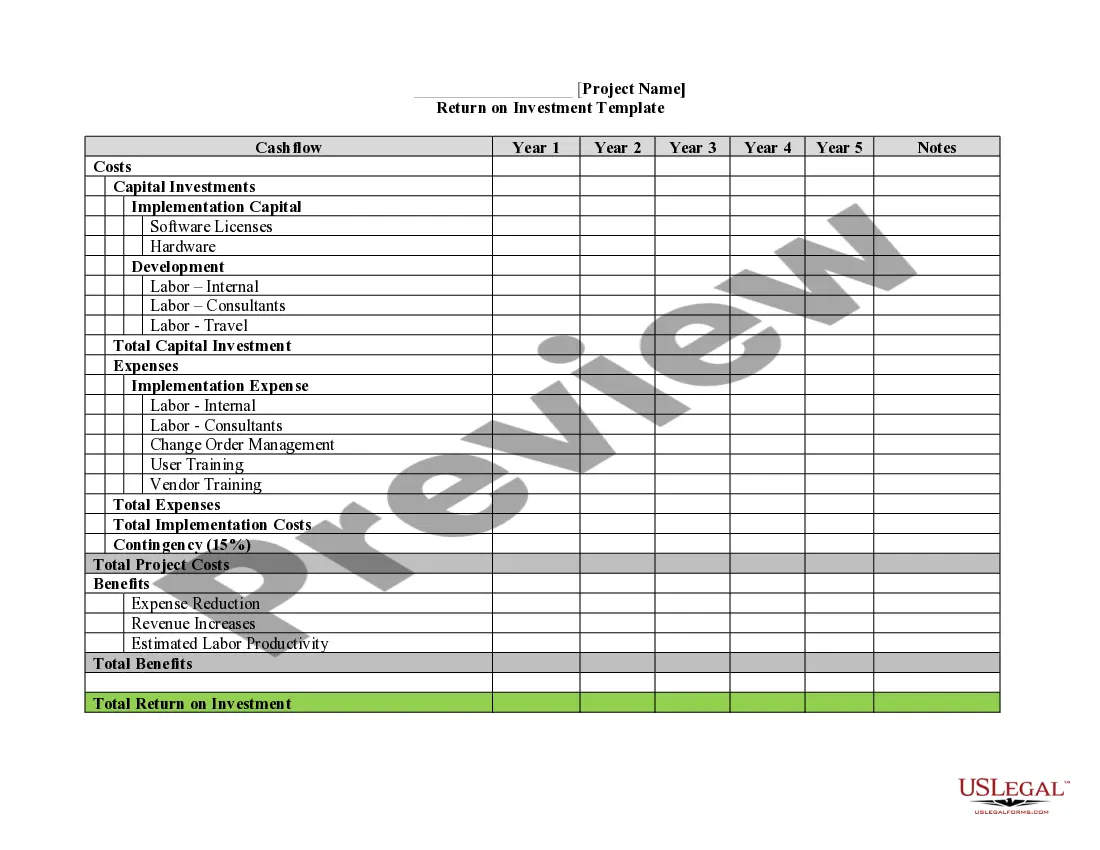

Return on Investment

Description

How to fill out Return On Investment?

Preparing legal paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state regulations and are checked by our specialists. So if you need to prepare Return on Investment, our service is the perfect place to download it.

Obtaining your Return on Investment from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they find the proper template. Afterwards, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a brief guide for you:

- Document compliance check. You should attentively examine the content of the form you want and make sure whether it suits your needs and complies with your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab above until you find a suitable template, and click Buy Now when you see the one you want.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Return on Investment and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to obtain any formal document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

You may calculate the return on investment using the formula: ROI = Net Profit / Cost of the investment 100 If you are an investor, the ROI shows you the profitability of your investments.

Return on investment (ROI) is calculated by dividing the profit earned on an investment by the cost of that investment. For instance, an investment with a profit of $100 and a cost of $100 would have an ROI of 1, or 100% when expressed as a percentage. Return on Investment (ROI): How to Calculate It and What It Means investopedia.com ? terms ? returnoninvestm... investopedia.com ? terms ? returnoninvestm...

Return on investment (ROI) is calculated by dividing the profit earned on an investment by the cost of that investment. For instance, an investment with a profit of $100 and a cost of $100 would have an ROI of 1, or 100% when expressed as a percentage.

ROI is calculated by subtracting the beginning value from the current value and then dividing the number by the beginning value.

Ing to many financial investors, 7% is an excellent return rate for most, while 5% is enough to be considered a 'good' return.

What Is a Good ROI? ing to conventional wisdom, an annual ROI of approximately 7% or greater is considered a good ROI for an investment in stocks. This is also about the average annual return of the S&P 500, accounting for inflation. What Is Return On Investment (ROI)? ? Forbes Advisor forbes.com ? advisor ? investing ? roi-retur... forbes.com ? advisor ? investing ? roi-retur...

The most common is net income divided by the total cost of the investment, or ROI = Net income / Cost of investment x 100.

There is no set percentage. Some agencies might be satisfied with a 5-percent ROI, while others might be on the lookout for a higher number like 20 percent for it to be considered good ROI.

An ROI of 30% can be good, but it can depend on how long your ROI has been at 30% in previous years.