Promissory Note - Payable on Demand

Description Promissory Note Pdf

How to fill out Demand Form Pdf?

Aren't you sick and tired of choosing from countless templates each time you require to create a Promissory Note - Payable on Demand? US Legal Forms eliminates the lost time countless American citizens spend searching the internet for suitable tax and legal forms. Our professional group of attorneys is constantly upgrading the state-specific Samples library, so it always has the proper documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have a subscription should complete a few simple steps before having the ability to get access to their Promissory Note - Payable on Demand:

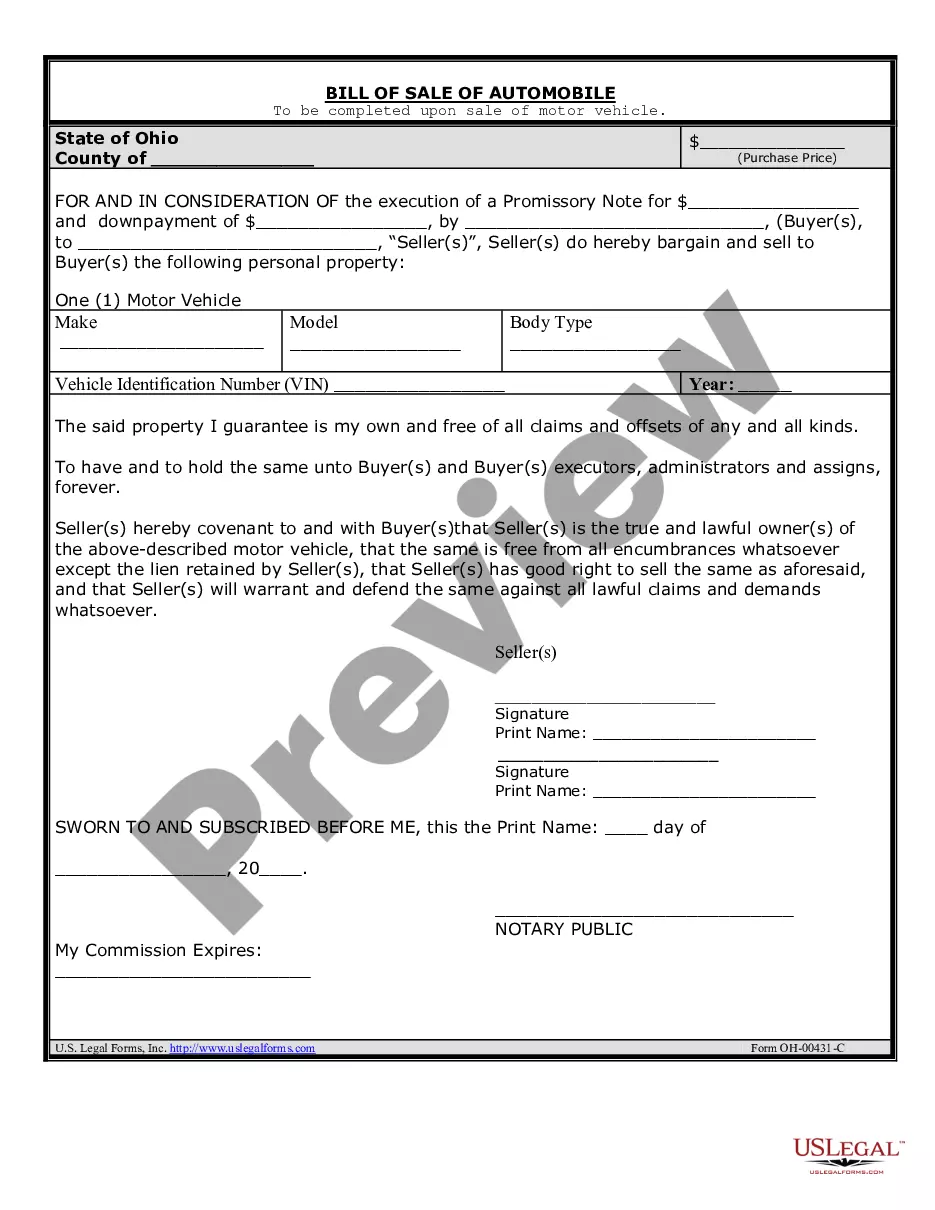

- Utilize the Preview function and read the form description (if available) to make certain that it is the best document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate example for your state and situation.

- Make use of the Search field at the top of the web page if you need to look for another file.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your document in a needed format to finish, print, and sign the document.

When you’ve followed the step-by-step guidelines above, you'll always be capable of sign in and download whatever document you want for whatever state you want it in. With US Legal Forms, completing Promissory Note - Payable on Demand samples or other legal documents is simple. Get going now, and don't forget to look at your examples with accredited attorneys!

Note Demand Form popularity

Promissory Note Demand Sample Other Form Names

Demand Form Draft FAQ

A demand note means that the balance owed does not have to be repaid until it is 'demanded' by the lender and the note does not have a specific end date listed.A promissory note, in contrast, can have the option for payment to be 'on demand' or at a specified date.

However, in California, the lender is not required to produce a Promissory Note to conduct a non-judicial foreclosure (also known as a Trustee's Sale).The Promissory Note is the debt instrument, just like an IOU. The person holding the original is the one the borrower has to pay.

The date of the letter. The names of the borrower and lender. The original amount of the loan. The date of the promissory note and any reference number or account number it contains. The payment schedule that was agreed upon.

All Promissory Notes are valid only for a period of 3 years starting from the date of execution, after which they will be invalid. There is no maximum limit in terms of the amount which can be lent or borrowed. The issuer / lender of the funds is normally the one who will hold the Promissory Note.

Promissory Notes In addition to the amount and the signature, any interest charged for the amount may also be stipulated in the note, as well as the name of the payee. If a promissory note has a date on it and the date has passed, that note can also be considered to be payable on demand.

The rule is merely a permissive one, permitting the use of an adhesive stamp on promissory notes payable on demand when the amount or value exceeds Rs. 250/-. The rule does not lay down that such a promissory note shall be stamped with adhesive stamp of the requisite value.

Full names of parties (borrower and lender) Repayment amount (principal and interest) Payment plan. Consequences of non-payment (default and collection) Notarization (if necessary) Other common details.

A written, signed, unconditional promise to pay a certain amount of money on demand at a specified time.The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.