Direct Deposit Form for Stimulus Check

Description Direct Deposit Form Download

How to fill out Direct Deposit Form For Stimulus Check?

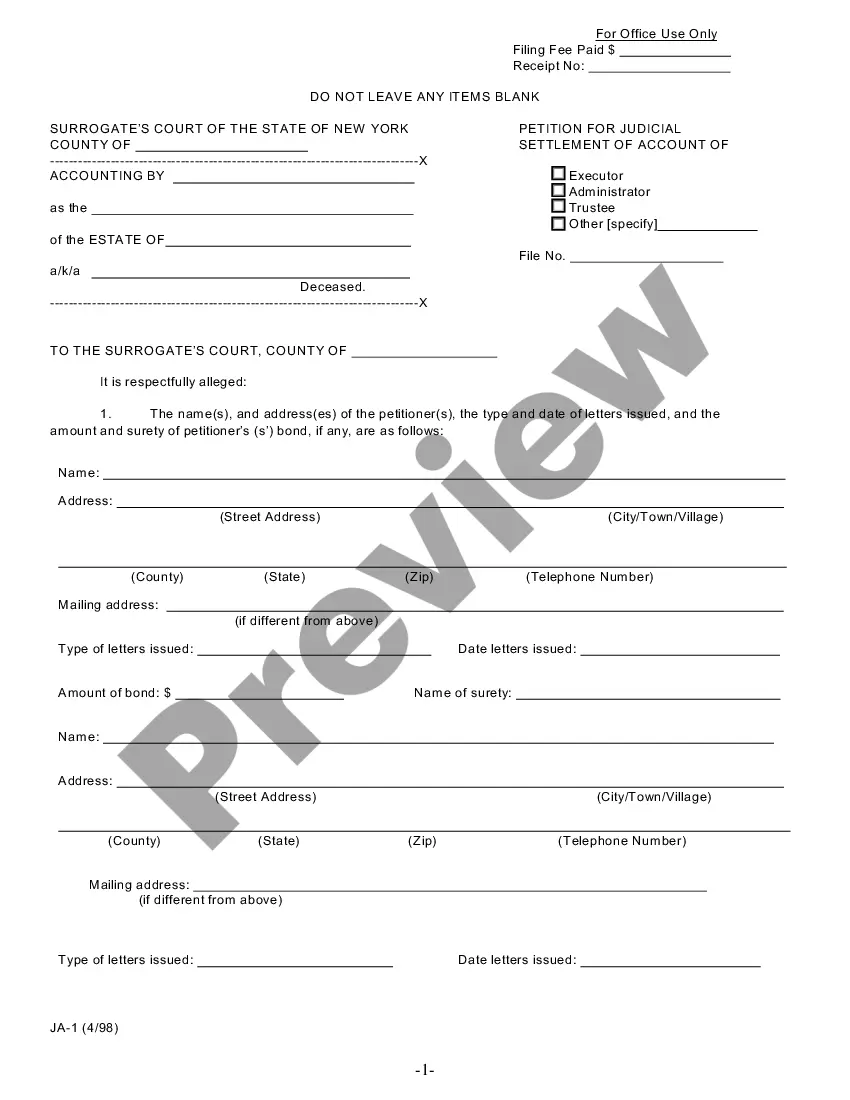

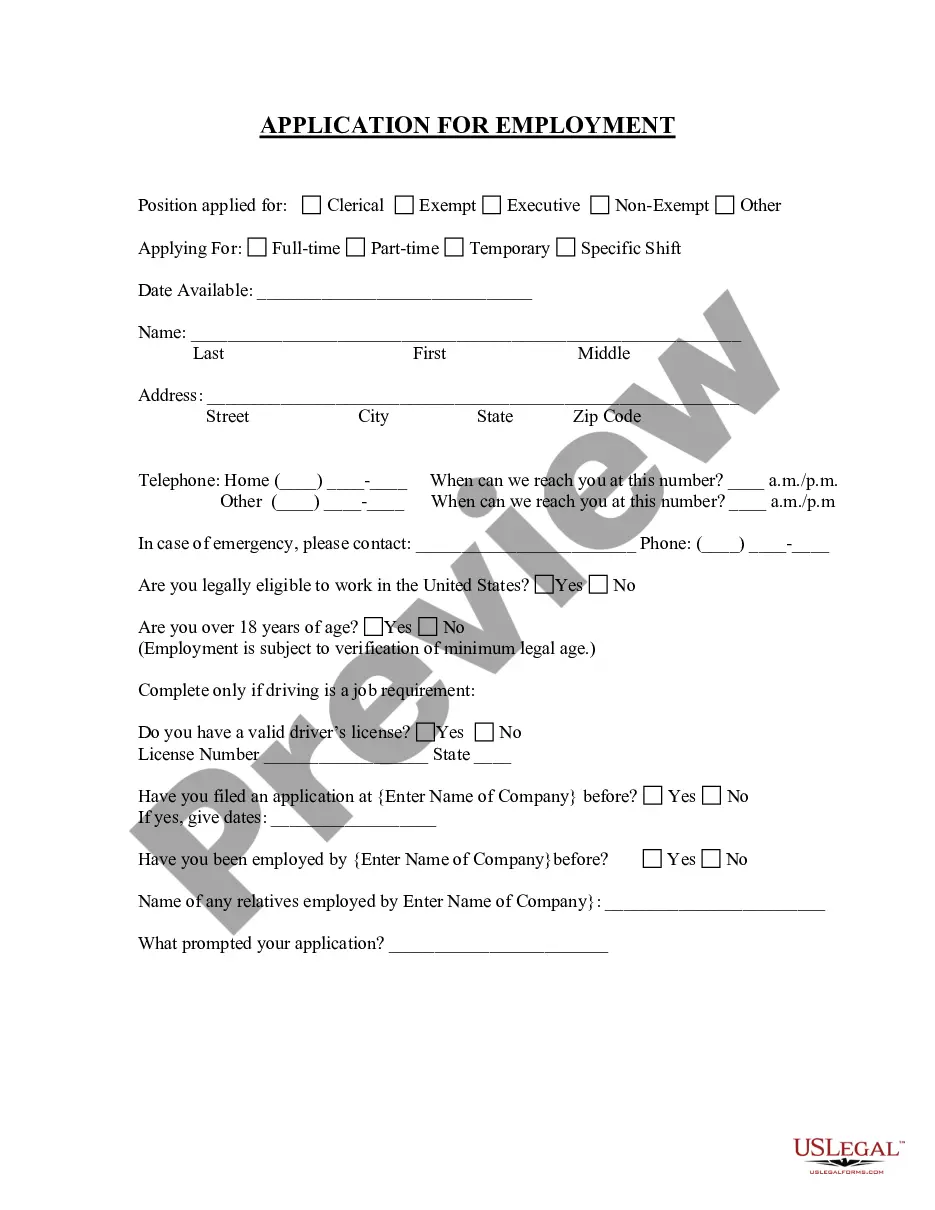

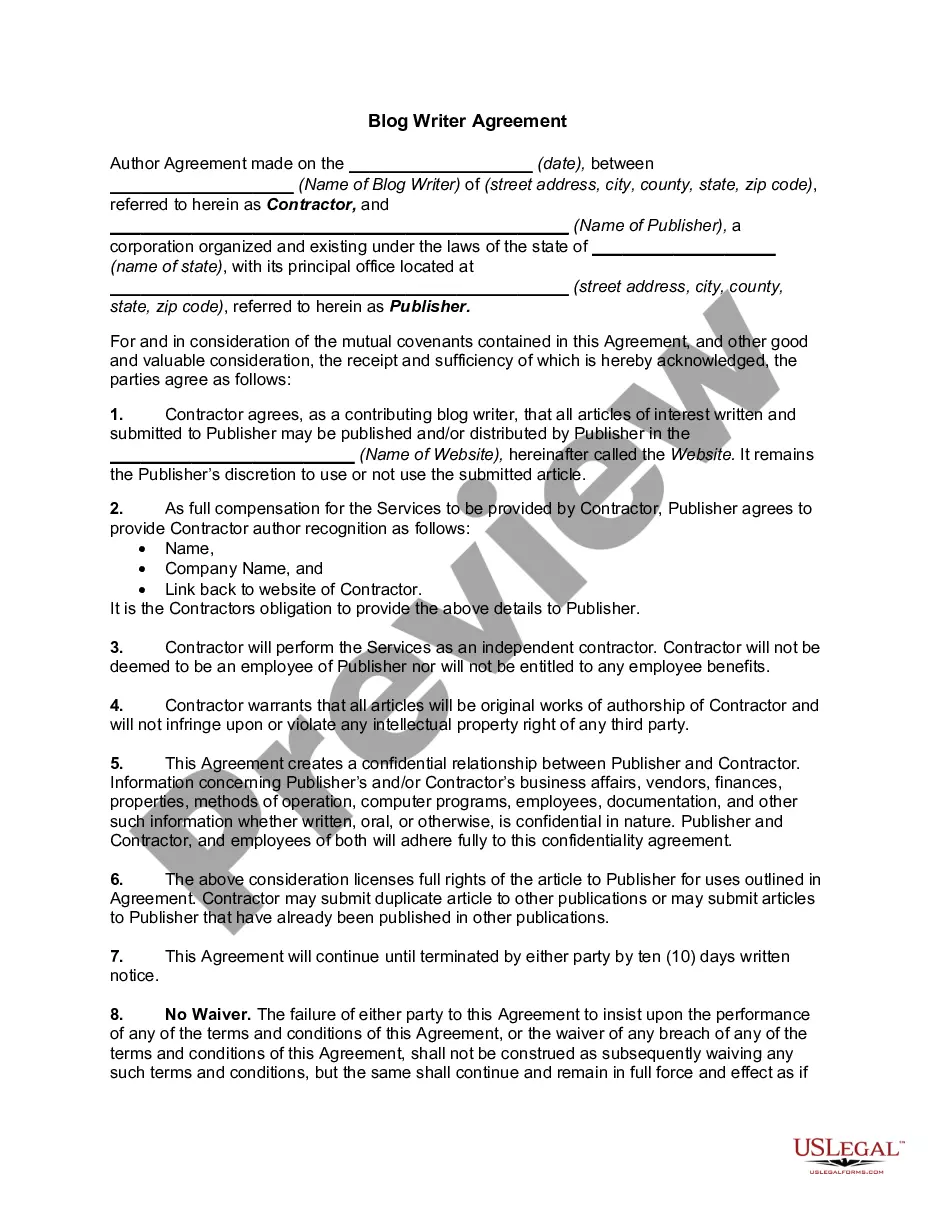

Use US Legal Forms to obtain a printable Direct Deposit Form for Stimulus Check. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms library on the web and offers cost-effective and accurate templates for consumers and lawyers, and SMBs. The documents are categorized into state-based categories and some of them can be previewed prior to being downloaded.

To download samples, users need to have a subscription and to log in to their account. Hit Download next to any form you want and find it in My Forms.

For individuals who don’t have a subscription, follow the following guidelines to easily find and download Direct Deposit Form for Stimulus Check:

- Check to ensure that you have the correct form with regards to the state it is needed in.

- Review the form by looking through the description and using the Preview feature.

- Click Buy Now if it’s the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it many times.

- Use the Search field if you want to get another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Direct Deposit Form for Stimulus Check. Above three million users have already utilized our service successfully. Select your subscription plan and get high-quality documents in just a few clicks.

Direct Deposit Form Print Form popularity

Direct Deposit Form Template Other Form Names

FAQ

You should receive a form, 1099-G, detailing your unemployment income and any taxes that were withheld, which you enter on your tax return.

As with the nonfilers, if you missed that deadline, the IRS says you can claim the payment on your 2020 federal tax return this year, by filing a 2020 Form 1040 or 1040-SR. Use our stimulus check calculator to get an idea of how much you may be owed.

There is nothing you need to do to get a stimulus payment. The IRS has begun issuing stimulus payments using the most recent information they have on file, from your 2019 or 2020 tax return, either by direct deposit or by check. Taxpayers with direct deposit information on file will receive the payment that way.

To claim your stimulus checks, you will need to file a Tax Year 2020 tax return (filed in 2021).Fill out the IRS Non-filer tool if you are not planning to file a 2018 or 2019 federal tax return and have not received your stimulus payment.

Social Security number. Date of birth, and. Mailing address used on their tax return.

On April 15, 2020, the IRS set up this online tool that allows you to track the status of your stimulus payment, and it allows you to provide your direct deposit information. Add the bank account number of your account.