Owner's and Contractor Affidavit of Completion and Payment to Subcontractors

Description

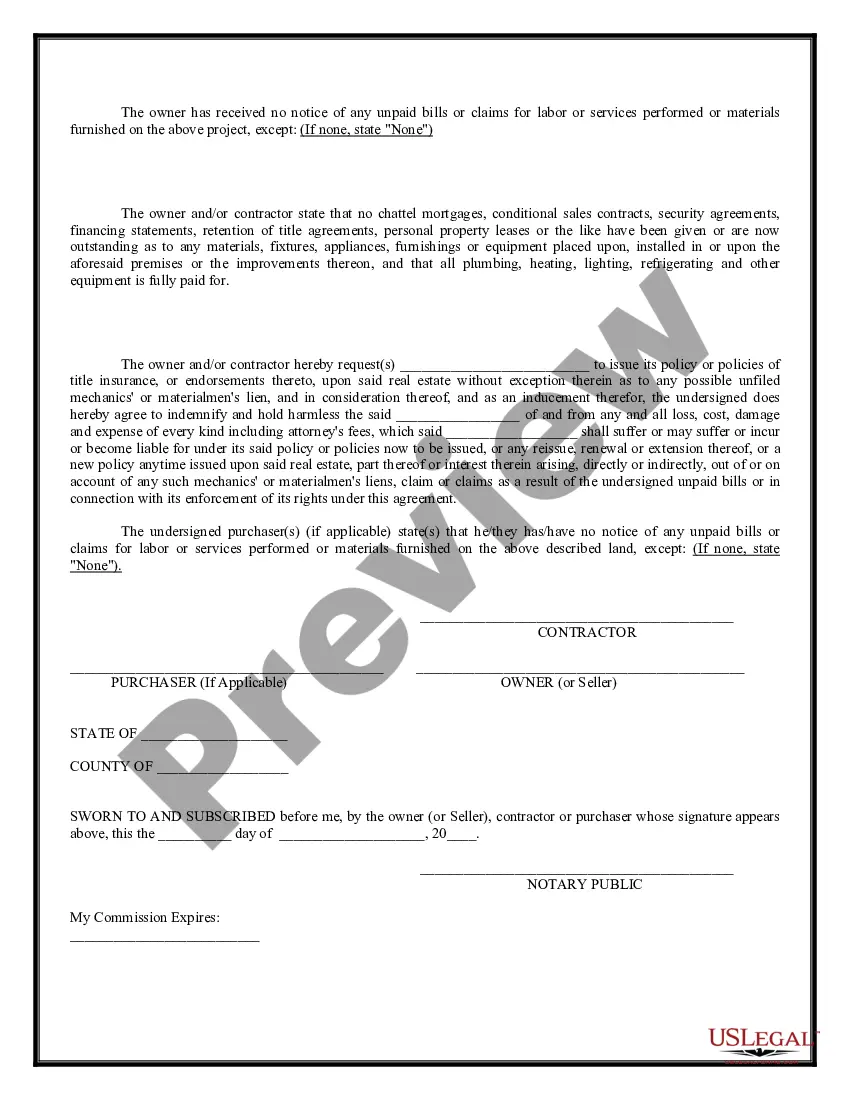

How to fill out Owner's And Contractor Affidavit Of Completion And Payment To Subcontractors?

Aren't you tired of choosing from countless samples each time you want to create a Owner's and Contractor Affidavit of Completion and Payment to Subcontractors? US Legal Forms eliminates the lost time millions of Americans spend surfing around the internet for suitable tax and legal forms. Our skilled group of lawyers is constantly modernizing the state-specific Samples library, to ensure that it always provides the right documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have a subscription need to complete quick and easy actions before being able to download their Owner's and Contractor Affidavit of Completion and Payment to Subcontractors:

- Make use of the Preview function and look at the form description (if available) to make sure that it’s the right document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the proper example to your state and situation.

- Make use of the Search field at the top of the web page if you want to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your template in a convenient format to complete, print, and sign the document.

After you’ve followed the step-by-step guidelines above, you'll always have the capacity to log in and download whatever file you require for whatever state you need it in. With US Legal Forms, completing Owner's and Contractor Affidavit of Completion and Payment to Subcontractors samples or other official files is not hard. Get going now, and don't forget to examine your examples with accredited attorneys!

Form popularity

FAQ

Determine How to Pay Contractors. Unlike with employees, you don't typically pay contractors a salary. Collect W-9 Form. Set Up a Contractor in the Payroll System. Process Payment to Independent Contractor. Send Form 1099-MISC.

The payment bond is backed by a surety company, and protects the owner and subcontractors. If a general contractor refuses to pay his subcontractors, they can make a claim against the payment bond. The surety company will pay out the subcontractors for at least part of their money and take the contractor to court.

You can withhold payments from a subcontractor if he does not perform the job in the time frame specified by contract.You cannot withhold payment from a subcontractor for work performed, but you can withhold time penalties and the cost of your damages until the issue is resolved in court.

The owner who disregards the terms of a contract by paying a subcontractor directly (leapfrogging) does so at its peril; the owner risks having to also pay the contractor for the same work or overpayment.Leapfrogging may abridge another subcontractor's mechanics lien rights or rights under a trust fund statute.

The law allows the government, contractors, and subcontractors to include a retainage provision in the contract that retains a specific amount from progress payments. However, the party must pay retainage within 30 days of final acceptance.

Under this doctrine, the subcontractor or supplier can sue the property owner for payment if the owner has not paid the general contractor for the particular work or materials. The theory is that the owner would be "unjustly enriched" if he were allowed to reap the benefit of the work or materials without paying.

A contractor who has been paid for a project and refuses to pay a subcontractor shall as a penalty, pay 2 percent of the amount due per month every month that the payment is not made. In addition, the prevailing party shall be entitled to his attorney's fees and costs.

Usually, anything that subcontractors would be liable for, general contractors may also be liable for (with the caveat that if the contractor has to pay for damages, the subcontractor who is legally responsible will often reimburse the general contractor).