Oil, Gas and Mineral Royalty Transfer

Description

How to fill out Oil, Gas And Mineral Royalty Transfer?

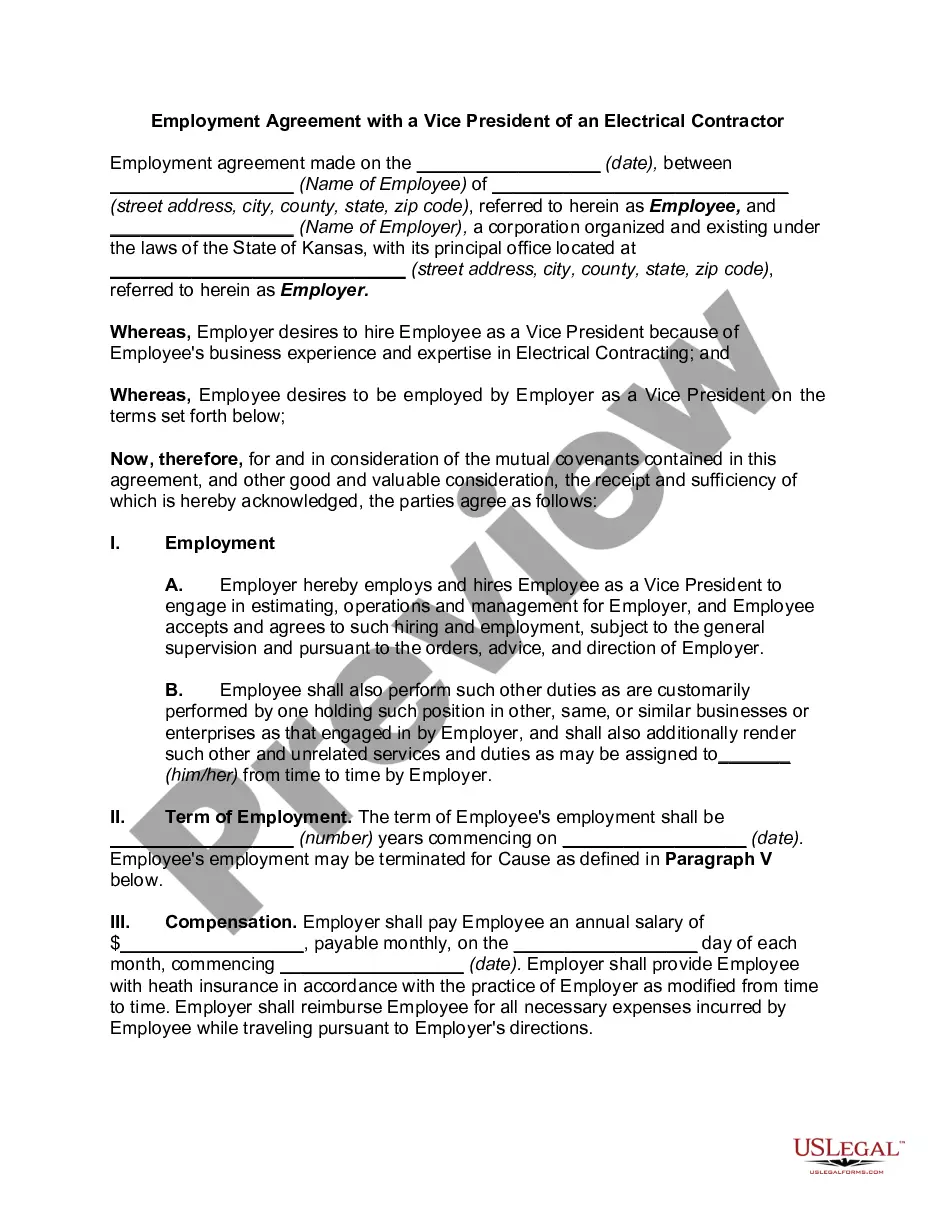

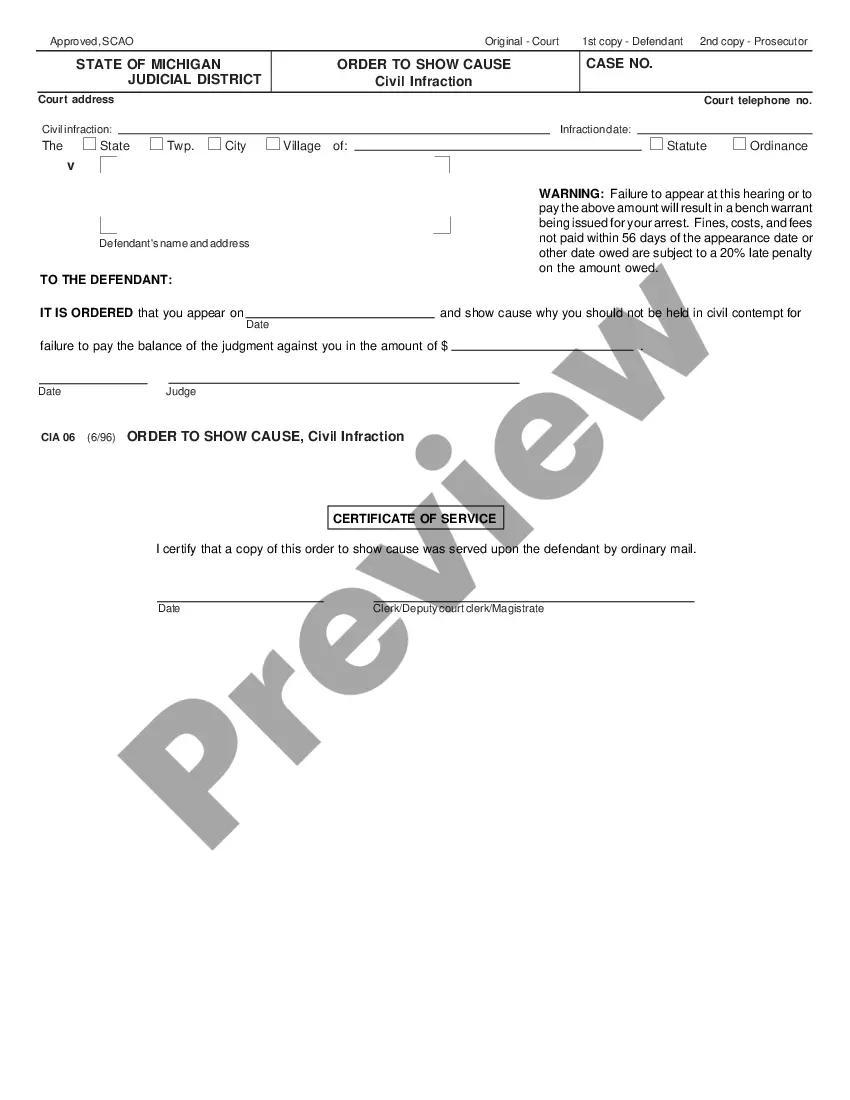

Aren't you tired of choosing from countless templates every time you want to create a Oil, Gas and Mineral Royalty Transfer? US Legal Forms eliminates the wasted time an incredible number of American citizens spend exploring the internet for appropriate tax and legal forms. Our expert group of lawyers is constantly changing the state-specific Templates collection, to ensure that it always offers the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have an active subscription should complete simple steps before having the capability to get access to their Oil, Gas and Mineral Royalty Transfer:

- Use the Preview function and look at the form description (if available) to make certain that it is the correct document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the right sample to your state and situation.

- Make use of the Search field at the top of the web page if you have to look for another document.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your sample in a convenient format to finish, create a hard copy, and sign the document.

As soon as you have followed the step-by-step instructions above, you'll always be capable of log in and download whatever document you need for whatever state you want it in. With US Legal Forms, completing Oil, Gas and Mineral Royalty Transfer templates or other official paperwork is not difficult. Get started now, and don't forget to look at the samples with accredited attorneys!

Form popularity

FAQ

Mineral rights have sold for as high as $40,000 per acre, and usually, the average price can be between $250 and $9,000. If mineral rights buyers and sellers conduct proper due diligence, both parties can negotiate the best mining rights deal and avoid future legal quagmires.

Mineral interests and royalty interests both involve ownership of the minerals under the ground. The main difference between the two is that the owner of a mineral interest has the right to execute leases and collect bonus payments and the owner of royalty interests does not execute leases or collect bonus payments.

The lessee is required to pay a certain amount in respect of the mineral extracted in proportion to the quantity extracted. Such payment is called royalty. Royalty is calculated on the quantity of minerals extracted or removed. The owner of the land is called lessor.

Investing in mineral rights is a complex investment strategy but can be a profitable real estate venture.Then investing in mineral rights may be a great fit for your next real estate venture. Investing in mineral rights has the potential to provide big returns.