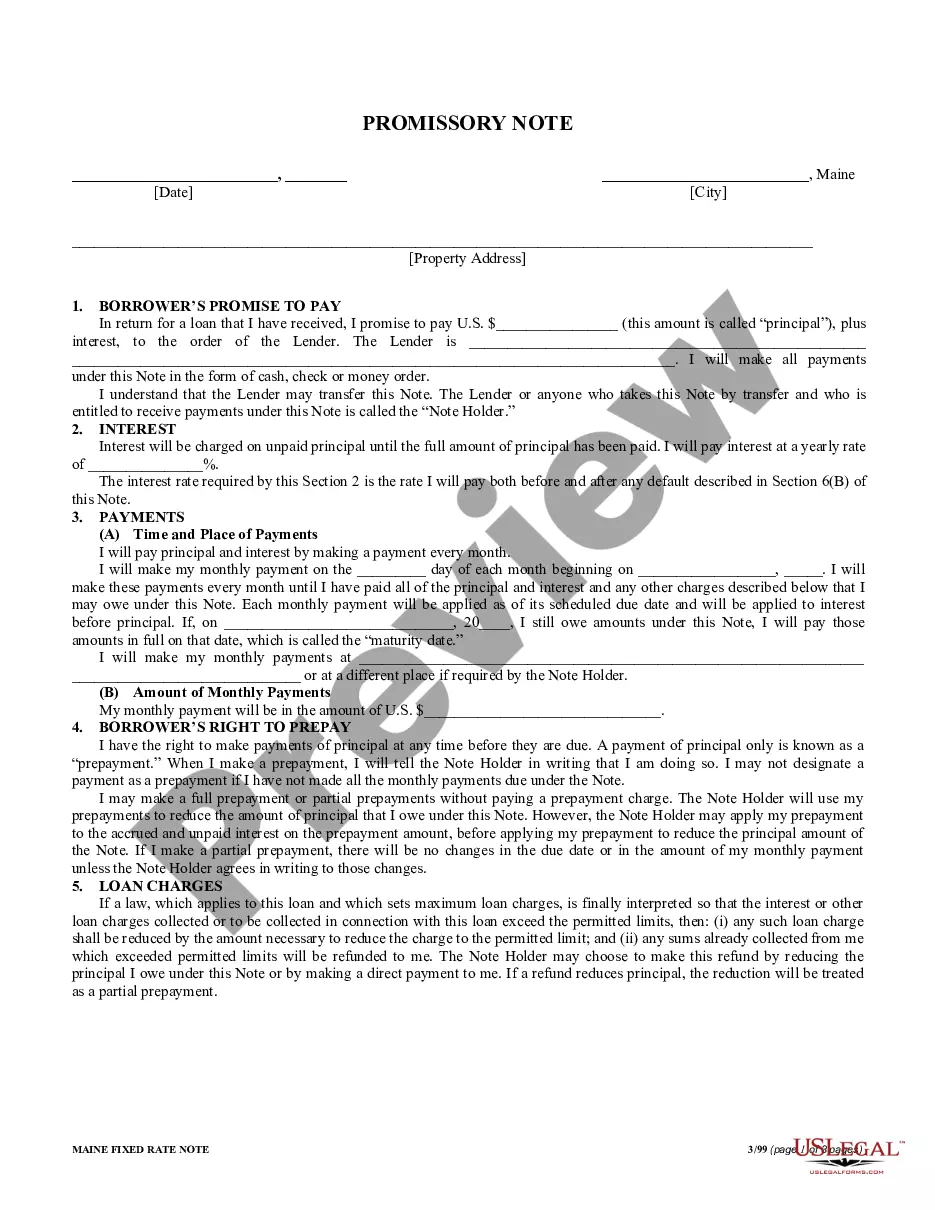

Earnest Money Promissory Note

Description Promissory Note Form

How to fill out Note Designate Payable?

Aren't you sick and tired of choosing from hundreds of templates each time you require to create a Earnest Money Promissory Note? US Legal Forms eliminates the wasted time an incredible number of American people spend surfing around the internet for appropriate tax and legal forms. Our expert crew of attorneys is constantly upgrading the state-specific Samples catalogue, so it always has the right files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have a subscription need to complete easy actions before having the ability to get access to their Earnest Money Promissory Note:

- Make use of the Preview function and look at the form description (if available) to ensure that it is the proper document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate template for the state and situation.

- Make use of the Search field at the top of the page if you need to look for another file.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your template in a convenient format to finish, create a hard copy, and sign the document.

As soon as you have followed the step-by-step guidelines above, you'll always be able to log in and download whatever document you need for whatever state you want it in. With US Legal Forms, finishing Earnest Money Promissory Note samples or any other official documents is simple. Get going now, and don't forget to examine your examples with accredited lawyers!

Money Promissory Note Form popularity

Money Promissory Other Form Names

Earnest Note Template FAQ

If you back out of the contract for reasons that aren't stipulated by your contract or its contingencies, you could be out your earnest money or, in extreme cases, you could even be sued by the seller. There are few instances that could put you at risk of a seller-driven lawsuit.

The earnest money can be held in escrow during the contract period by a title company, lawyer, bank, or brokerwhatever is specified in the contract. Most U.S. jurisdictions require that when a buyer timely and properly drops out of a contract, the money be returned within a brief period of time, say, 48 hours.

Generally, these funds are held in an escrow account managed by the buyer's real estate agent or the title company. The deposit is then applied to your closing costs or returned to you at closing. Earnest money funds are usually applied to a loan's closing costs or to the down payment.

Assuming the seller does not contest to you getting your earnest money back, then you should both sign release forms. This says that you both agree that the earnest money will be returned to you. Make sure to contact your realtor or lawyer to find out about any other forms you need to sign.