Sales Invoice

Description

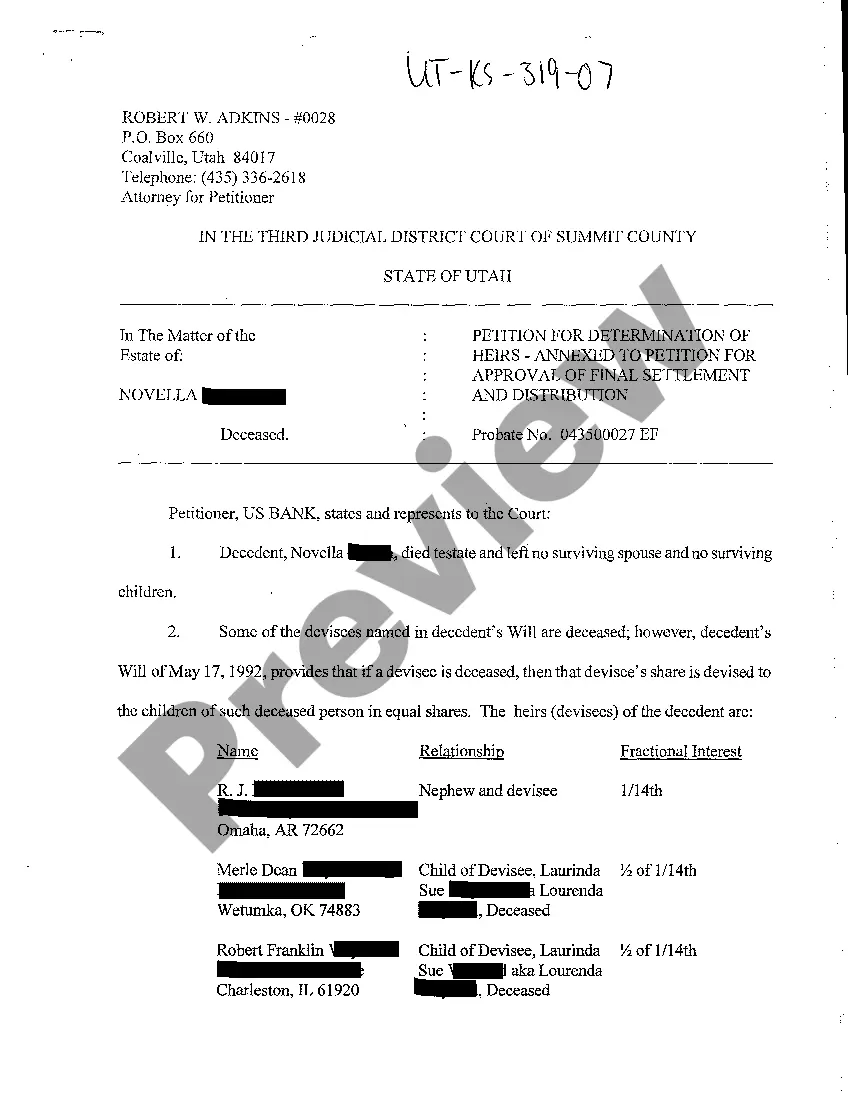

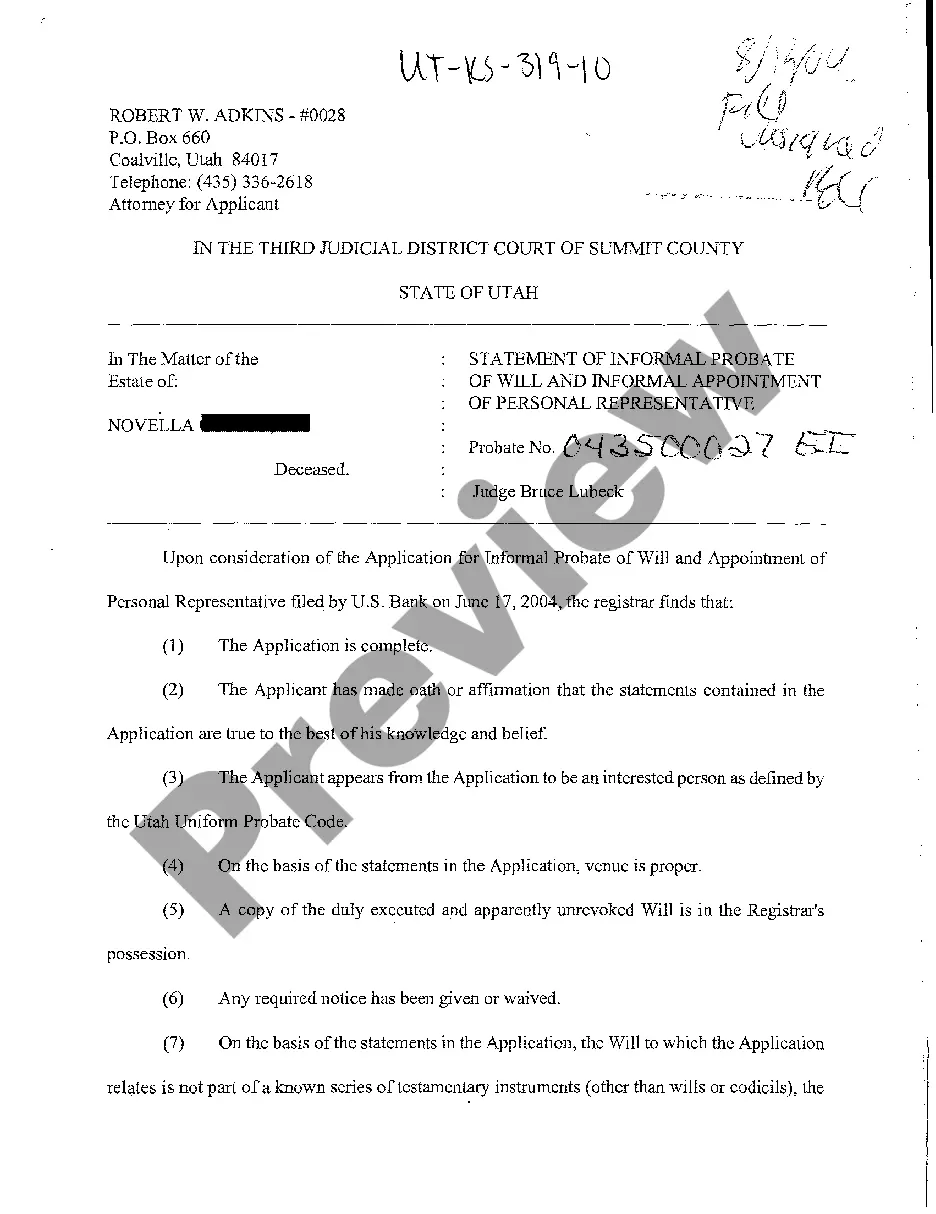

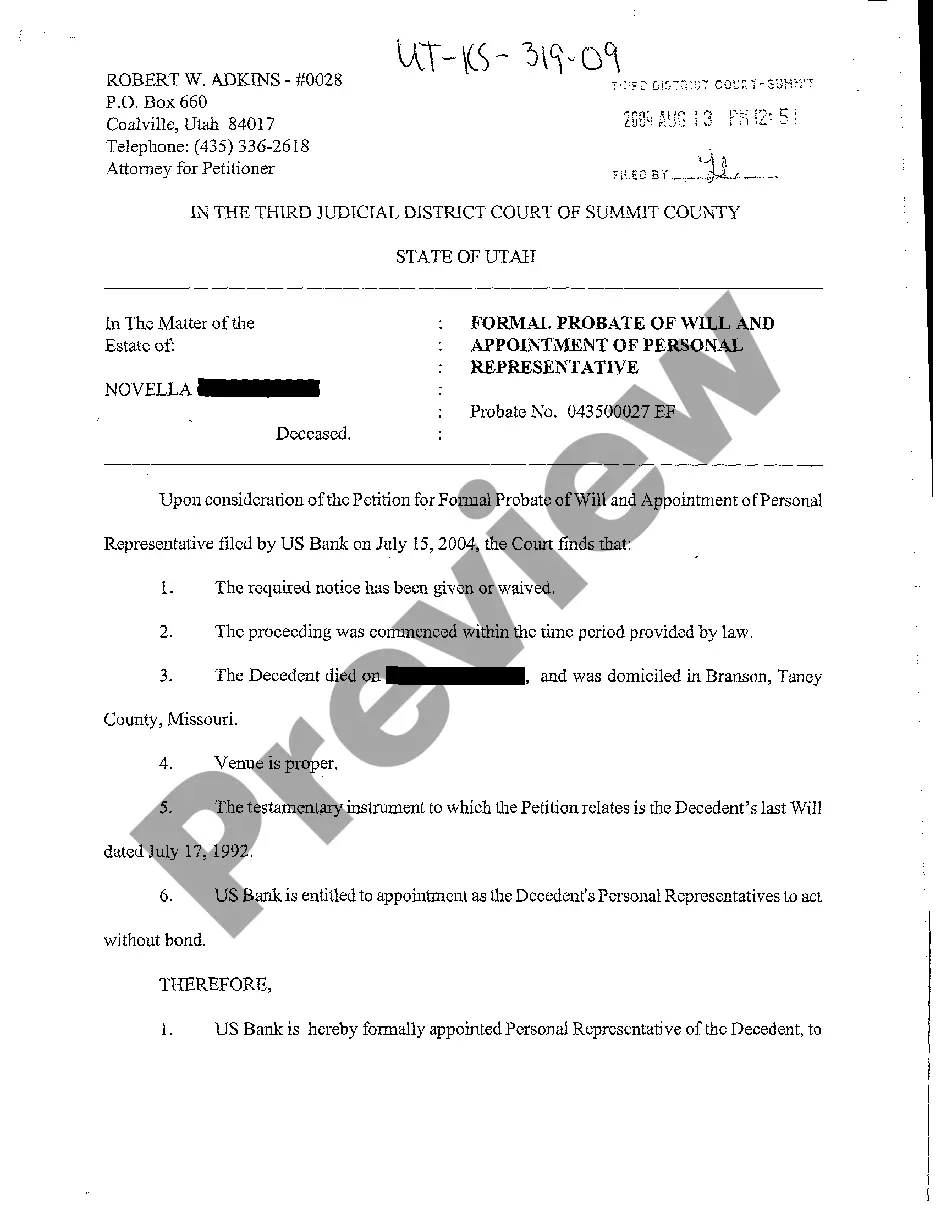

How to fill out Sales Invoice?

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state laws and are checked by our experts. So if you need to complete Sales Invoice, our service is the best place to download it.

Getting your Sales Invoice from our catalog is as simple as ABC. Previously authorized users with a valid subscription need only log in and click the Download button after they locate the correct template. Later, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a quick instruction for you:

- Document compliance verification. You should attentively review the content of the form you want and check whether it satisfies your needs and meets your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable blank, and click Buy Now when you see the one you want.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Sales Invoice and click Download to save it on your device. Print it to complete your paperwork manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

Whereas, a sales invoice is a bill issued by the seller and is proof the selling process has already happened. It addresses how much the buyer owes to the seller. For example, if a baker receives a request for a birthday cake due in two weeks, that is recorded as a purchase order.

Each document differs based on the type of sale they cover. Sales invoices are for the sale of goods or property, while official receipts are for the sale of services or leases of property. Both are considered principal evidence for these transactions.

B. Note: When the taxpayer is engaged in sale of goods or properties, it will need to issue a sales invoice when the goods is sold to the buyer, whether cash or on credit. If the sale was on credit, the seller will then issue an collection receipt upon receipt of cash as payment from the buyer.

Who issues the sales invoice? The seller or service provider issues the invoice. An invoice is proof from the seller that a product or service has been provided, and it is a request for payment from the buyer.

Businesses need to create invoices to ensure they get paid by their clients. Invoices serve as legally enforceable agreements between a business and its clients, as they document services rendered and payment owed. Invoices also help businesses track their sales and manage their finances.

While an invoice is a request for payment, a receipt is the proof of payment. It is a document confirming that a customer received the goods or services they paid a business for ? or, conversely, that the business was appropriately compensated for the goods or services they sold to a customer.

Sales invoice is issued by the seller to the buyer as written evidence on sale of goods or properties in an ordinary course of business, whether cash or on account (credit). Sales invoice list down the details of the items or goods sold. It will also be the basis of the percentage tax liability of the seller.

A sales invoice is a document sent to your customer or purchaser that names them, the goods or services you've provided to them, and when those items were delivered. A sales invoice might also include an itemized portion of the final fee noting the sales tax, shipping fees, or any other external costs.