Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft

Description

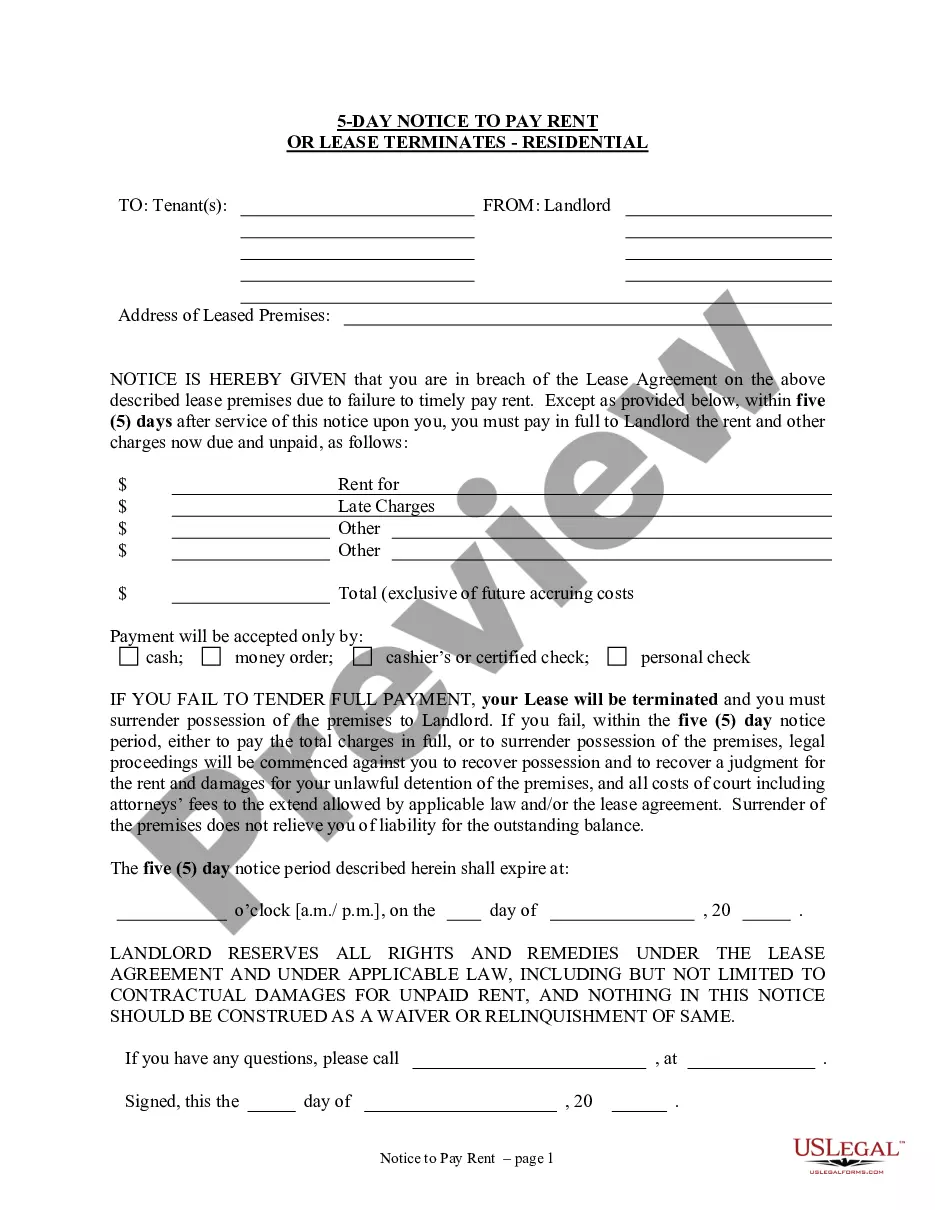

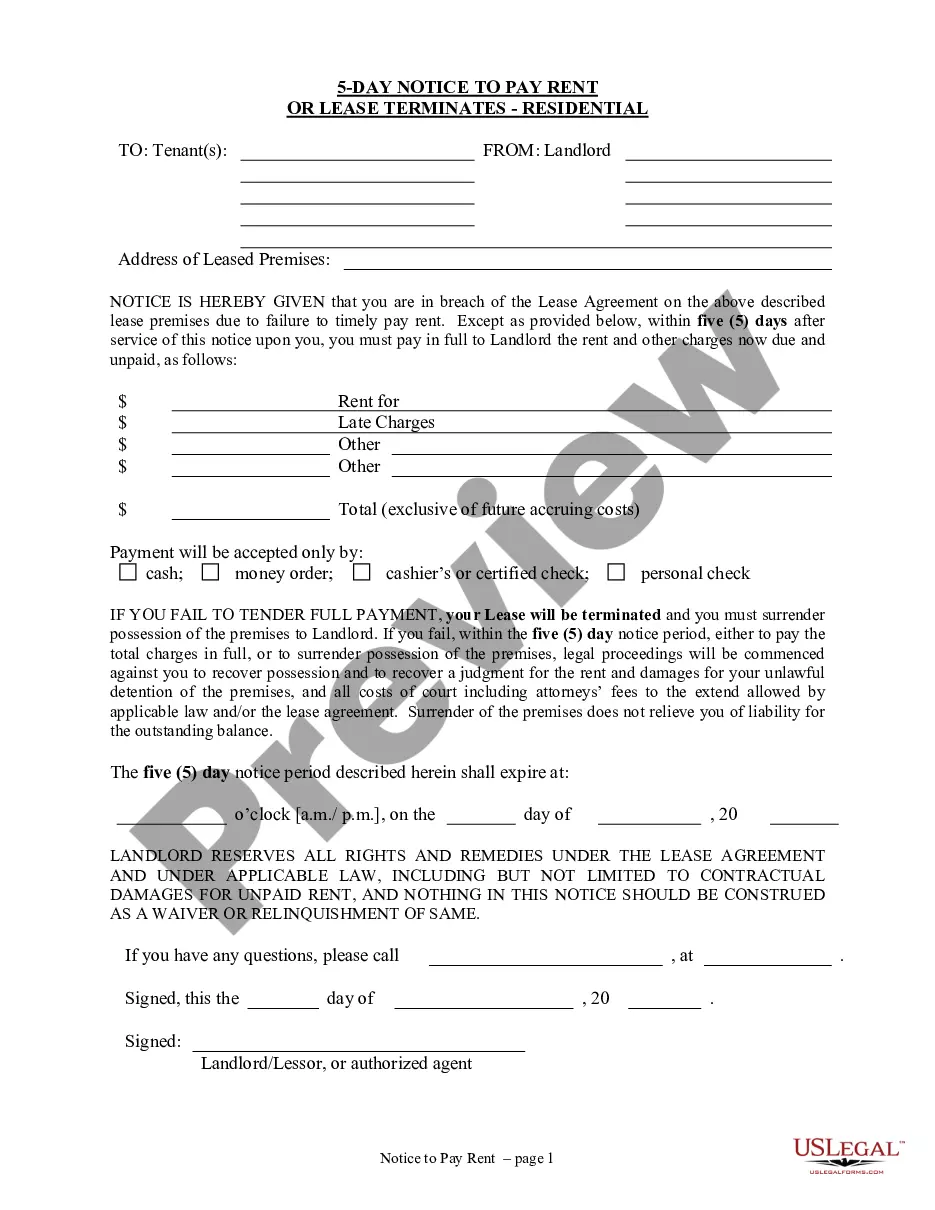

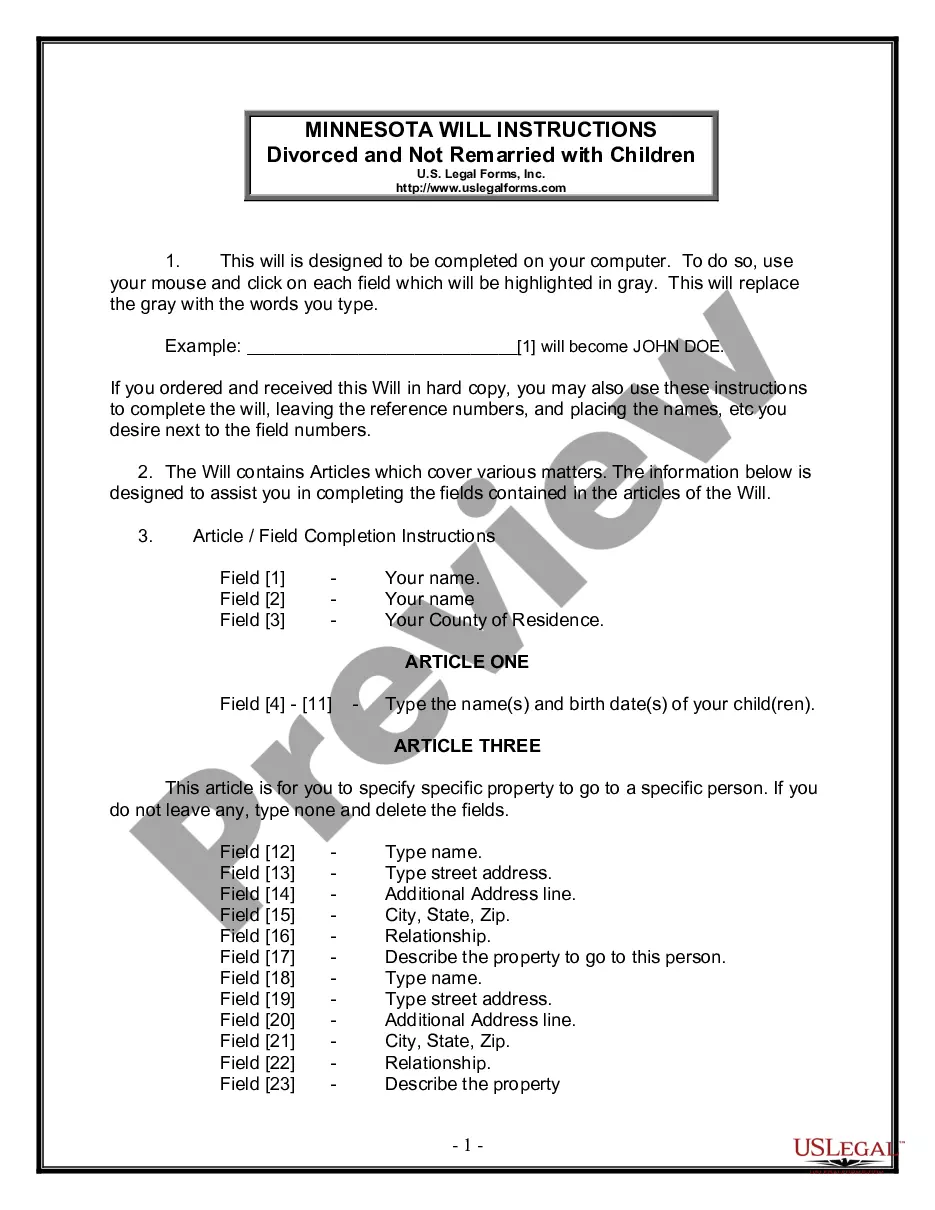

How to fill out Letter To Credit Reporting Company Or Bureau Regarding Known Imposter Identity Theft?

Aren't you sick and tired of choosing from hundreds of samples every time you want to create a Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft? US Legal Forms eliminates the wasted time countless American citizens spend surfing around the internet for suitable tax and legal forms. Our expert crew of attorneys is constantly changing the state-specific Samples collection, to ensure that it always offers the appropriate files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have a subscription should complete a few simple actions before having the ability to get access to their Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft:

- Make use of the Preview function and look at the form description (if available) to make sure that it is the appropriate document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the correct template for your state and situation.

- Make use of the Search field at the top of the web page if you want to look for another file.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your sample in a convenient format to complete, print, and sign the document.

When you have followed the step-by-step guidelines above, you'll always have the capacity to log in and download whatever document you will need for whatever state you need it in. With US Legal Forms, finishing Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft samples or any other legal paperwork is not difficult. Get started now, and don't forget to recheck your examples with accredited attorneys!

Form popularity

FAQ

Experian. P.O. Box 4500. Allen, TX 75013. TransUnion Consumer Solutions. P.O. Box 2000. Chester, PA 19016-2000. Equifax. P.O. Box 740241. Atlanta, GA 30374-0241.

A 609 letter is a method of requesting the removal of negative information (even if it's accurate) from your credit report, thanks to the legal specifications of section 609 of the Fair Credit Reporting Act.

The name 623 dispute method refers to section 623 of the Fair Credit Reporting Act (FCRA). The method allows you to dispute a debt directly with the creditor in question as long as you have already filed your complaint with the credit bureau and completed their process.

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338.

What is a credit dispute letter? A credit dispute letter is a document you can send to the credit bureaus to point out inaccuracies on your credit reports and to request the removal of the errors. In the letter, you can explain why you believe the items are inaccurate and provide any supporting documents.

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338.

Step 1: Call the companies where you know fraud occurred. Call the fraud department. Step 2: Place a fraud alert and get your credit reports. Place a free, one-year fraud alert by contacting one of the three credit bureaus. Step 3: Report identity theft to the FTC.

A credit dispute letter doesn't automatically fix this issue or repair your credit. And there are no guarantees the credit reporting agency will remove an itemespecially if you don't have strong documentation that it's an error. But writing a credit dispute letter costs little more than a bit of time.

Experian. Dispute Department. PO Box 4500. Allen, TX 75013. Equifax. PO Box 740256. Atlanta, GA 30374-0256. TransUnion. TransUnion Consumer Solutions. PO Box 2000. Chester, PA 19016-2000.