Officers Bonus - Percent of Profit - Resolution Form

Description

How to fill out Officers Bonus - Percent Of Profit - Resolution Form?

Aren't you tired of choosing from numerous samples every time you want to create a Officers Bonus - Percent of Profit - Resolution Form? US Legal Forms eliminates the lost time an incredible number of American people spend browsing the internet for appropriate tax and legal forms. Our expert team of lawyers is constantly changing the state-specific Samples catalogue, so that it always has the proper documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

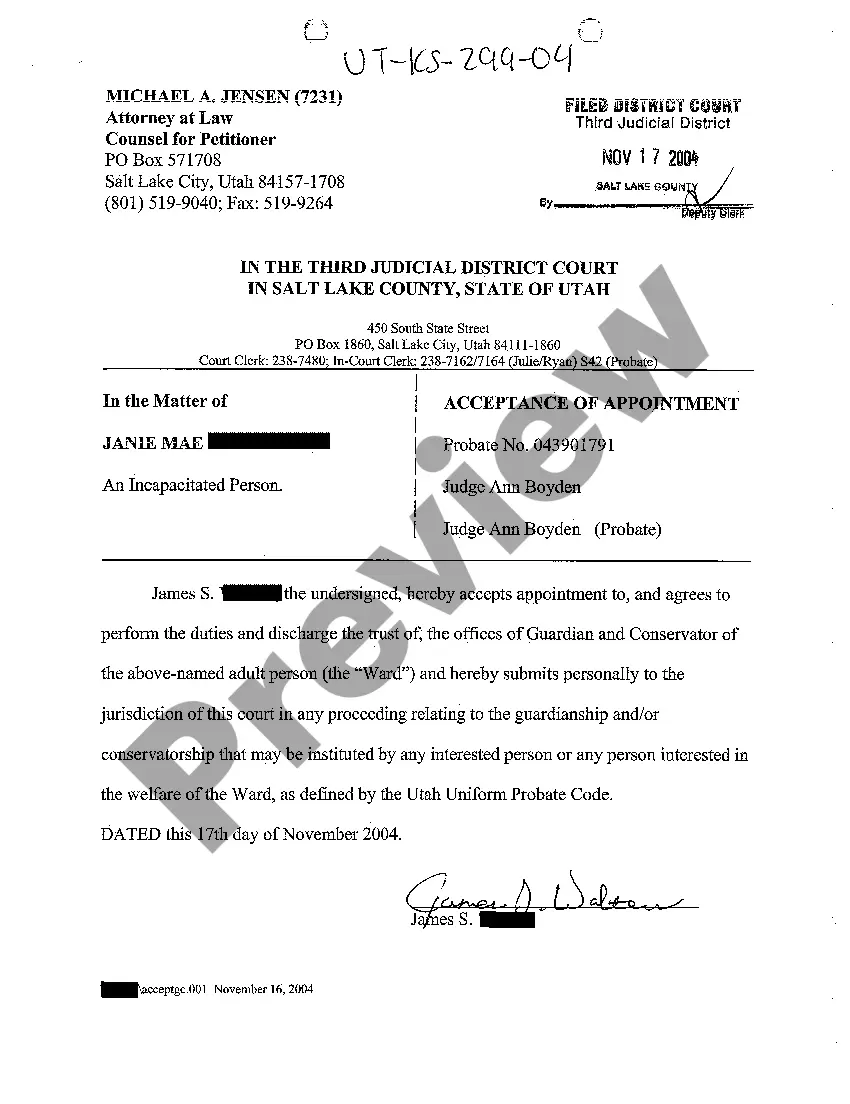

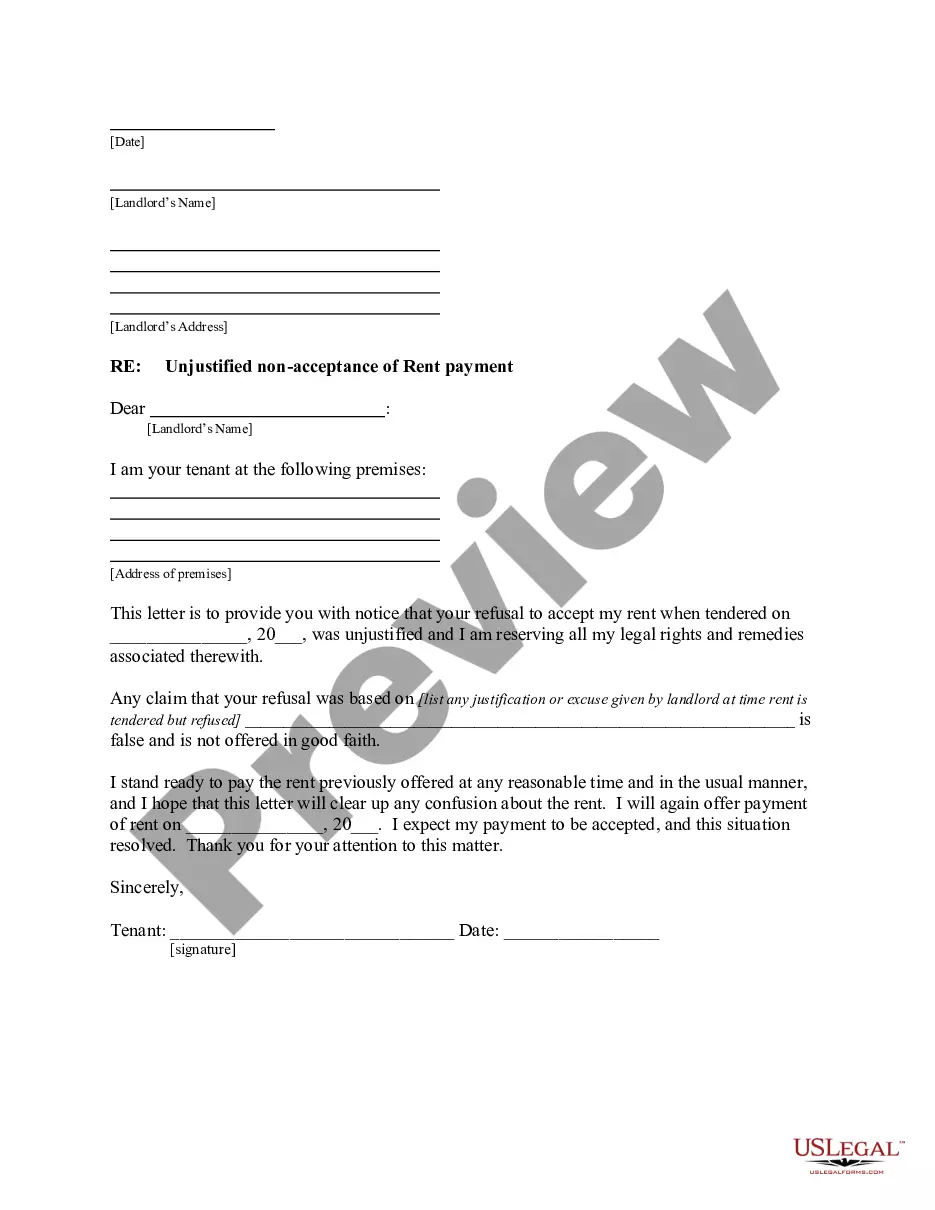

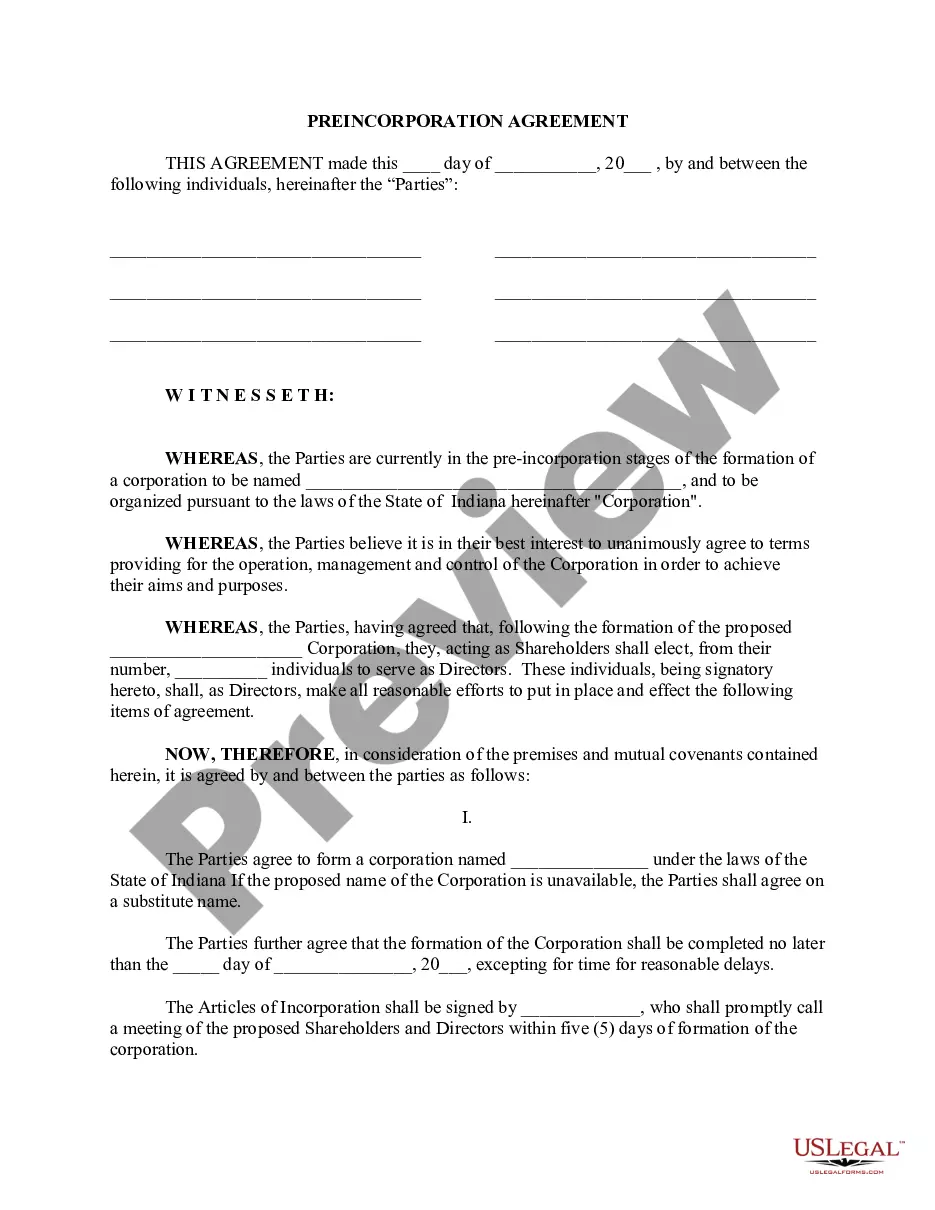

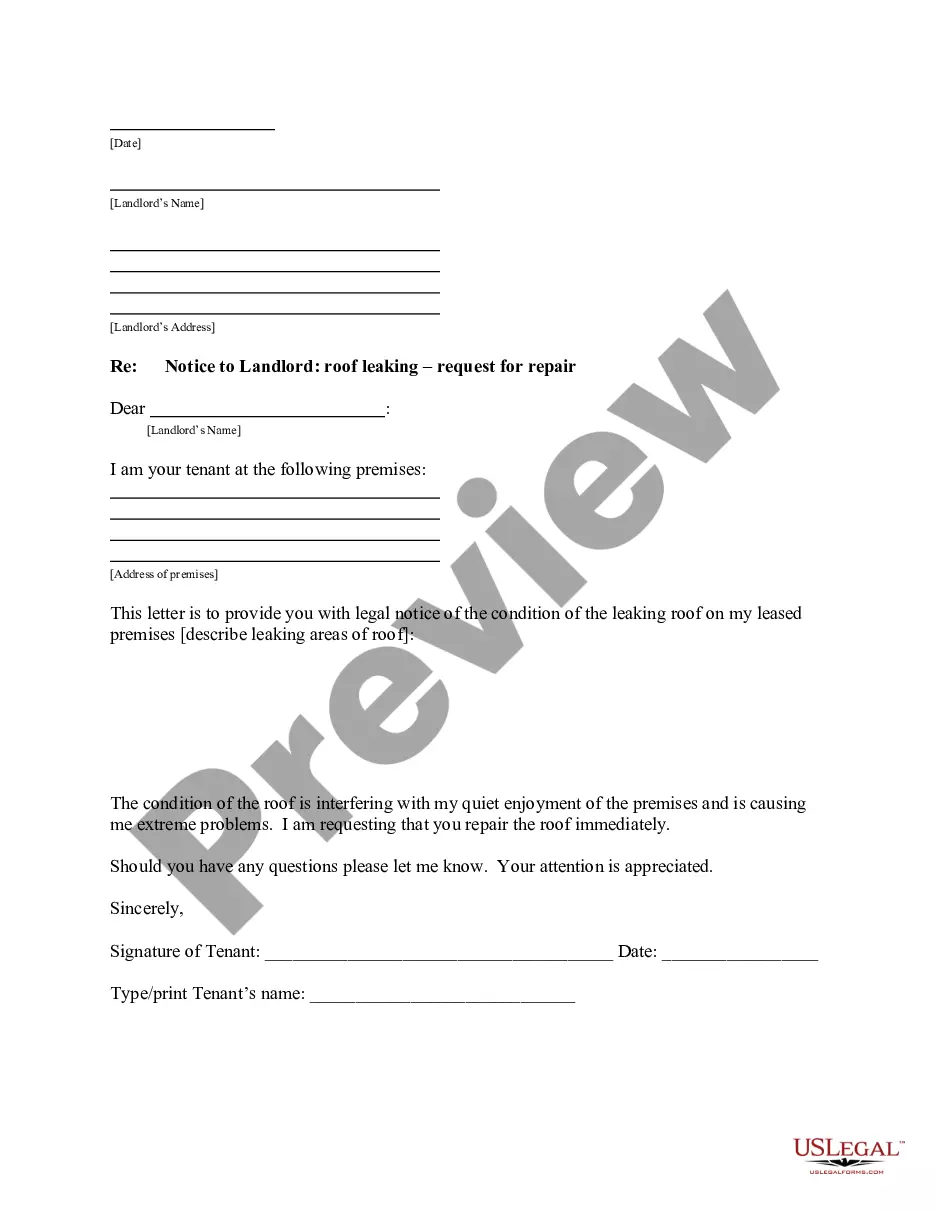

Visitors who don't have a subscription should complete quick and easy actions before being able to download their Officers Bonus - Percent of Profit - Resolution Form:

- Use the Preview function and look at the form description (if available) to be sure that it’s the appropriate document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the proper example for your state and situation.

- Utilize the Search field on top of the page if you need to look for another file.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your template in a convenient format to finish, create a hard copy, and sign the document.

When you’ve followed the step-by-step instructions above, you'll always have the ability to log in and download whatever file you require for whatever state you require it in. With US Legal Forms, completing Officers Bonus - Percent of Profit - Resolution Form samples or other legal documents is simple. Get going now, and don't forget to recheck your samples with certified lawyers!

Form popularity

FAQ

What is a Good Bonus Percentage? A good bonus percentage for an office position is 10-20% of the base salary. Some Manager and Executive positions may offer a higher cash bonus, however this is less common.

Usually a lump-sum payment (cash, shares, etc.) made once a year in addition to an employee's normal salary or wage for a fiscal or calendar year. Generally nondiscretionary and not based on predetermined performance criteria or standards.

Key Takeaways. A bonus payment is additional pay on top of an employee's regular earnings. A bonus payment can be discretionary or nondiscretionary, depending on whether it meets certain criteria. Bosses hand out bonus payments for a variety of reasons, including as a reward for meeting individual or company goals.

Put the employee bonus plan in writing. Base the bonus on results that are measurable or quantifiable. Give incentives to employees to meet goals. Be clear on the WHAT, the WHY, and the HOW. Make sure everybody gets something. Make the financial reward a strong enough incentive.

An annual bonus is usually based on overall company performance. So you may get a large or small bonus (or no bonus at all) depending on how successful your organization or specific department was that year, as well as how big a part of that success you were. This can also be considered profit sharing.

The average retention bonus is between 10-15% of an employee's base income, but the amount can go up to 25%. Employers must consider why they are giving the retention bonus to determine the amount given.

A company sets aside a predetermined amount; a typical bonus percentage would be 2.5 and 7.5 percent of payroll but sometimes as high as 15 percent, as a bonus on top of base salary. Such bonuses depend on company profits, either the entire company's profitability or from a given line of business.

A 35% pay increase seems to be the current average. The size of a raise will vary greatly by one's experience with the company as well as the company's geographic location and industry sector. Sometimes raises will include non-cash benefits and perks that are not figured into the percentage increase surveyed.

As an example, a company might pay one employee $50,000 a year and make them eligible for a 5% bonus if goals are met, but pay another employee $100,000 a year with a possible 10% bonus. Bonuses based on pay grade recognize that a senior employee may have a more significant impact on the company's performance.