Direct Deposit Agreement

Description How To Print A Direct Deposit Form From Chase

- Instant access to the funds via an ATM or check card;

- A check can be lost or stolen anywhere between the sender and the intended payee;

- Payments made electronically can be less expensive to the payor.

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check.

How to fill out Employee Direct Deposit Authorization Form?

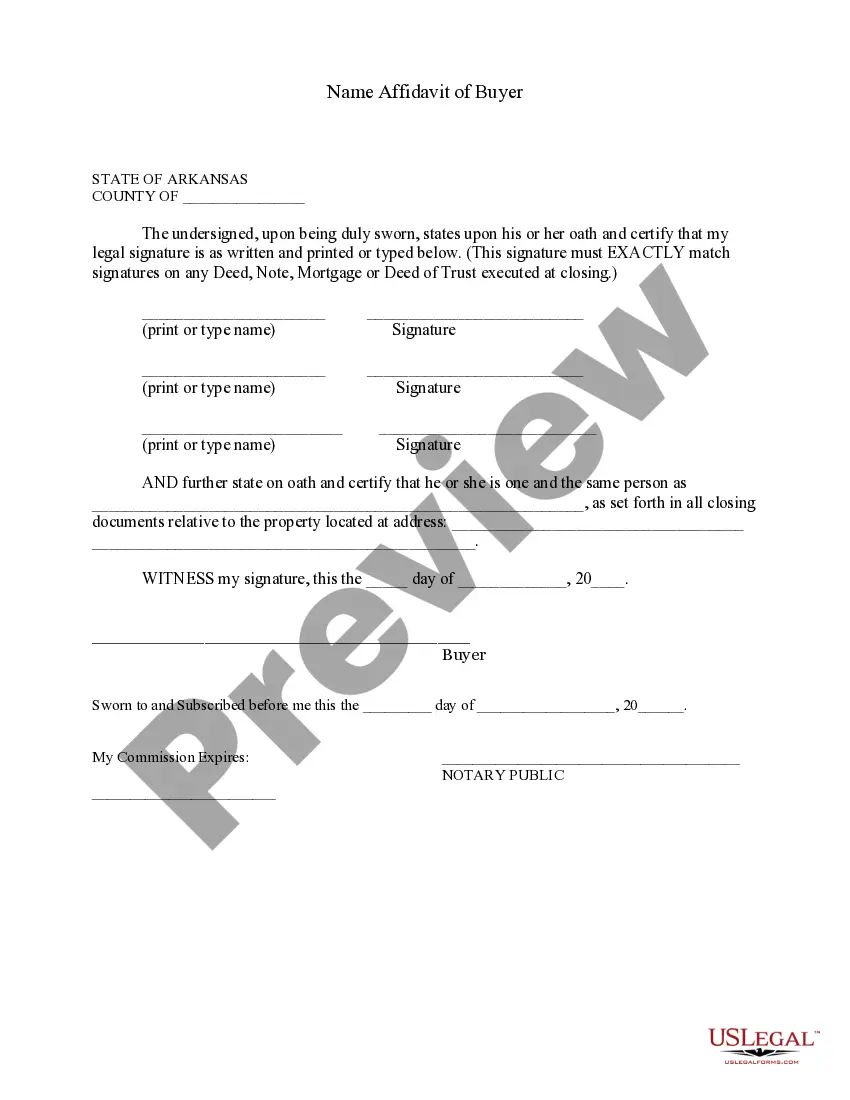

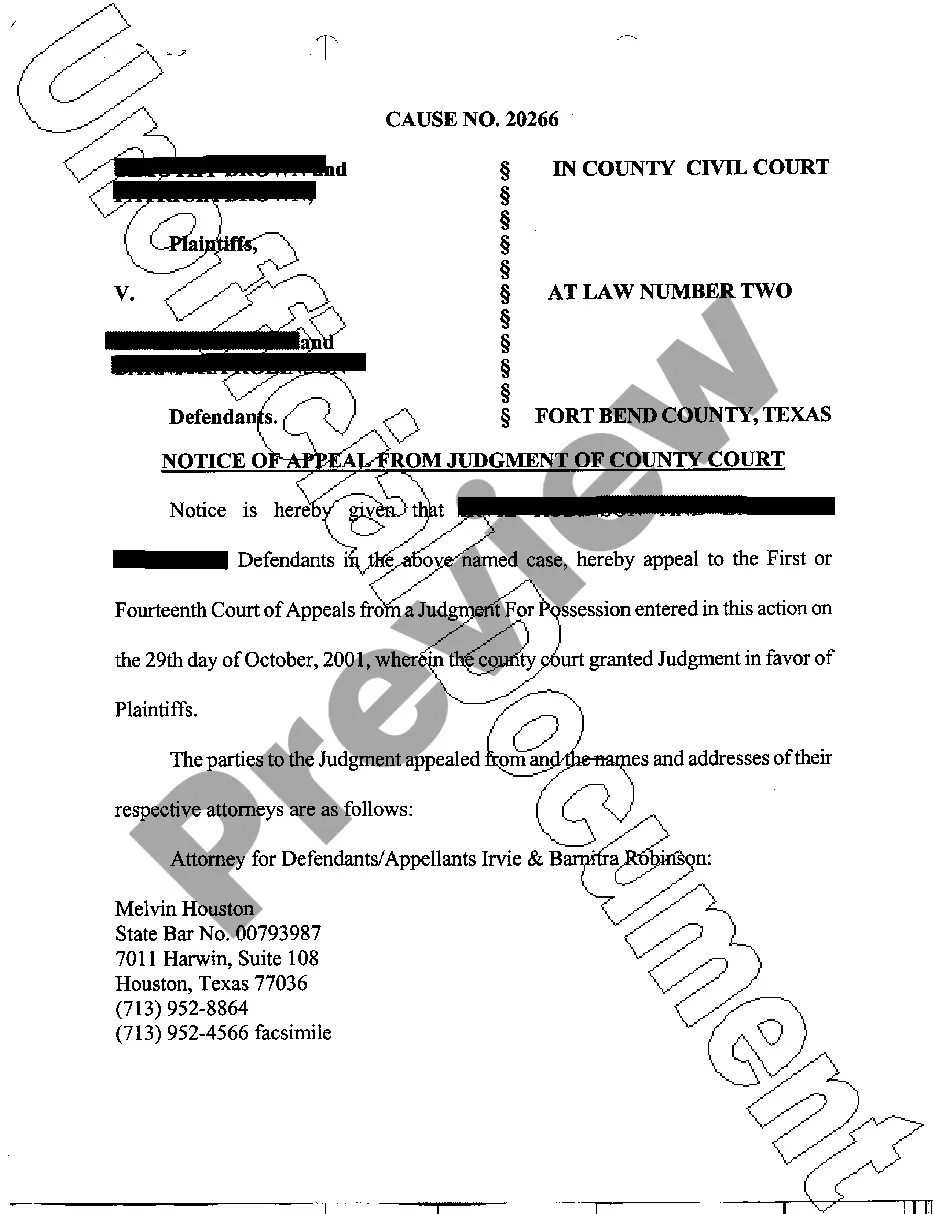

Aren't you tired of choosing from hundreds of samples each time you want to create a Direct Deposit Agreement? US Legal Forms eliminates the lost time numerous American citizens spend exploring the internet for suitable tax and legal forms. Our expert group of attorneys is constantly changing the state-specific Samples catalogue, so it always has the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have a subscription need to complete a few simple actions before having the ability to get access to their Direct Deposit Agreement:

- Use the Preview function and look at the form description (if available) to make sure that it’s the correct document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate template for your state and situation.

- Utilize the Search field at the top of the webpage if you need to look for another file.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your document in a required format to complete, print, and sign the document.

As soon as you have followed the step-by-step guidelines above, you'll always have the capacity to sign in and download whatever document you need for whatever state you need it in. With US Legal Forms, finishing Direct Deposit Agreement samples or any other legal files is not difficult. Begin now, and don't forget to look at the samples with accredited lawyers!

Direct Deposit Form Fillable Form popularity

Direct Deposit Pdf Form Other Form Names

Direct Deposit Form Printable FAQ

Bank account number. Routing number. Type of account (typically a checking account) Bank name and addressyou can use any branch of the bank or credit union you use. Name(s) of account holders listed on the account.

Download our Direct Deposit Authorization form. Fill out the form and staple a voided Fifth Third check to it. For a voided check, write VOID across a blank check. Give the completed form to the company making the direct deposit. For payroll direct deposit, give the form to your HR contact.

Get a direct deposit form from your employer. Fill in account information. Confirm the deposit amount. Attach a voided check or deposit slip, if required. Submit the form.

Take an unused check from your checkbook for the account into which you want the funds deposited. Use a black pen or marker and write "VOID" in large letters across the front of the blank check. Submit your voided check, along with the completed direct deposit authorization form, to your employer.

Bank account number. Routing number. Type of account (typically a checking account) Bank name and addressyou can use any branch of the bank or credit union you use. Name(s) of account holders listed on the account.

How to set up direct deposit for your paycheck. Ask for a copy of your employer's direct deposit signup form, or download the U.S. Bank Direct Deposit Authorization Form (PDF). Provide your U.S. Bank deposit account type (checking or savings), account number and routing number, and other required information.

Choose a direct deposit payroll provider. You will need to set up a payroll service. Collect information from your employees. Add employees to the payroll system. Select your deposit schedule.

A direct deposit authorization form is a document that authorizes a third (3rd) party, usually an employer for payroll, to send money to a bank account by simply using the ABA routing and account numbers.

Get a direct deposit form from your employerAsk for a written or online direct deposit form. If that isn't available, ask your bank or credit union for one. We've included a list of forms from top banks, including the Capital One and Bank of America direct deposit forms.