Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act

Description What Is A Successor Custodian

How to fill out Custodian Uniform Minors?

Aren't you tired of choosing from numerous samples every time you require to create a Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act? US Legal Forms eliminates the lost time countless American people spend surfing around the internet for ideal tax and legal forms. Our skilled team of lawyers is constantly upgrading the state-specific Templates collection, so that it always provides the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription need to complete simple actions before having the ability to download their Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act:

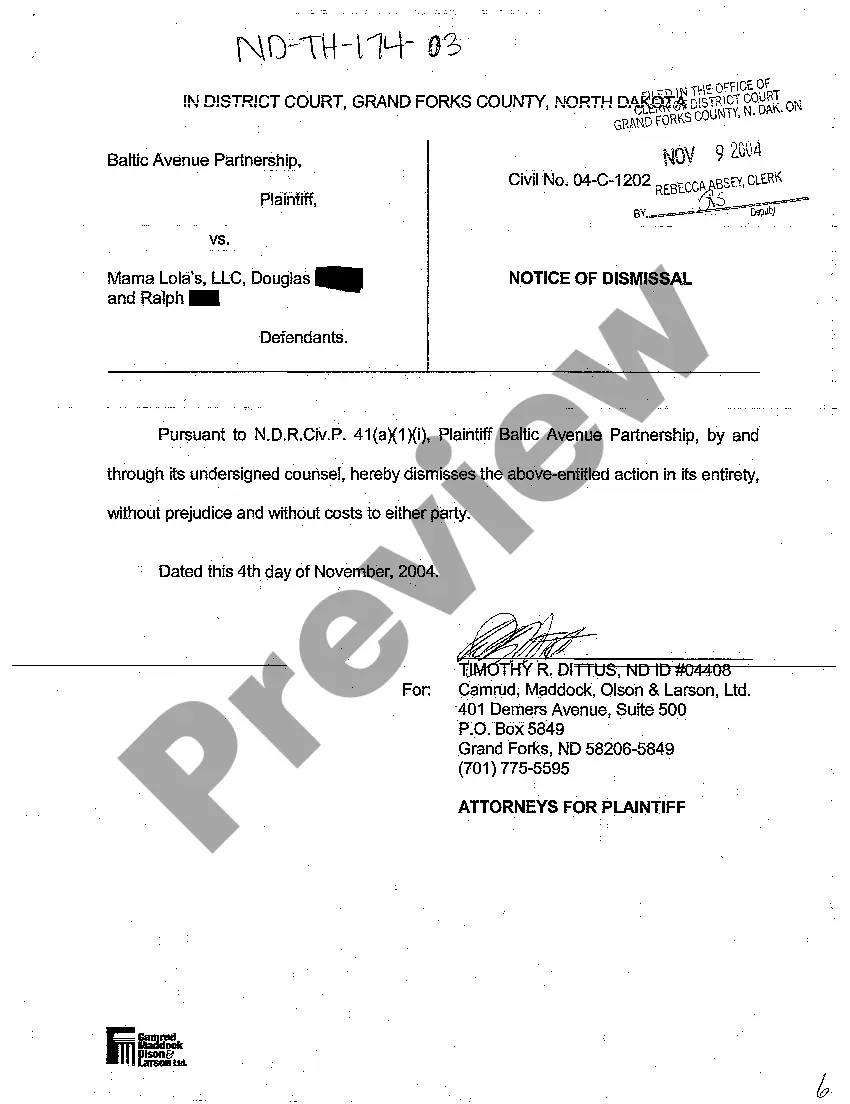

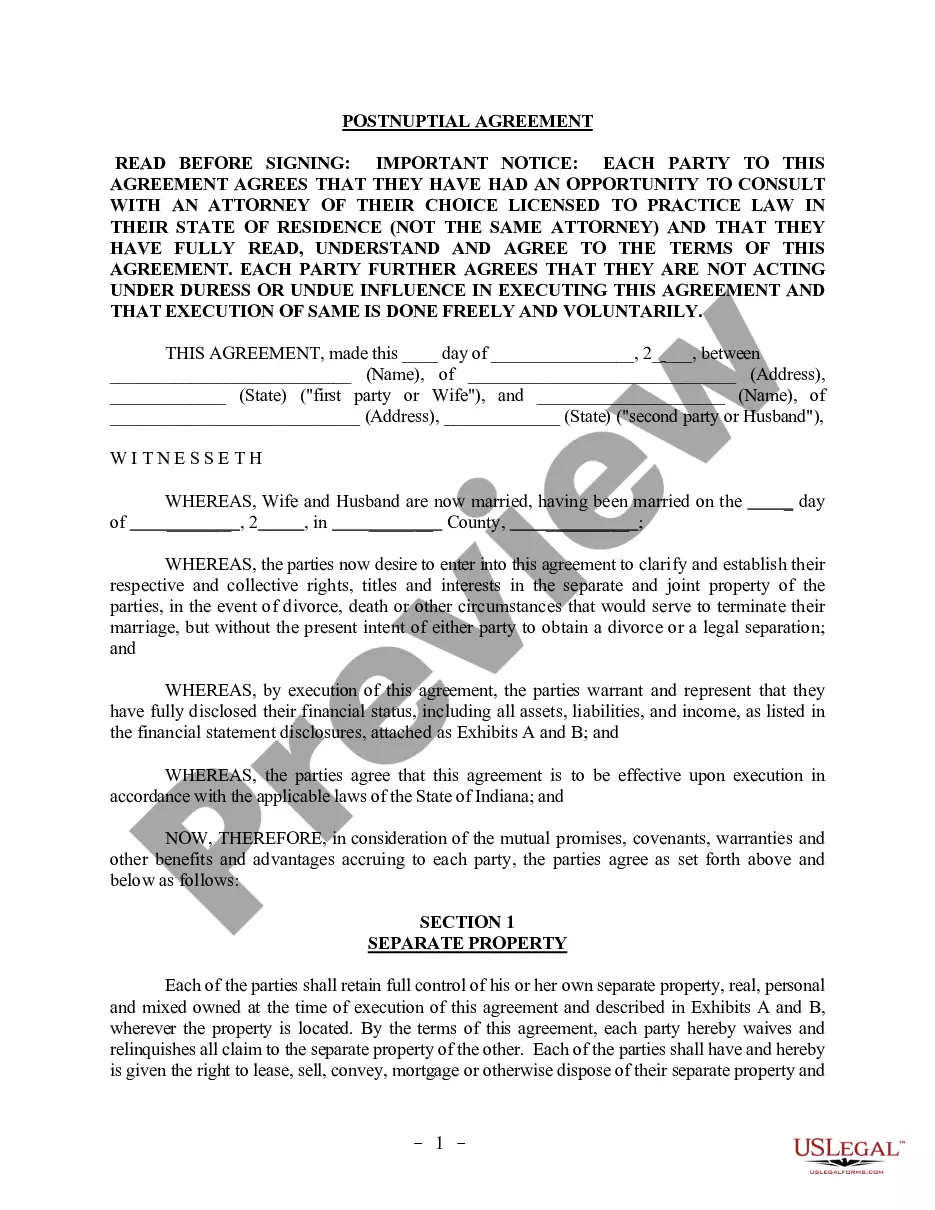

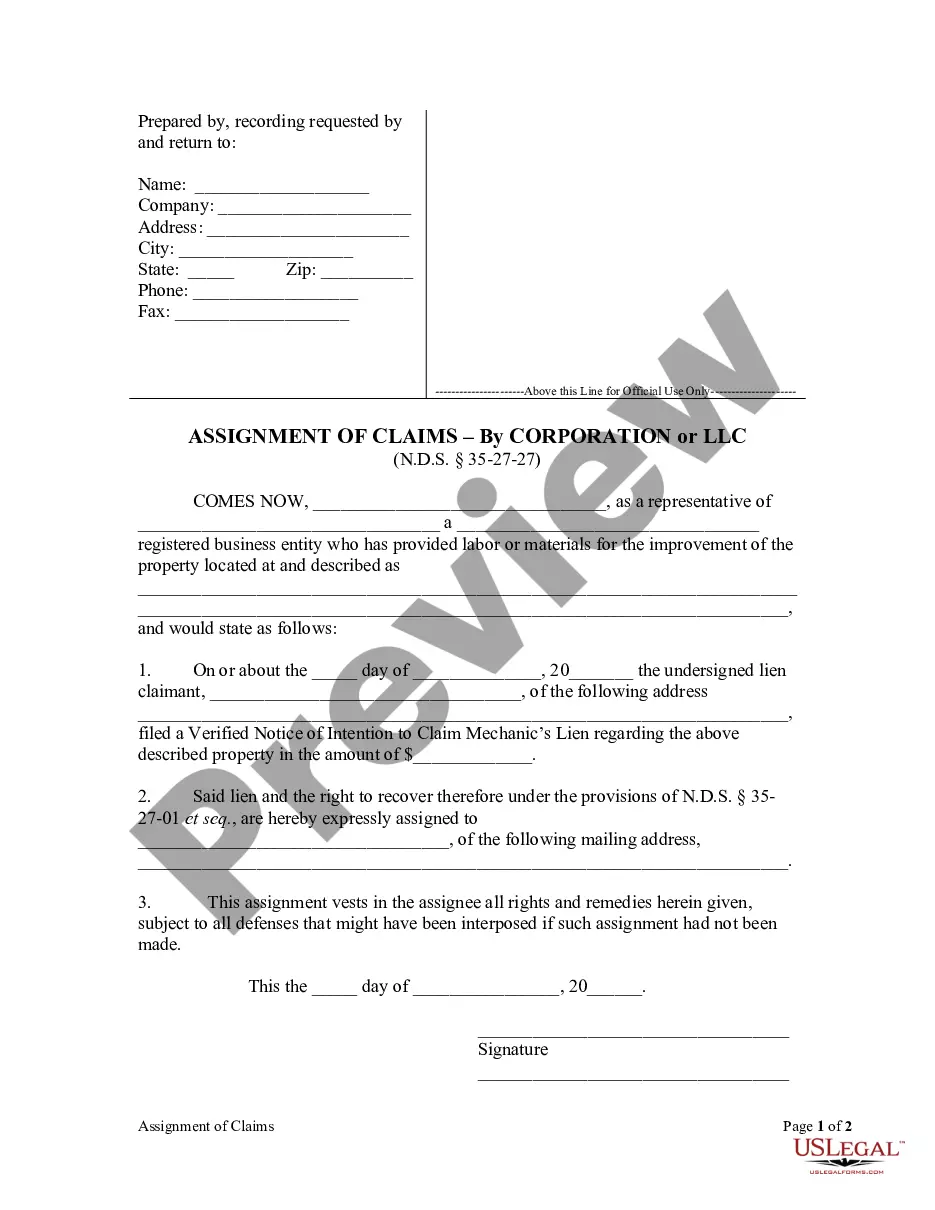

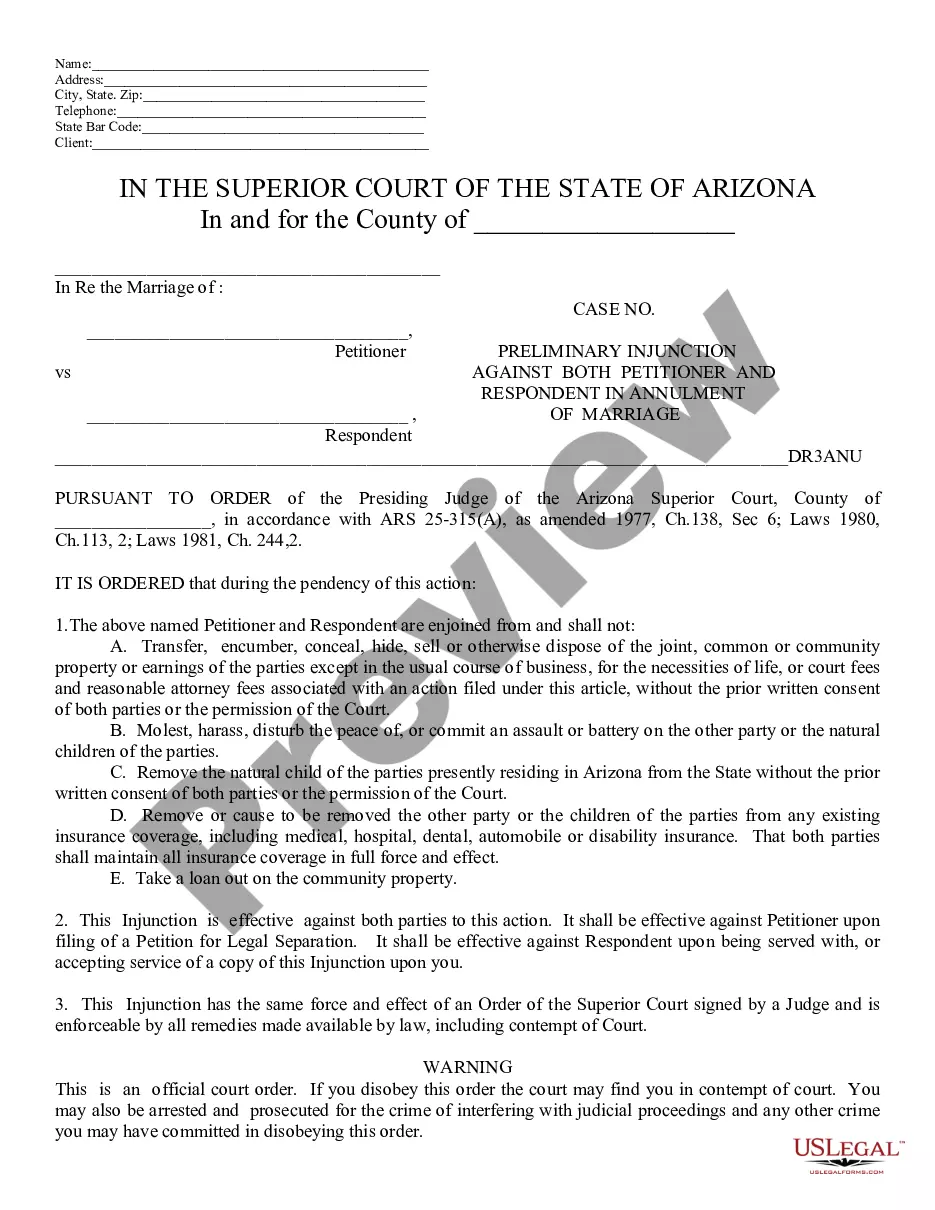

- Make use of the Preview function and look at the form description (if available) to make certain that it is the best document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the right template for your state and situation.

- Utilize the Search field at the top of the web page if you need to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your sample in a convenient format to complete, print, and sign the document.

After you have followed the step-by-step instructions above, you'll always be capable of log in and download whatever document you will need for whatever state you want it in. With US Legal Forms, completing Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act templates or any other official paperwork is not hard. Begin now, and don't forget to examine your examples with accredited lawyers!

Successor Custodian Utma Form Form popularity

Successor Custodian Form Other Form Names

Utma Washington State FAQ

A custodial account will automatically close when the custodian releases the assets to the new adult. But the custodian has no authority to close a custodial account before then. A custodial account can only be transferred to another custodian on the child's behalf.

There is no ability to transfer a UGMA or UTMA account to another child or to change beneficiaries. You are not supposed to use a UTMA-529 or UGMA-529 account conversion to change the beneficiary either because that would equate to giving your child's money to someone else.

Every UTMA account has a designated custodian who can make withdrawals or cash in the account at any time. However, the cash can't be used for day-to-day expenses like groceries. It can be used for school outings, music lessons and other non-essentials that benefit the child.

Opening Custodial Account Whether more than one custodian can be listed on the account depends on state law and the policy of the individual bank. If two custodians are permitted, each will have authority to conduct transactions on the account, including withdrawals.

If a donor acting as the custodian dies before the account terminates, the account value will be included in the donor's estate for estate tax purposes. If a minor dies before the age of majority, a custodial account is considered part of the minor's estate and is distributed according to state law.

UTMA stands for the Uniform Transfers to Minors Act, which is the legal provision in many states that authorizes a custodian to hold assets on behalf of a minor child until the child reaches the age of majority -- typically either 18 or 21.

The Uniform Transfers to Minors Act (UTMA) allows an adult to transfer assets to a minor by opening a custodial account. This type of account is managed by an adult the custodian who holds onto the assets until the minor reaches a certain age, usually 18 or 21.

(A) Any person who is eighteen years of age or older or a trust company is eligible to become a successor custodian. A successor custodian has all the rights, powers, duties, and immunities of a custodian designated in a manner prescribed by sections 5814.01 to 5814.10 of the Revised Code.