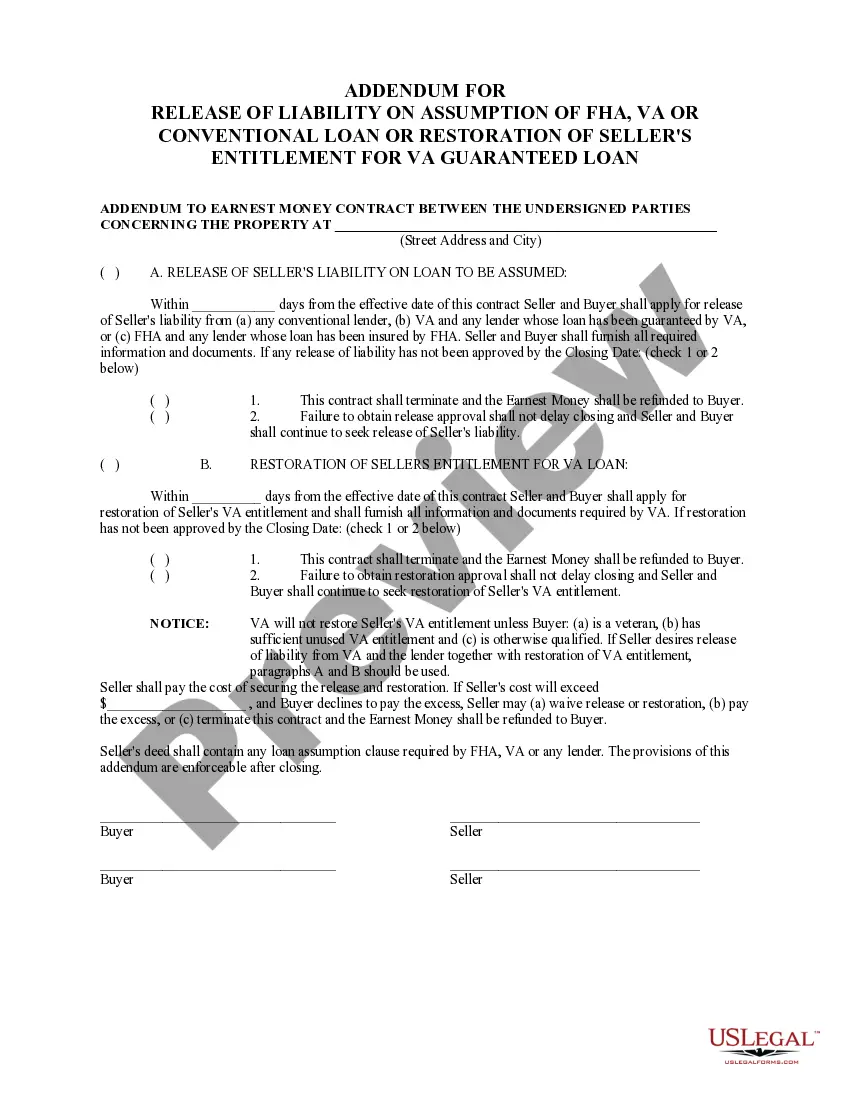

Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description Va Conventional Loan

How to fill out Fha Va Contract?

Aren't you tired of choosing from hundreds of templates every time you need to create a Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan? US Legal Forms eliminates the wasted time countless American people spend exploring the internet for ideal tax and legal forms. Our professional crew of lawyers is constantly updating the state-specific Templates catalogue, so it always offers the right documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have an active subscription need to complete simple steps before having the capability to download their Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan:

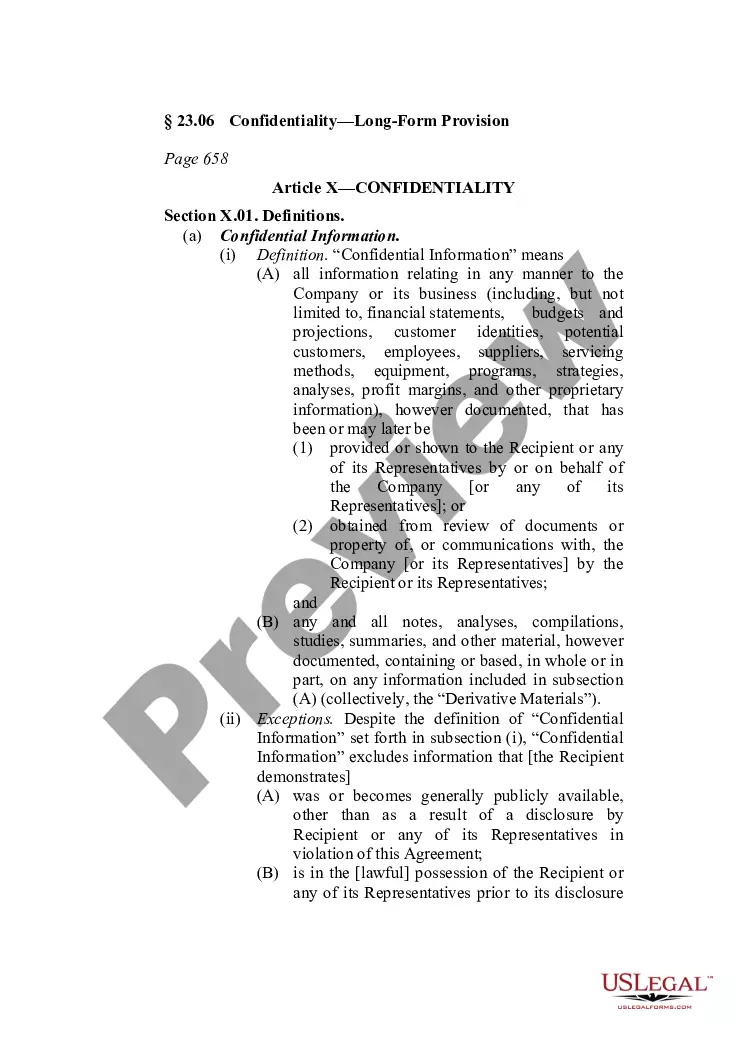

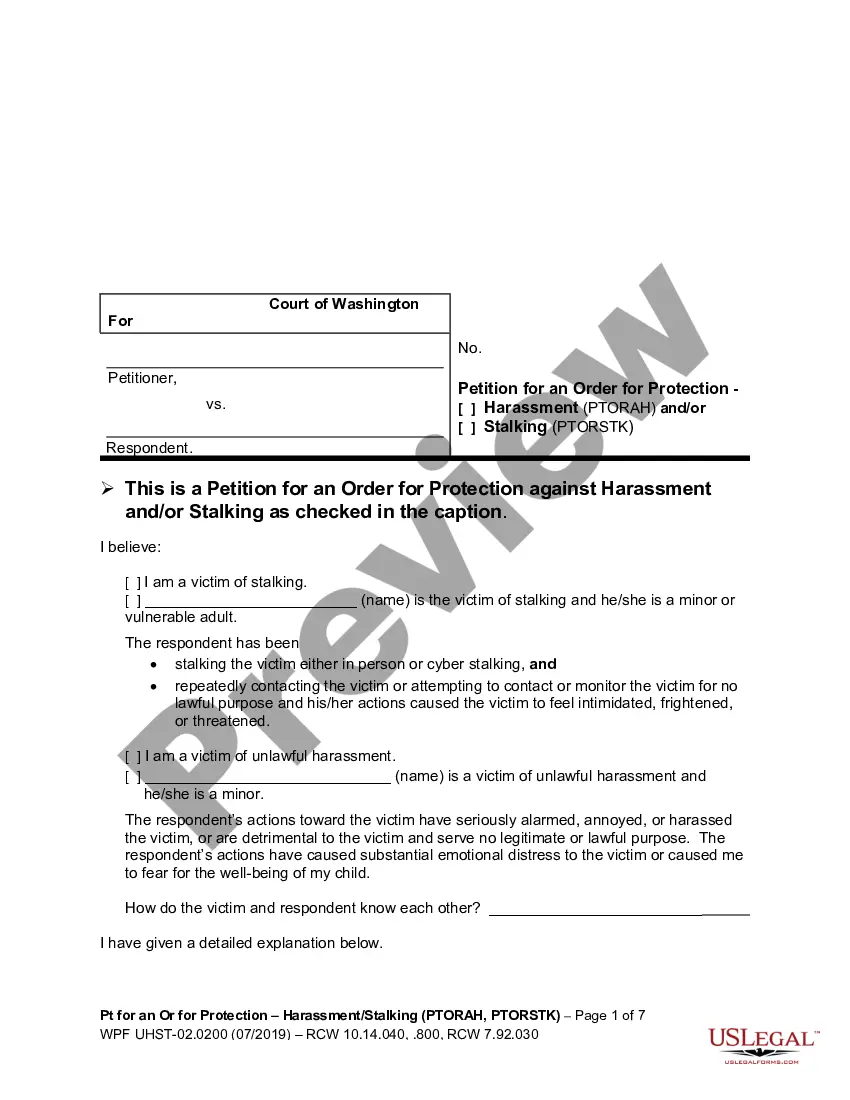

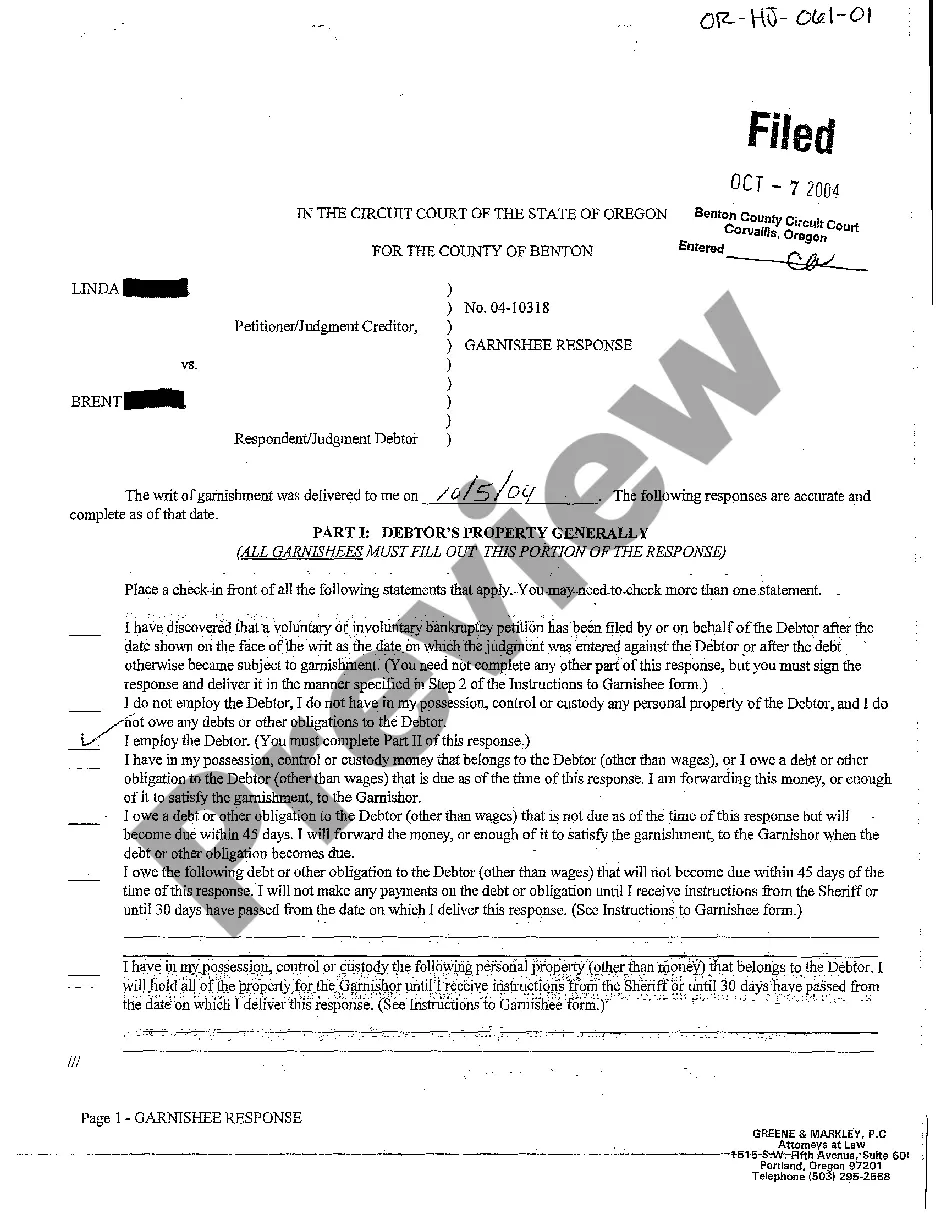

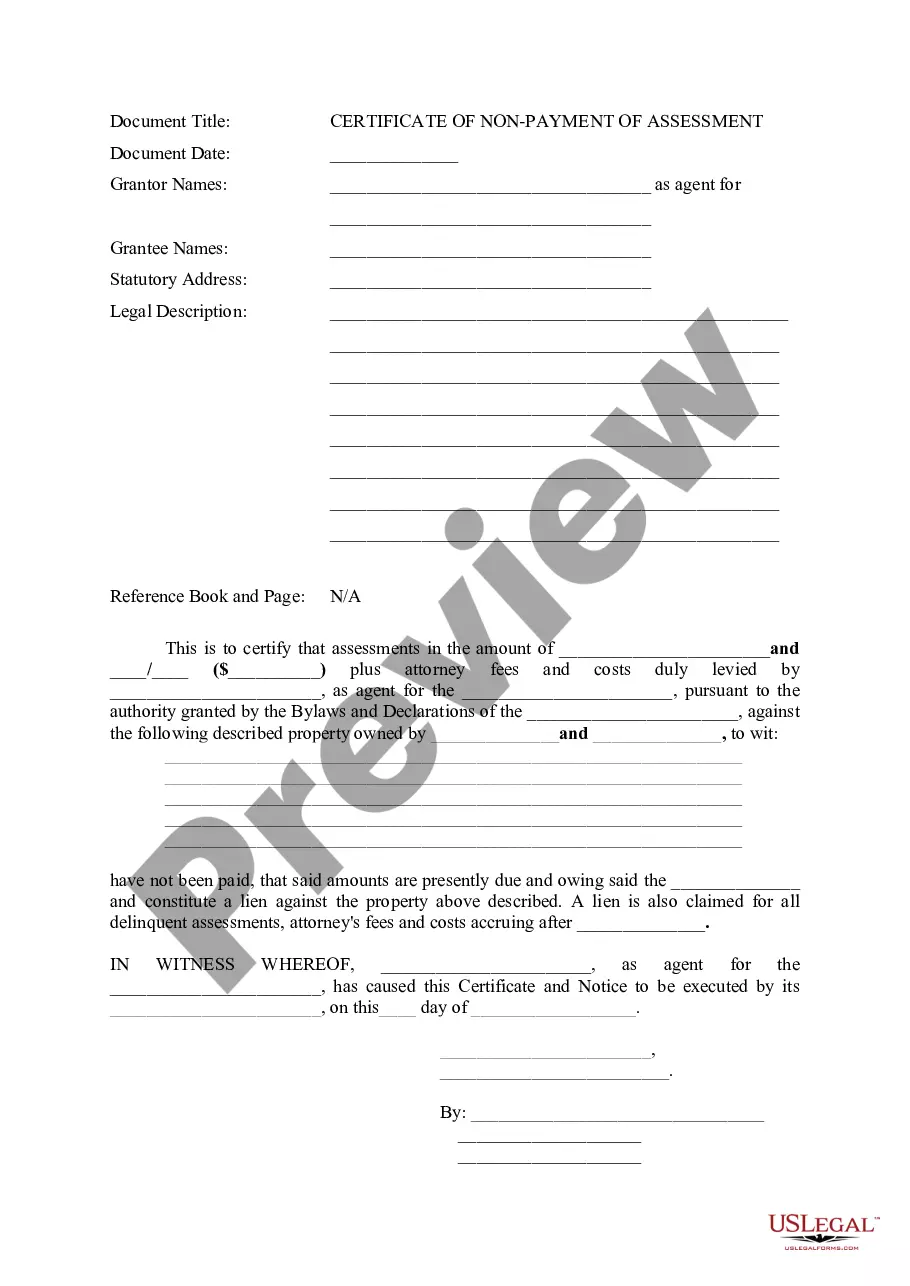

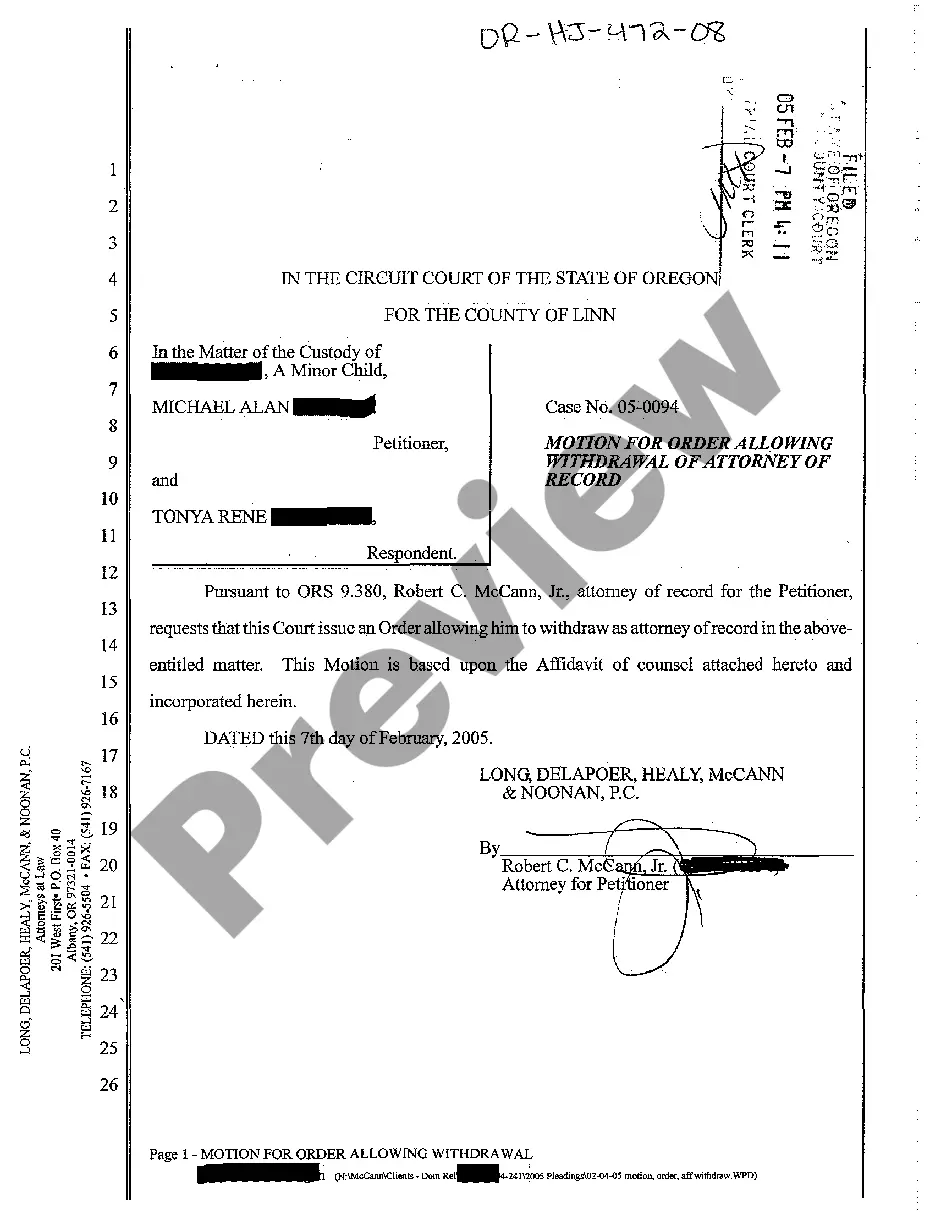

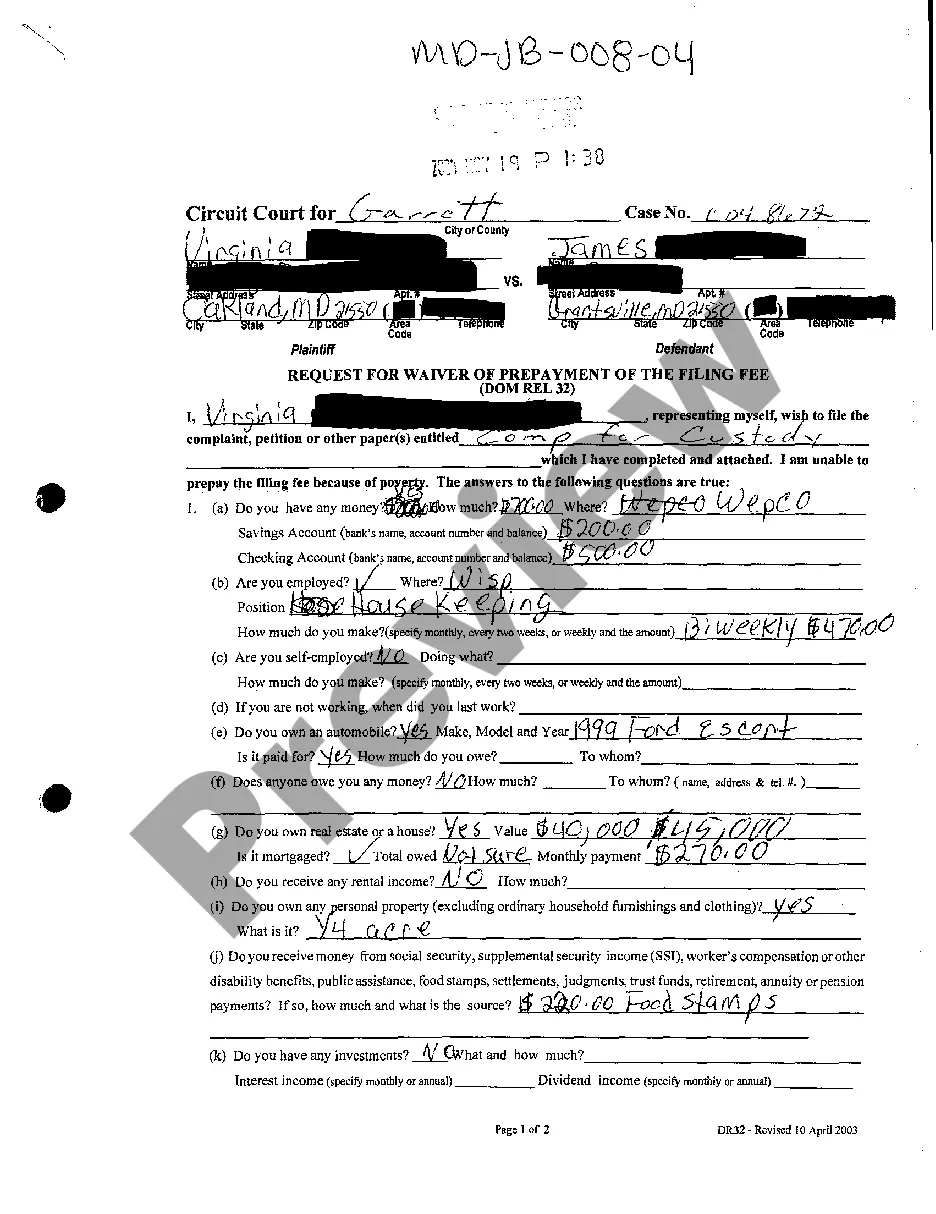

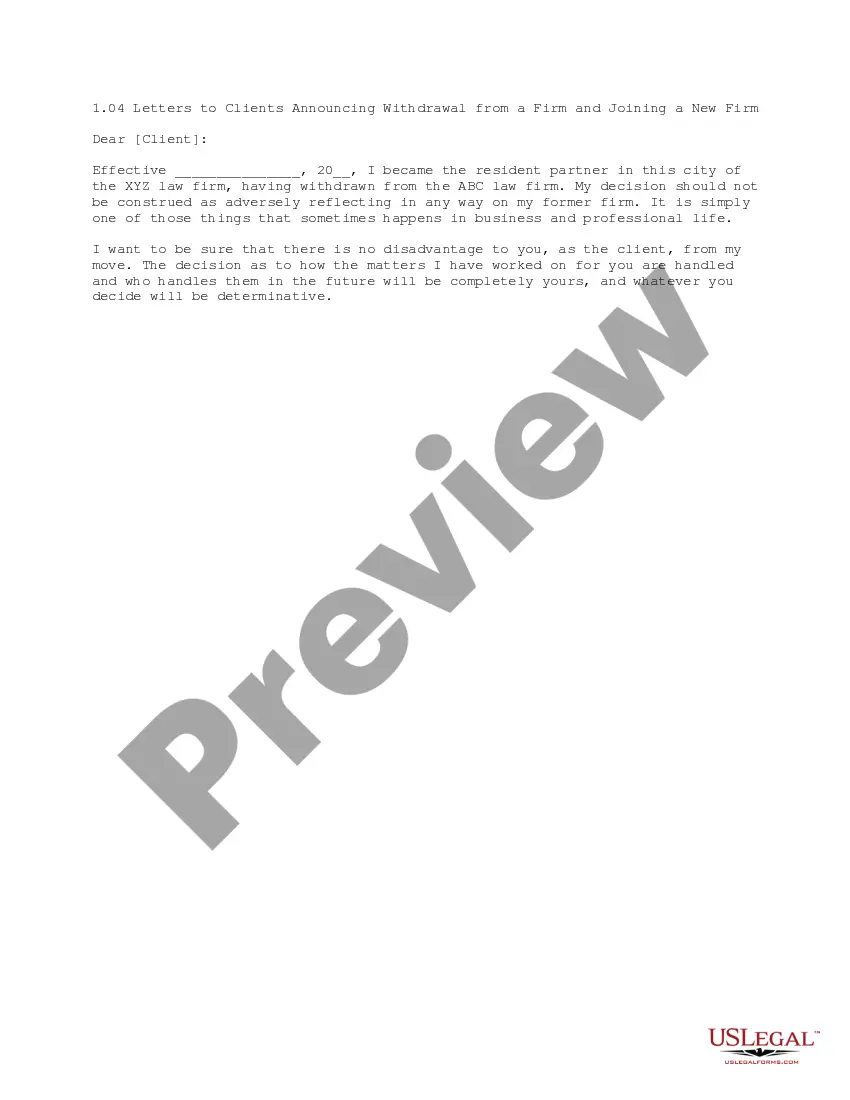

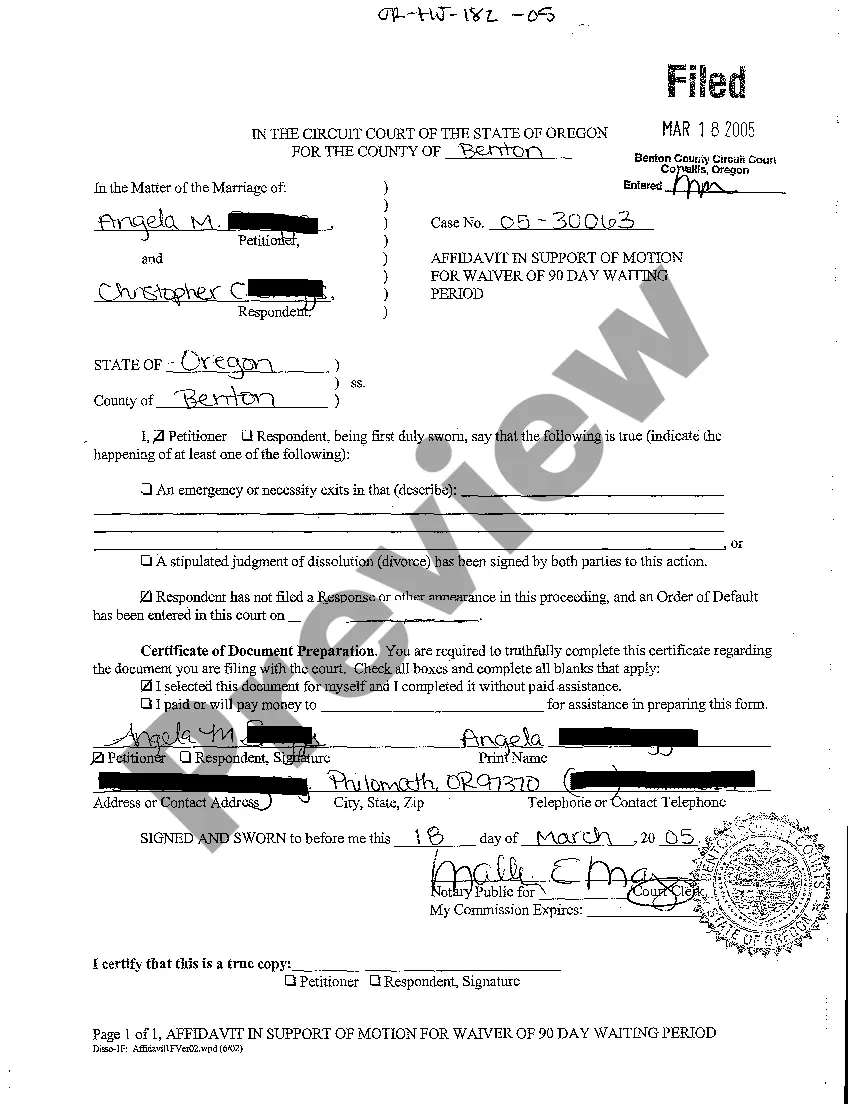

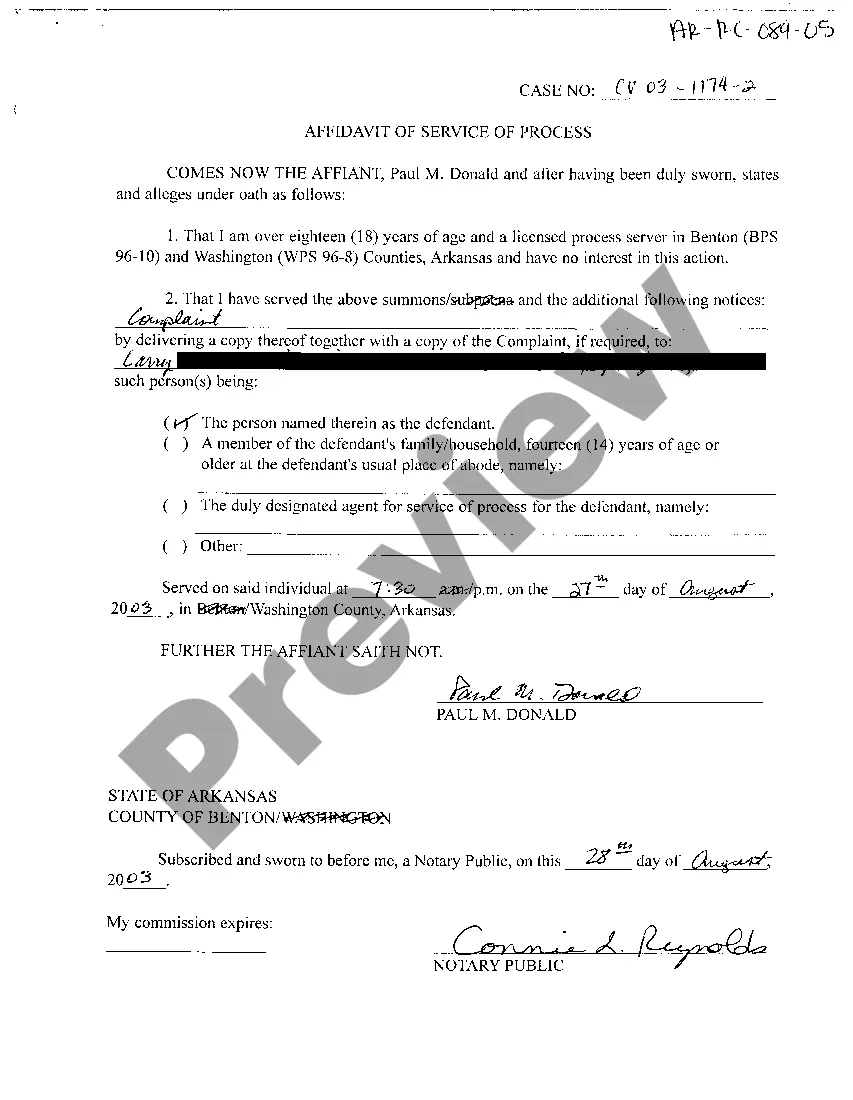

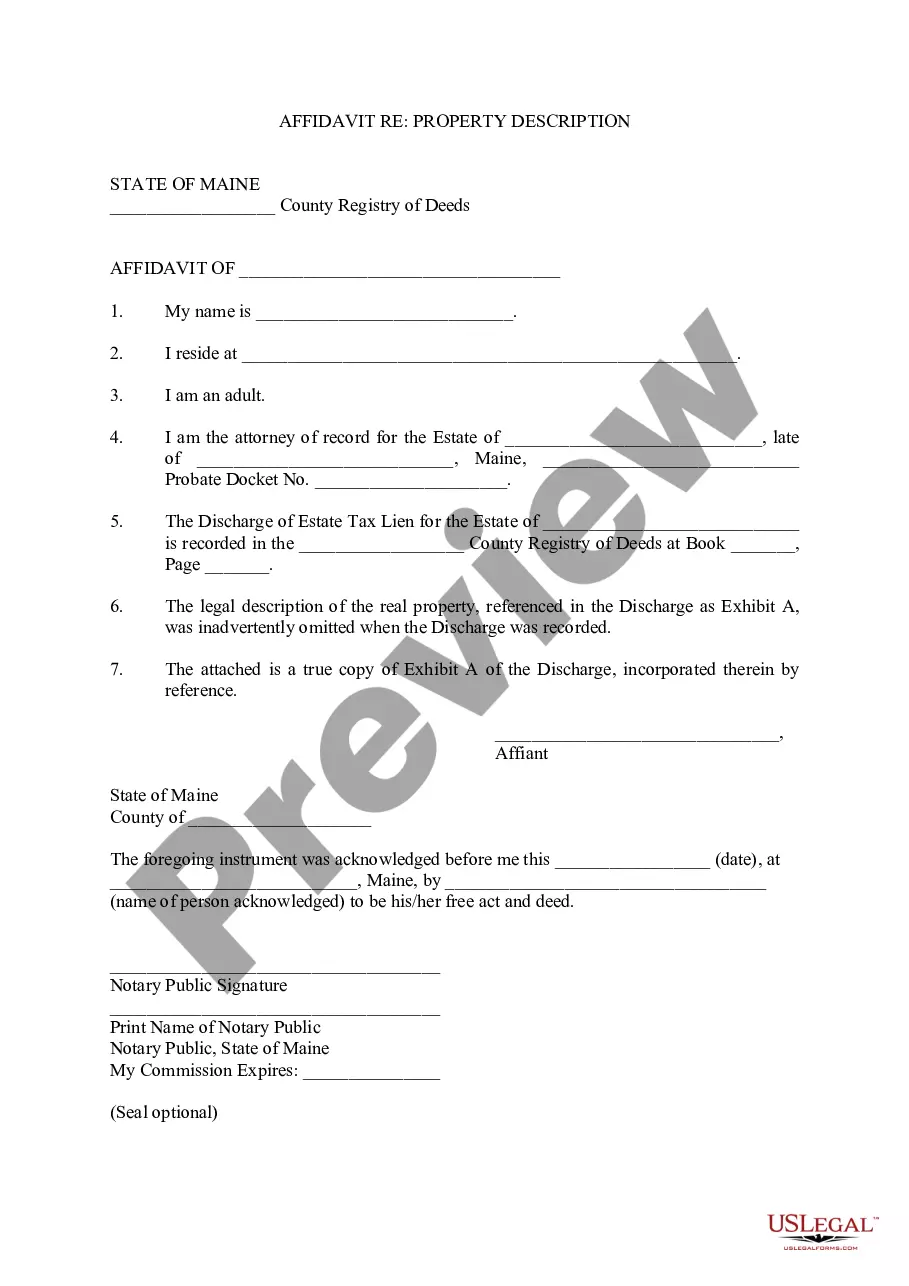

- Use the Preview function and read the form description (if available) to ensure that it is the proper document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right example for the state and situation.

- Utilize the Search field at the top of the site if you have to look for another document.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your document in a convenient format to complete, create a hard copy, and sign the document.

When you have followed the step-by-step instructions above, you'll always have the capacity to log in and download whatever document you will need for whatever state you require it in. With US Legal Forms, finishing Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan samples or other legal paperwork is not difficult. Get started now, and don't forget to examine your samples with accredited attorneys!

Fha Guaranteed Form popularity

Fha Va Conventional Other Form Names

Entitlement Refunded Guaranteed FAQ

Yet another benefit: VA loans are assumable. A VA loan assumption allows a borrower to take over the terms of an existing mortgage, even if they aren't a military service member, veteran or eligible surviving spouse.

For VA case numbers and appraisals already in existence with another lender: A transfer request must be made of the existing lender to transfer the case number and appraisal to MSF. This transfer must be requested by the broker or MSF.

An addendum is an additional document that gets added to the purchase and sale agreement. The document will include any additional information or requests that the buyer did not put into the original purchase and sale agreement.Another example of an addendum is one that includes contingencies.

A fee that the buyer of a property with an assumable mortgage pays to the lender for the ability to take over the mortgage.

The loan assumption addendum is a piece of paperwork that will be provided to the individual that is assuming the loan. This paperwork is going to provide them with important information about assuming the loan and how the process will work.

Complete the addendum, including your name, the purchaser's name and a description of the property. Include the type of financing that you are providing, such as first mortgage, second mortgage or deed of trust. List the terms of the loan.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

Loan Guaranty Certificate (LGC) is the lender's record that VA has guaranteed the loan.This system enables participating lenders to electronically submit a loan to VA for guaranty.

One of the more under-the-radar benefits of VA loans is that they're assumable. An assumption is defined as a purchase transaction where the purchaser takes over the seller's liability of an existing mortgage.That includes your loan balance, your interest rate, and your monthly mortgage payment.