Ground Lease for Land on which Cabin is Built as a Non-Permanent Structure - Real Estate Rental

Description Lease Land Rental Agreement

How to fill out Ground Lease Real Estate Rental?

Aren't you tired of choosing from numerous samples each time you require to create a Ground Lease for Land on which Cabin is Built as a Non-Permanent Structure - Real Estate Rental? US Legal Forms eliminates the lost time millions of American people spend exploring the internet for suitable tax and legal forms. Our professional crew of attorneys is constantly modernizing the state-specific Templates library, so that it always provides the appropriate files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription need to complete a few simple steps before having the capability to get access to their Ground Lease for Land on which Cabin is Built as a Non-Permanent Structure - Real Estate Rental:

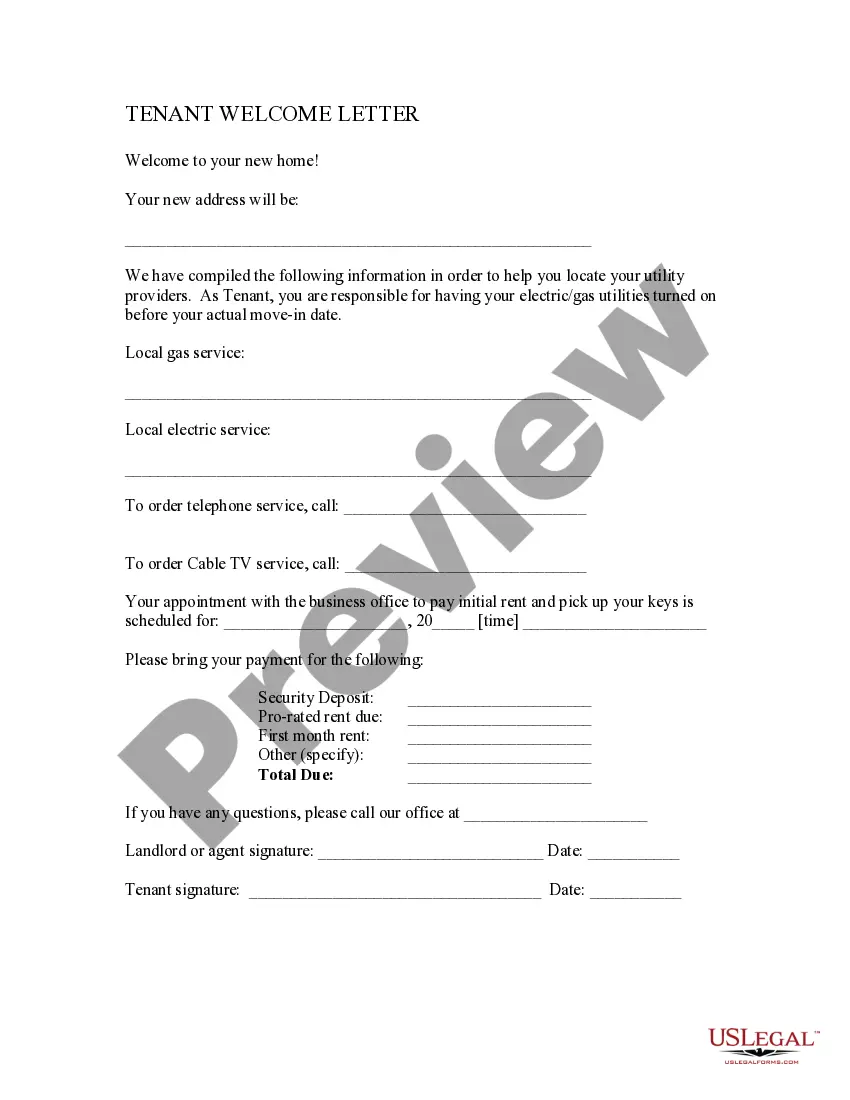

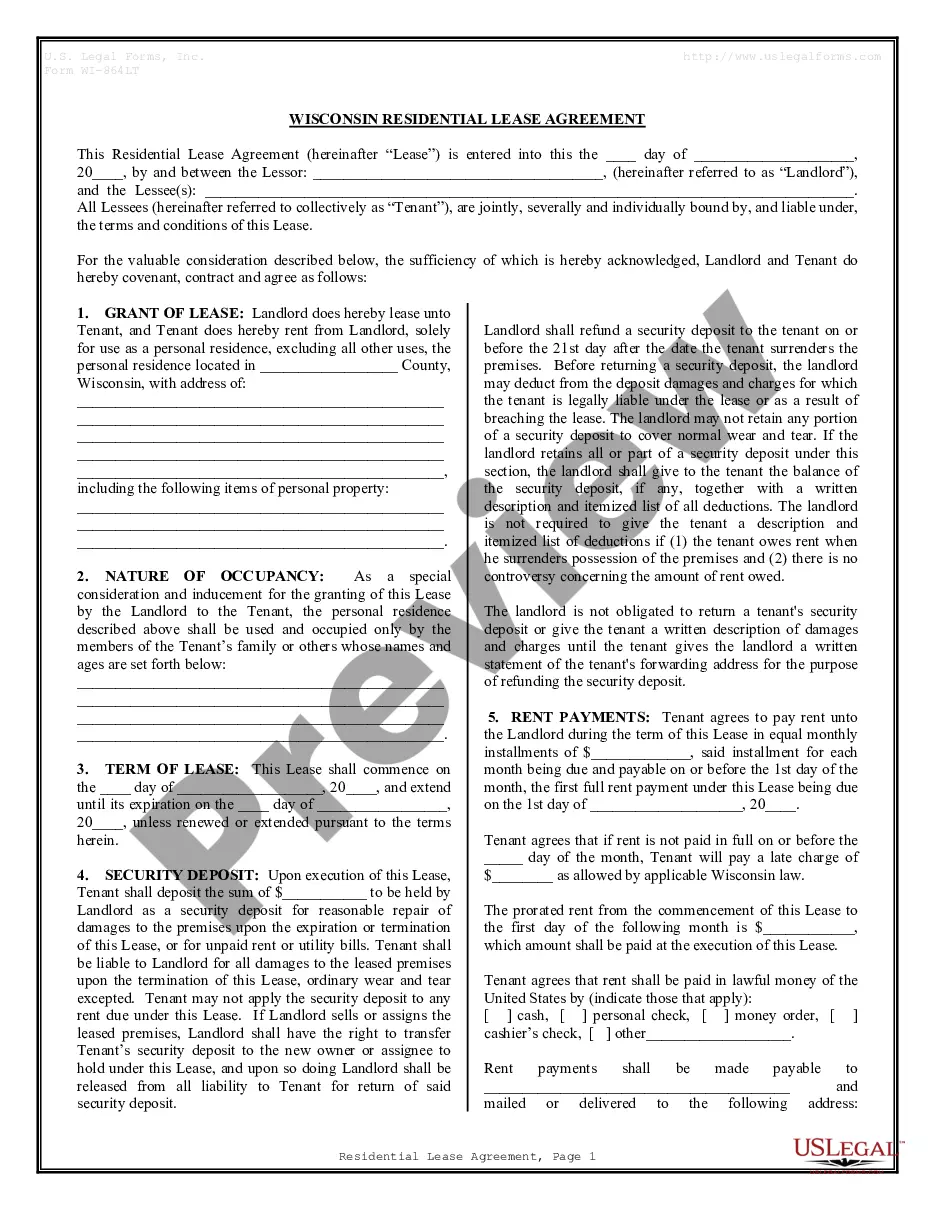

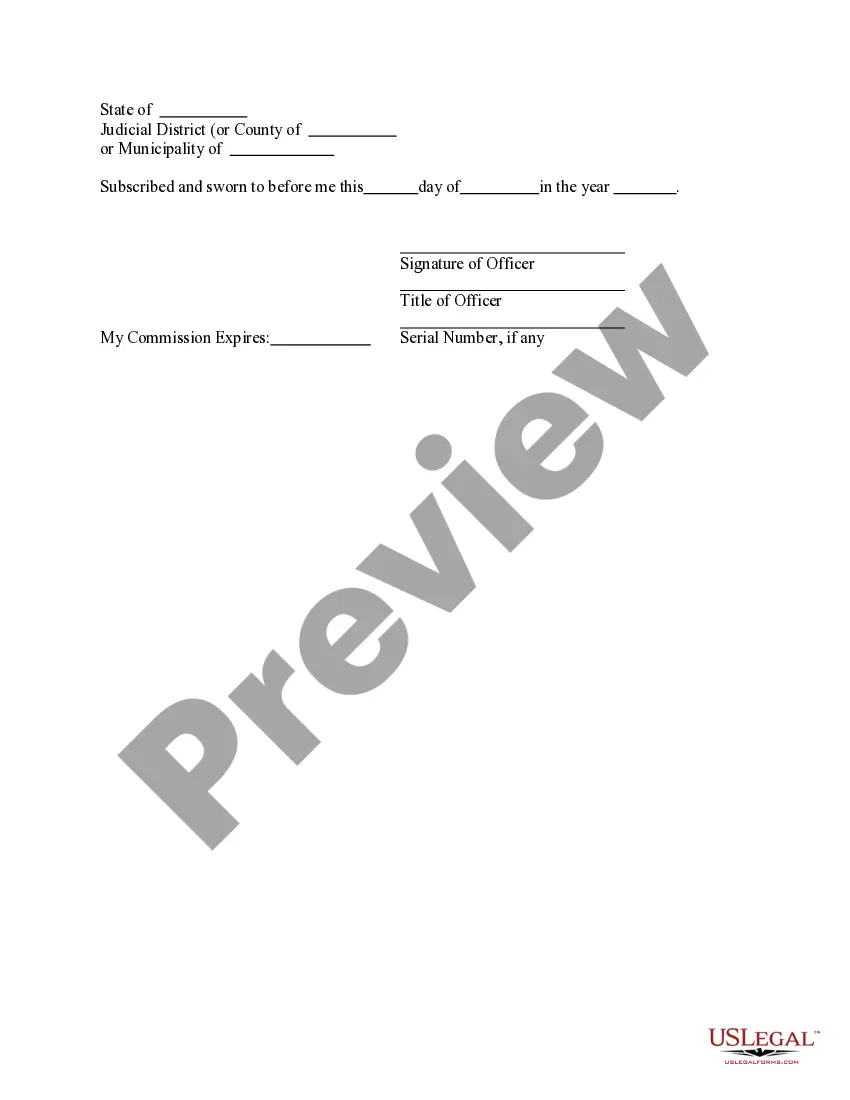

- Make use of the Preview function and look at the form description (if available) to be sure that it’s the correct document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the correct sample for the state and situation.

- Make use of the Search field on top of the site if you have to look for another file.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your file in a required format to complete, print, and sign the document.

When you have followed the step-by-step guidelines above, you'll always have the capacity to log in and download whatever file you require for whatever state you need it in. With US Legal Forms, completing Ground Lease for Land on which Cabin is Built as a Non-Permanent Structure - Real Estate Rental templates or any other legal files is not difficult. Get started now, and don't forget to double-check your examples with accredited lawyers!

Ground Lease Form popularity

Cabin Rental Agreement Other Form Names

Ground Real Rental FAQ

A ground lease is a long-term agreement between a landlord and a tenant in which the tenant is allowed to develop the leased property. At the end of the lease term, the landlord retains ownership of the improvements made by the tenant.

A ground lease is an agreement between a landowner and a tenant, in which the tenant leases land for a new build. The lessee is the owner of the building only, and is responsible for all the expenses and costs associated to constructing and maintaining a business location on a leased piece of land.

Ground leases can provide great investment opportunities for people who want to deploy capital in real estate while never having to think about property management.The value of the rental stream and the landlord's position will typically end up well below half the value of the land and building as a whole.

A ground lease involves a landowner granting a long-term lease on a parcel of land to someone so they can construct a building on it. In return the landowner then receives a steady long-term income flow in the form of a ground rent.

A ground lease is an agreement between a landowner and a tenant, in which the tenant leases land for a new build. The lessee is the owner of the building only, and is responsible for all the expenses and costs associated to constructing and maintaining a business location on a leased piece of land.

To be financeable, the ground lease should include the right of the ground lessee to mortgage the leasehold without obtaining the ground lessor's consent, coupled with the right of the lender to enforce its rights under the leasehold mortgage against the ground lease as its collateral, including the acquisition of the

A ground lease involves leasing land for a long-term periodtypically for 50 to 99 yearsto a tenant who constructs a building on the property.Many landlords use ground leases as a way to retain ownership of their property for planning reasons, to avoid any capital gains, and to generate income and revenue.

Ground Lease PV Valuation To calculate the value of the ground lease, we take the present value of all ground lease payments plus the reversion value of the ground lease at maturity. Discount Rate The discount rate at which to calculate the present value of the ground lease cash flows.

Disadvantages. The most significant downside to owning a home on leased land relates to building equity. For many people, home ownership is a major source of wealth. With a leased-land property, you risk losing all of your equity at lease expiration, depending on the terms of the surrender clause.