Sample Letter for Agreement to Extend Debt Payment

Description Agreement Payment Fill

How to fill out Letter Of Agreement For Payment?

Among countless free and paid templates that you can find on the web, you can't be certain about their accuracy and reliability. For example, who made them or if they are qualified enough to take care of what you need those to. Always keep relaxed and utilize US Legal Forms! Discover Sample Letter for Agreement to Extend Debt Payment templates developed by professional attorneys and avoid the high-priced and time-consuming procedure of looking for an attorney and then paying them to draft a document for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the file you are searching for. You'll also be able to access all of your earlier saved samples in the My Forms menu.

If you are utilizing our website for the first time, follow the guidelines below to get your Sample Letter for Agreement to Extend Debt Payment easily:

- Make sure that the document you find applies where you live.

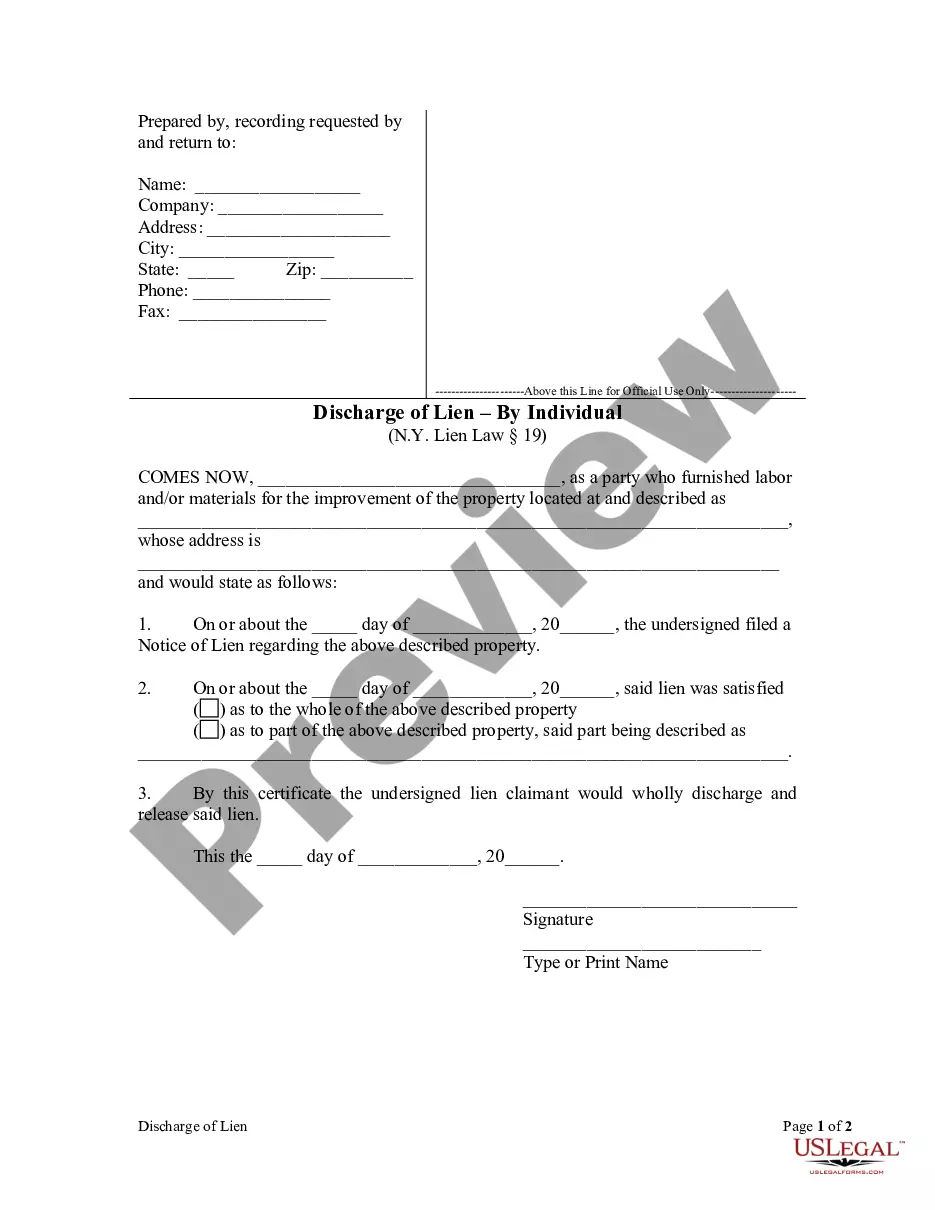

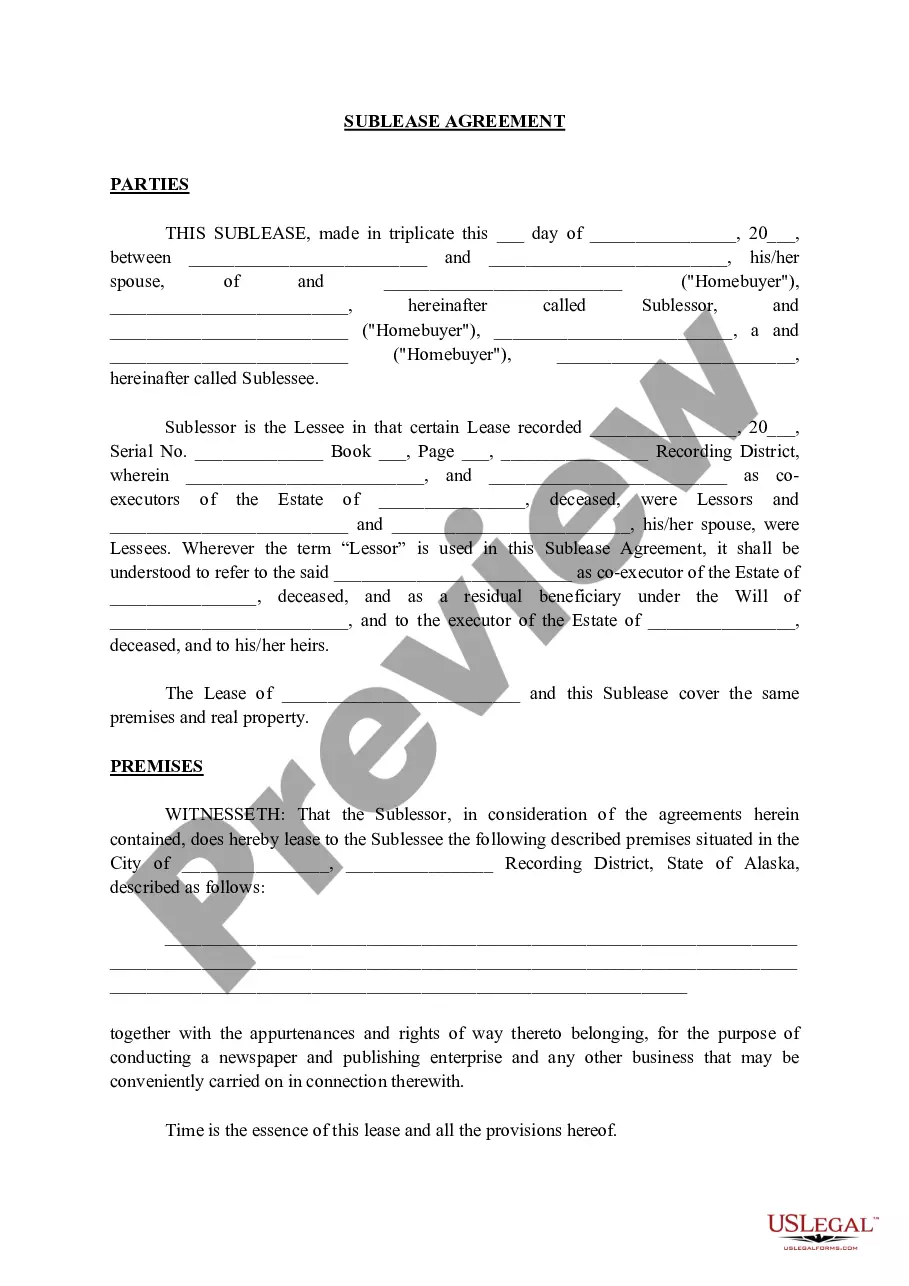

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering process or find another sample utilizing the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

Once you’ve signed up and paid for your subscription, you can utilize your Sample Letter for Agreement to Extend Debt Payment as many times as you need or for as long as it stays active in your state. Change it in your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Agreement Debt Form popularity

Agreement Payment Pdf Other Form Names

Payment Agreement Letter Format FAQ

The creditor and/or debt collectors name. The date the letter was drafted. Your name. Your account number.

Use formal and polite language. Give date expecting to return. Be brief about the reason for the extension. Express your gratitude in advance. Apologize for the inconvenience.

Due to an unexpected emergency that has occurred, I will be unable to make this payment by the date I am requesting an extension of time to make this payment. If you review my file, I believe you will find that my payments have generally been made in a timely fashion.

A clear subject line detailing what the email is about. An opening line that's warm. State the purpose of the email in a non-harassing tone (include amount owed, invoice number, and due date) Inquire about the progress of the invoice.

Offer a specific dollar amount that is roughly 30% of your outstanding account balance. The lender will probably counter with a higher percentage or dollar amount. If anything above 50% is suggested, consider trying to settle with a different creditor or simply put the money in savings to help pay future monthly bills.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

Original creditor and collection agent's company name. Date the letter was written. Your name. Your account number. Outstanding balance owed on the account (optional) Amount agreed to as settlement. Terms and amounts of payments to be made (if not a lump-sum)

The request for extension should be made up to two months from the schedule due date of payment of fee. There should not be any dues pending for the previous term(s). For this the parent of the student should send an application (as per annexure-I) citing the reason for extension in payment of fee.

Your company name and address. recipient's name and address. today's date. a clear reference and/or any account reference numbers. the amount outstanding. original payment due date. a brief explanation that no payment has been received.