Restricted Endowment to Educational, Religious, or Charitable Institution

Description

How to fill out Restricted Endowment To Educational, Religious, Or Charitable Institution?

Aren't you tired of choosing from numerous samples every time you require to create a Restricted Endowment to Educational, Religious, or Charitable Institution? US Legal Forms eliminates the lost time millions of American people spend surfing around the internet for suitable tax and legal forms. Our professional group of attorneys is constantly changing the state-specific Forms collection, to ensure that it always provides the proper files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form may be found in the My Forms tab.

Users who don't have an active subscription should complete easy steps before being able to get access to their Restricted Endowment to Educational, Religious, or Charitable Institution:

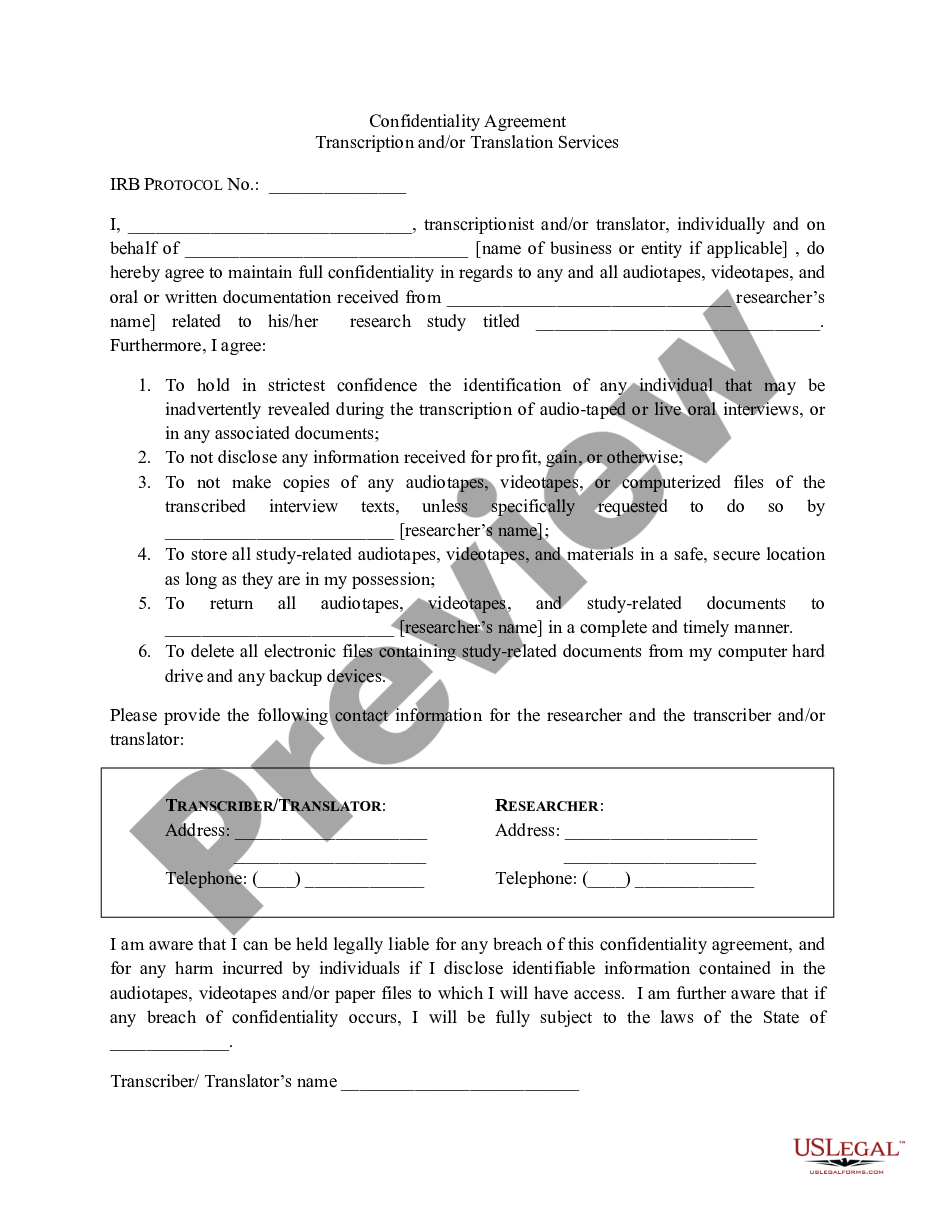

- Utilize the Preview function and read the form description (if available) to make certain that it’s the appropriate document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the proper template to your state and situation.

- Make use of the Search field at the top of the site if you need to look for another file.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your document in a needed format to complete, print, and sign the document.

As soon as you have followed the step-by-step recommendations above, you'll always have the capacity to log in and download whatever document you require for whatever state you require it in. With US Legal Forms, finishing Restricted Endowment to Educational, Religious, or Charitable Institution templates or any other official files is simple. Get started now, and don't forget to recheck your samples with accredited lawyers!

Form popularity

FAQ

The first, or sometimes called a true endowment, is a gift permanently restricted by the donor, whereas a temporary or term endowment is only temporarily restricted.

Endowment funds are established to fund charitable and nonprofit institutions such as churches, hospitals, and universities. Donations to endowment funds are tax-deductible.

Financial endowments are typically structured, so the principal amount invested remains intact, while investment income is available for immediate funding for use to keep a nonprofit company operating efficiently.Endowments also may be given with specific uses stated by the donor, further complicating disbursements.

Tax Implications In the case of an endowment, tax on investment income is withheld and dealt with, within the investment itself at a rate of 30% for a natural person. Interest earned within an endowment will be taxed at the 30% rate from the first Rand.

An endowment is a donation of money or property to a nonprofit organization, which uses the resulting investment income for a specific purpose.Most endowments are designed to keep the principal amount intact while using the investment income for charitable efforts.

Endowments are donations, usually of money or other financial assets, made to nonprofit organizations with the sole intention of investment to earn additional income, and can thus last in perpetuity. Endowment funds often come with caveats stating how much of each year's income can be spent by the charity.

Restricted funds may be restricted income funds, which are expendable at the discretion of the trustees in furtherance of some particular aspect(s) of the objects of the charity, or they may be capital funds, where the assets are required to be invested, or retained for actual use, rather than expended.

A You will be pleased to hear that no, you won't face a tax bill on the proceeds when your policy matures. Although the fund that your regular premiums are invested in pays tax, the proceeds are tax-free at maturity, even if you are a higher rate taxpayer.

Typically you can claim your donations of money and goods if you itemize your tax deductions.This will be something for taxpayers to keep in mind since close to 90% of taxpayers now claim the standard deduction instead of itemizing and are no longer able to deduct charitable contributions under tax reform.