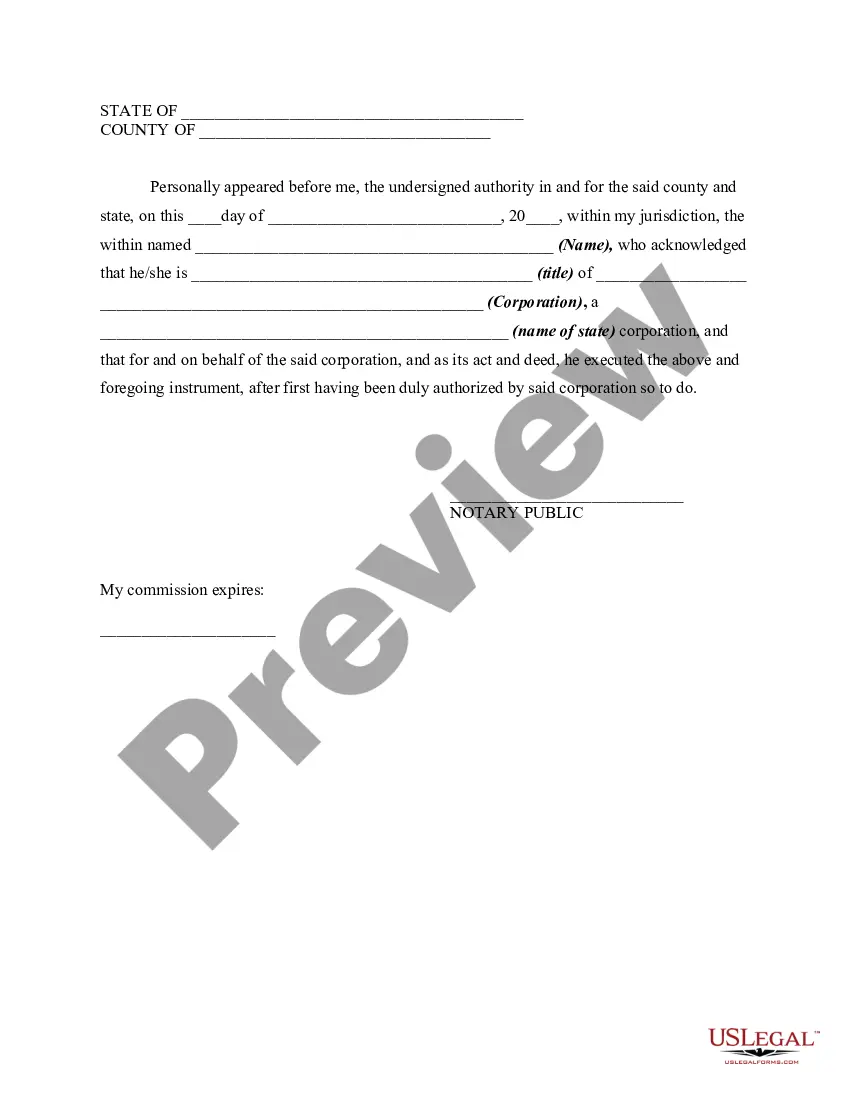

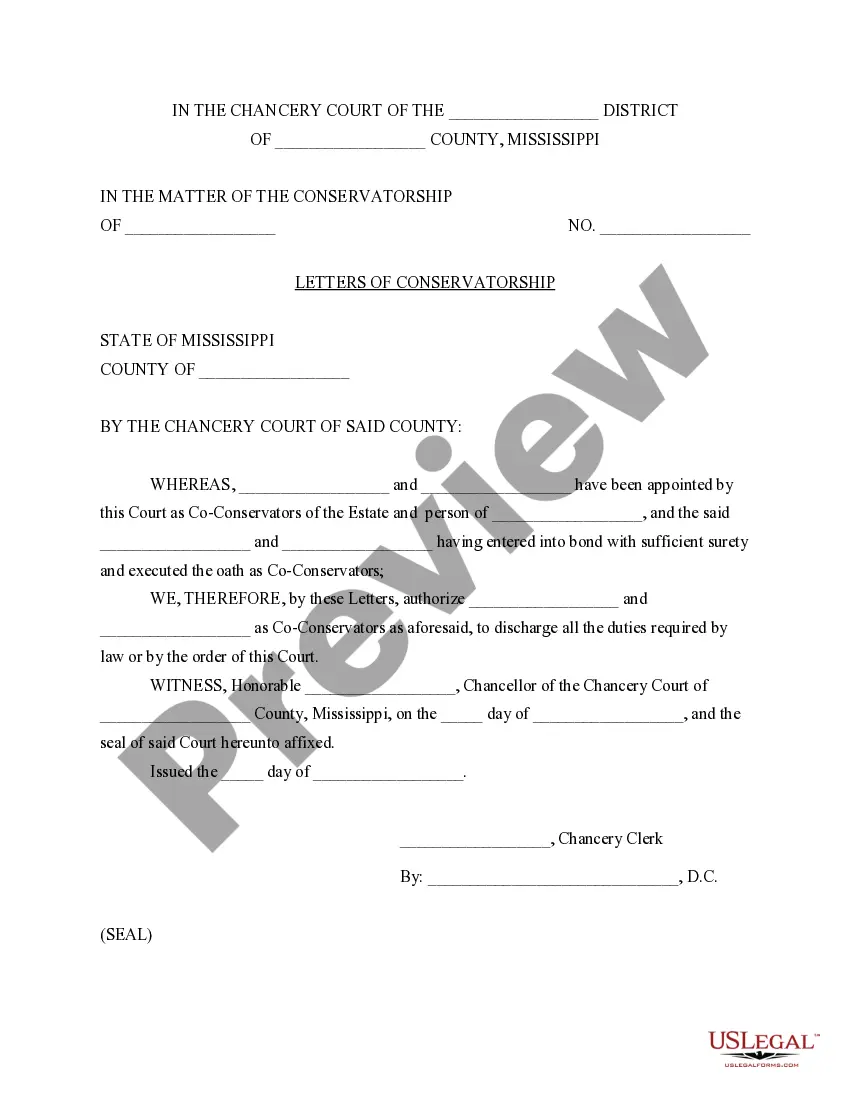

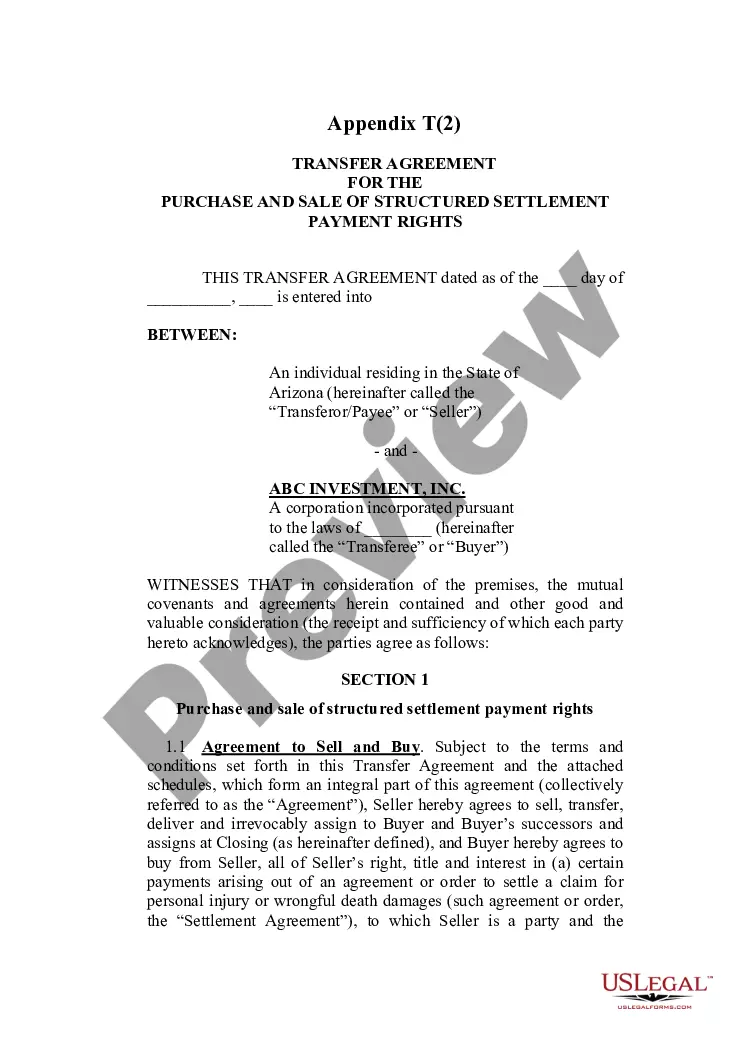

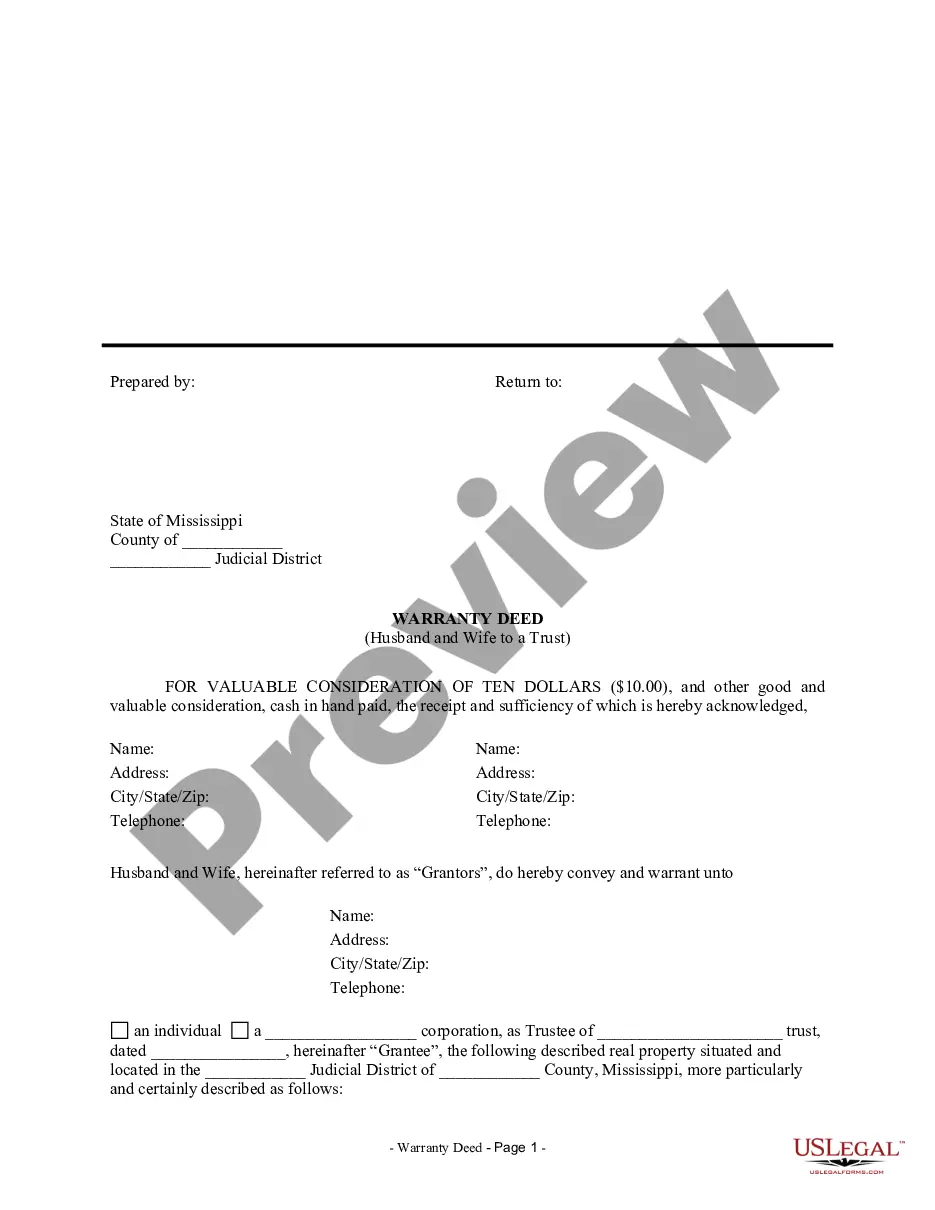

Agency is a relationship based on an agreement authorizing one person, the agent, to act for another, the principal. An agency can be created for the purpose of doing almost any act the principal could do. In this form, a person is being given the authority to collect money for a corporation, the principal.

Notice to Debtor of Authority of Agent to Receive Payment

Description Notice Authority Document

How to fill out Debtor Chapter Post?

Aren't you sick and tired of choosing from countless samples every time you want to create a Notice to Debtor of Authority of Agent to Receive Payment? US Legal Forms eliminates the wasted time countless American citizens spend browsing the internet for perfect tax and legal forms. Our professional crew of lawyers is constantly modernizing the state-specific Forms library, so it always offers the right files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription need to complete simple actions before having the capability to get access to their Notice to Debtor of Authority of Agent to Receive Payment:

- Utilize the Preview function and look at the form description (if available) to be sure that it’s the best document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the proper sample for the state and situation.

- Utilize the Search field on top of the page if you need to look for another document.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your file in a needed format to complete, print, and sign the document.

As soon as you have followed the step-by-step guidelines above, you'll always be able to sign in and download whatever file you need for whatever state you require it in. With US Legal Forms, completing Notice to Debtor of Authority of Agent to Receive Payment templates or other legal files is simple. Begin now, and don't forget to recheck your samples with accredited attorneys!

Notice Agent Contract Form popularity

Notice Agent Form Other Form Names

Notice Authority Sample FAQ

When a Debt Collector Calls, How Should You Answer? The phone call from a debt collector never comes at a good timebut the best response is to confront the state of these affairs head-on. You may want to hide or ignore the situation and hope it goes awaybut that can make things worse.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

At a minimum, it must produce: A copy of the original written agreement between the parties, such as the loan note or credit card agreement, preferably signed by you. If the account has been sold to another creditor, then that creditor must prove that it has the right to sue to collect the debt.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

However there are times when you should not pay a collection agency: If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

Here's some basic information you should write down anytime you speak with a debt collector: date and time of the phone call, the name of the collector you spoke to, name and address of collection agency, the amount you allegedly owe, the name of the original creditor, and everything discussed in the phone call.

Find out background information of the collector. Focus on business. Make a partial payment of the debt, enough to cover the commission of the collector. Do not bow to any threats but instead ask to speak to a senior staff. In case of a threat to sue, reason with the company of the extra cost involved in the process.