Deferred Compensation Agreement - Short Form

What is this form?

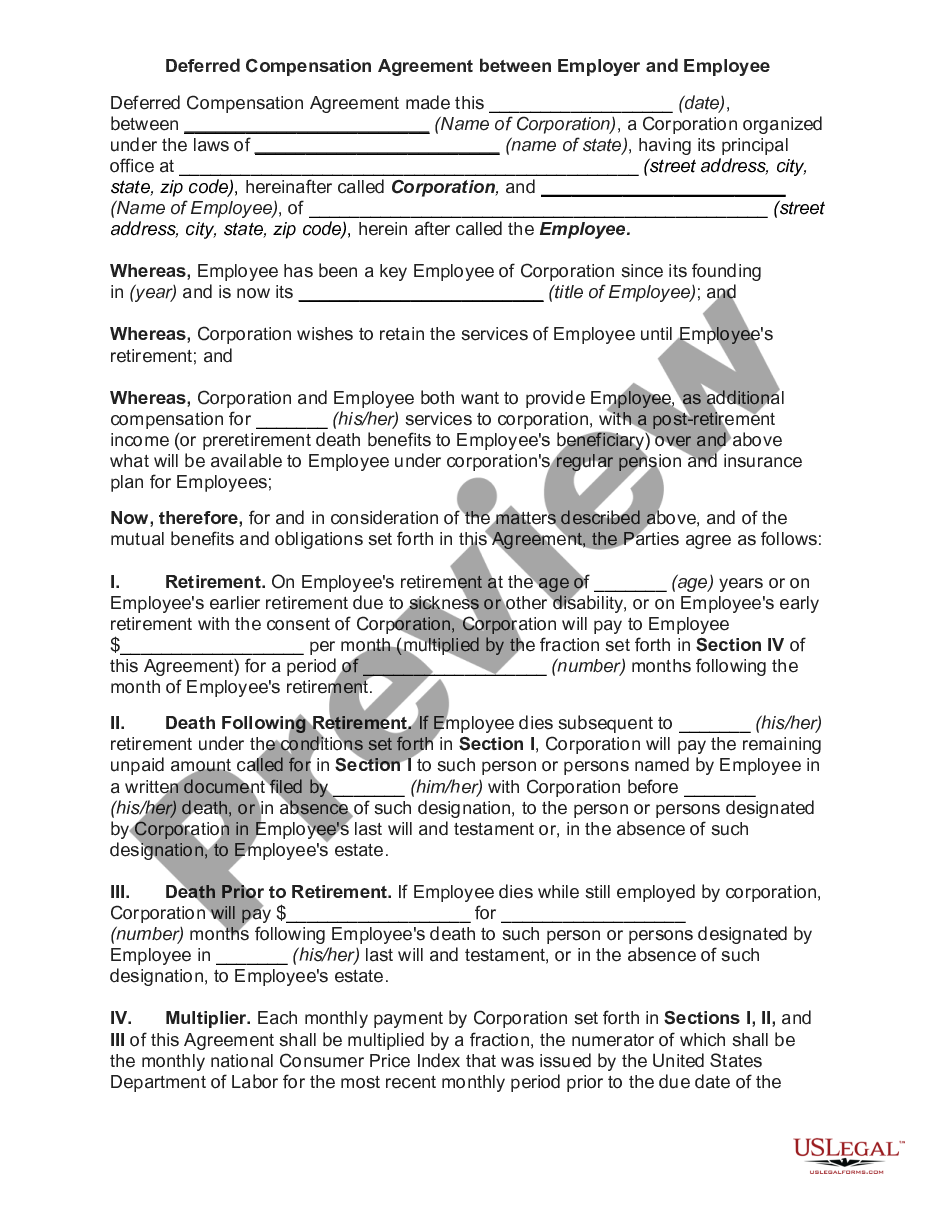

The Deferred Compensation Agreement - Short Form is a legal contract that allows an employee or independent contractor to defer a portion of their income to be paid out in a future year. This arrangement aims to encourage retention until retirement while providing potential tax benefits. Unlike standard employment agreements, this form specifically addresses the timing and conditions under which deferred payments are made, often coinciding with retirement or significant life events like death or disability.

Key components of this form

- Identification of the employer and employee, including contact information.

- Details regarding the compensation to be deferred and its payment schedule.

- Conditions under which payments will begin, such as retirement or termination.

- Provisions related to the termination of the agreement and obligations of both parties.

- Signatures of both parties to validate the agreement.

When to use this document

This form should be used when an employer wishes to create a deferred compensation arrangement with an employee. It is particularly useful in scenarios where the employer aims to incentivize long-term employment, provide a financial safety net during retirement, or offer additional post-retirement income. An employee may also use this form when negotiating their compensation package to include deferred payment options that can reduce their immediate tax liabilities.

Who should use this form

- Employers looking to retain key employees until retirement.

- Employees or independent contractors seeking to negotiate deferred compensation agreements.

- Human resources professionals responsible for employee benefits and compensation packages.

How to complete this form

- Identify the parties involved by entering their names and addresses.

- Specify the amount of income to be deferred and the date it will be paid out.

- Outline the conditions for payment commencement, such as the retirement date.

- Include any additional provisions regarding termination of employment or agreement.

- Have both parties sign and date the agreement to ensure mutual consent and enforceability.

Does this form need to be notarized?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Common mistakes

- Failing to clearly define the payment schedule and conditions.

- Omitting necessary signatures of both parties.

- Not reviewing local laws that may impact the validity of the deferred compensation agreement.

Why complete this form online

- Convenient access to templates that are created by licensed attorneys.

- Editability allows users to customize the agreement according to their specifics.

- Fast and reliable downloading process ensures immediate availability for use.

Key takeaways

- A Deferred Compensation Agreement enables employees to receive part of their income later, promoting long-term employment.

- The form should clearly outline payment conditions and timelines.

- Both parties must review and sign the agreement for it to be valid.

Form popularity

FAQ

A deferred comp plan is most beneficial when you're able to reduce both your present and future tax rates by deferring your income. Unfortunately, it's challenging to project future tax rates. This takes analysis, projections, and assumptions.

To set up a NQDC plan, you'll have to: Put the plan in writing: Think of it as a contract with your employee. Be sure to include the deferred amount and when your business will pay it. Decide on the timing: You'll need to choose the events that trigger when your business will pay an employee's deferred income.

If your deferred compensation comes as a lump sum, one way to mitigate the tax impact is to "bunch" other tax deductions in the year you receive the money. "Taxpayers often have some flexibility on when they can pay certain deductible expenses, such as charitable contributions or real estate taxes," Walters says.

Money saved in a 457 plan is designed for retirement, but unlike 401(k) and 403(b) plans, you can take a withdrawal from the 457 without penalty before you are 59 and a half years old.There is no penalty for an early withdrawal, but be prepared to pay income tax on any money you withdraw from a 457 plan (at any age).

Deferred compensation plans are funded informally. There is essentially just a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k) a formally established account exists.

For a privately-held company, the 409A valuation is the only method you can use to grant options on a tax-free basis to your employees.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump-sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, retirement plans, and employee stock options.

Section 409A applies to anyone subject to U.S. federal income taxation who receives nonqualified deferred compensation, including (1) U.S. tax residents and (2) nonresidents of the United States who earn U.S.-source compensation.

In a broad sense, a nonqualified deferred compensation plan refers to compensation that the company promises to pay to its participants in a subsequent plan year. Essentially, workers earn a sum of money in one year and they get paid at some time in the future.