Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description 00704 Zip Code

How to fill out Letter Creditors Form?

Aren't you sick and tired of choosing from hundreds of samples each time you want to create a Letter to Creditors Notifying Them of Identity Theft for New Accounts? US Legal Forms eliminates the wasted time numerous American people spend browsing the internet for suitable tax and legal forms. Our professional team of lawyers is constantly changing the state-specific Templates library, to ensure that it always provides the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Users who don't have a subscription should complete quick and easy steps before having the capability to download their Letter to Creditors Notifying Them of Identity Theft for New Accounts:

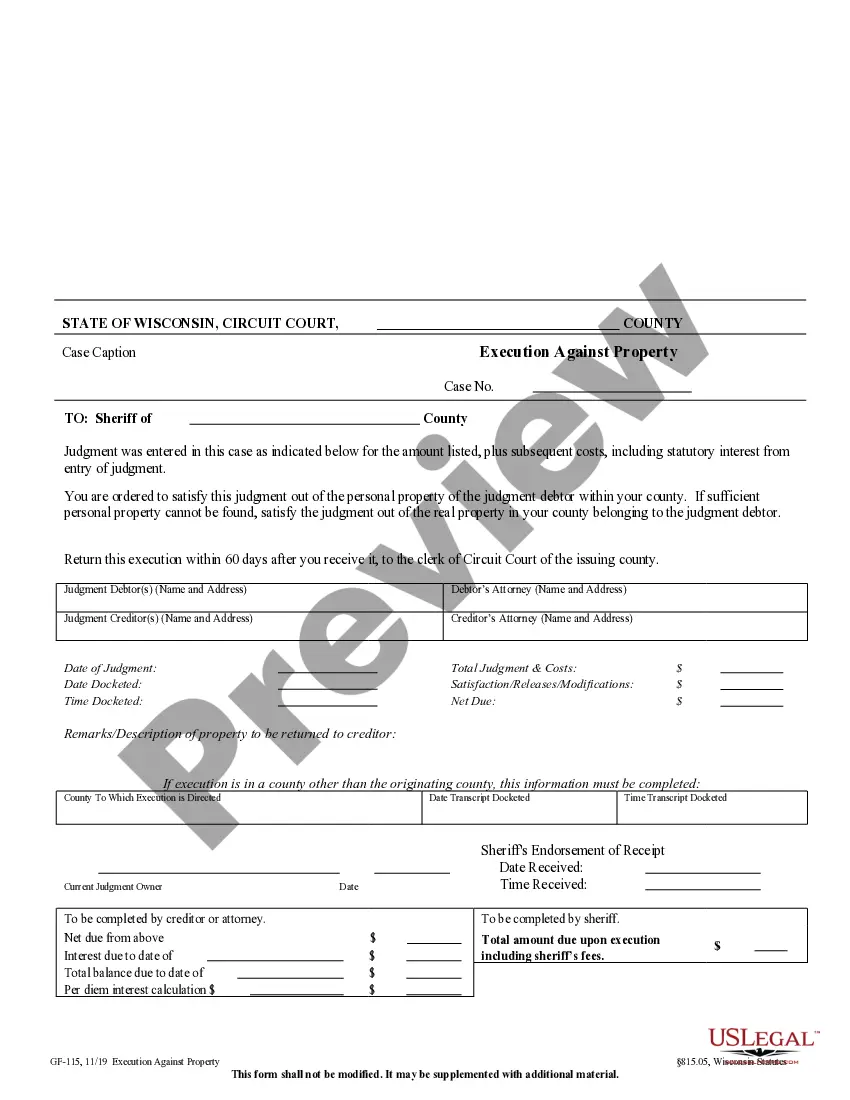

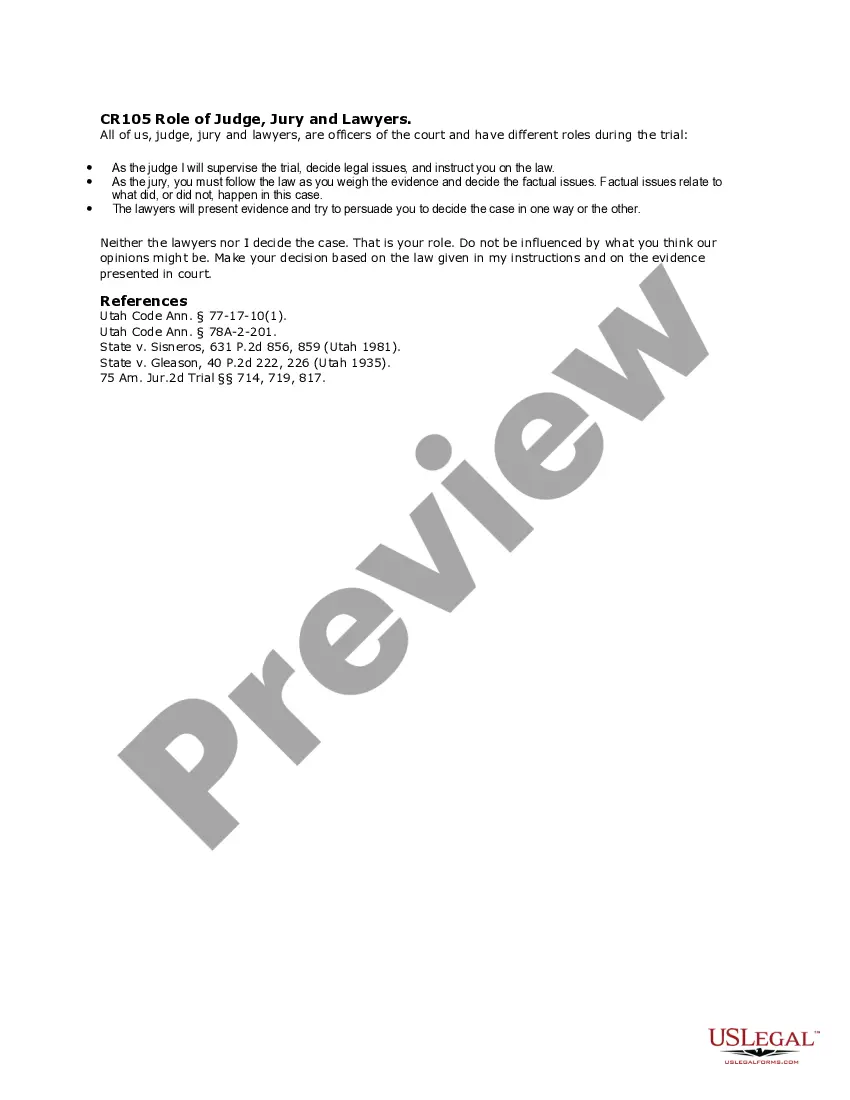

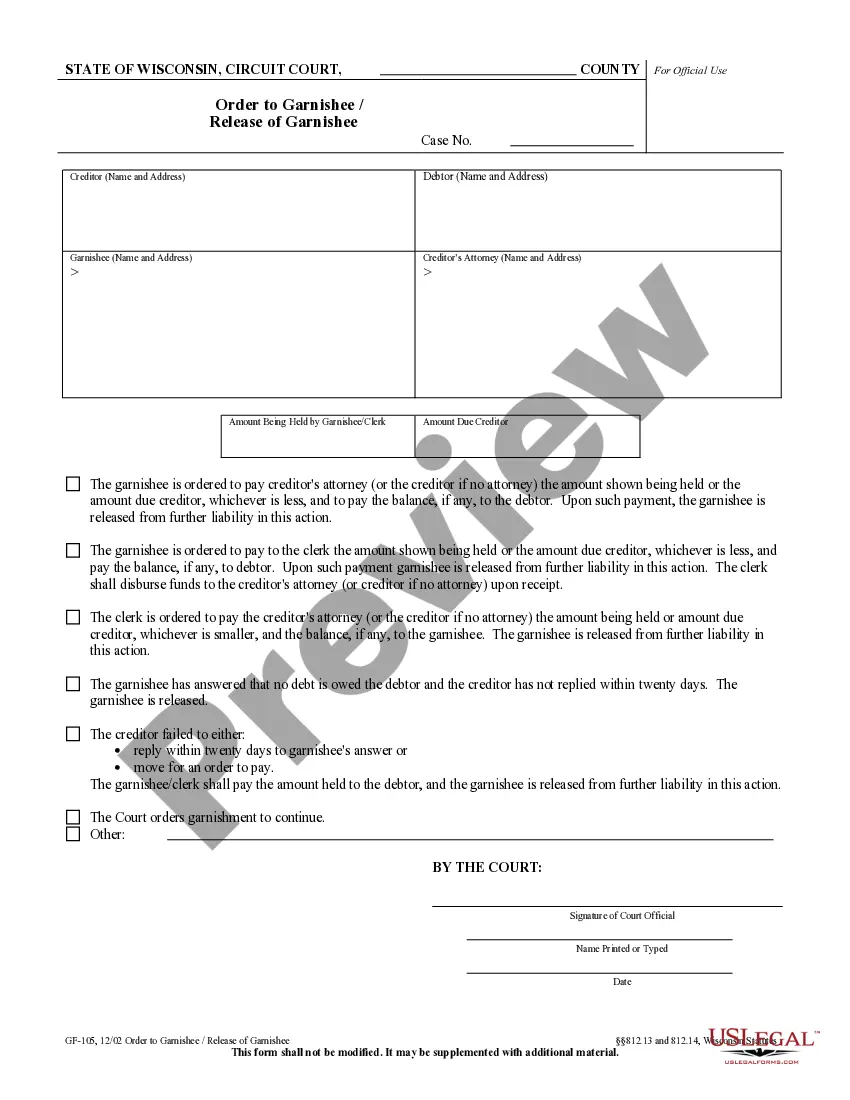

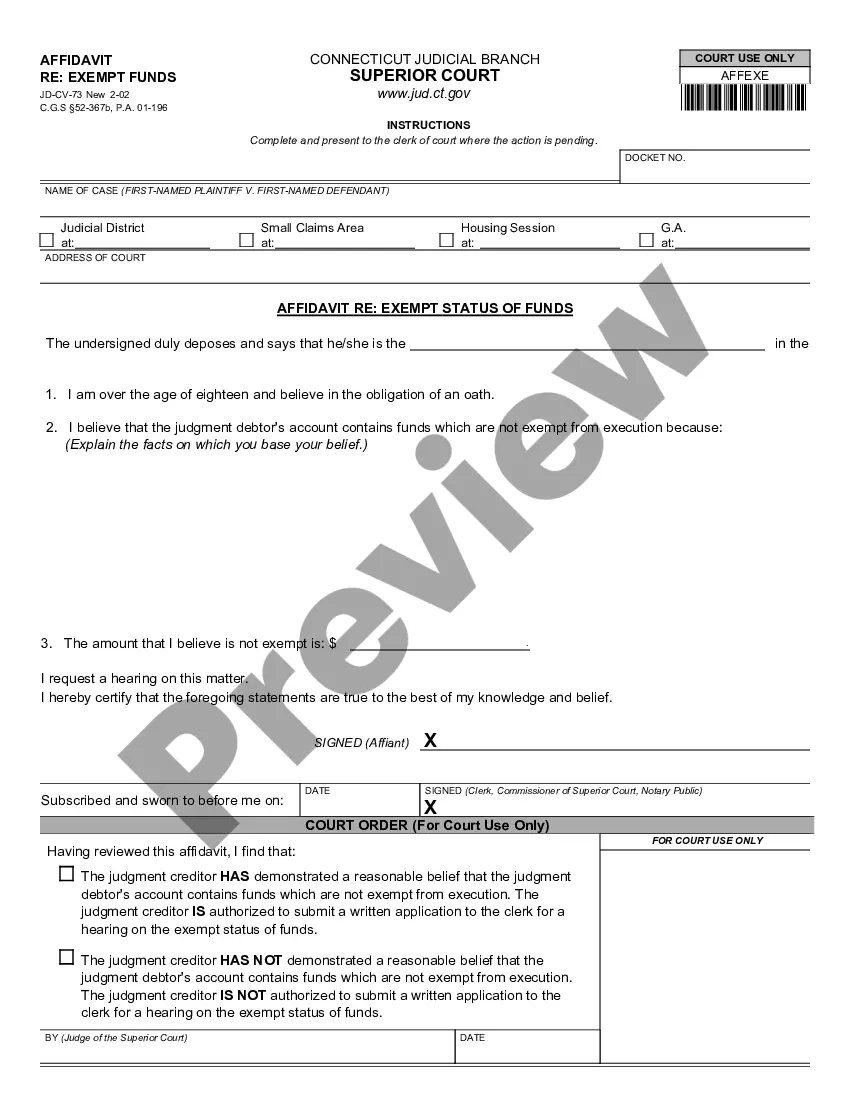

- Utilize the Preview function and read the form description (if available) to make certain that it is the correct document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate template for your state and situation.

- Make use of the Search field at the top of the page if you want to look for another document.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your template in a convenient format to complete, print, and sign the document.

As soon as you have followed the step-by-step recommendations above, you'll always be capable of log in and download whatever document you will need for whatever state you require it in. With US Legal Forms, completing Letter to Creditors Notifying Them of Identity Theft for New Accounts samples or any other official paperwork is not difficult. Begin now, and don't forget to double-check your examples with accredited attorneys!

Letter Theft Form popularity

Letter Theft Template Other Form Names

Letter Creditors Template FAQ

Mail the letter first class. You should send the letter first class, return receipt requested. The receipt will serve as proof that the creditor received the letter. Be sure to attach any supporting documentation, such as a copy of your credit report.

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338.

You can call the Federal Trade Commission (FTC) at 1-877-438-4338 or TDD at 1-866-653-4261, or online at http://www.consumer.ftc.gov/features/feature-0014-identity-theft to report identity theft.

File a claim with your identity theft insurance, if applicable. Notify companies of your stolen identity. File a report with the FTC. Contact your local police department. Place a fraud alert on your credit reports. Freeze your credit. Sign up for a credit monitoring service, if offered.

What is the first step in protecting yourself from identity theft? Never provide personal data about yourself unless absolutely necessary.

Step 1: Call the companies where you know fraud occurred. Ask them to close or freeze the accounts. Then, no one can add new charges unless you agree. Change logins, passwords and PINS for your accounts. You might have to contact these companies again after you have an FTC Identity Theft Report.

File a claim with your identity theft insurance, if applicable. Notify companies of your stolen identity. File a report with the FTC. Contact your local police department. Place a fraud alert on your credit reports. Freeze your credit. Sign up for a credit monitoring service, if offered.

Equifax. Equifax.com/personal/credit-report-services. 800-685-1111. Experian. Experian.com/help. 888-EXPERIAN (888-397-3742) Transunion. TransUnion.com/credit-help. 888-909-8872.

If you're a victim of identity theft, filing a report will start an investigation to restore your credit and good name.Also, creditors, financial institutions, and debt collectors might require you to file a police report and/or Federal Trade Commission (FTC) identity theft report.