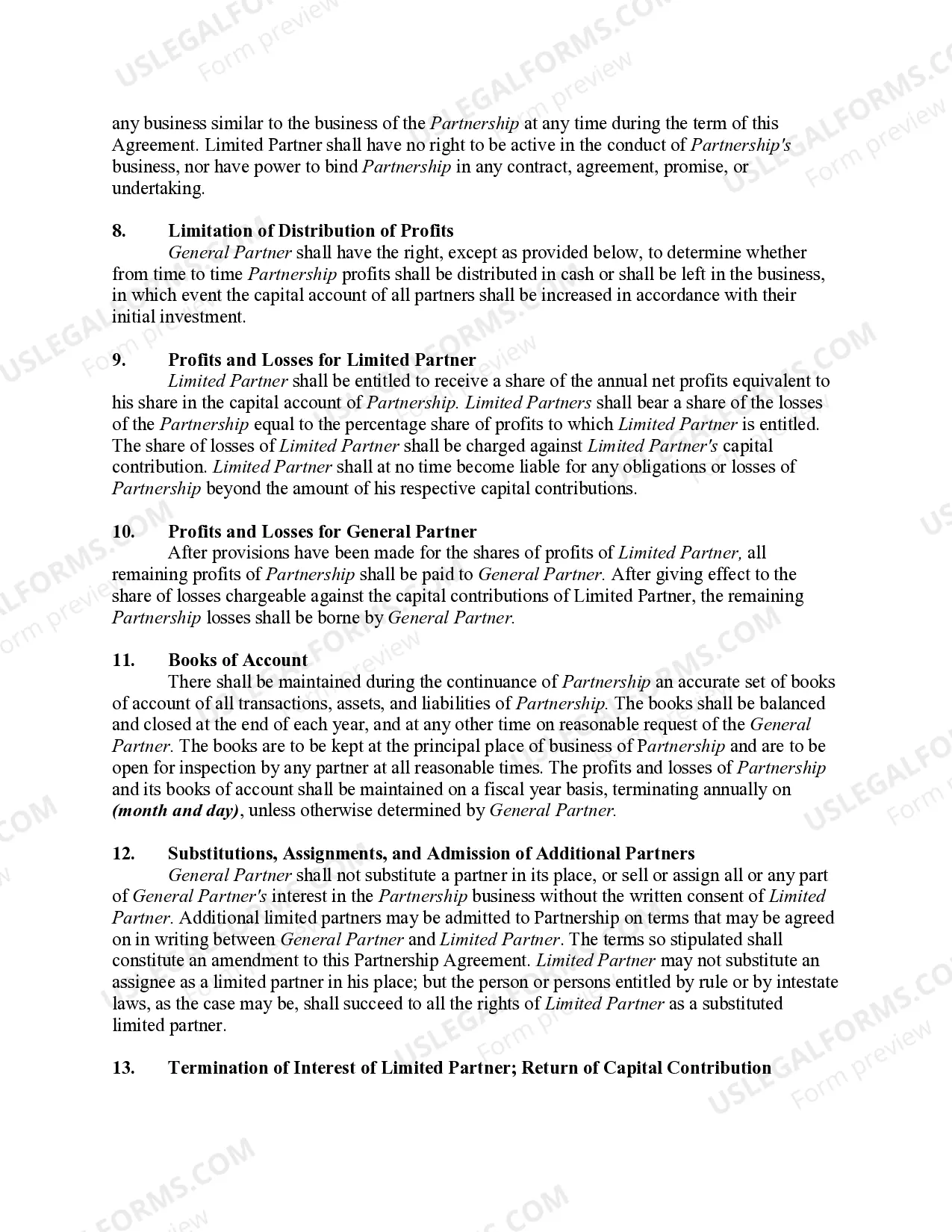

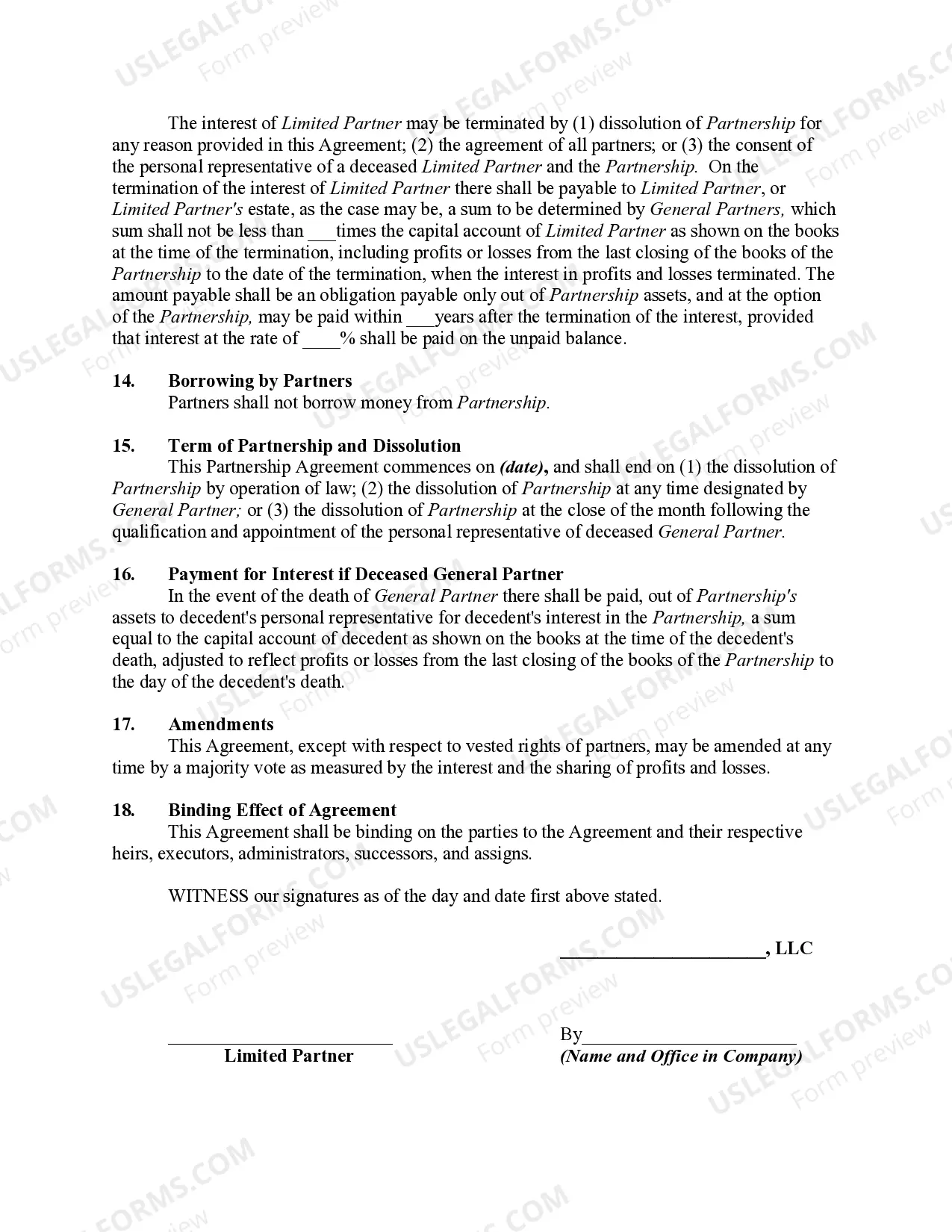

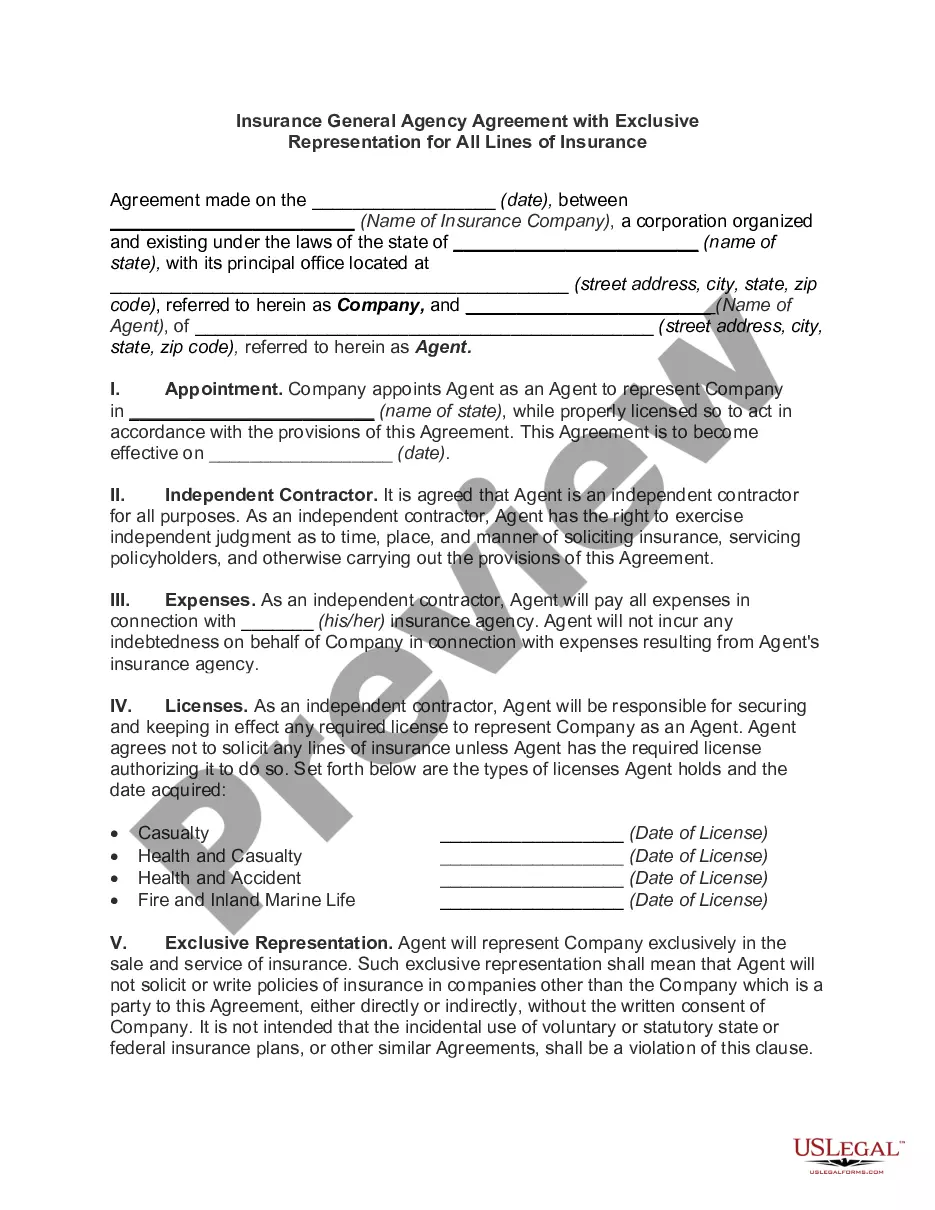

Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Description

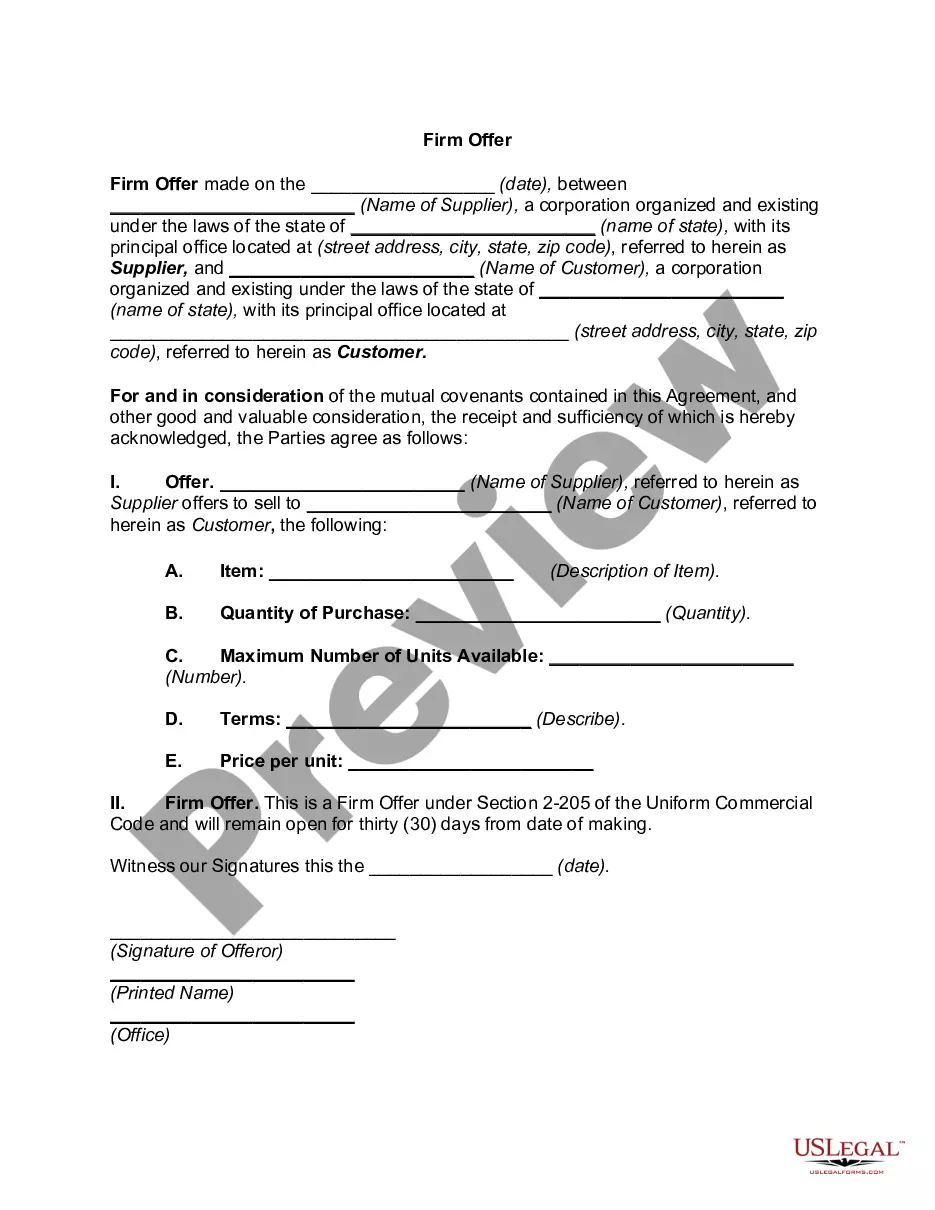

How to fill out Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

Aren't you sick and tired of choosing from hundreds of samples each time you need to create a Limited Partnership Agreement Between Limited Liability Company and Limited Partner? US Legal Forms eliminates the lost time numerous American people spend browsing the internet for ideal tax and legal forms. Our professional team of attorneys is constantly upgrading the state-specific Templates catalogue, so it always offers the appropriate documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have an active subscription need to complete simple actions before having the ability to get access to their Limited Partnership Agreement Between Limited Liability Company and Limited Partner:

- Use the Preview function and look at the form description (if available) to be sure that it’s the best document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the correct example to your state and situation.

- Utilize the Search field at the top of the web page if you have to look for another document.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your file in a required format to complete, print, and sign the document.

After you’ve followed the step-by-step instructions above, you'll always have the capacity to sign in and download whatever document you will need for whatever state you need it in. With US Legal Forms, completing Limited Partnership Agreement Between Limited Liability Company and Limited Partner samples or other official documents is not difficult. Begin now, and don't forget to look at your samples with certified attorneys!

Form popularity

FAQ

A limited partnership only requires one managing general partner. However, several natural persons or legal entities can also be active as general partners and jointly manage the company within the framework of a management board, and represent it externally.

A limited partner is a part-owner of a company whose liability for the firm's debts cannot exceed the amount that an individual invested in the company. Limited partners are often called silent partners.

Limited partners (limited in both their ability to manage the partnership and liability for the partnership's debts) can exclude their distributive share for self-employment tax purposes.An LLC member can enjoy limited liability and yet still participate actively in the LLC's management.

Understanding Limited Partnerships (LPs) General partners have unlimited liability and have full management control of the business. Limited partners have little to no involvement in management, but also have liability that's limited to their investment amount in the LP.

An LLC partnership can have two or more owners, called members. Limited liability companies with multiple members are referred to as multi-member LLCs or LLC partnerships. Under an LLC partnership, members' personal assets are protected. In most cases, members can't be sued for the business's actions or debts.

Limited partnerships (LPs) and limited liability partnerships (LLPs) are both businesses with more than one owner, but unlike general partnerships, limited partnerships and limited liability partnerships offer some of their owners limited personal liability for business debts.

What does a partner in a limited liability partnership have that a limited partner in a limited partnership does not have? business involvement.

The difference between a general partner vs. limited partner is a general partner is an owner of the partnership, and a limited partner is a silent partner in the business. A general partner is an owner of a partnership.

General partnerships have no restrictions on who can be owners. Owners can range from individuals to corporations to LLCs. In addition, states do not place restrictions on the types of businesses in which LLCs can participate. Therefore, LLCs can serve as general partners in a partnership.