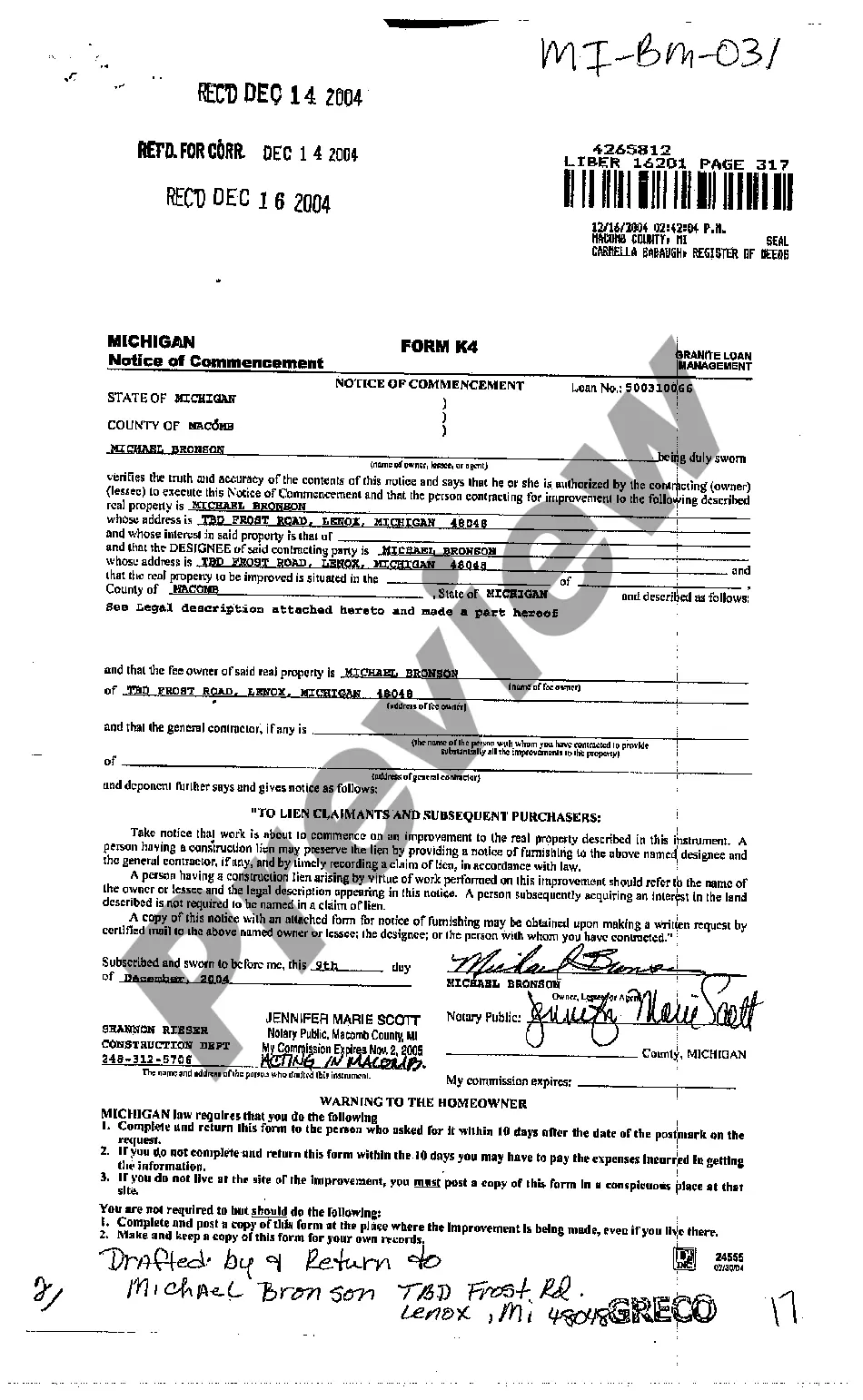

Agreement with Sales Representative to Sell Advertising and Related Services

Description Agreement Sales Services

How to fill out Agreement With Sales Representative To Sell Advertising And Related Services?

Aren't you tired of choosing from hundreds of templates each time you require to create a Agreement with Sales Representative to Sell Advertising and Related Services? US Legal Forms eliminates the lost time an incredible number of Americans spend searching the internet for ideal tax and legal forms. Our professional team of attorneys is constantly changing the state-specific Samples collection, to ensure that it always provides the proper files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Users who don't have a subscription need to complete easy actions before having the ability to download their Agreement with Sales Representative to Sell Advertising and Related Services:

- Use the Preview function and read the form description (if available) to make sure that it’s the correct document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the proper example to your state and situation.

- Utilize the Search field at the top of the site if you want to look for another document.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your template in a needed format to complete, print, and sign the document.

After you’ve followed the step-by-step recommendations above, you'll always be able to sign in and download whatever file you will need for whatever state you require it in. With US Legal Forms, completing Agreement with Sales Representative to Sell Advertising and Related Services templates or other official documents is simple. Get going now, and don't forget to recheck your examples with accredited attorneys!

Agreement Representative Services Form popularity

Agree Representative Sale Other Form Names

FAQ

1Sell to key retail accounts.2Contact new and existing customers to meet and exceed sales objectives.3Organize, rotate, and stock shelves during each store visit.4Participate in sales meetings and on-site training.5Negotiate and use persuasion skills to overcome objections.Sales Representative Job Description: Salary, Skills, & More\nwww.thebalancecareers.com > what-does-a-sales-representative-do-526065

An attorney or accountant who has his or her own office, advertises in the yellow pages of the phone book under Attorneys or Accountants, bills clients by the hour, is engaged by the job or paid an annual retainer, and can hire a substitute to do the work is an example of an independent contractor.

Make Sure You're Actually Ready to Hire Commission Only Sales Reps. Put Your Best Foot Forward. Provide the Sales Training that Your Reps and Teams Need. Explain Your Sales Process Clearly. Create the Right Power Dynamic.

Independent contractors typically are independent they set their own schedule, choose where to work and control what they do.Some companies may pay actors as independent contractors even if they should be classified as employees.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.

You must also include commissions as employee income on Form 941, your quarterly payroll tax report, and make periodic payments of these taxes to the IRS. Reporting Non-Employee Commissions.These workers are considered self-employed and the payments you give them are subject to self-employment taxes on these payments.

A sales agent is an independent contractor. They earn a percentage of what they sell or a commission based on sales.The sales rep is usually paid a salary with a commission or bonus based on how many sales she made. Sales reps usually work on the company premises.

A sales representative is the public face of a company.The enclosed document is an exclusive sales representative agreement. This means that the company is not entitled to hire additional representatives to sell the same products.

A commission agreement form includes some important information. It should contain the name and address of the business. Also, it should contain the name of the agent or employee involved in the contract. Finally, it should contain all the details of the commission-based payment.