A nominee trust is a trust in which the trustee holds legal title to the trust property for the trust's beneficiaries, but the beneficiaries exercise the controlling powers, and the actions that the trustees may take on their own are very limited. Such trusts are a common device for holding title to real estate, and afford certain tax advantages. A nominee trust is not a trust in the strict classical sense, because of the trustee-beneficiary relationship. Despite a nominee trust's nontraditional relationship between trustee and beneficiary, such a trust must still adhere to the rule that no trust exists when the same individual is the sole settlor, sole trustee, and sole beneficiary. The trustees of a nominee trust act at the direction of the beneficiaries.

Nominee Trust

Description Nominee Trust

How to fill out Nominee Trust Sample?

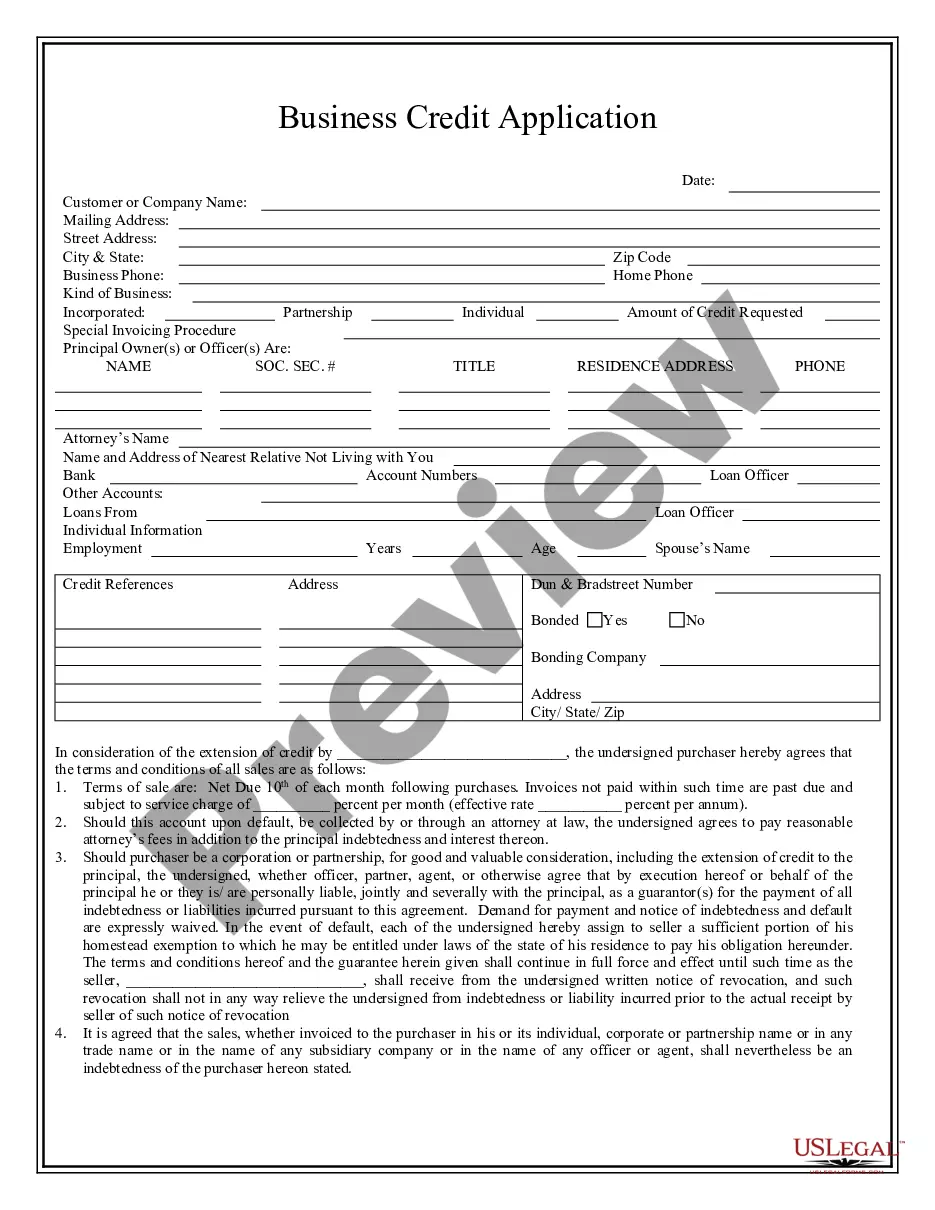

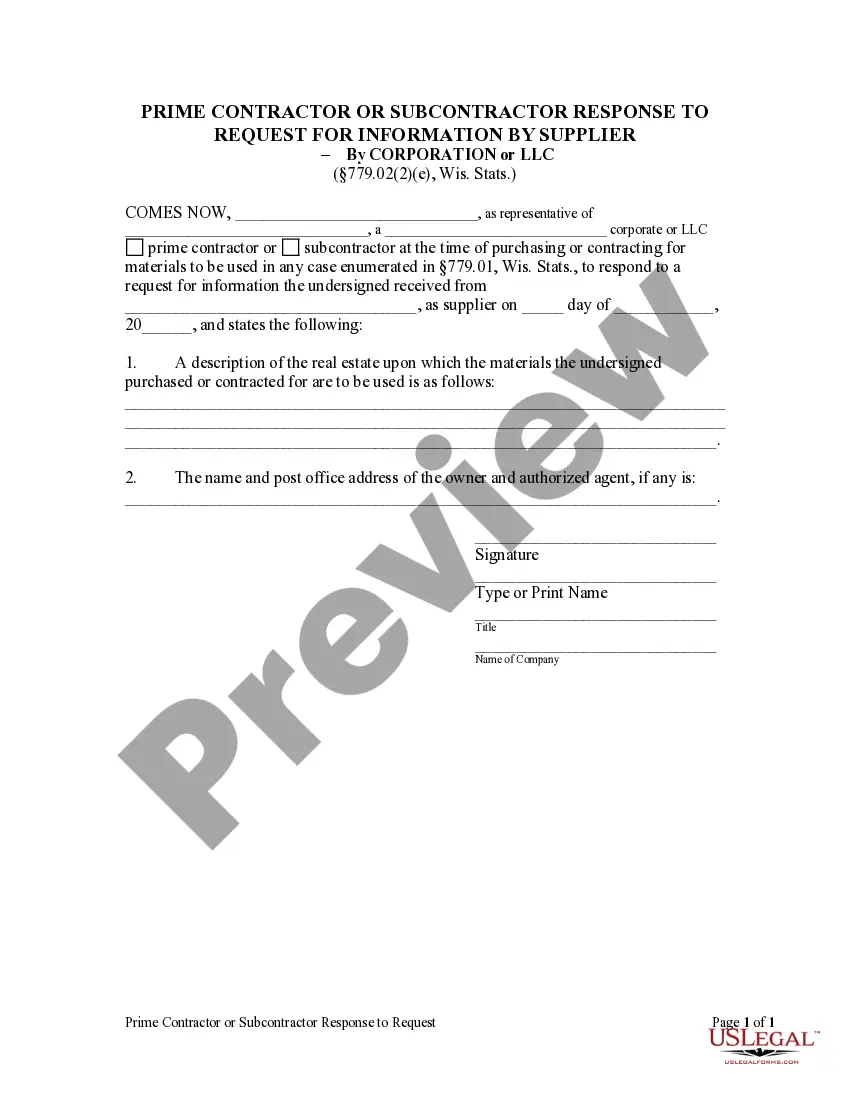

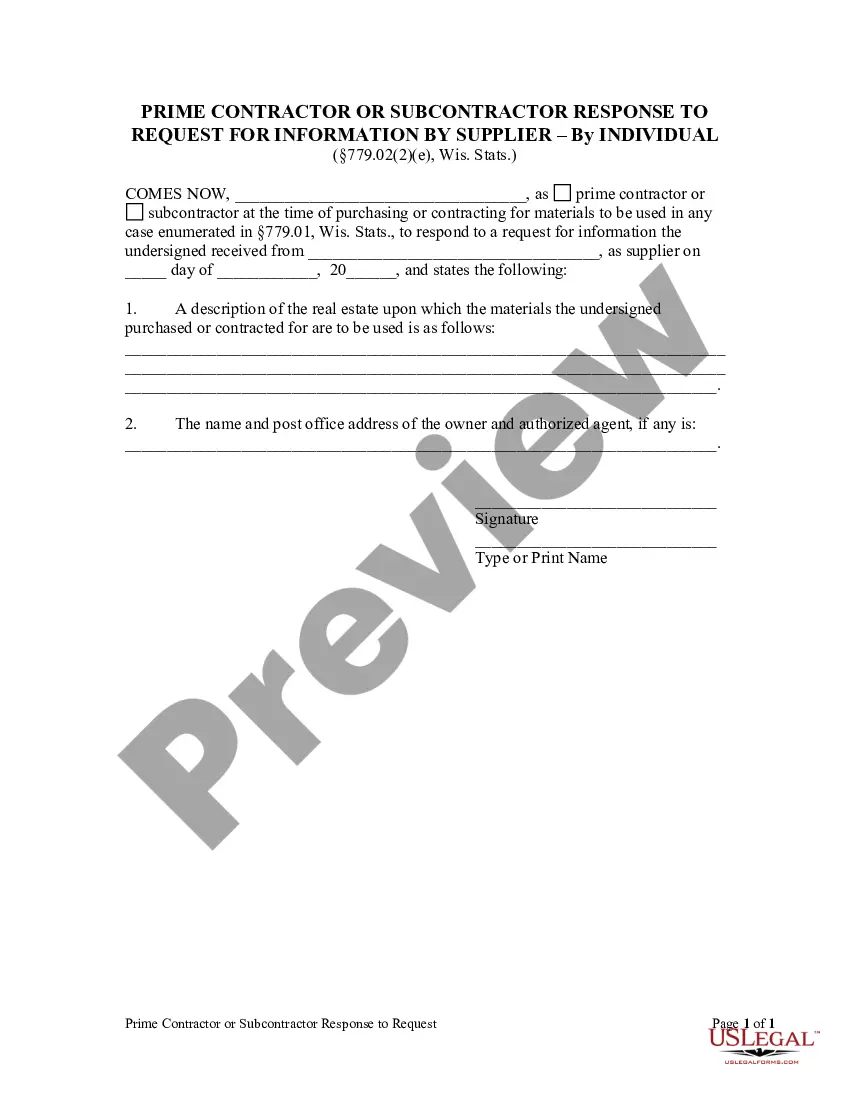

Aren't you sick and tired of choosing from numerous templates each time you need to create a Nominee Trust? US Legal Forms eliminates the lost time an incredible number of American people spend surfing around the internet for suitable tax and legal forms. Our skilled crew of lawyers is constantly changing the state-specific Templates catalogue, to ensure that it always offers the appropriate documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Users who don't have an active subscription should complete quick and easy actions before having the ability to get access to their Nominee Trust:

- Use the Preview function and look at the form description (if available) to ensure that it’s the right document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the proper template to your state and situation.

- Use the Search field at the top of the web page if you want to look for another file.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your template in a convenient format to complete, print, and sign the document.

When you have followed the step-by-step instructions above, you'll always have the ability to log in and download whatever document you require for whatever state you require it in. With US Legal Forms, finishing Nominee Trust samples or any other official files is simple. Begin now, and don't forget to examine your samples with accredited lawyers!

Totten Trust Example Form popularity

Nominee Realty Trust Other Form Names

Living Trust Terms FAQ

There are three main ways for a beneficiary to receive an inheritance from a trust: Outright distributions. Staggered distributions. Discretionary distributions.

Nominee realty trusts are a hybrid between true trusts and agency agreements where one or more individuals are appointed to act for others. Typically, the trustee or trustees of a nominee trust act on behalf of beneficiaries named in a separate document.

A nominee trust is an example of a bare trust: this is a simple type of trust where the trustee acts as the legal owner of some property but is under no obligation to manage the trust fund other than as directed by the beneficiary, and where there are no restrictions beneficiary's right to use the property.

Living trusts, Totten trusts, and nominee trusts are the main types of revocable trusts. They can be revoked, amended, or terminated by the trust grantor, the person who creates the trust, any time before his or her death.

As the grantor, you can sell properties in a revocable trust the same way you would sell any other property titled in your own name. You can take the property out of the trust and retitle it in your name, but that isn't necessary.

Trustee is the person who take care of the money payout based on your trust deed. Nominee is the person you nominate to claim the death payout from your life insurance. Beneficiary is the person who can use and enjoy the death payout from your life insurance.