Obtain S Corporation Status - Corporate Resolutions Forms

Description S Corporation Online

How to fill out Taxationmeaning?

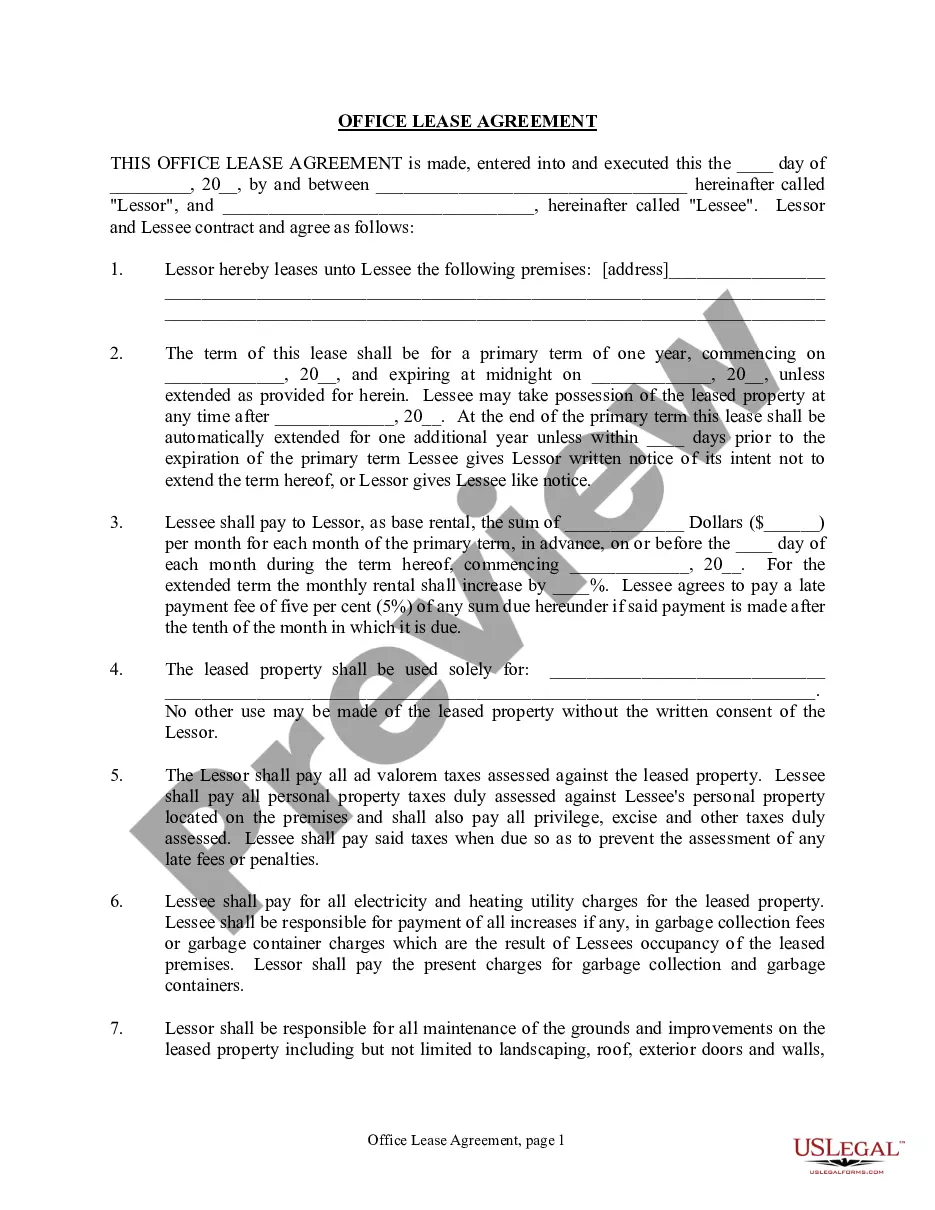

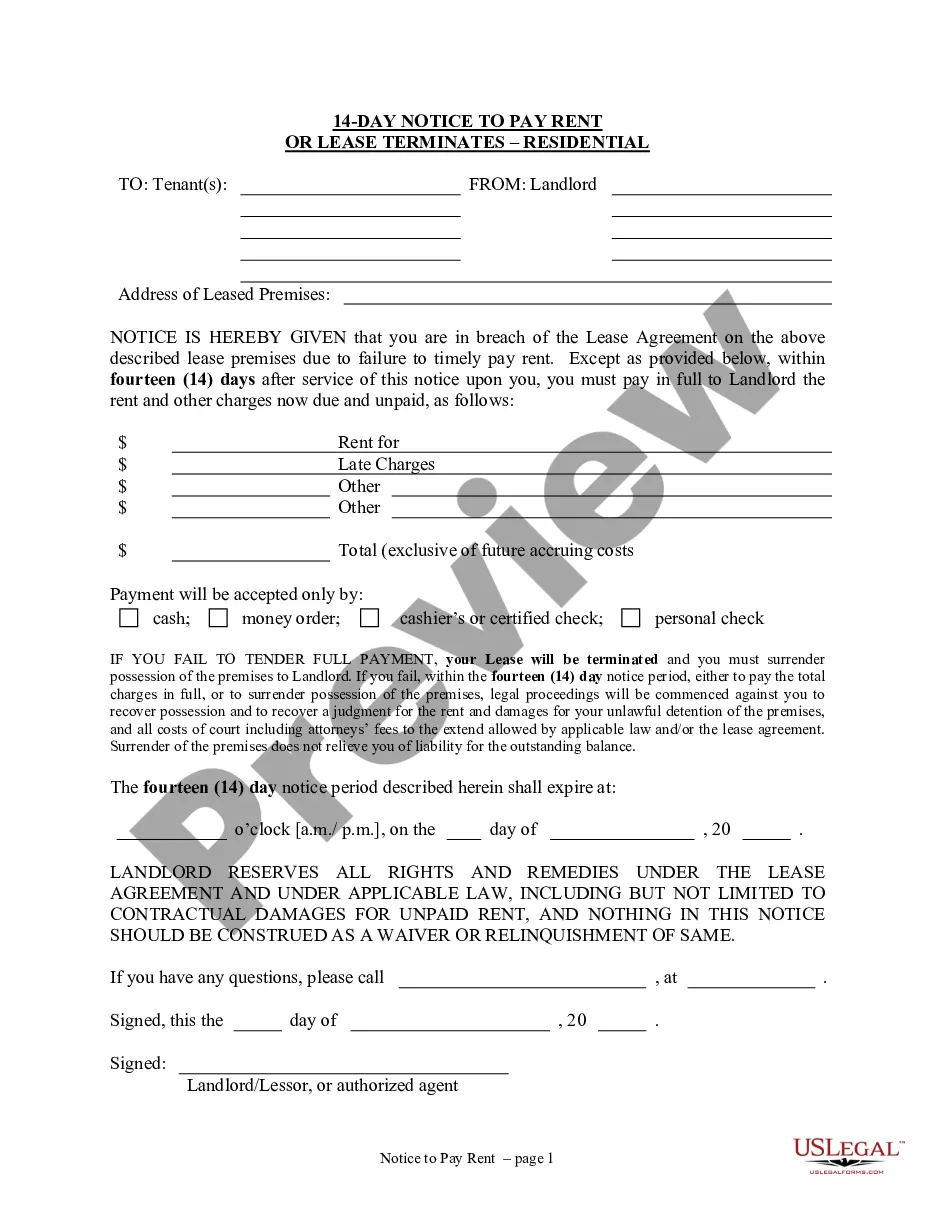

Aren't you tired of choosing from hundreds of samples each time you want to create a Obtain S Corporation Status - Corporate Resolutions Forms? US Legal Forms eliminates the wasted time an incredible number of American people spend browsing the internet for ideal tax and legal forms. Our expert crew of attorneys is constantly upgrading the state-specific Templates catalogue, so that it always offers the appropriate documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have a subscription should complete a few simple actions before having the ability to download their Obtain S Corporation Status - Corporate Resolutions Forms:

- Make use of the Preview function and read the form description (if available) to make sure that it’s the appropriate document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the correct template to your state and situation.

- Make use of the Search field on top of the page if you have to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your file in a convenient format to finish, create a hard copy, and sign the document.

As soon as you have followed the step-by-step guidelines above, you'll always have the ability to sign in and download whatever file you want for whatever state you want it in. With US Legal Forms, completing Obtain S Corporation Status - Corporate Resolutions Forms templates or other official documents is not hard. Get going now, and don't forget to double-check your examples with accredited attorneys!

S Corporation Status Form popularity

Company Profile Sample Pdf Other Form Names

Corporation Status Fill FAQ

One major advantage of an S corporation is that it provides owners limited liability protection, regardless of its tax status. Limited liability protection means that the owners' personal assets are shielded from the claims of business creditorswhether the claims arise from contracts or litigation.

Is an S Corp or LLC better? That is a bit of a misguided question. An LLC is a legal entity only and must choose to pay tax either as an S Corp, C Corp, Partnership, or Sole Proprietorship. Therefore, for tax purposes, an LLC can be an S Corp, so there is really no difference.

Specifically, S corporation shareholders must be individuals, specific trusts and estates, or certain tax-exempt organizations (501(c)(3)). Partnerships, corporations, and nonresident aliens cannot qualify as eligible shareholders.

The C corporation is the standard (or default) corporation under IRS rules. The S corporation is a corporation that has elected a special tax status with the IRS and therefore has some tax advantages. Both business structures get their names from the parts of the Internal Revenue Code that they are taxed under.

Generally, taxes are considered the biggest and most important difference between these two types of corporations. C-corps are subject to the corporate tax rate, whereas S-corps allow for pass-through taxationmeaning business profits and losses are reported on the owners' personal income tax returns.

An S-corp is not a business entity like an LLC, sole proprietorship, partnership or corporation.An LLC is a matter of state law, while an S-corp is a matter of federal tax law. In an LLC, members must pay self-employment taxes, which are Social Security and Medicare taxes, directly to the IRS.

Call the IRS Business Assistance Line at 800-829-4933. The IRS can review your business file to see if your company is a C corporation, S corporation, partnership, single-member LLC, or sole proprietor based on any elections you may have made and the type of income tax returns you file.