Identity Theft Checklist

Description

How to fill out Identity Theft Checklist?

Aren't you sick and tired of choosing from hundreds of samples each time you want to create a Identity Theft Checklist? US Legal Forms eliminates the lost time an incredible number of American people spend searching the internet for ideal tax and legal forms. Our skilled crew of lawyers is constantly changing the state-specific Forms collection, so it always offers the right documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

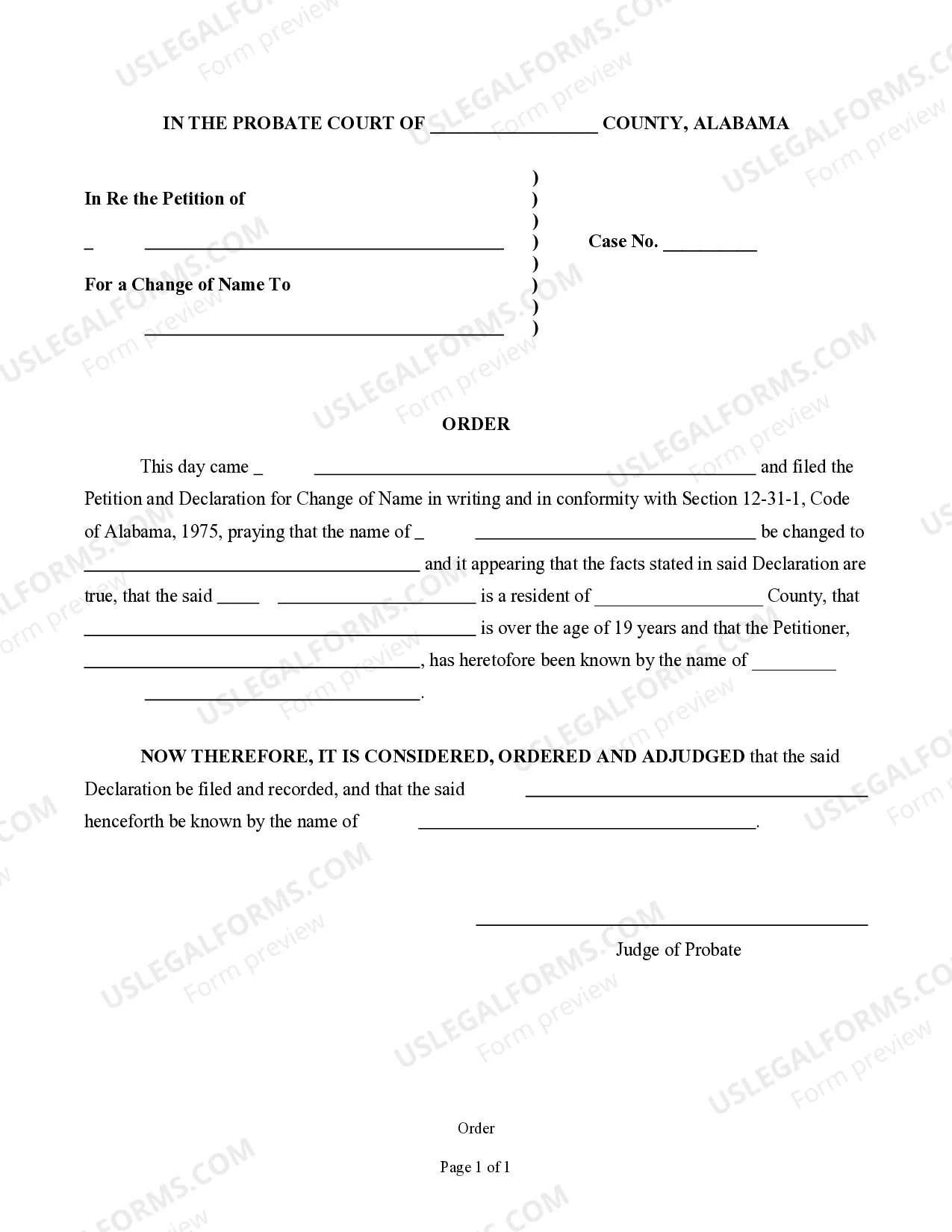

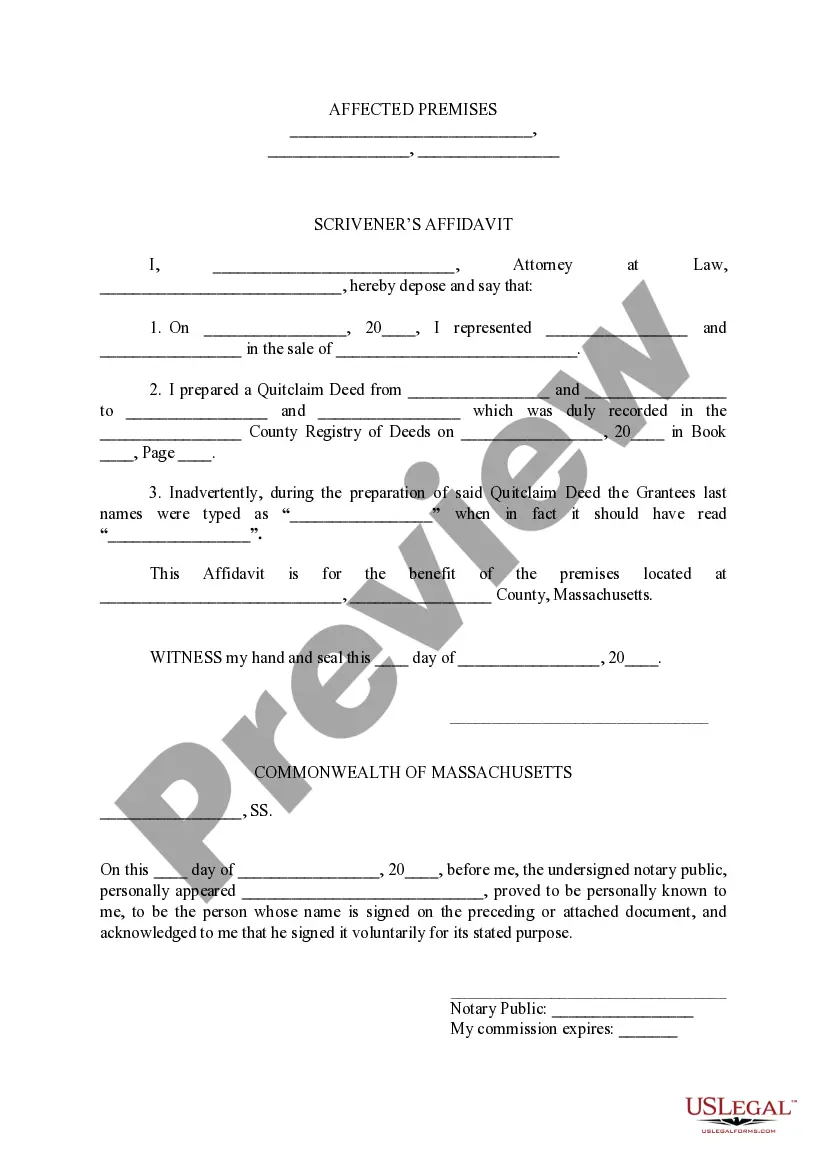

Users who don't have an active subscription need to complete quick and easy actions before having the ability to get access to their Identity Theft Checklist:

- Make use of the Preview function and read the form description (if available) to make certain that it’s the proper document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the proper example for your state and situation.

- Use the Search field on top of the site if you want to look for another file.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your template in a convenient format to complete, create a hard copy, and sign the document.

Once you have followed the step-by-step guidelines above, you'll always have the ability to sign in and download whatever file you require for whatever state you want it in. With US Legal Forms, finishing Identity Theft Checklist samples or any other legal documents is not hard. Get going now, and don't forget to recheck your samples with accredited attorneys!

Form popularity

FAQ

Police departments can do very little to investigate and prosecute identity theft.You can use the Identity Theft Report to help get false information taken off your credit reports, stop a company from collecting debts and place an extended fraud alert on your credit reports.

Periodically check your credit reports. Coming across suspicious activity on your credit reports, such as new accounts you don't recognize, is a quick way to identify potential fraud. You can get free copies of your credit reports from all three major credit bureaus through AnnualCreditReport.com.

Identity theft in California can be charged as either a felony or a misdemeanor depending on (1) the defendant's criminal history, and (2) the specific facts of the case. A person convicted of misdemeanor identity theft faces up to one year in county jail, a fine of up to $1,000, or both.

The stress can even take a toll on you physically. For example, a study by the Identity Theft Resource Center found that 41% of identity theft victims experience sleep disturbances, and 29% develop other physical symptoms, including aches and pains, heart palpitations, sweating and stomach issues.

The four types of identity theft include medical, criminal, financial and child identity theft.

File a claim with your identity theft insurance, if applicable. Notify companies of your stolen identity. File a report with the FTC. Contact your local police department. Place a fraud alert on your credit reports. Freeze your credit. Sign up for a credit monitoring service, if offered.

Under California law, you can report identity theft to your local police department. Ask the police to issue a police report of identity theft. Give the police as much information on the theft as possible. One way to do this is to provide copies of your credit reports showing the items related to identity theft.

Notify affected creditors or banks. Put a fraud alert on your credit report. Check your credit reports. Freeze your credit. Report the identity theft to the FTC. Go to the police. Remove fraudulent info from your credit report.