Letter to Report False Submission of Deceased Person's Information

Description Report False Sample

How to fill out Report False Fill?

Aren't you sick and tired of choosing from countless samples each time you need to create a Letter to Report False Submission of Deceased Person's Information? US Legal Forms eliminates the lost time an incredible number of American citizens spend exploring the internet for appropriate tax and legal forms. Our professional team of lawyers is constantly modernizing the state-specific Forms catalogue, so it always has the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have an active subscription need to complete simple steps before having the ability to download their Letter to Report False Submission of Deceased Person's Information:

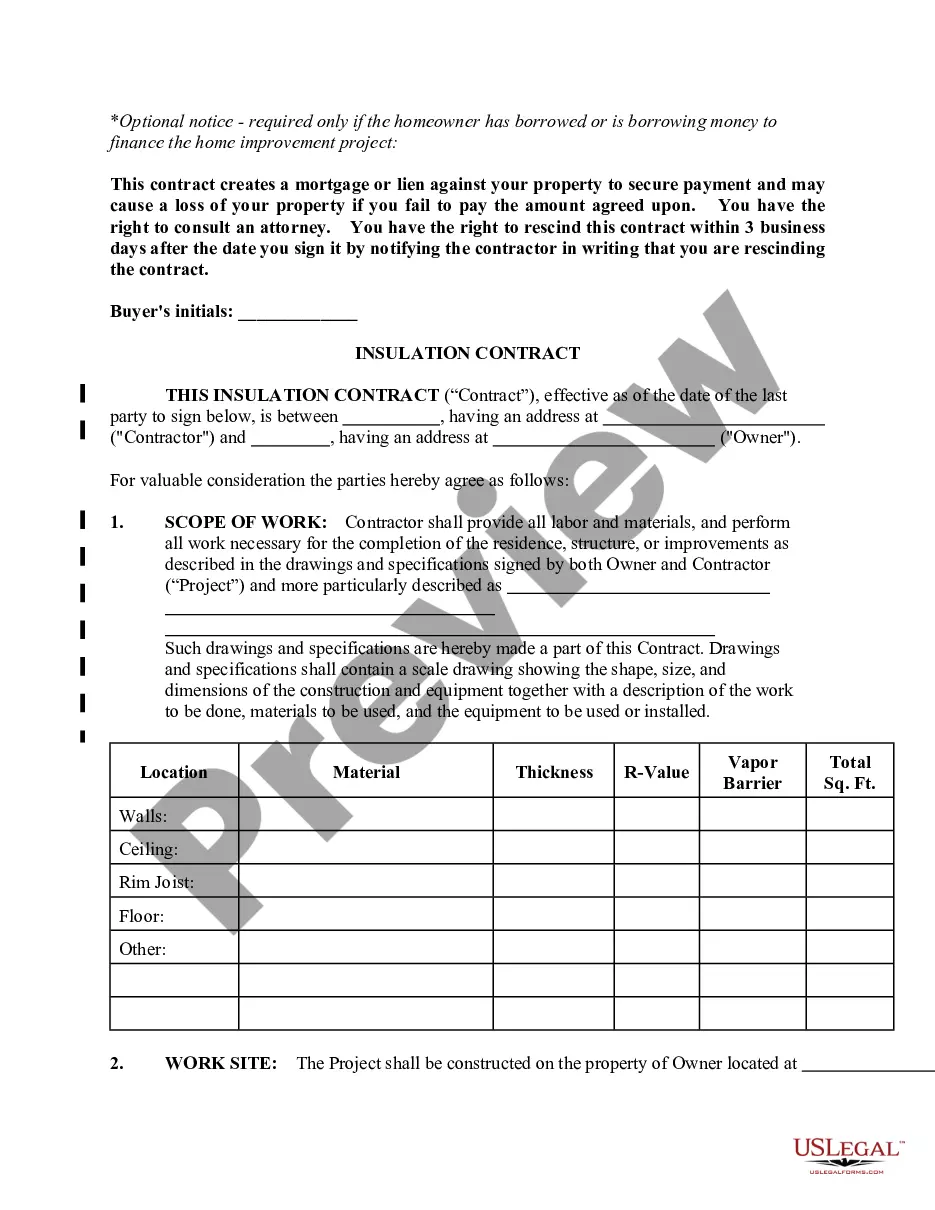

- Use the Preview function and look at the form description (if available) to make certain that it’s the proper document for what you are looking for.

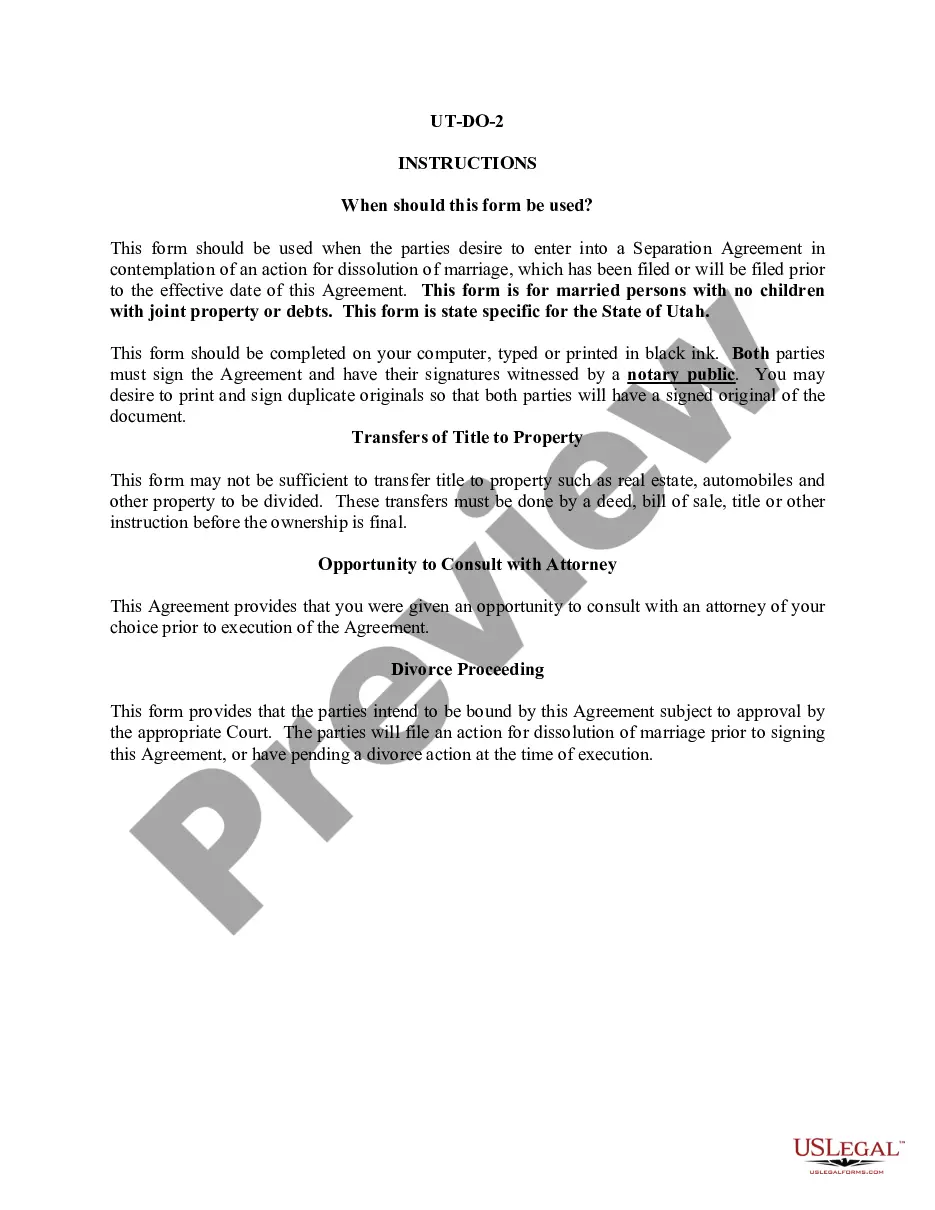

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate example to your state and situation.

- Use the Search field on top of the site if you have to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your file in a needed format to complete, print, and sign the document.

After you have followed the step-by-step guidelines above, you'll always be able to sign in and download whatever document you need for whatever state you want it in. With US Legal Forms, finishing Letter to Report False Submission of Deceased Person's Information templates or other official files is not difficult. Get started now, and don't forget to look at your examples with accredited attorneys!

Letter False Person Form popularity

Report False Template Other Form Names

Report False Submission FAQ

In most cases, the funeral home will report the person's death to us. You should give the funeral home the deceased person's Social Security number if you want them to make the report. If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778).

However, once the three nationwide credit bureaus Equifax, Experian and TransUnion are notified someone has died, their credit reports are sealed and a death notice is placed on them. That notification can happen one of two ways from the executor of the person's estate or from the Social Security Administration.

If you wish, you may mail a copy of your mother's death certificate to Experian, P.O. Box 4500, Allen, TX 75013. You may also submit it online by uploading your documents.

You may need to contact lenders and creditors to notify them the person is deceased and the accounts need to be closed, even if the account has a zero balance. Lender and creditor contact information can be found on the credit reports.

How to notify credit bureaus of death. A person's credit report is not automatically closed after someone passes away. Instead, credit bureaus wait for notification from the executor of the deceased's estate or the Social Security Administration.

Dear {Name}, This letter is to inform you that {Name} has passed away and to request that a formal death notice be added to {his/her} file in your accounts. {Name}'s full name was {Full Name}. At the time of death, {his/her} residence was {Address}, {City} in {County} County, {State}.

How do I obtain a credit report for a deceased person? The spouse or executor of the estate may request the deceased person's credit report by mailing a request to each of the credit reporting companies.A copy of the death certificate or letters testamentary.

Write a letter to one of the nationwide credit reporting agencies. Whichever agency you contactTransUnion, Equifax or Experianwill then notify the other two on your behalf. Along with a copy of the death certificate, please also include the following for the deceased: Legal name.

Agencies by telephone to report the death: Experian (888-397-3742), Equifax (800-685-1111) and TransUnion (800-888-4213). Request the credit report is flagged as Deceased. Do Not Issue Credit. Follow up with a written correspondence to each agency sent via certified mail.