Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts

Description

Key Concepts & Definitions

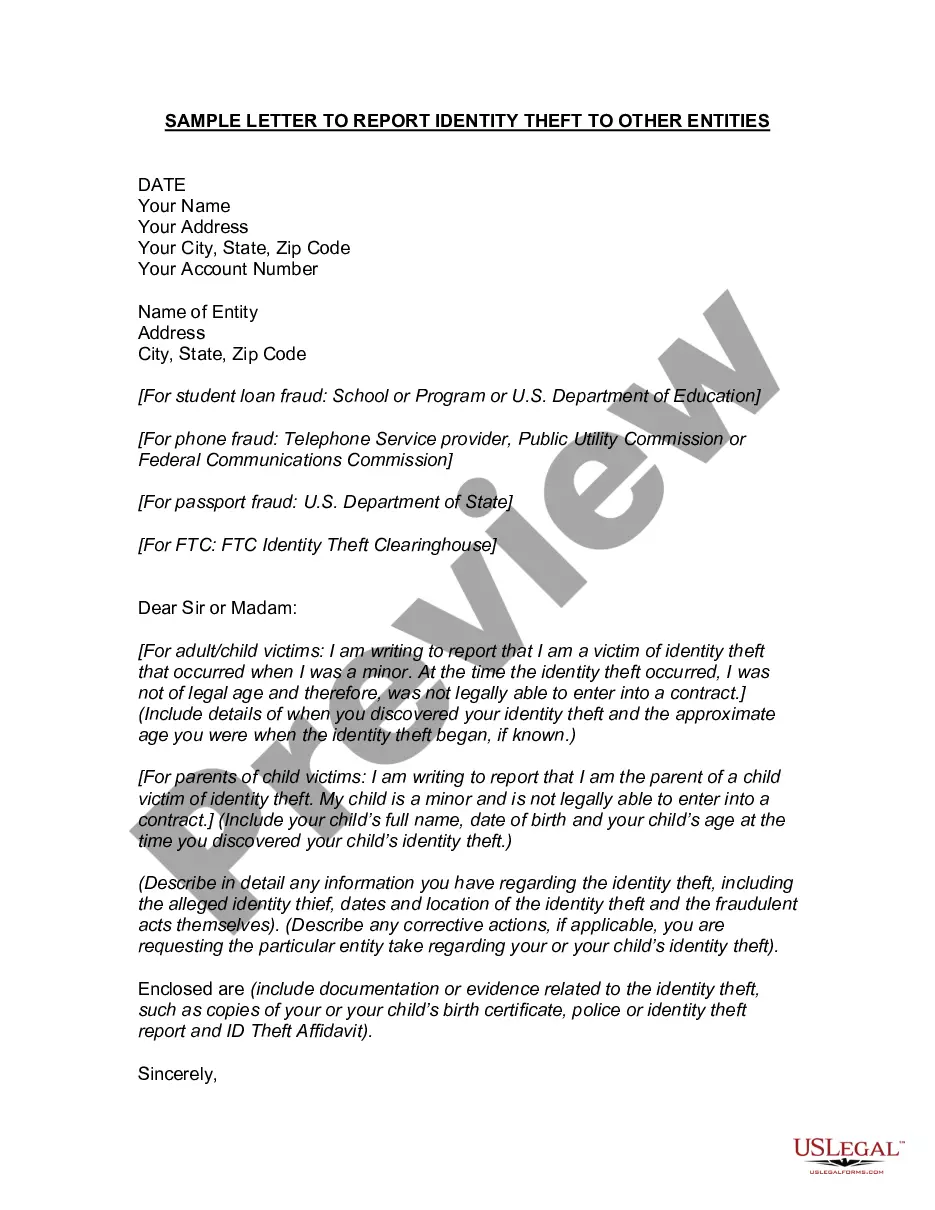

A letter to creditors notifying them of identity theft is a written communication used to inform creditors about fraudulent activities conducted using an individual's identity. It typically requests that the creditor freezes or closes the affected accounts, and initiates an investigation into the disputed charges.

Step-by-Step Guide

- Gather Information: Collect all necessary details such as account numbers, specific transactions that were fraudulent, and your contact information.

- Write the Letter: Craft a clear and concise letter stating that you are a victim of identity theft and specify what action you want the creditor to take.

- Include Supporting Documents: Attach a copy of your identity theft report and any other supporting documents.

- Send the Letter: Mail the letter via certified mail to ensure you have a record of its delivery.

- Follow Up: Keep in touch with the creditor until the issue is resolved to ensure all fraudulent charges and accounts are handled properly.

Risk Analysis

Sending a letter to creditors notifying them of identity theft involves several risks:

- Delay in Action: Delay in notifying might result in more fraudulent transactions.

- Inadequate Response: Some creditors may not take the necessary actions promptly or thoroughly.

- Privacy Concerns: Sharing sensitive information might lead to privacy leaks if not handled properly.

Best Practices

- Prompt Notification: Notify the creditors as soon as possible after discovering the fraud.

- Detailed Information: Provide specific details about the fraud to avoid confusion and aid in quick resolution.

- Secure Sending Methods: Use secure sending methods such as certified mail to protect your information.

Common Mistakes & How to Avoid Them

- Vague Details: Avoid vagueness by specifying fraudulent transactions and including all necessary details in the notification letter.

- Ignores Follow-ups: Regular follow-up is crucial to ensure that the matter is being attended to and resolved.

- Lack of Documentation: Always keep copies of all correspondence and any related information for your records.

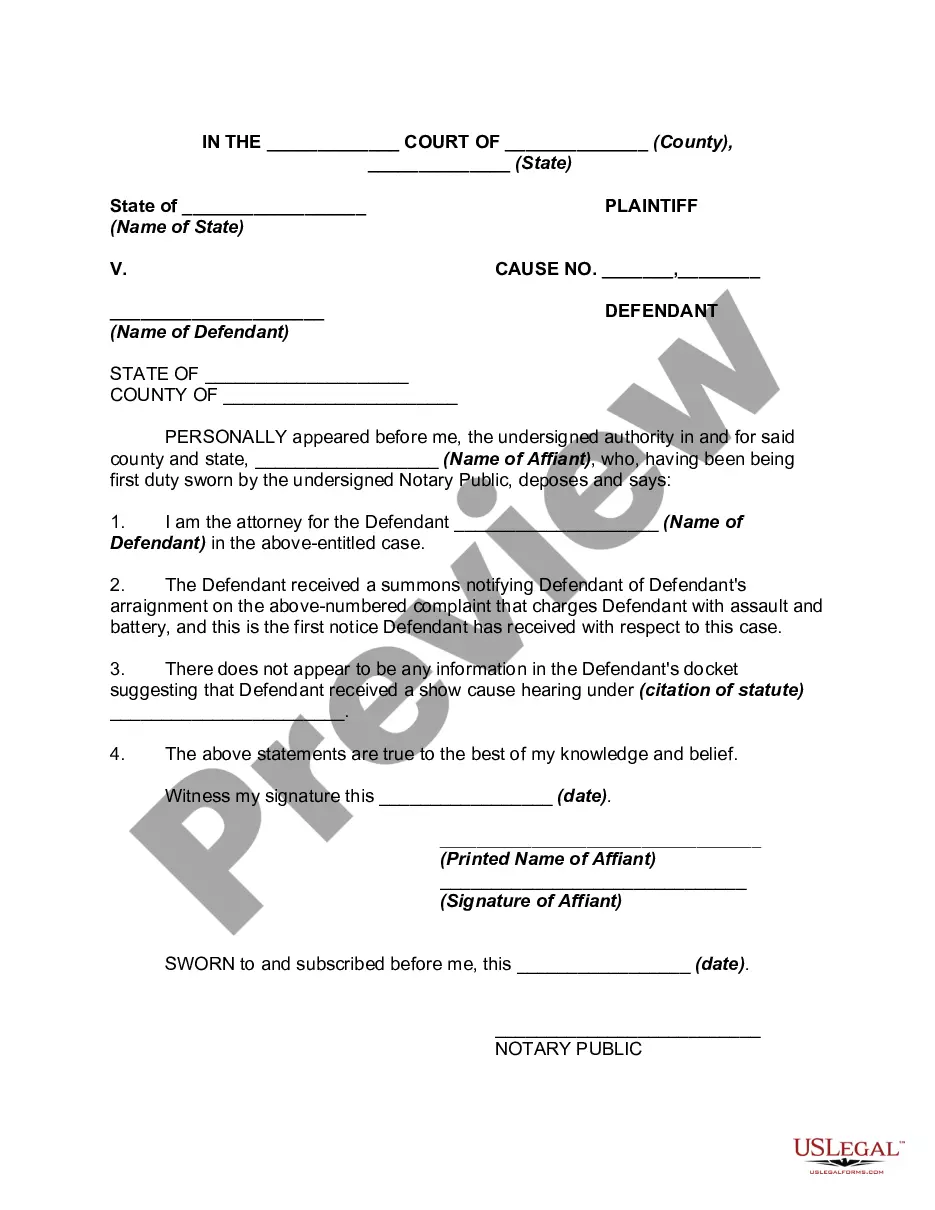

How to fill out Letter To Creditors Notifying Them Of Identity Theft Of Minor For New Accounts?

Aren't you tired of choosing from numerous templates each time you require to create a Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts? US Legal Forms eliminates the lost time numerous American citizens spend exploring the internet for suitable tax and legal forms. Our professional group of lawyers is constantly modernizing the state-specific Forms catalogue, to ensure that it always has the proper files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form may be found in the My Forms tab.

Users who don't have an active subscription need to complete easy actions before being able to download their Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts:

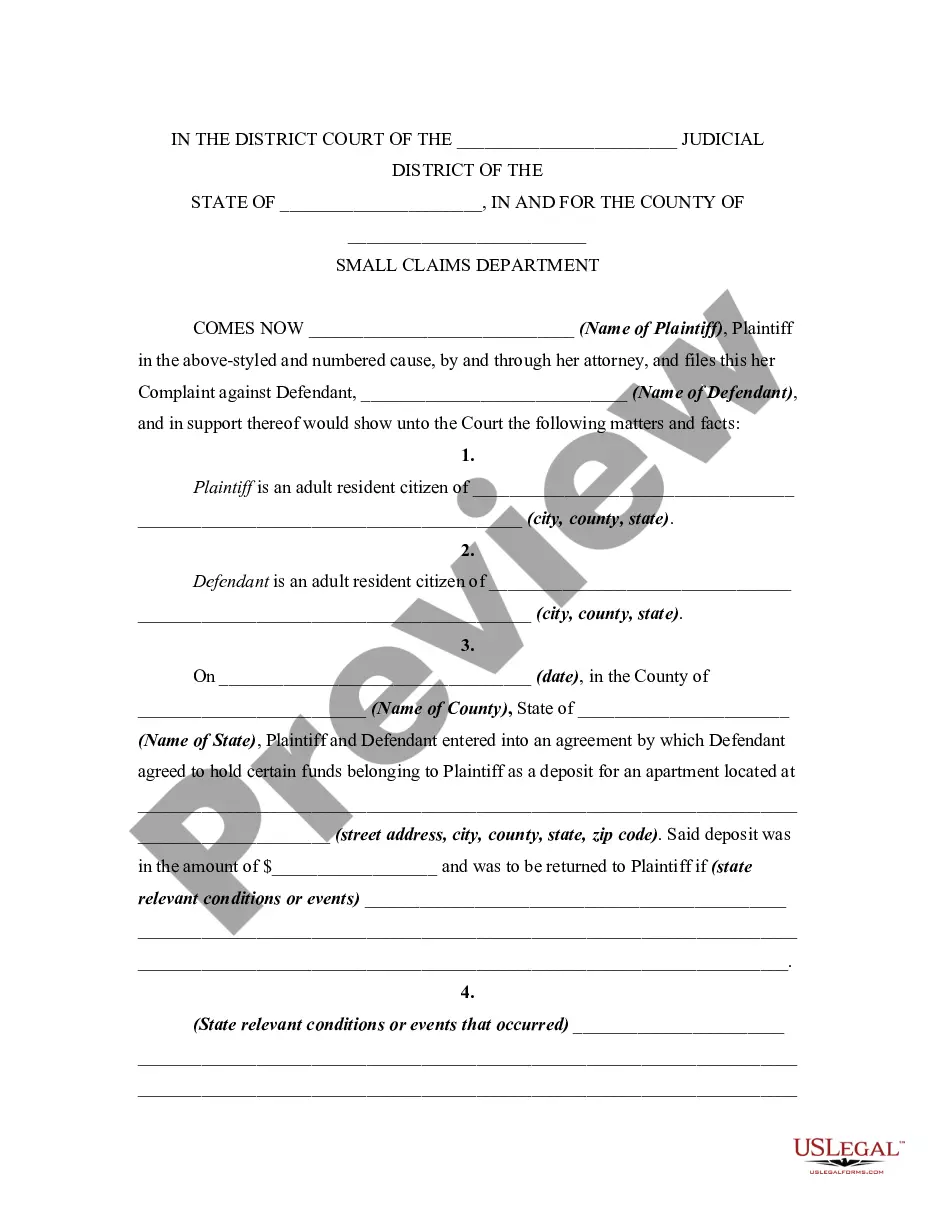

- Use the Preview function and look at the form description (if available) to make certain that it is the appropriate document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the correct example to your state and situation.

- Utilize the Search field at the top of the web page if you need to look for another file.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your sample in a required format to finish, create a hard copy, and sign the document.

Once you’ve followed the step-by-step recommendations above, you'll always be capable of log in and download whatever file you will need for whatever state you need it in. With US Legal Forms, completing Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts templates or any other official documents is easy. Get started now, and don't forget to recheck your samples with certified attorneys!

Form popularity

FAQ

U.S.A. (888) 202-4025. Canada. (800) 278-0278. U.S.A. (800) 831-5614 (Consumer Credit Reporting) U.S.A. (800) 478-0650 (Commercial Credit Reporting) U.S.A. (866) 922-2100. Canada. (800) 565-2280. U.S.A. (614) 538-2123. U.S.A. (512) 794-7520 (Commercial Credit Reporting)

You have limited liability for fraudulent debts caused by identity theft. Under most state laws, you're not responsible for any debt incurred on fraudulent new accounts opened in your name without your permission. Under federal law, the amount you have to pay for unauthorized use of your credit card is limited to $50.

Step 1: Call the companies where you know fraud occurred. Ask them to close or freeze the accounts. Then, no one can add new charges unless you agree. Change logins, passwords and PINS for your accounts. You might have to contact these companies again after you have an FTC Identity Theft Report.

File a claim with your identity theft insurance, if applicable. Notify companies of your stolen identity. File a report with the FTC. Contact your local police department. Place a fraud alert on your credit reports. Freeze your credit. Sign up for a credit monitoring service, if offered.

You can create a myEquifax2122 account online to place a fraud alert on your Equifax credit report. You can also download this form for instructions on mailing your request or call Equifax at (888) 836-6351.

Option 1: Online. You can upload the documentation verifying your identity online along with your request to have the alert removed. Option 2: Mail. You can mail your request to Experian along with copies of documentation verifying your identity.

File a claim with your identity theft insurance, if applicable. Notify companies of your stolen identity. File a report with the FTC. Contact your local police department. Place a fraud alert on your credit reports. Freeze your credit. Sign up for a credit monitoring service, if offered.

Equifax. Equifax.com/personal/credit-report-services. 800-685-1111. Experian. Experian.com/help. 888-EXPERIAN (888-397-3742) Transunion. TransUnion.com/credit-help. 888-909-8872.

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338.