Privacy and Confidentiality of Credit Card Purchases

Description

The following form seeks to give such assurance.

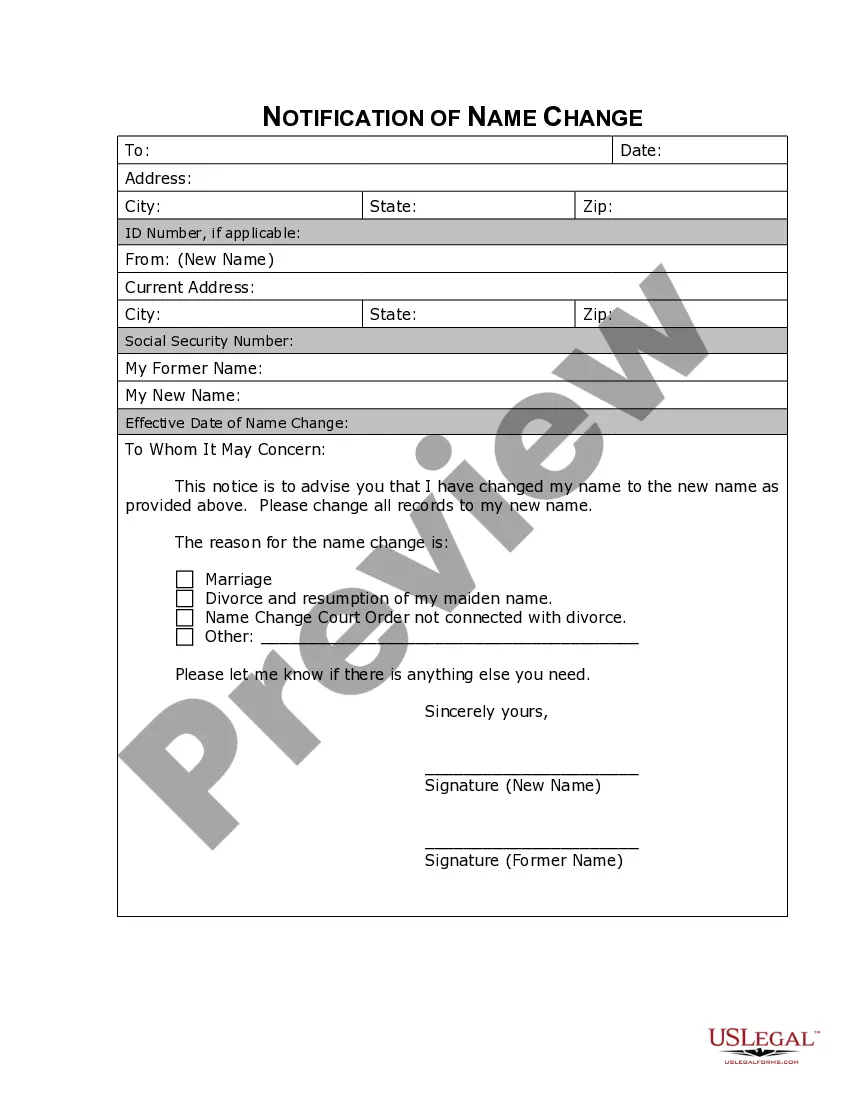

How to fill out Privacy And Confidentiality Of Credit Card Purchases?

Aren't you sick and tired of choosing from hundreds of samples each time you require to create a Privacy and Confidentiality of Credit Card Purchases? US Legal Forms eliminates the wasted time an incredible number of Americans spend browsing the internet for perfect tax and legal forms. Our expert crew of attorneys is constantly updating the state-specific Forms collection, so that it always provides the proper files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have an active subscription need to complete quick and easy steps before having the ability to get access to their Privacy and Confidentiality of Credit Card Purchases:

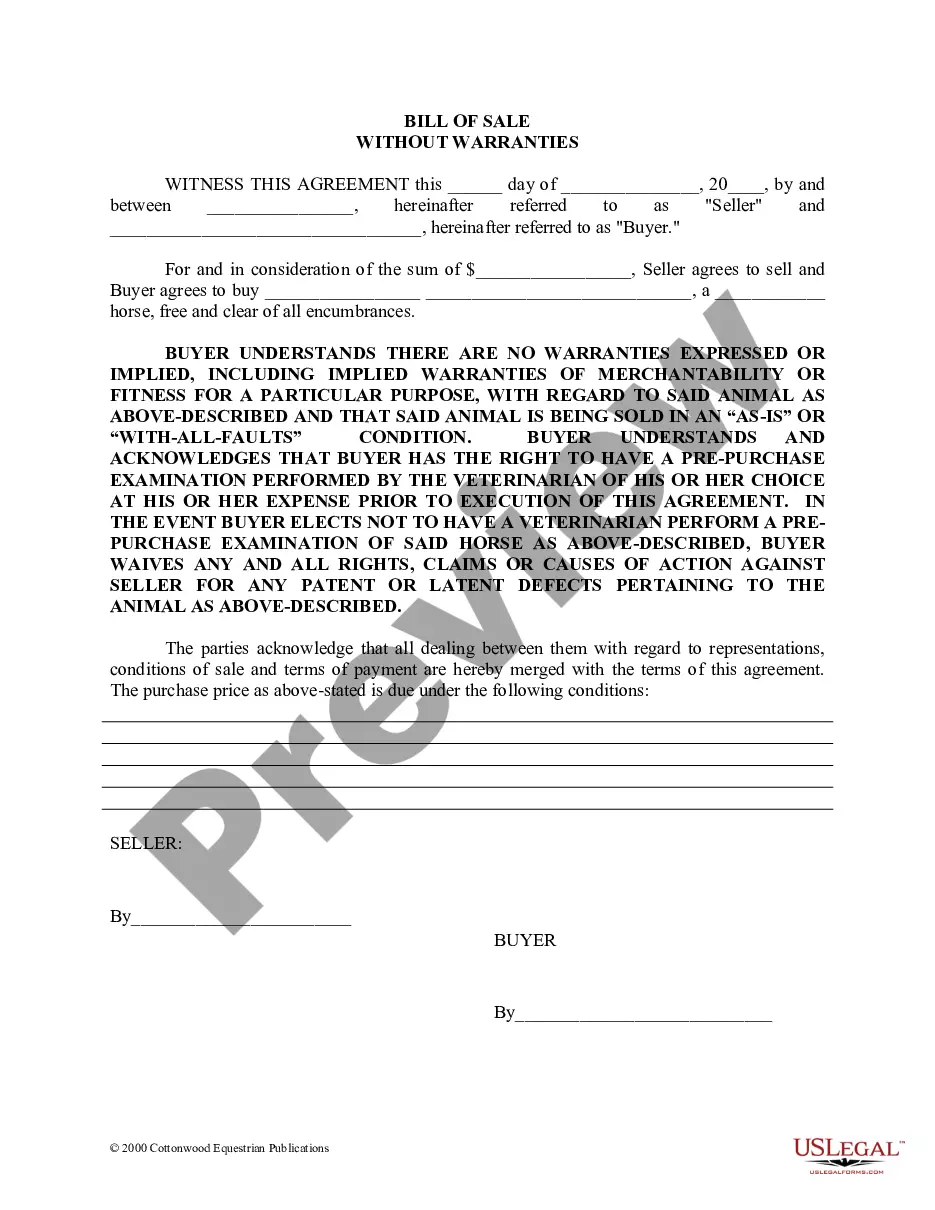

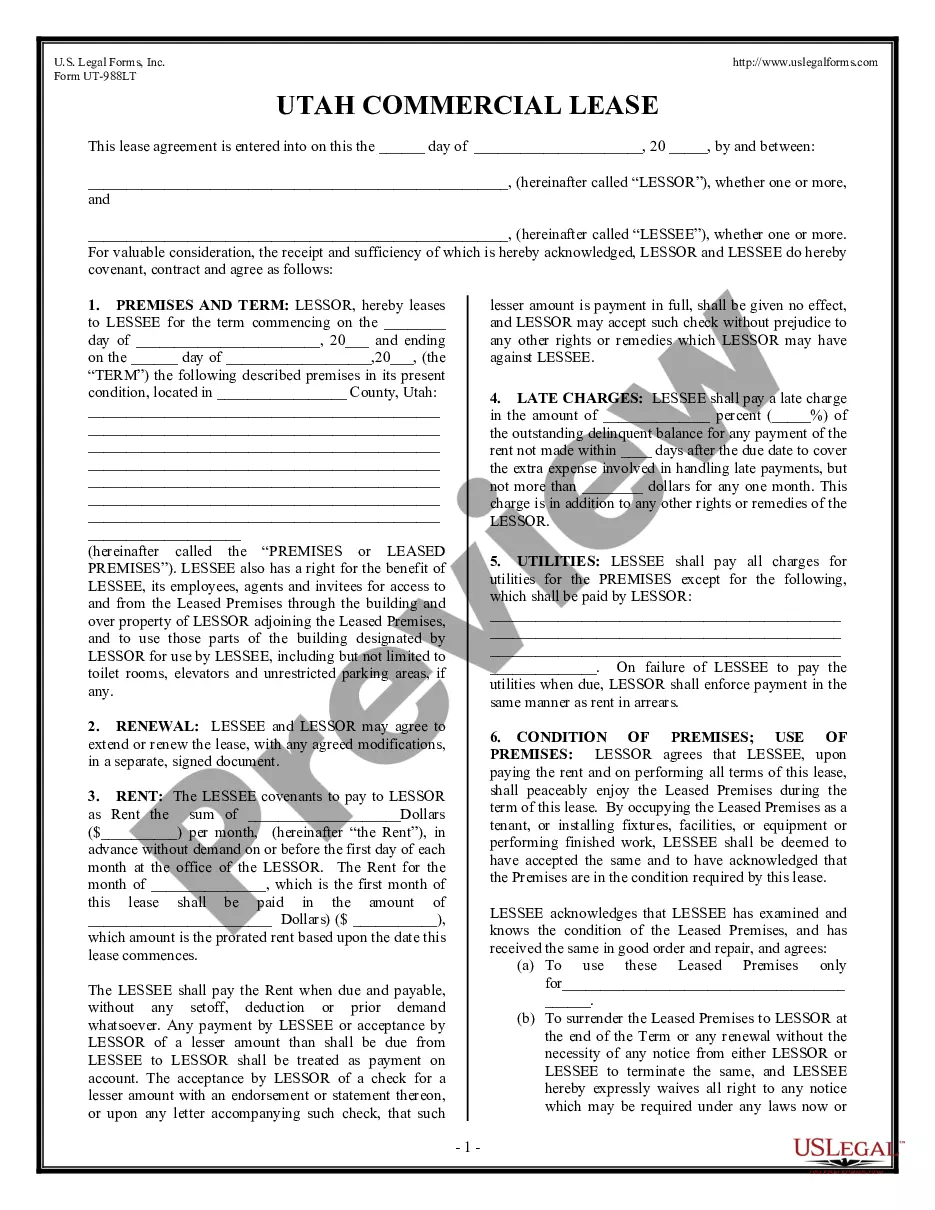

- Utilize the Preview function and look at the form description (if available) to ensure that it is the proper document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the proper example to your state and situation.

- Utilize the Search field at the top of the web page if you have to look for another file.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your sample in a required format to complete, print, and sign the document.

As soon as you have followed the step-by-step guidelines above, you'll always be able to sign in and download whatever document you require for whatever state you need it in. With US Legal Forms, finishing Privacy and Confidentiality of Credit Card Purchases templates or any other official documents is not difficult. Get going now, and don't forget to examine your examples with certified attorneys!

Form popularity

FAQ

Data covered by the GLBA includes non-public personal information or personally identifiable information, such as names, addresses, and phone numbers, bank and credit card account numbers, income and credit histories, and Social Security numbers of customers.

The notice must include a description of the type of info that the financial institution may disclose, and "reasonable means" to opt-out, such as opt-out forms or toll-free telephone numbers to representatives who will accept the opt-out information.

Under the Gramm-Leach-Bliley Act, a financial institution must provide its customers with a notice of its privacy policies and practices, and must not disclose nonpublic personal information about a consumer to nonaffiliated third parties unless the institution provides certain information to the consumer and the

Under the law, agencies enforce the Financial Privacy Rule, which governs how financial institutions can collect and disclose customers' personal financial information; the Safeguards Rule, which requires all financial institutions to maintain safeguards to protect customer information; and another provision designed

The CFPB will enforce over a dozen consumer financial protection laws, including the Fair Credit Reporting , Fair Debt Collection Practices Act, and Truth-in-Lending Act.

You must provide a clear and conspicuous notice to customers that accurately reflects your privacy policies and practices not less than annually during the continuation of the customer relationship. Annually means at least once in any period of 12 consecutive months during which that relationship exists.

Credit card issuers have access to a wealth of information about where you shop, how much you spend and how often. Increasingly, they use that data to change your access to credit.

Categories of information disclosed. For example, information from an application, such as name, address, and phone number; Social Security number; account information; and account balances. Categories of affiliates and nonaffiliated third parties to whom you disclose the information.

The notice must include a description of the type of info that the financial institution may disclose, and "reasonable means" to opt-out, such as opt-out forms or toll-free telephone numbers to representatives who will accept the opt-out information.