Guaranty of Open Account - Alternate Form

Description Open Account Form Fill

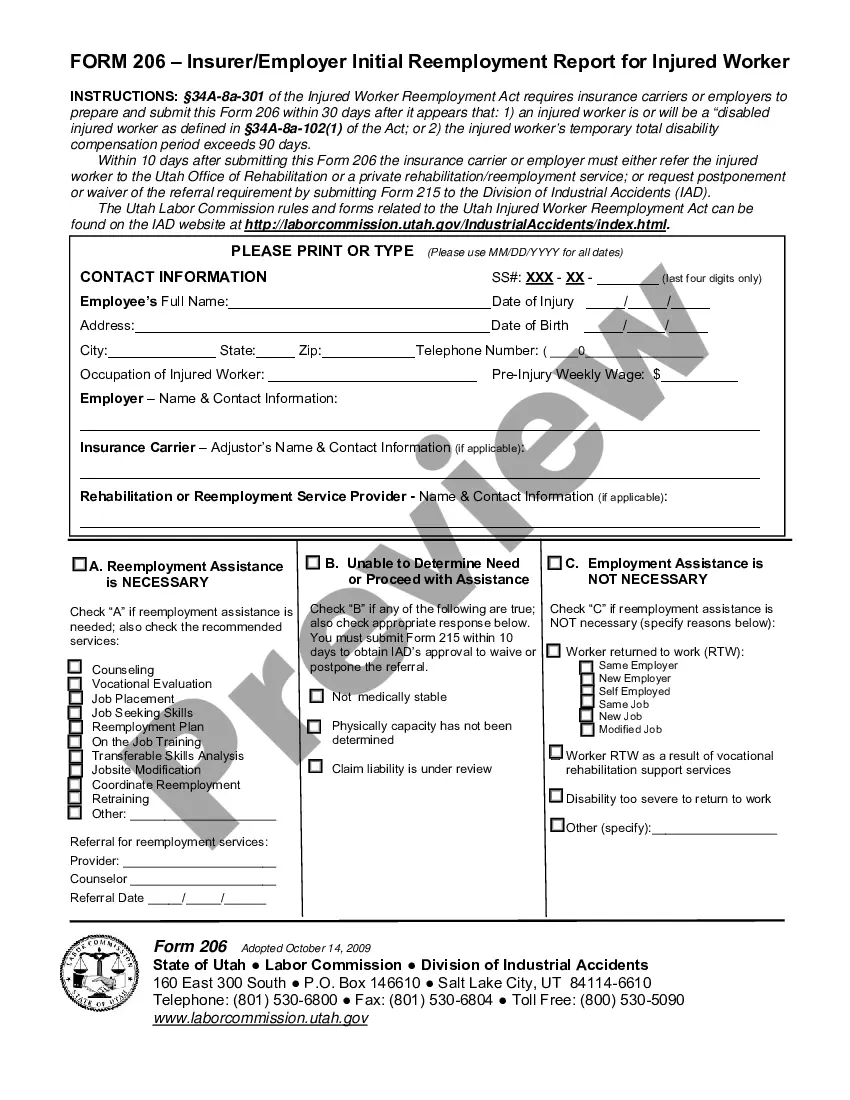

How to fill out Guaranty Of Open Account - Alternate Form?

Aren't you tired of choosing from countless templates every time you require to create a Guaranty of Open Account - Alternate Form? US Legal Forms eliminates the lost time numerous Americans spend browsing the internet for perfect tax and legal forms. Our professional crew of attorneys is constantly upgrading the state-specific Forms collection, to ensure that it always has the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have a subscription need to complete quick and easy steps before being able to get access to their Guaranty of Open Account - Alternate Form:

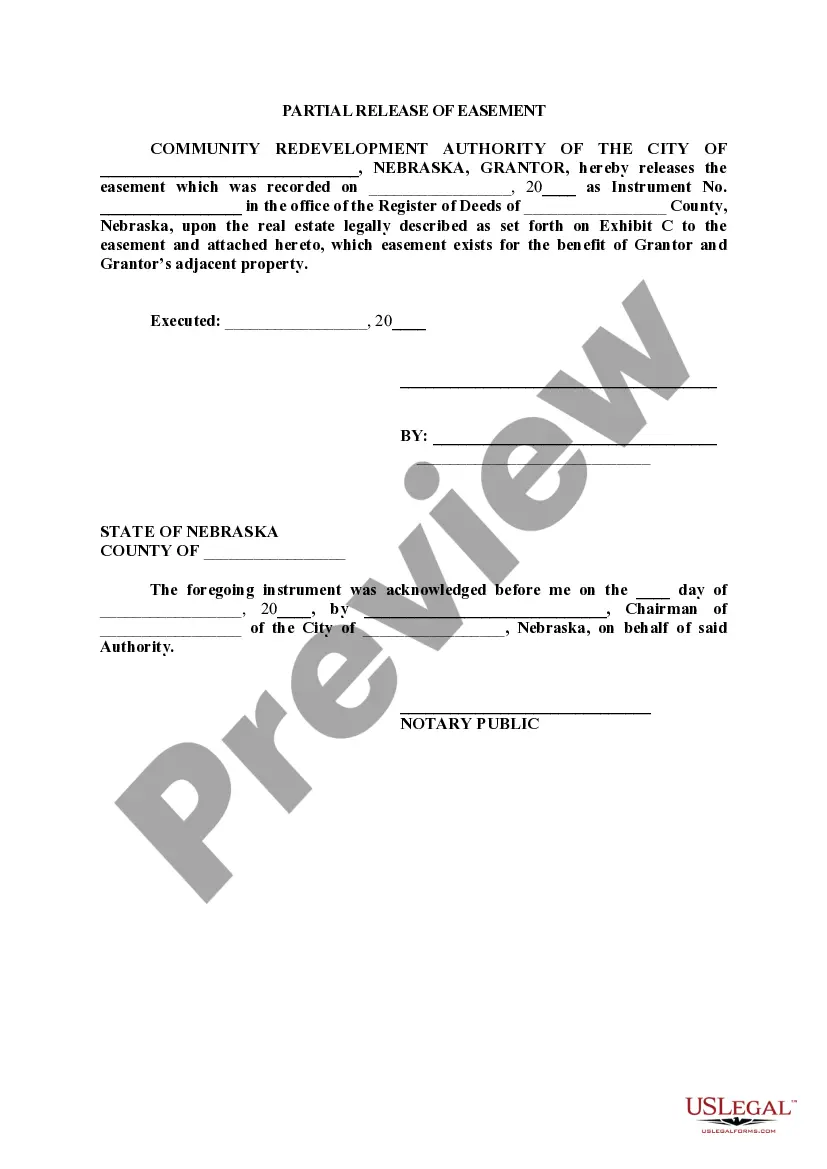

- Utilize the Preview function and look at the form description (if available) to be sure that it’s the best document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate template to your state and situation.

- Use the Search field at the top of the page if you need to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your sample in a required format to finish, create a hard copy, and sign the document.

As soon as you’ve followed the step-by-step recommendations above, you'll always have the ability to log in and download whatever document you need for whatever state you need it in. With US Legal Forms, completing Guaranty of Open Account - Alternate Form templates or any other legal documents is simple. Get started now, and don't forget to recheck your examples with accredited lawyers!

Form popularity

FAQ

Can you open a bank account online for free? There are free online bank accountsboth checking and savingsthat require no deposit. Some banks will require you to put a little money in your account when you create it. This is called a minimum opening deposit, and it can vary based on the type of account you choose.

Decide the Type of Bank Account you want to Open. Approach any Bank of choice & meet its Bank Officer. Fill up Bank Account Opening Form - Proposal Form. Give References for Opening your Bank Account. Submit Bank Account Opening Form and Documents.

An account opening form is filled in by someone opening an account with a bank, credit union, or other financial institution. It provides the bank with important details like contact info, monthly salary, home address, and more, so they have all the information they need to create a new bank account.

Bank Account Initial Deposit When you open a bank account, you'll often need to make an opening deposit. This deposit amount will vary based on the bank and account type. Many checking accounts require a deposit of at least $25, and some may require a minimum deposit amount to avoid fees.

You can open a bank account for someone else, but only if you are a co-owner of the account. If opening the account at a branch location, you will have to bring the other person with you. You can't open an account for another person if he or she is the sole owner of the account, even if you are related.

Driving Licence. Voters' Identity Card. PAN Card. Aadhaar Card issued by UIDAI and.

Choose the type of savings account you would like to open. Step 2: Visit the nearest bank branch of your choice and take along a copy of your identity proof, age proof, address proof, income/employment proof (if necessary), and photographs.

Choose a Bank or Credit Union. Visit the Bank Branch or Website. Pick the Product You Want. Provide Your Information. Your Financial History. Consent to the Terms. Print, Sign, and Mail (If Required) Fund Your Account.

First off, you need to bring at least one form of photo ID. Some banks may require two forms of identification. These forms can be a state ID, Social Security card, passport or birth certificate. You will need to provide personal information like your date of birth, physical address and phone number.

There are no credit score requirements to open a checking account with U.S. Bank, since it is not a line of credit. However, U.S. Bank could check your ChexSystems reporter for more information on your past history.