Guaranty of Promissory Note by Individual - Corporate Borrower

Description

How to fill out Guaranty Of Promissory Note By Individual - Corporate Borrower?

Aren't you tired of choosing from countless samples every time you require to create a Guaranty of Promissory Note by Individual - Corporate Borrower? US Legal Forms eliminates the wasted time an incredible number of Americans spend exploring the internet for suitable tax and legal forms. Our skilled crew of lawyers is constantly updating the state-specific Samples library, so it always has the right documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Users who don't have a subscription should complete a few simple actions before having the capability to get access to their Guaranty of Promissory Note by Individual - Corporate Borrower:

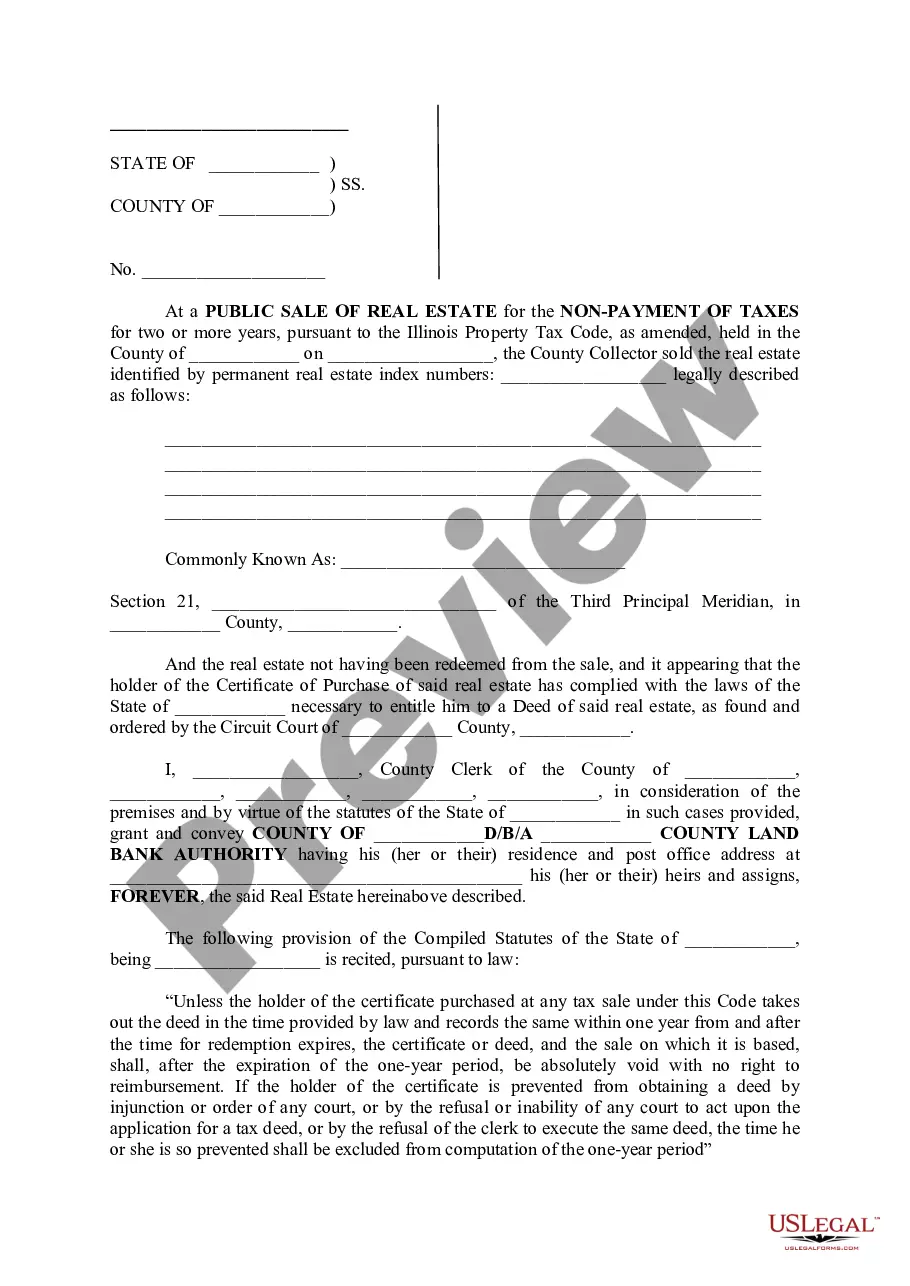

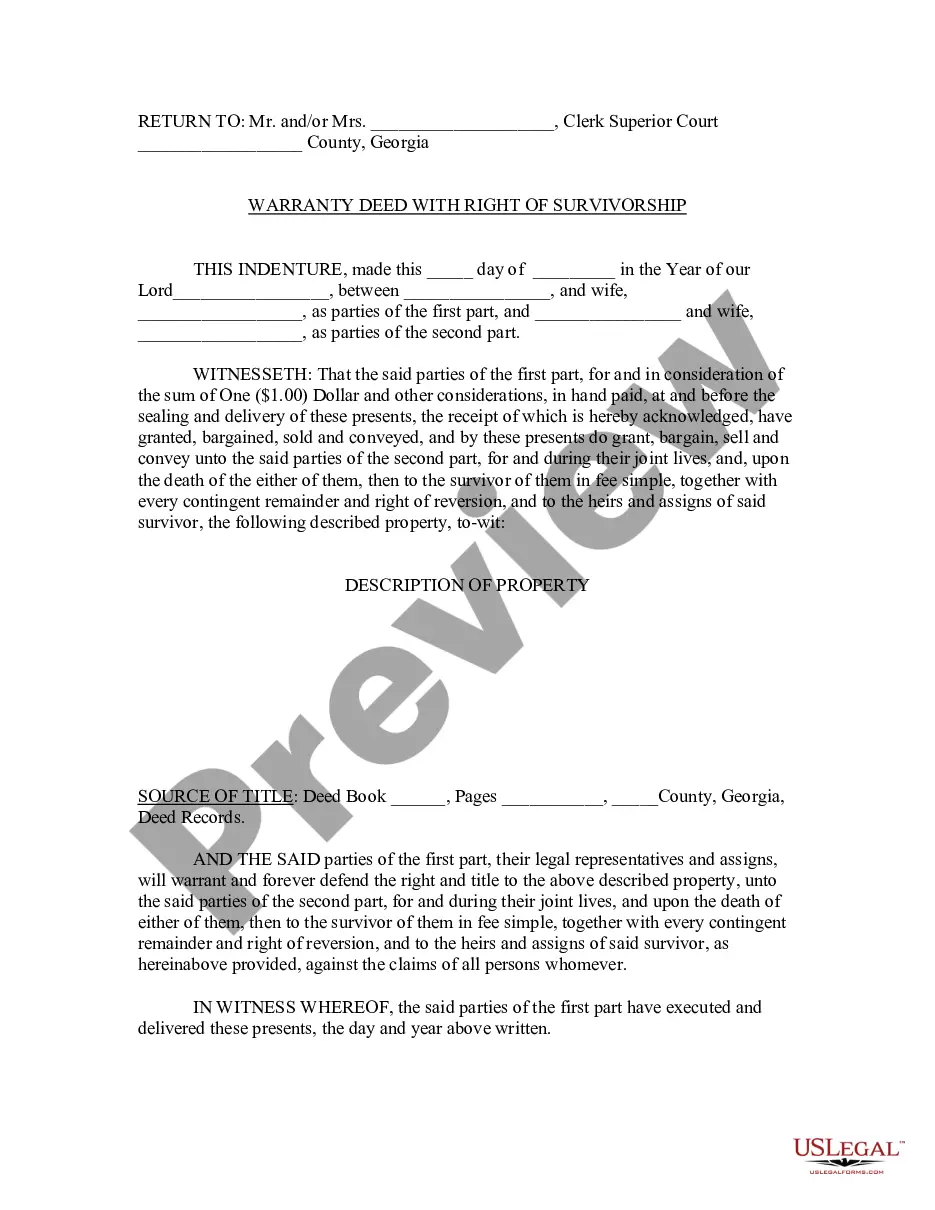

- Utilize the Preview function and read the form description (if available) to make certain that it is the right document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the proper sample for the state and situation.

- Use the Search field on top of the webpage if you want to look for another document.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your template in a needed format to complete, print, and sign the document.

Once you’ve followed the step-by-step recommendations above, you'll always have the ability to log in and download whatever document you require for whatever state you want it in. With US Legal Forms, finishing Guaranty of Promissory Note by Individual - Corporate Borrower templates or other official paperwork is easy. Begin now, and don't forget to recheck your samples with certified lawyers!

Form popularity

FAQ

Summary. A corporate guarantee is a legal agreement between a borrower, lender, and guarantor, whereby a corporation (e.g., an insurance company) takes responsibility for the debt repayment of the borrower provided it faced bankruptcy. A personal guarantee is a similar document to the corporate guarantee.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

As per Section 186 a company cannot give any loan or guarantee or provide security in connection with a loan to any other body corporate or person: exceeding sixty per cent. of its paid-up share capital, free reserves and securities premium account or one hundred per cent.

A personal guarantee is a promise made by a person or an organization (the guarantor) to accept responsibility for some other party's debt (the debtor) if the debtor fails to pay it.A guarantor can be any party, including an individual or another organization, with a credit history.

That's why your promissory note could include a personal guarantee. Since a promissory note is basically just an IOU, a lender will want some kind of collateral to secure the loan.With a business loan, a personal guarantee means that you -- not your business -- are personally responsible for the loan.

The main difference between a bank guarantee and corporate guarantee is, in a bank guarantee the bank is providing assurance for repayment in defaults but in a corporate guarantee, the guarantor has the responsibility of repayment in defaults.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

Section 186 of the 2013 Act requires that a company will not (i) give loans to any person/other body corporate, (ii) give guarantee or provide security in connection with a loan to any person/body corporate and (iii) acquire securities of any other body corporate, exceeding the higher of (a) 60% of its paid-up share