Option For the Sale and Purchase of Real Estate - Farm Land

Description Real Estate Agreement Contract

How to fill out Option Real Agreement?

Aren't you tired of choosing from numerous templates every time you require to create a Option For the Sale and Purchase of Real Estate - Farm Land? US Legal Forms eliminates the lost time countless American people spend surfing around the internet for appropriate tax and legal forms. Our professional group of attorneys is constantly upgrading the state-specific Samples library, to ensure that it always offers the proper files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Users who don't have a subscription should complete easy actions before being able to download their Option For the Sale and Purchase of Real Estate - Farm Land:

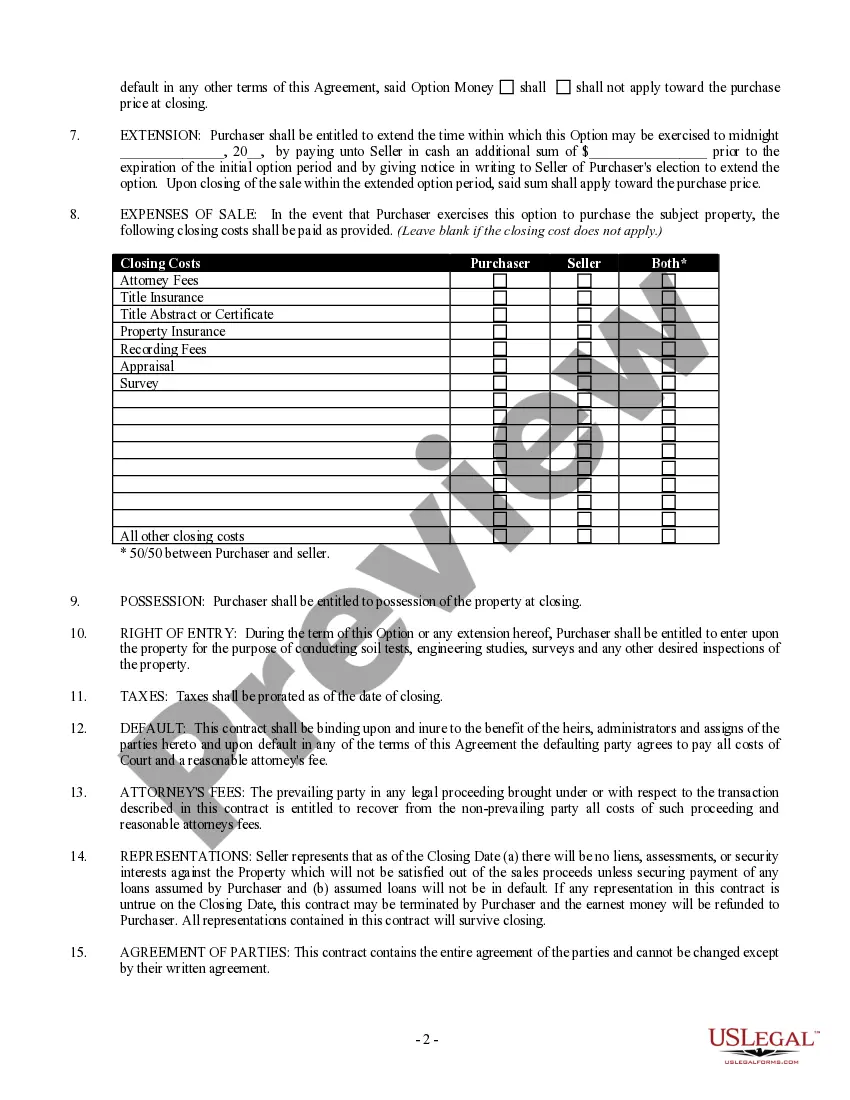

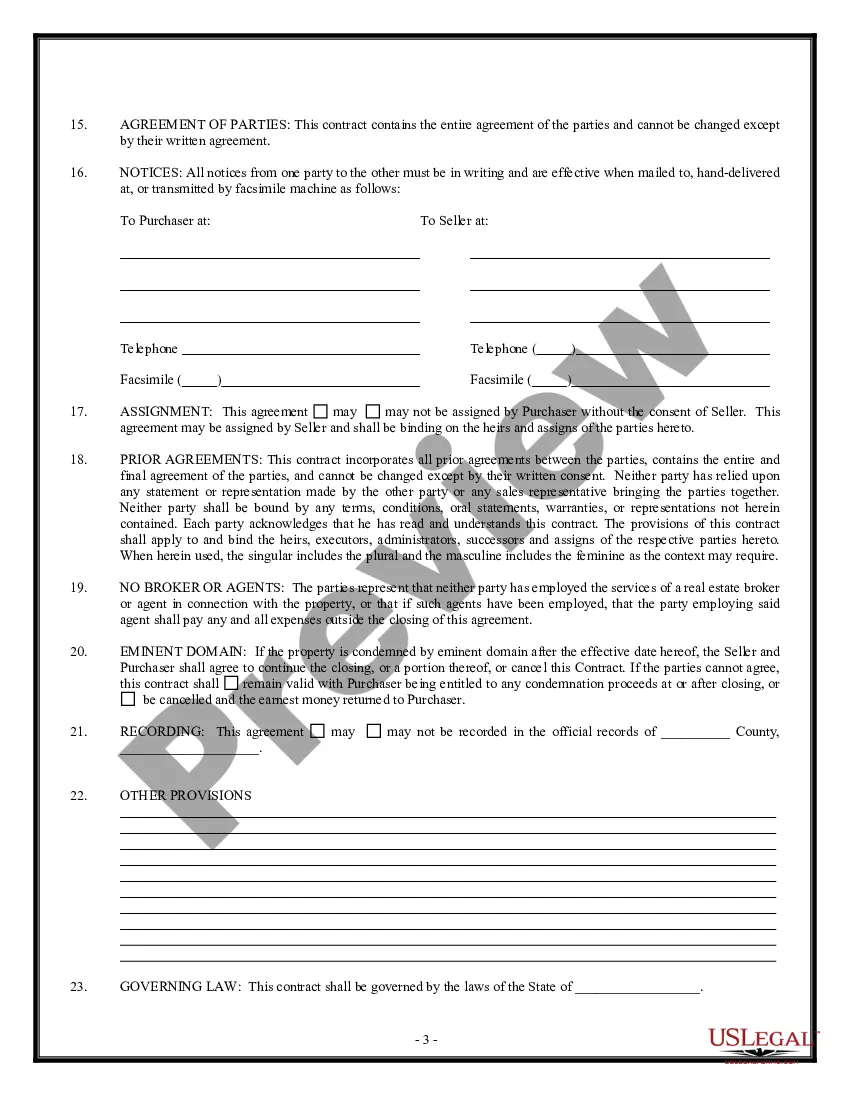

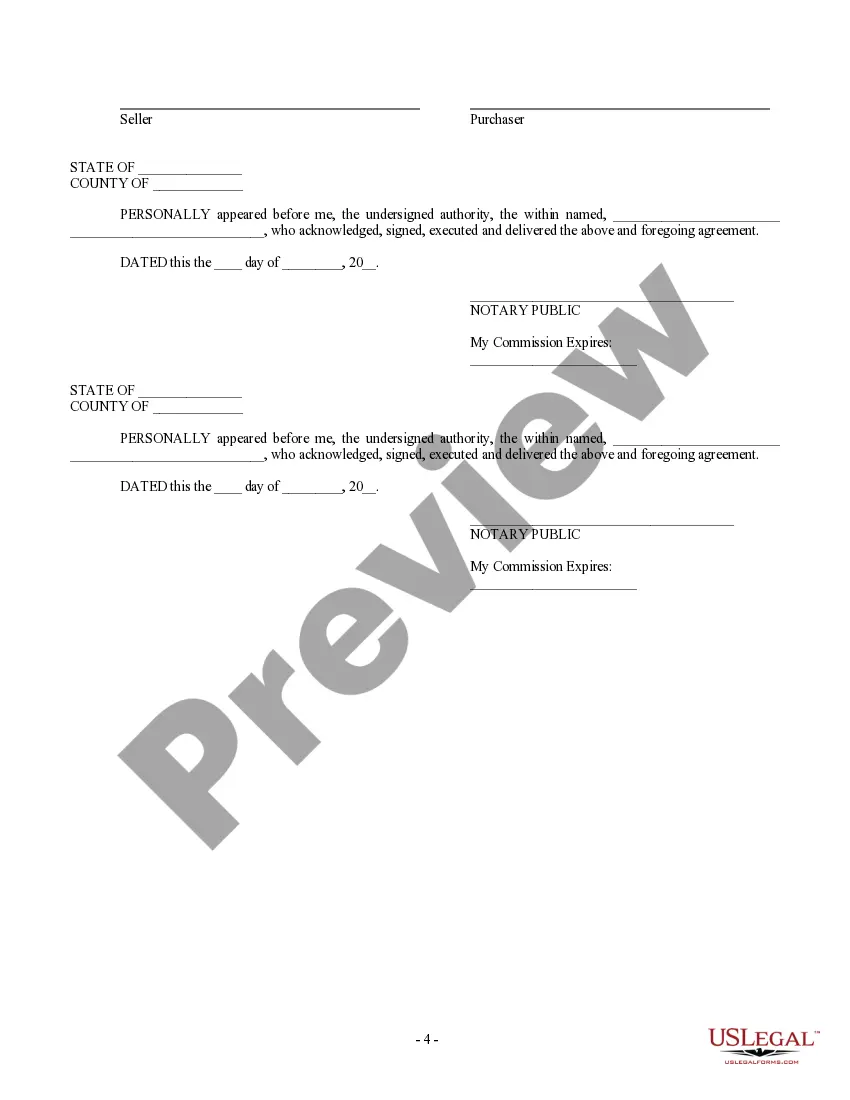

- Use the Preview function and look at the form description (if available) to make sure that it’s the best document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right sample to your state and situation.

- Utilize the Search field at the top of the page if you need to look for another document.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your sample in a required format to finish, print, and sign the document.

As soon as you’ve followed the step-by-step recommendations above, you'll always have the capacity to sign in and download whatever document you need for whatever state you require it in. With US Legal Forms, finishing Option For the Sale and Purchase of Real Estate - Farm Land samples or other official files is not difficult. Begin now, and don't forget to look at the samples with accredited lawyers!

Option Sale Estate Form popularity

Sale Purchase Agreement Other Form Names

Option Land FAQ

The closest that an investor can get to owning a farm without actually doing so is by investing in a farming-focused real estate investment trust (REIT). Some examples include Farmland Partners Inc. (FPI) and Gladstone Land Corporation (LAND). These REITs typically purchase farmland and then lease it to farmers.

Use a reputable agent. Check planning restrictions and legal responsibilities. Inspect farm infrastructure. Check access to markets and services. Understand land and water. Consider weeds and pests. Assess natural resources. Meet the neighbours and assess any land use impacts.

You may want to operate the land yourself, or sell it and lease it back to maintain a stream of income. If you don't have farming experience, you may want to hold onto the land and lease it out to earn farmland rental income.

Down Payment loans require loan applicants to provide 5 percent of the purchase price of the farm. As established by the Beginning Farmer definition, loan applicants interested in the Down Payment loan may not own more than 30 percent of the average size farm at the time of the application.

As a result, farmland is a red-hot investment right now, and, according to Marketwire, has appreciated at a rate 2% higher than inflation since the 1950s. Historically, farmland also offers higher total returns than many other types of real estate investments, and also exhibits a much lower level of risk.

West-Central Texas. $600/acre. Annual land payment: $50/acre. Central Wisconsin. $5,000/acre. South-Central Florida. $10,000/acre. Northern Missouri. $1,400/acre. Eastern Ohio. $5,000/acre. Southwest Iowa. $4,000/acre. Southeastern Wyoming. $4,000/acre (irrigation in place) Eastern North Dakota. $5,000/acre.

Learn About the Land's Previous Use. Test the Soil's Acidity and Nutrients. Observe the Farmland's Soil Drainage. Analyze the Agricultural Land's Topology. Research Access to Resources. Know Whether the Existing Infrastructure Meets Your Needs. Determine How Easily You Can Reach The Farmland That's for Sale.

Historically, farmland also offers higher total returns than many other types of real estate investments, and also exhibits a much lower level of risk. That's because farmland continues to produce product that are in high demand and likely always will be: meats, grains, fruits, and vegetables.