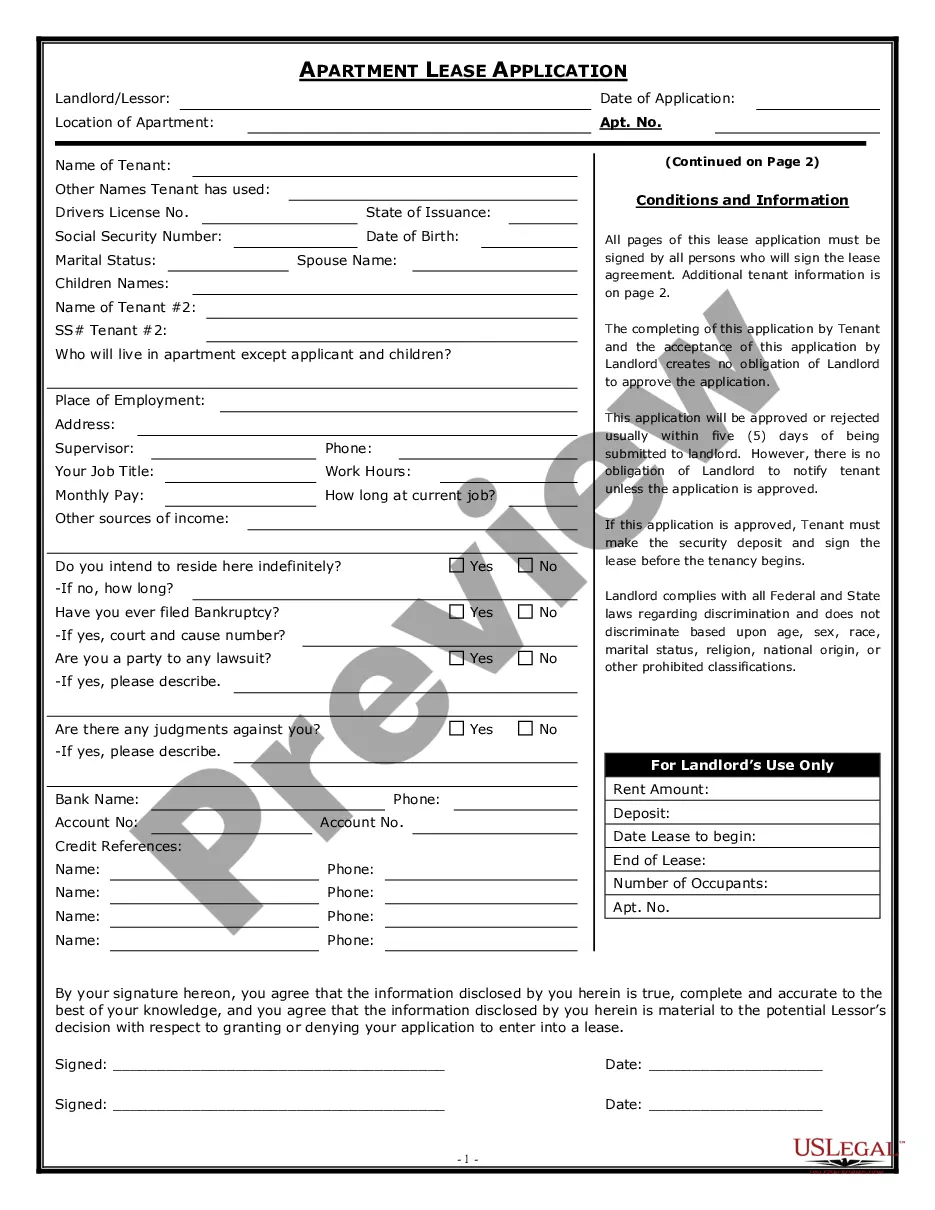

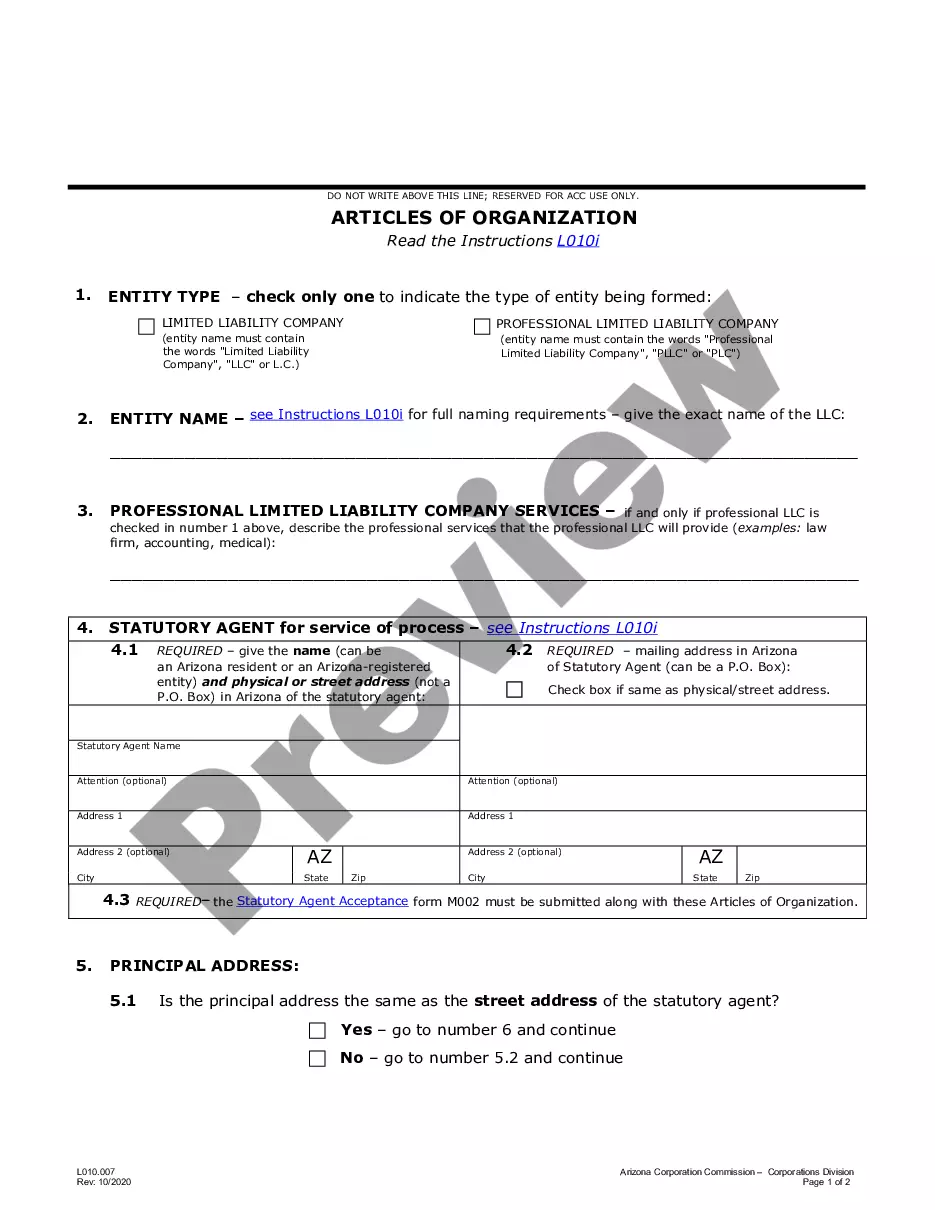

Aren't you sick and tired of choosing from countless samples every time you need to create a Affidavit of Lost Promissory Note? US Legal Forms eliminates the lost time countless American people spend browsing the internet for appropriate tax and legal forms. Our expert crew of lawyers is constantly changing the state-specific Forms catalogue, so it always offers the proper documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have a subscription need to complete easy steps before being able to download their Affidavit of Lost Promissory Note:

- Utilize the Preview function and read the form description (if available) to be sure that it’s the appropriate document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the correct sample to your state and situation.

- Make use of the Search field at the top of the web page if you want to look for another document.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your sample in a needed format to complete, print, and sign the document.

As soon as you’ve followed the step-by-step instructions above, you'll always be capable of log in and download whatever file you require for whatever state you require it in. With US Legal Forms, completing Affidavit of Lost Promissory Note templates or other legal files is not difficult. Get started now, and don't forget to look at the examples with accredited lawyers!

Affidavit Of Loss Template Word Form popularity

Printable Affidavit Form Other Form Names

Michigan Notary Examples FAQ

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

The lender can provide copies of the documents signed at closing. If the loan has changed hands, contact the most current servicer for a copy of your mortgage or deed of trust documents. A lender is required under the Federal Servicer Act to provide you copies of your loan documents if you submit a written request.

The buyer of the note becomes what is called a holder because they hold your note as the owner of it. A holder has a special right to collect from you right away if you don't pay. But only the holder of an original promissory note can collect from you. A promissory note can change many hands as it is bought and sold.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

A promissory note, in simplest terms, is the acknowledgment of a debt.Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

Search the county recorder's records. Promissory notes are typically recorded as public documents and accessible shortly after the closing. The trustee maintains the original deed until the loan is satisfied.