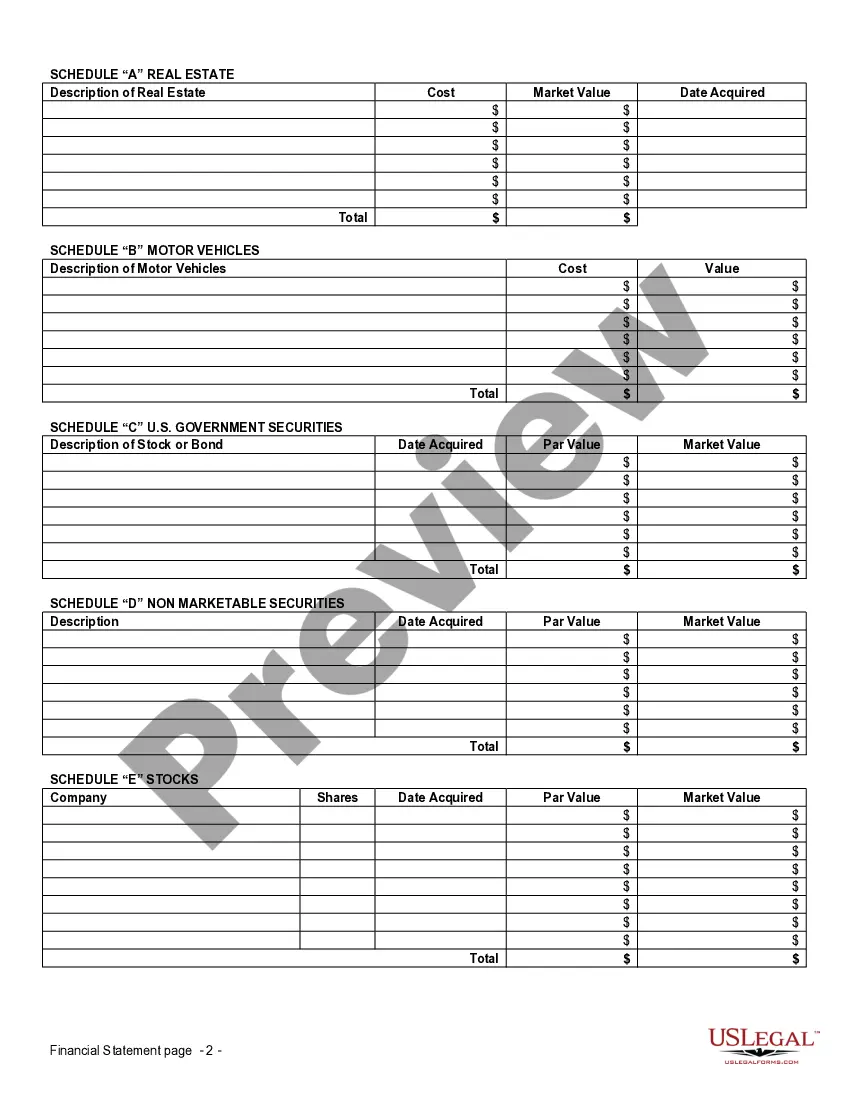

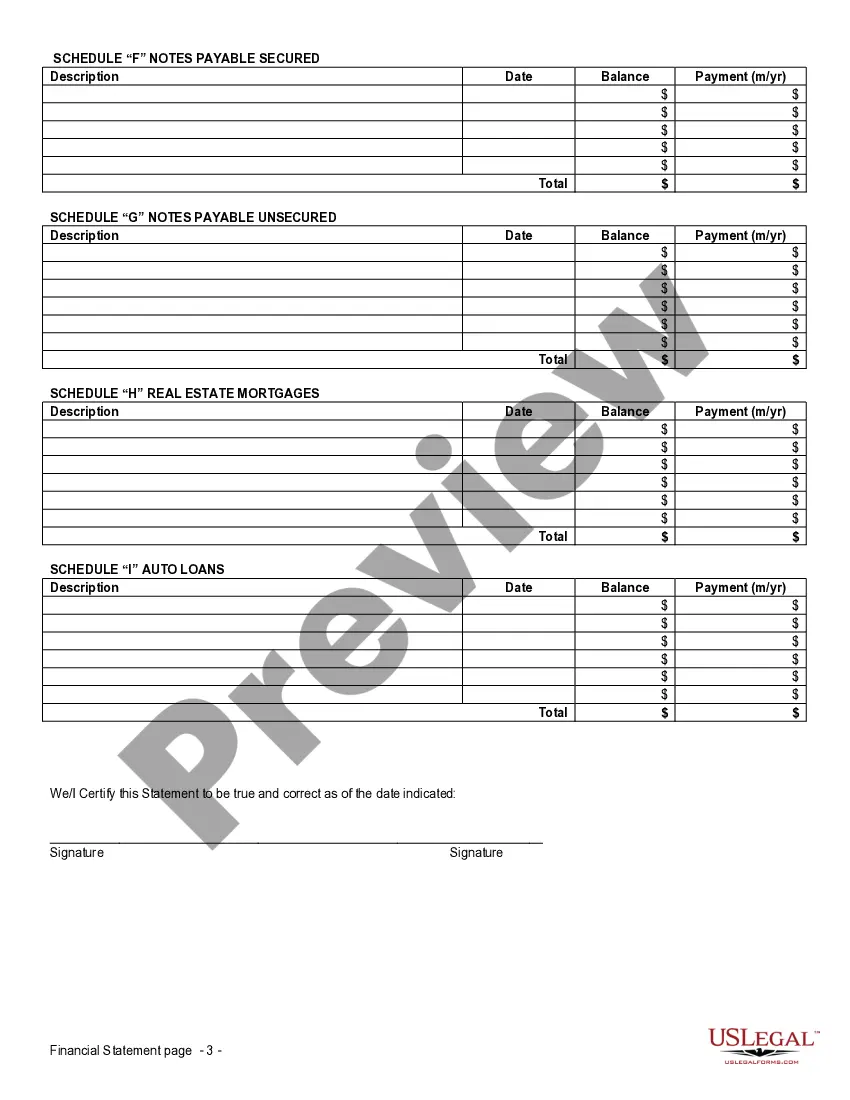

Financial Statement Form - Husband and Wife Joint

Description

How to fill out Financial Statement Form - Husband And Wife Joint?

Aren't you tired of choosing from numerous samples each time you need to create a Financial Statement Form - Husband and Wife Joint? US Legal Forms eliminates the wasted time an incredible number of American citizens spend searching the internet for perfect tax and legal forms. Our skilled team of attorneys is constantly updating the state-specific Forms library, so it always has the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have an active subscription should complete quick and easy actions before having the ability to get access to their Financial Statement Form - Husband and Wife Joint:

- Utilize the Preview function and read the form description (if available) to make certain that it’s the right document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the proper template to your state and situation.

- Make use of the Search field at the top of the site if you have to look for another file.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your template in a convenient format to finish, create a hard copy, and sign the document.

Once you’ve followed the step-by-step instructions above, you'll always be capable of sign in and download whatever document you need for whatever state you want it in. With US Legal Forms, finishing Financial Statement Form - Husband and Wife Joint templates or other official files is not hard. Get started now, and don't forget to examine your examples with accredited lawyers!

Form popularity

FAQ

The Form 8938 filing requirement does not replace or otherwise affect a taxpayer's obligation to file FinCEN Form 114 (Report of Foreign Bank and Financial Accounts). Unlike Form 8938, the FBAR (FinCEN Form 114) is not filed with the IRS.Form 8938 and Instructions can be found at About Form 8938.

Form 8938 (FATCA) It requires more in-depth reporting, and also includes assets beyond accounts, such as Stock ownership. The form is filed alongside the tax return.FBAR, is that the Form 8938 is only filed when a person meets the threshold for filing AND has to file a tax return.

Unmarried individuals residing in the United States are required to file Form 8938 if the market value of their foreign financial assets is greater than $50,000 on the last day of the year or greater than $75,000 at any time during the year.

The Form 8938 filing requirement does not replace or otherwise affect a taxpayer's obligation to file FinCEN Form 114 (Report of Foreign Bank and Financial Accounts). Unlike Form 8938, the FBAR (FinCEN Form 114) is not filed with the IRS.Form 8938 and Instructions can be found at About Form 8938.

Use Form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold.

Unmarried individuals residing in the United States are required to file Form 8938 if the market value of their foreign financial assets is greater than $50,000 on the last day of the year or greater than $75,000 at any time during the year.

For most individual taxpayers, this means they will start filing Form 8938 with their 2011 income tax return.If you do not have to file an income tax return for the tax year, you do not need to file Form 8938, even if the value of your specified foreign assets is more than the appropriate reporting threshold.

Wondering who files an FBAR? Whether you live in the U.S. or abroad, every U.S. person (U.S. citizens, green card holders, resident aliens) is required to file FinCEN Form 114 if they are an owner, nominee, or can control the distribution of the account's funds.