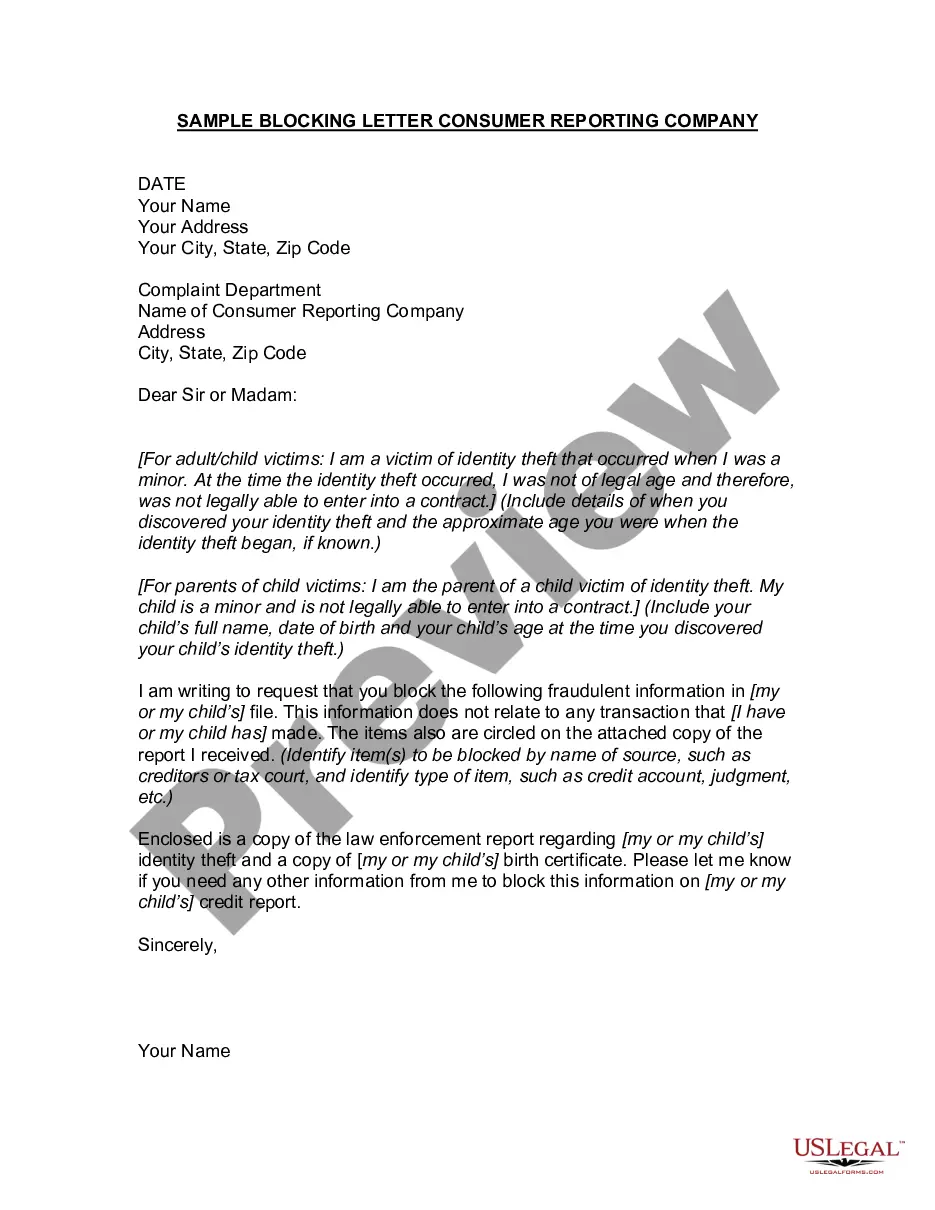

Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor

Description What Is A Blocked Account For A Minor

How to fill out Letter To Credit Reporting Company Or Bureau Regarding Identity Theft Of Minor?

Aren't you sick and tired of choosing from numerous samples every time you want to create a Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor? US Legal Forms eliminates the wasted time millions of American people spend exploring the internet for ideal tax and legal forms. Our professional team of lawyers is constantly modernizing the state-specific Samples library, to ensure that it always provides the right files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have a subscription need to complete easy actions before having the ability to download their Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor:

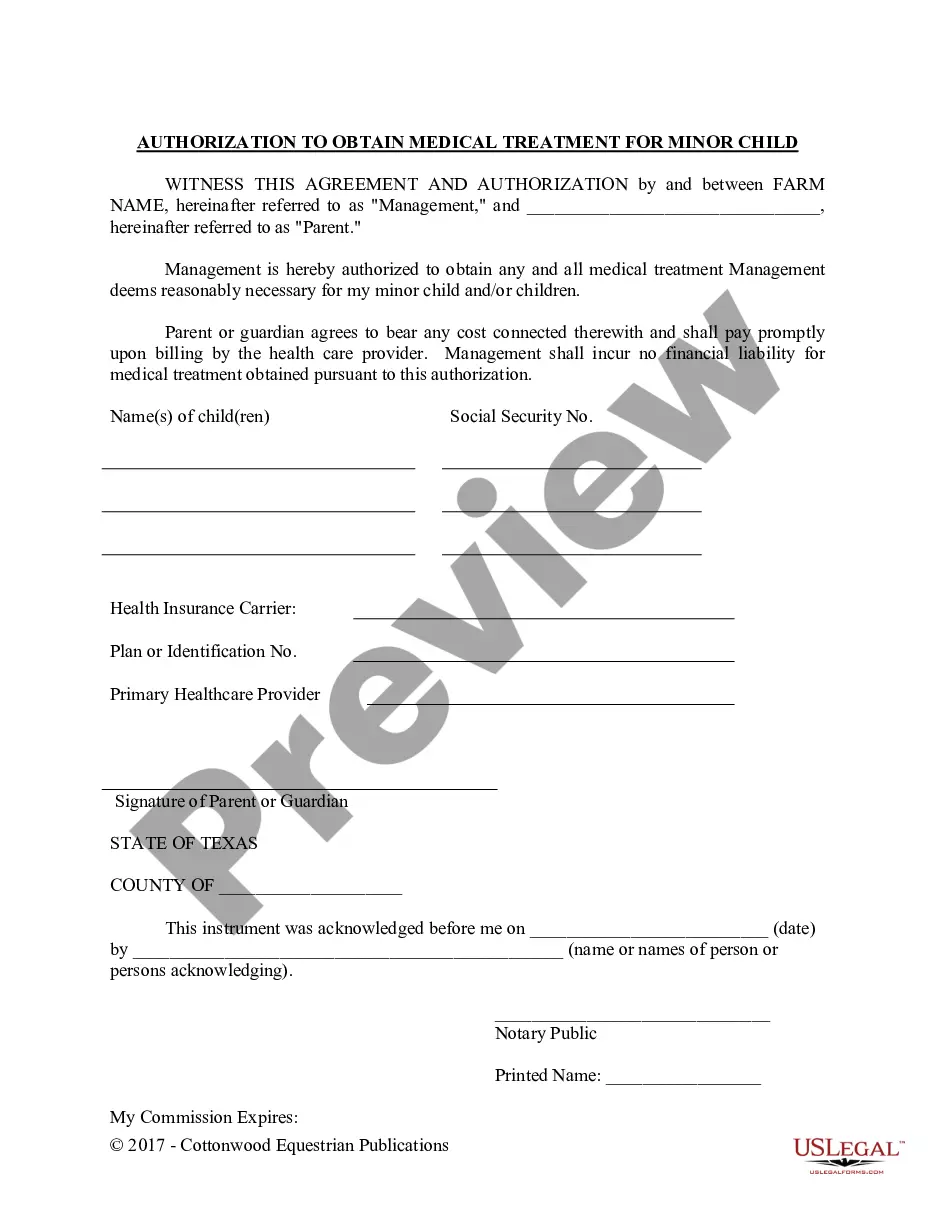

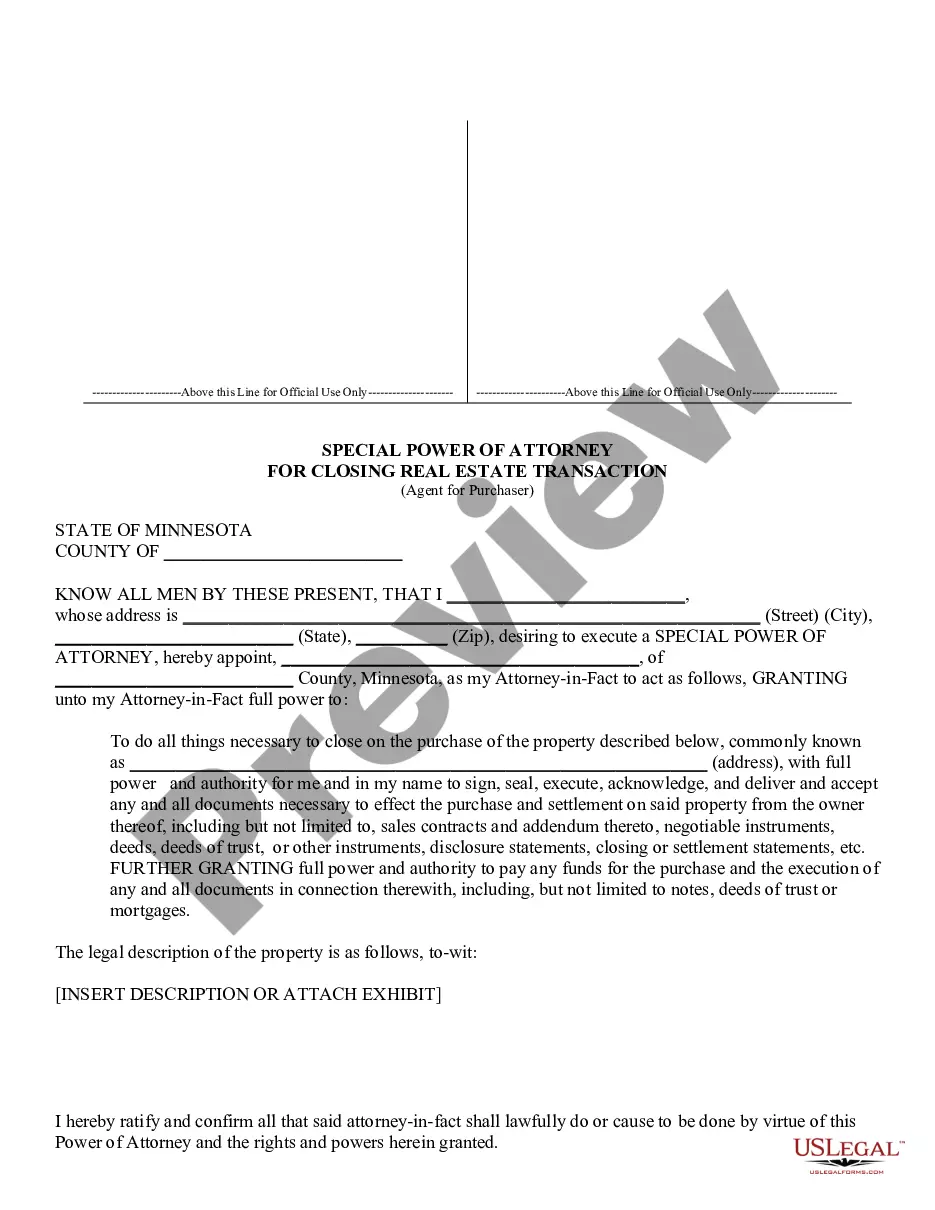

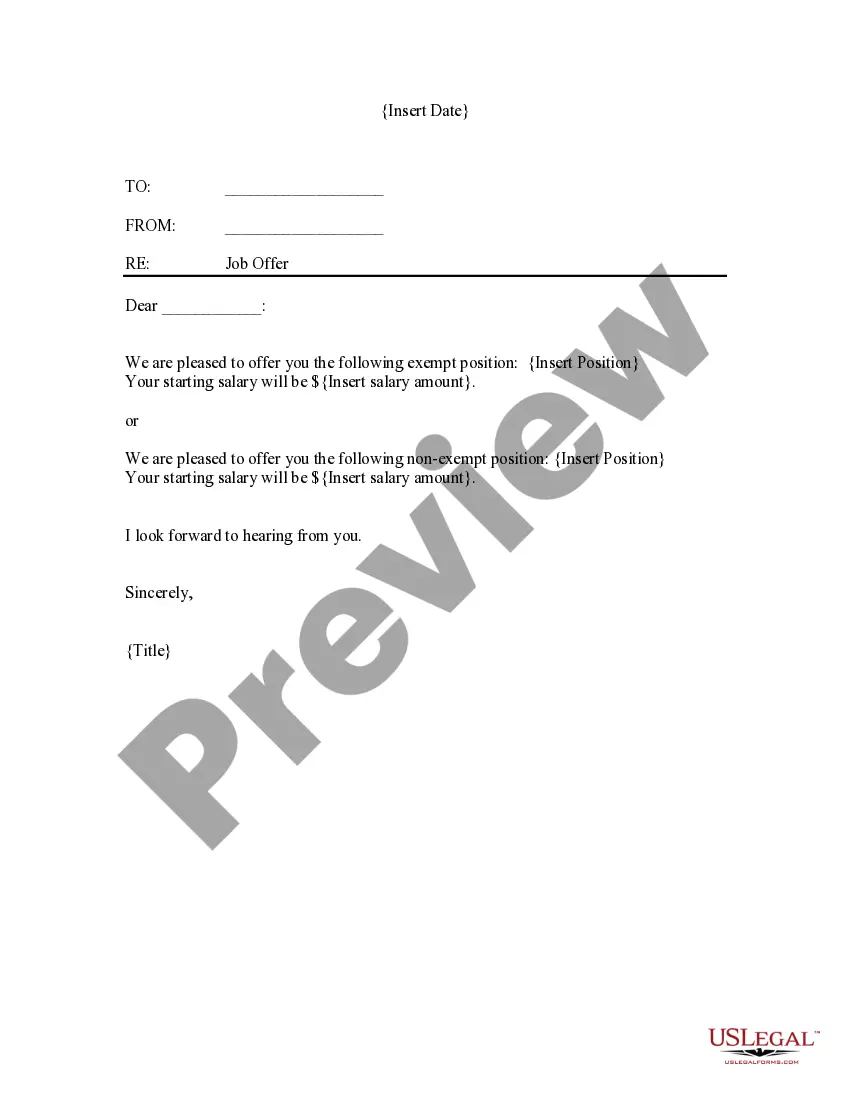

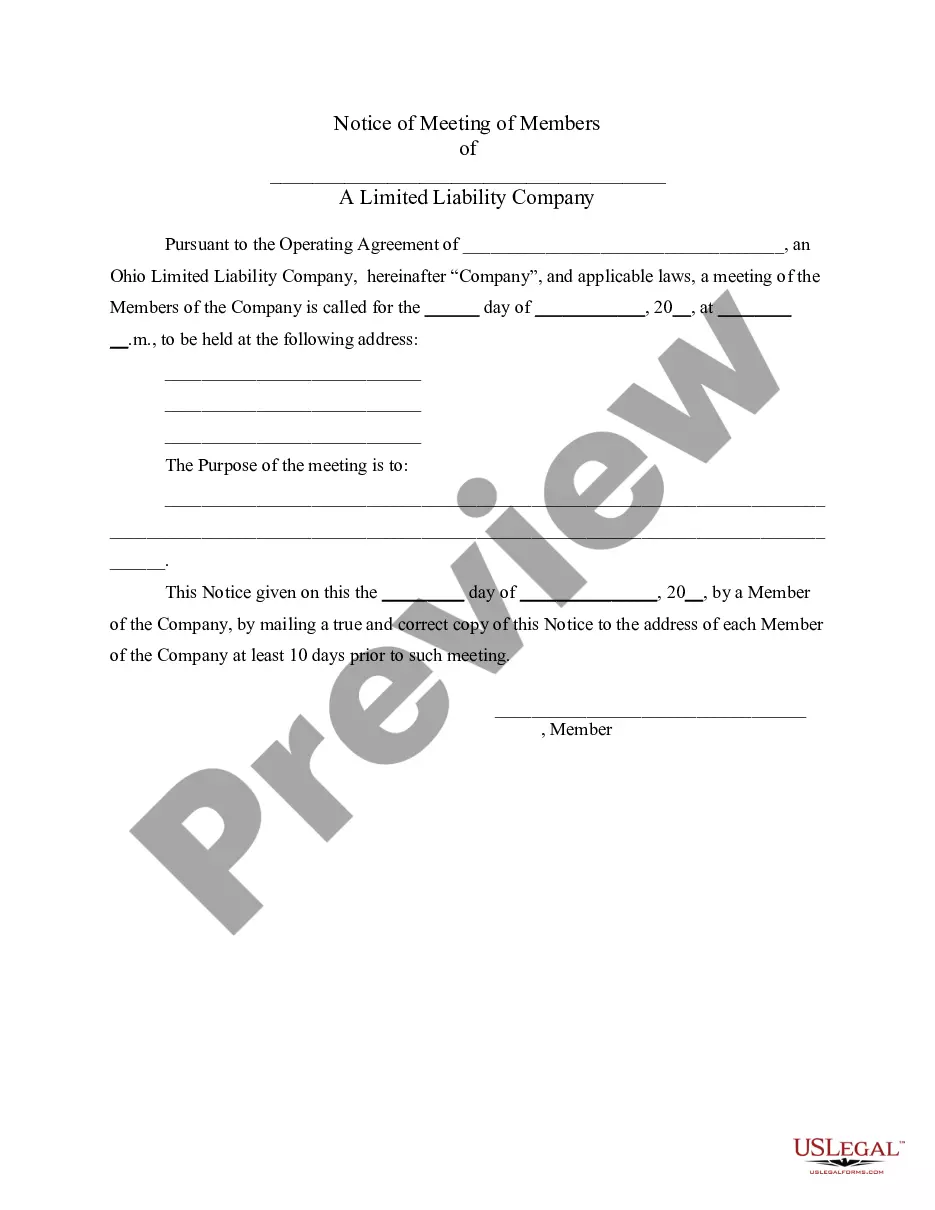

- Utilize the Preview function and look at the form description (if available) to ensure that it is the appropriate document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate example for your state and situation.

- Make use of the Search field at the top of the site if you have to look for another file.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your template in a convenient format to complete, create a hard copy, and sign the document.

After you have followed the step-by-step instructions above, you'll always be capable of log in and download whatever document you want for whatever state you need it in. With US Legal Forms, completing Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor templates or other legal paperwork is not hard. Begin now, and don't forget to look at your examples with accredited lawyers!

Form popularity

FAQ

Contact one of the credit reporting agencies' fraud alert departments and place a fraud alert on your credit report. Tell the agency you think your identity has been stolen. One call does it all. Call 1-800-525-6285. Visit www.equifax.com. Call 1-888-397-3742.

Children 13 and older can check their credit the same way adults do. By visiting AnnualCreditReport.com the only website federally authorized to provide credit reports from Experian, Equifax and TransUnion for free your child can enter his or her personal information to receive a copy of each report.

Check all your financial accounts for errors or suspicious activity. Enroll in a credit monitoring service. Place a fraud alert on your credit reports. Consider freezing your credit. Alert the authorities. Always use strong passwords and be aware of information you give out. Bottom line.

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338.

You may want to enclose a copy of your credit report with the items in question circled. Send your letter by certified mail, return receipt requested, so you can document that the credit bureau received your correspondence. Keep copies of your dispute letter and enclosures.

You can call the Federal Trade Commission (FTC) at 1-877-438-4338 or TDD at 1-866-653-4261, or online at http://www.consumer.ftc.gov/features/feature-0014-identity-theft to report identity theft.

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338.

If your information was accessed in a data breach, you may be offered complimentary credit monitoring. These services watch credit reports for suspicious activity and send alerts whenever a new account is opened. If you aren't offered free credit monitoring, you can sign up for a reputable service yourself.

Option 1: Online. You can upload the documentation verifying your identity online along with your request to have the alert removed. Option 2: Mail. You can mail your request to Experian along with copies of documentation verifying your identity.