Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust

Description Mortgage Deed Trust

How to fill out Sale Leaseback Form Agreement?

Aren't you tired of choosing from numerous samples every time you need to create a Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust? US Legal Forms eliminates the lost time countless American people spend exploring the internet for suitable tax and legal forms. Our skilled crew of lawyers is constantly changing the state-specific Templates collection, to ensure that it always has the appropriate documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

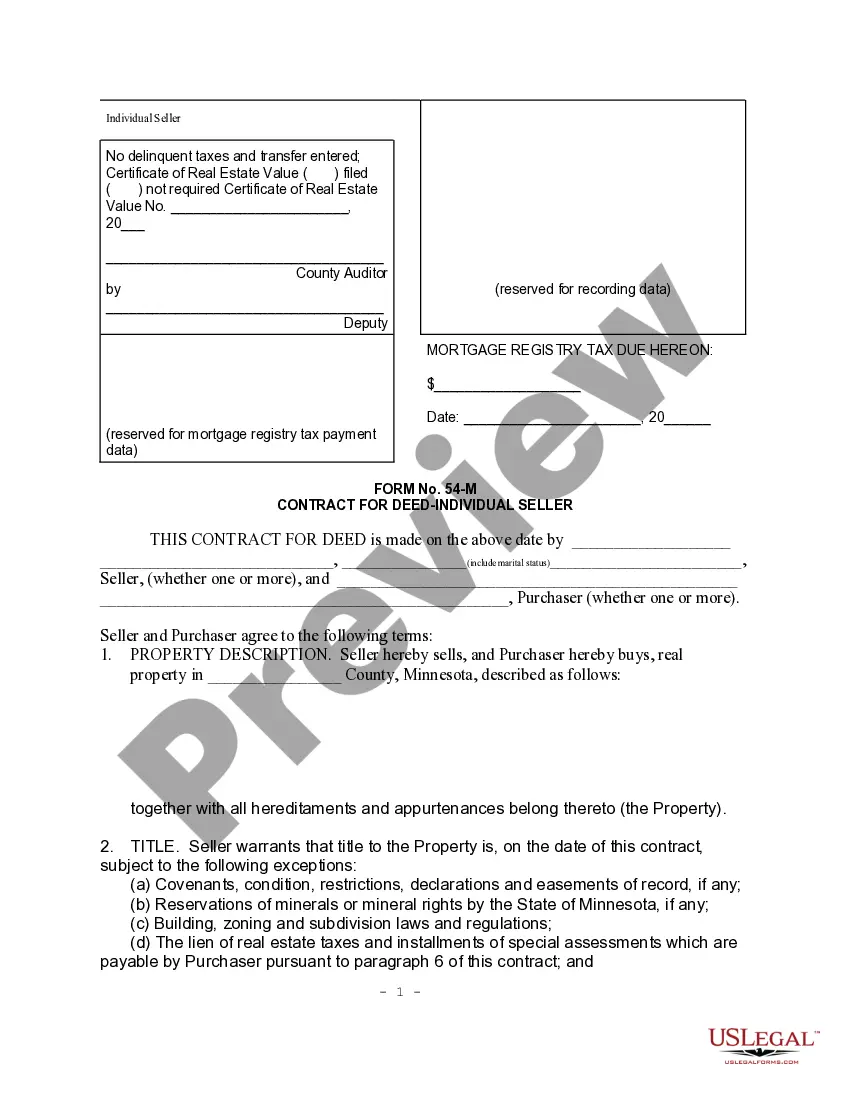

Visitors who don't have an active subscription should complete simple steps before having the ability to get access to their Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust:

- Use the Preview function and look at the form description (if available) to ensure that it is the proper document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the correct template to your state and situation.

- Make use of the Search field at the top of the webpage if you need to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your sample in a needed format to complete, print, and sign the document.

When you’ve followed the step-by-step guidelines above, you'll always have the capacity to log in and download whatever document you need for whatever state you require it in. With US Legal Forms, finishing Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust templates or any other official paperwork is simple. Begin now, and don't forget to look at the examples with accredited attorneys!

Contract Deed Form Sample Form popularity

States Mortgage Or Deed Of Trust Other Form Names

Apartment Building Note Secured Agreement FAQ

In a sale-leaseback, sometimes called a sale-and-leaseback, you can sell an asset you own to a leasing company or lender and then lease it back from them. This is how sale-leasebacks usually work in commercial real estate, where companies often use them to free up capital that's tied up in a real estate investment.

Compare the difference between the sale price of the asset and its fair value. Compare the present value of the lease payments and the present value of market rental payments. This can include an estimation of any variable lease payments reasonably expected to be made.

Compare the difference between the sale price of the asset and its fair value. Compare the present value of the lease payments and the present value of market rental payments. This can include an estimation of any variable lease payments reasonably expected to be made.

The buyer in a sale-leaseback reports rental payments as ordinary income as they are received over the lease term. In a loan transaction, the lender is taxed only on the interest portion of the payment and not on the amount that represents the repayment of principal.

THE NATURE OF LEASEBACKS A sale and leaseback, or more simply, a leaseback, is a contract between a seller and a buyer where the former sells an asset to the latter and then enters into a second contract to lease the asset back from the buyer.

More and more retirees are taking advantage of the leaseback option. It gives them the ability to continue living in the home they owned while having more money for retirement. And of course, it is good option for people who have suffered financial reverses due to job loss or other difficult circumstances.

The main advantages of sale and leaseback are that it enables businesses to release cash from existing items of value such as equipment, plant and machinery. The cash gained can be used for many purposes including business acquisitions or simply providing extra working capital.

Capital For Growth: The key benefit to a seller engaged in a sale-leaseback transaction is the ability to convert illiquid equity to spendable cash.