Correction of Invoice

Description

How to fill out Correction Of Invoice?

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them correspond with federal and state regulations and are verified by our specialists. So if you need to prepare Correction of Invoice, our service is the best place to download it.

Obtaining your Correction of Invoice from our library is as easy as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they find the correct template. Afterwards, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a quick instruction for you:

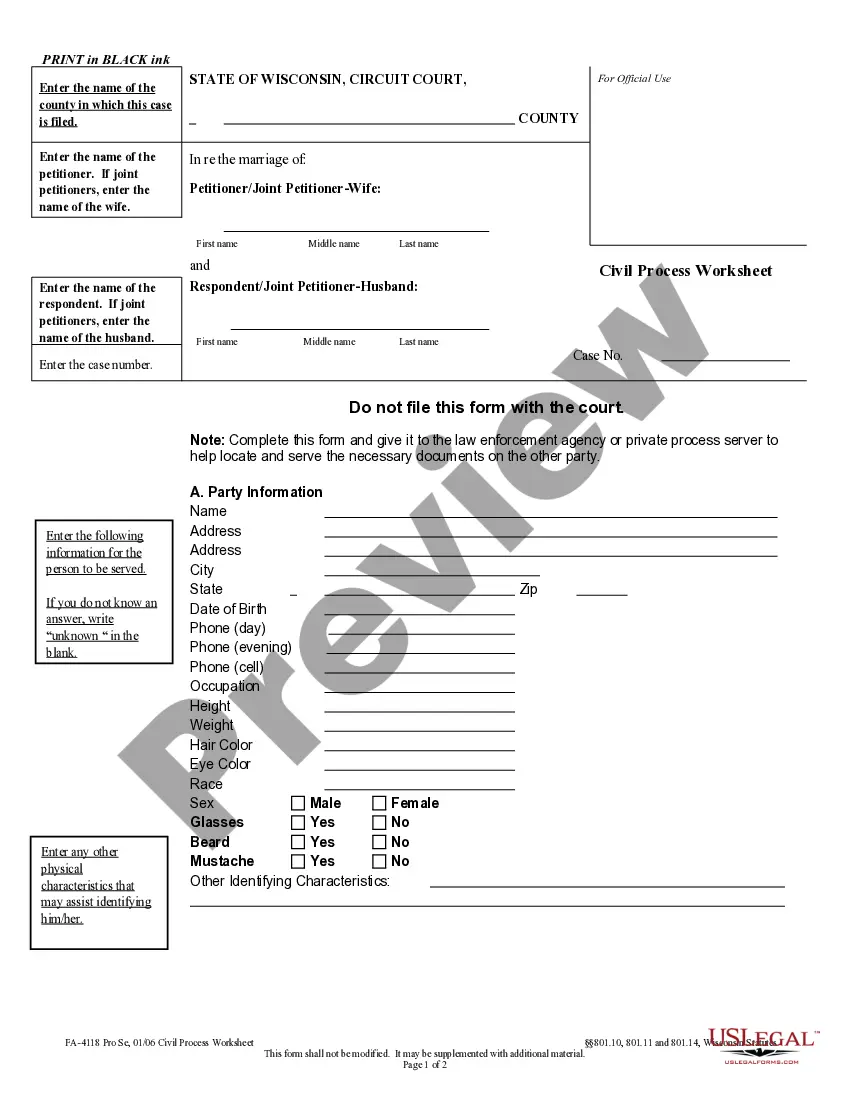

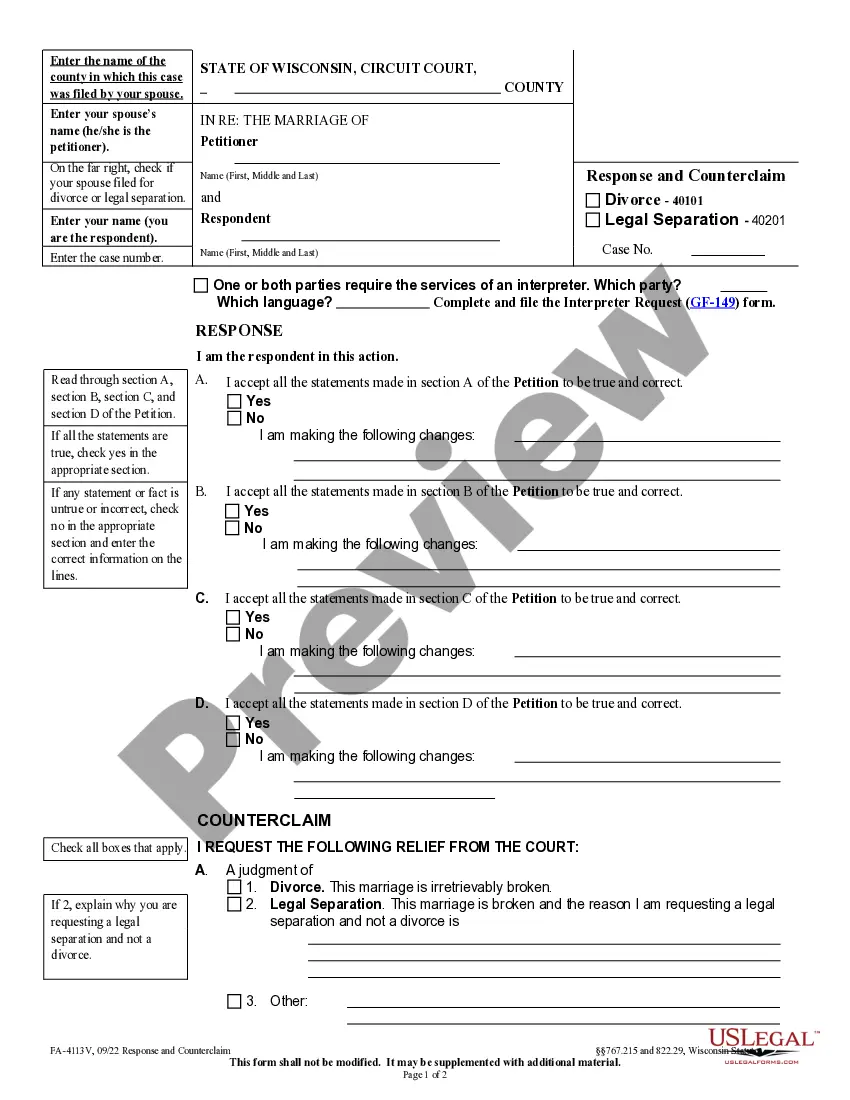

- Document compliance verification. You should carefully examine the content of the form you want and check whether it satisfies your needs and meets your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab on the top of the page until you find a suitable template, and click Buy Now when you see the one you need.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Correction of Invoice and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Amendment can be made in the later tax period also but the date of revised amended invoice date must be the last date of the original invoice tax period.

Invoiced amount is not correct Please find attached a copy of the contract. I request you to correct or void this invoice and send me a confirmation in writing ingly within 7 days of the date in this <letter/email>. I assume that you will suspend any further collection measures until this issue is cleared up.

In general, it is possible to amend an invoice in situations where a business made an error or the invoice is missing certain information. Invoices that have not been sent to a client should simply be amended and reviewed again before being sent.

In cases where you want to delete or amend an invoice, a credit note will usually suffice as the solution. A credit note allows you to effectively - and legally - cancel an invoice. It's required by law that you always keep a copy of all invoices you issue for control purposes.

If you would like to change the original amount issued on the invoice, you'll need to issue a credit note. This occurs in cases where you forgot to include a discount, or you need to issue a refund to someone for damaged goods.

The bottom line. While amended invoices are legal in most cases, it's still best practice to avoid issuing incorrect invoices to begin with. It's worth setting up an efficient invoicing procedure as part of your business accounting strategy.

If an incorrect invoice has been sent, the business must issue a cancellation invoice with its own, new invoice number. This will include a negative invoice amount, as well as the original invoice number and the date it was issued. Then, a correct invoice can be raised with a different invoice number.