Invoice 8 is a document that is used in business to keep track of transactions between parties. It provides an itemized listing of goods or services that have been purchased and the corresponding costs. The invoice typically includes the date of purchase, the customer's name, the item(s) purchased, the cost of each item, any taxes applicable, and the total amount due. There are several types of Invoice 8, including the Pro Forma Invoice, the Tax Invoice, and the Commercial Invoice. The Pro Forma Invoice is used to provide an estimate of the cost of goods or services, and the Tax Invoice is used to calculate the applicable taxes. The Commercial Invoice is used to record a transaction for accounting purposes.

Invoice 8

Description

How to fill out Invoice 8?

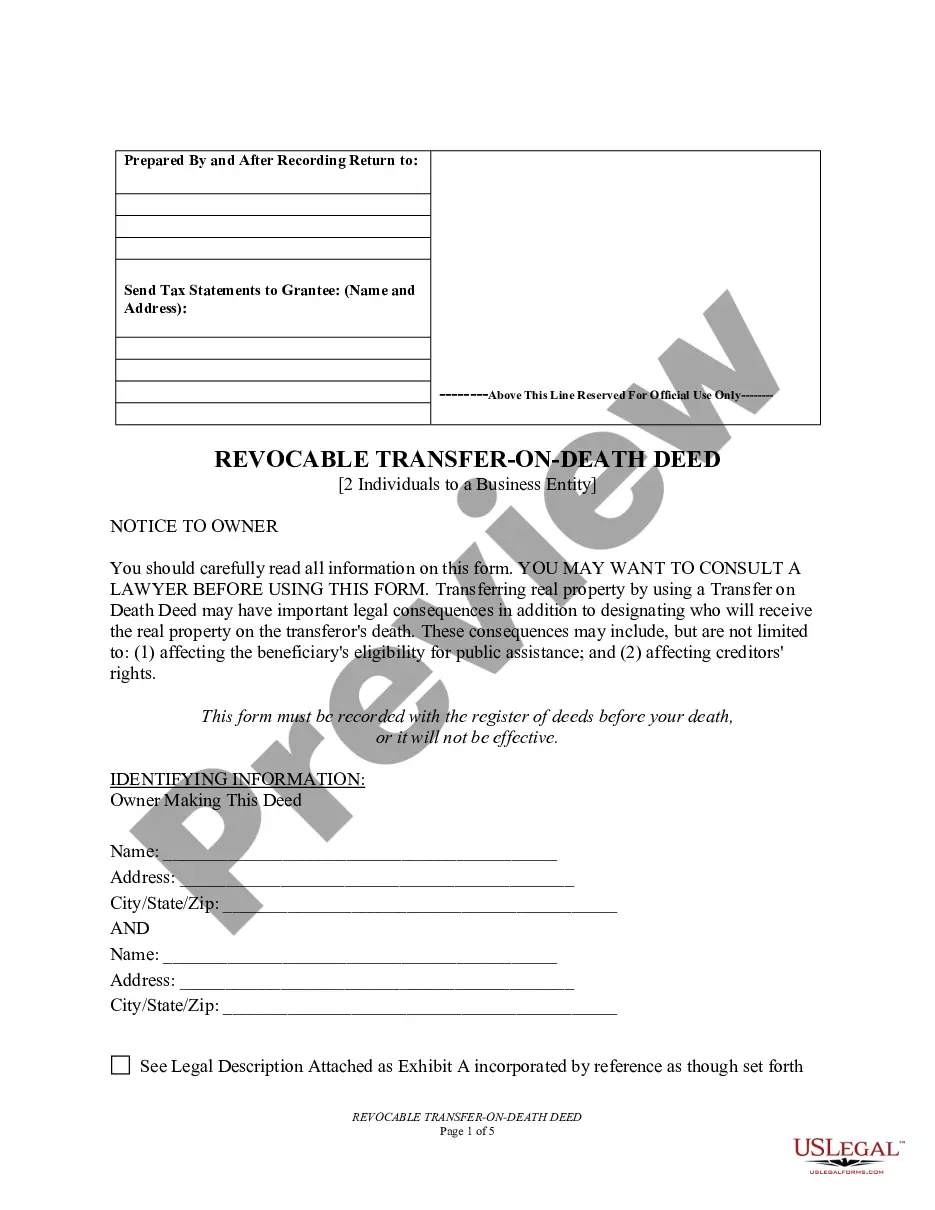

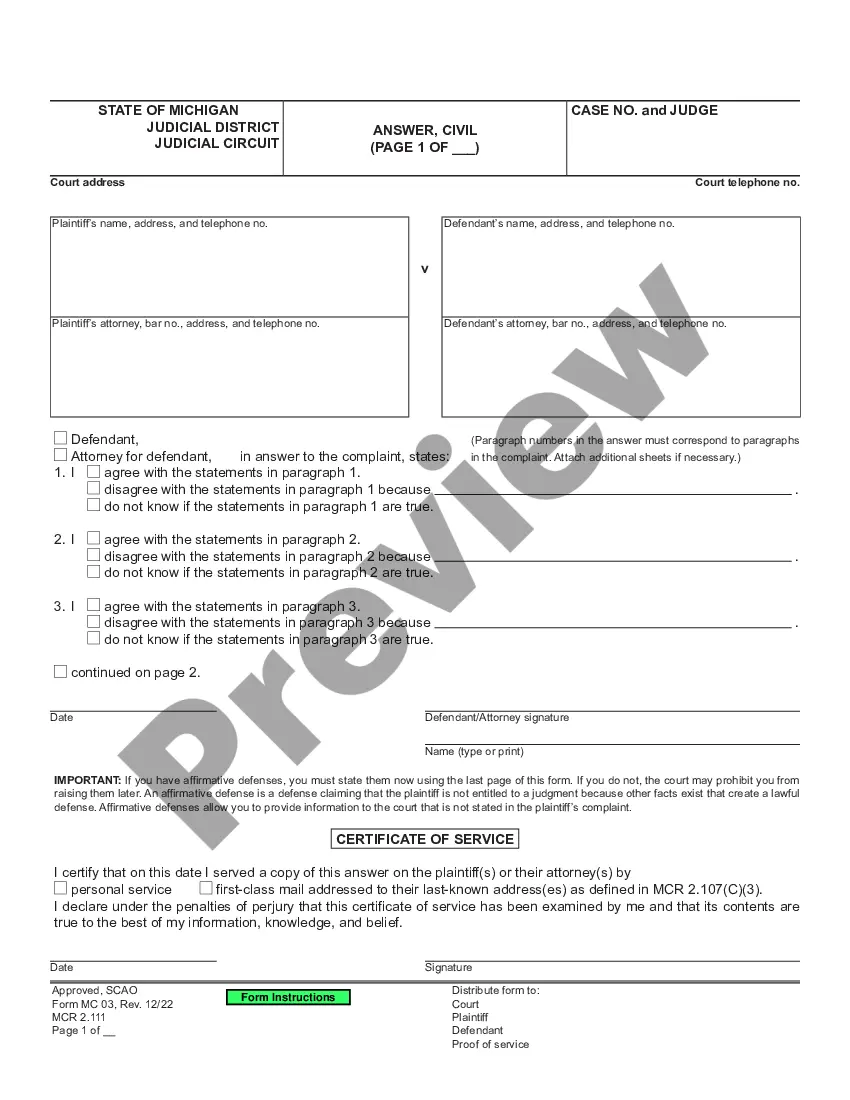

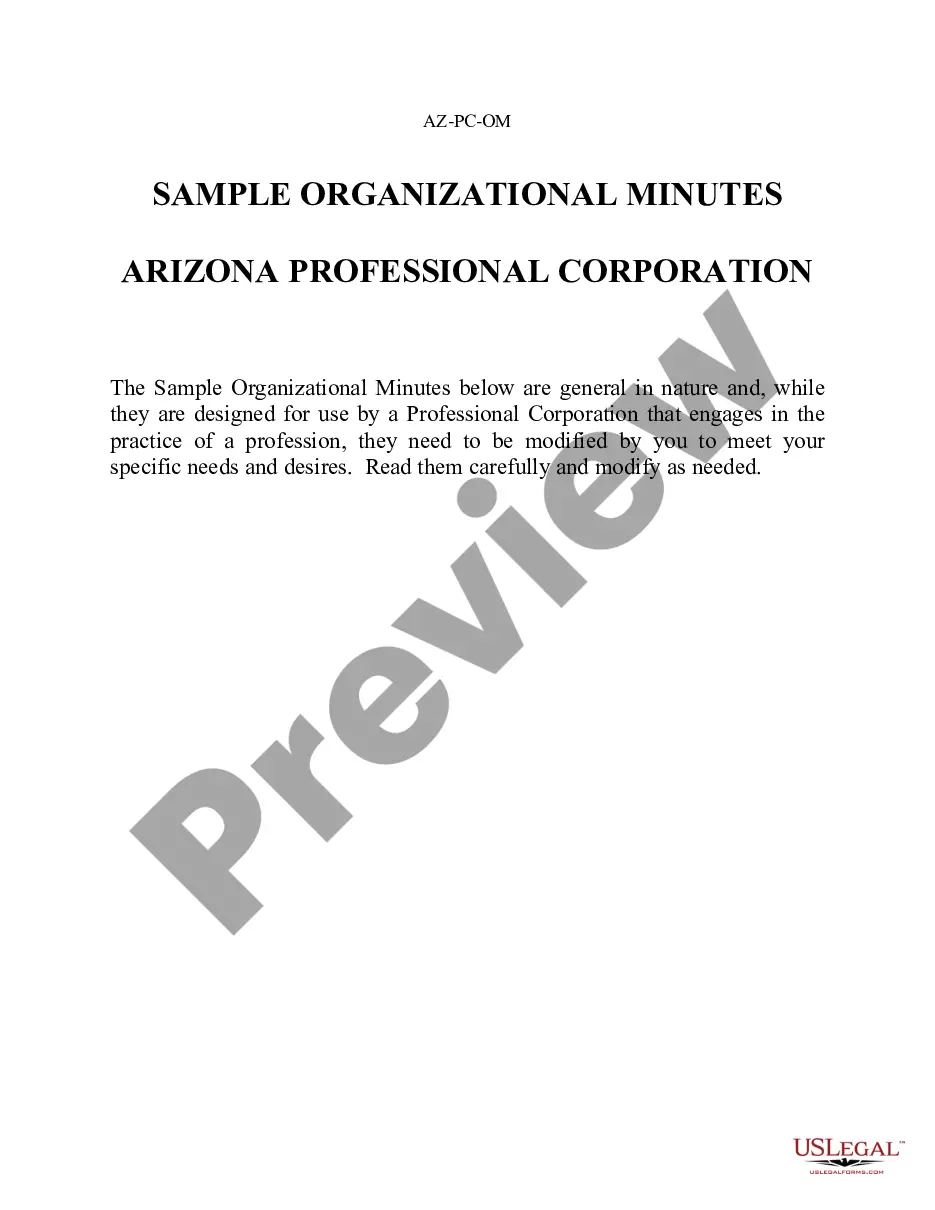

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state laws and are verified by our specialists. So if you need to fill out Invoice 8, our service is the best place to download it.

Getting your Invoice 8 from our library is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they find the correct template. Afterwards, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a brief guide for you:

- Document compliance verification. You should carefully review the content of the form you want and make sure whether it suits your needs and complies with your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab on the top of the page until you find a suitable blank, and click Buy Now when you see the one you need.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Invoice 8 and click Download to save it on your device. Print it to complete your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to get any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Items sold by Amazon and most sellers come with a downloadable invoice. The items have some text that reads: GST invoice on their product detail page. You can identify items that come with a downloadable invoice to ensure you always get one.

Go to Your Orders. Select View Order Details next to the order. Tip: If you don't see the order you're looking for, select another option from the Orders placed in menu. Select Invoice, you'll see the option to print your invoice.

Amazon's invoice is a legally binding receipt, containing all necessary information about your order, including the shopper's and seller's details. These invoices can be used, for instance, as proof of expenditures to get reimbursed by the company you are employed by or claim tax write-offs for your business expenses.

Invoice coding is the process of embedding additional information into an invoice using a unique system of codes. At a high level, it's really that simple. But there are important differences in invoice coding between the invoices that companies send to customers and the invoices that companies receive from vendors.

An invoice number is a unique, sequential code that is systematically assigned to invoices. Invoice numbers are one of the most important aspects of invoicing as they ensure that income is properly documented for tax and accounting purposes. They also make it easier to track payments and manage overdue invoices.

Pay by Invoice gives eligible Amazon Business customers an extended due date for payment by purchasing on credit. You can improve cash flow and streamline purchasing and payments processes using this method.

How to create an invoice number numbering your invoices sequentially, for example, INV00001, INV00002. starting with a unique customer code, for example, XER00001. including the date at the start of your invoice number, for example, 2023-01-001. combining the customer code and date, for example, XER-2023-01-001.

Open the Amazon application on your Android or iOS device. Click on the Hamburger menu and then go to the Orders section. Now, search for the order for which you want to download the invoice.