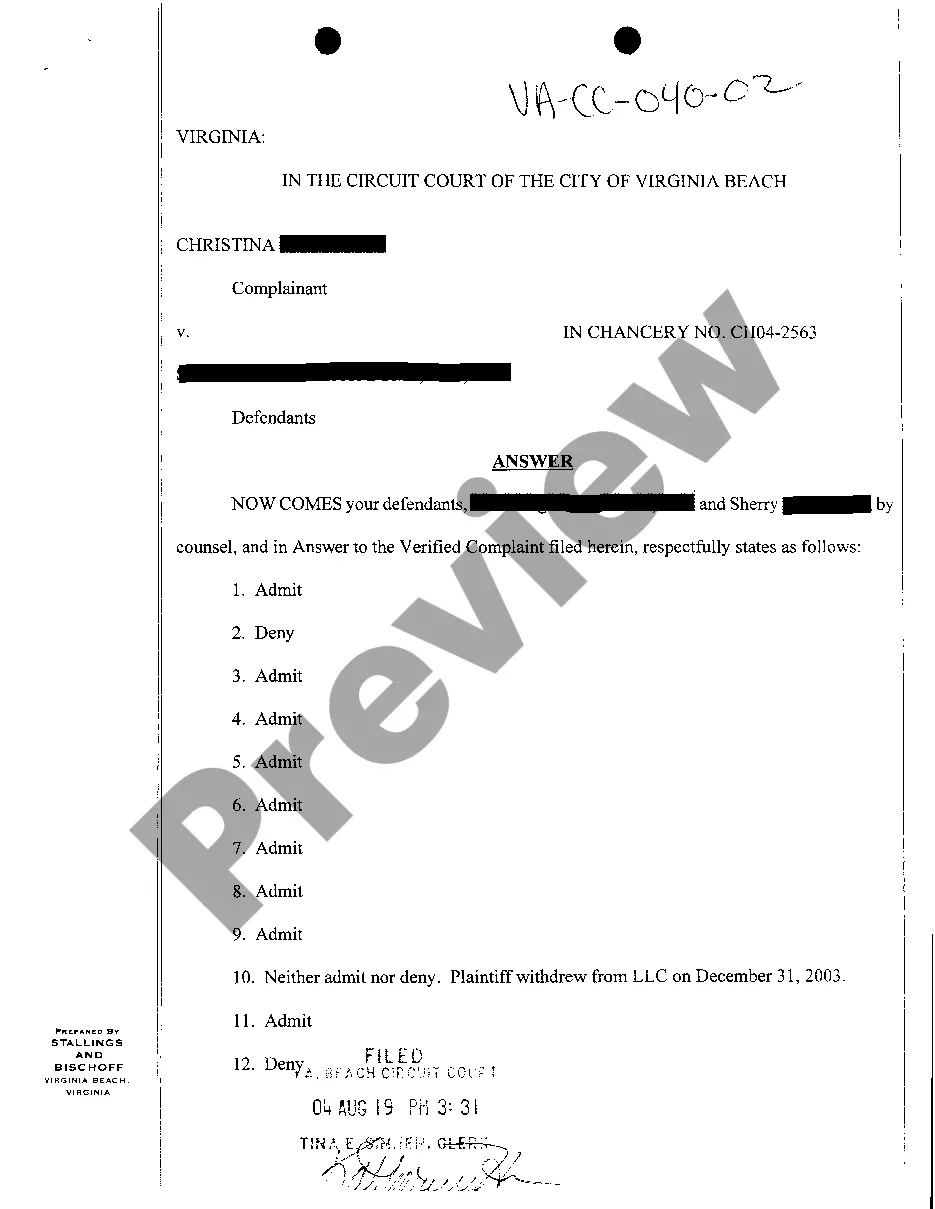

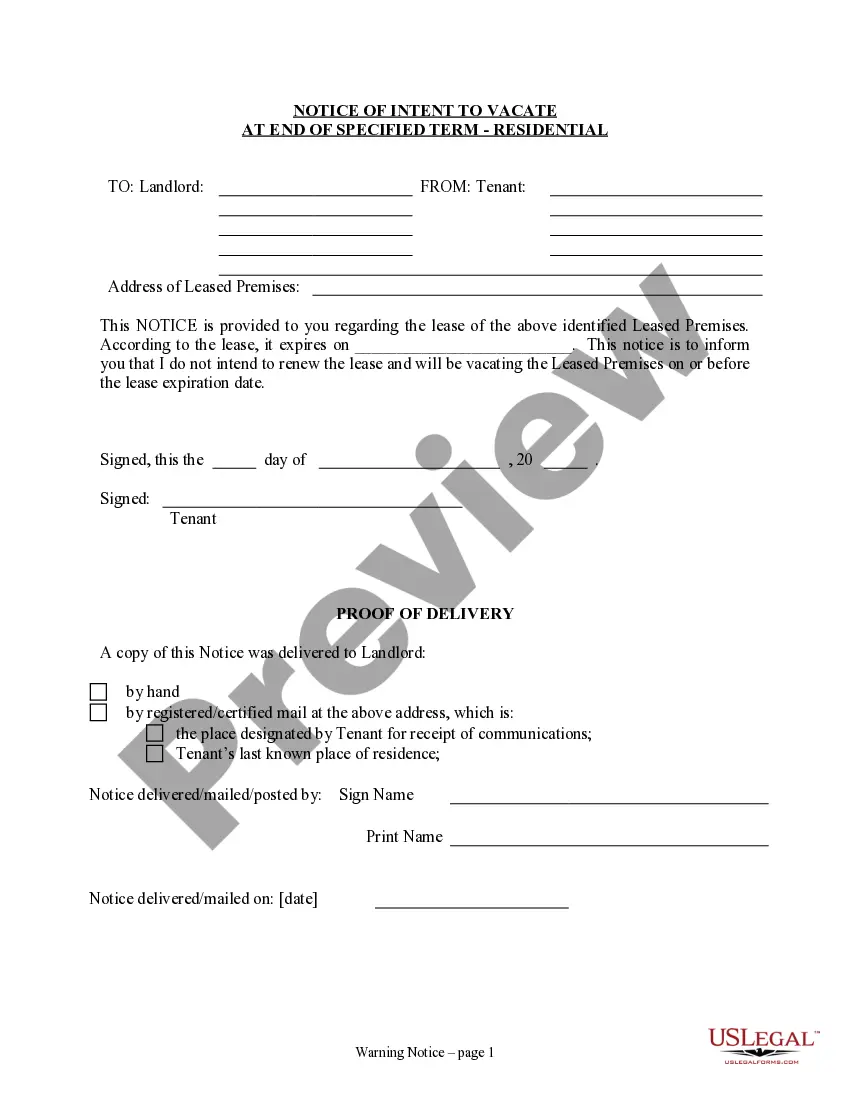

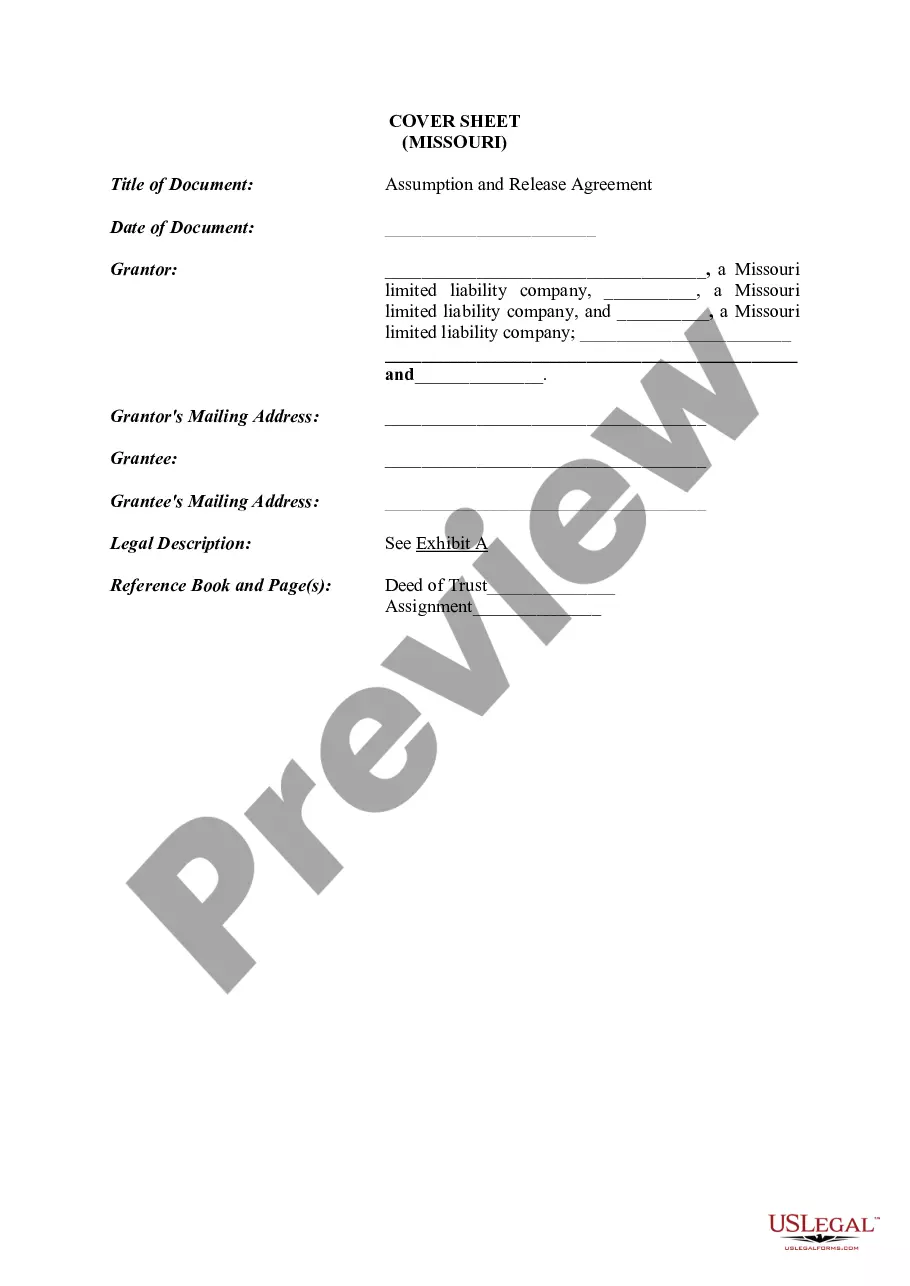

Sample Letter for Request for Free Credit Report Based on Denial of Credit

Description Letter Denial

How to fill out Letter Credit Report Sample?

Among countless paid and free samples which you find on the internet, you can't be certain about their accuracy and reliability. For example, who created them or if they are qualified enough to take care of what you require these to. Keep calm and use US Legal Forms! Find Sample Letter for Request for Free Credit Report Based on Denial of Credit templates created by skilled lawyers and get away from the high-priced and time-consuming process of looking for an attorney and after that having to pay them to write a document for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button near the form you are trying to find. You'll also be able to access all of your previously saved documents in the My Forms menu.

If you are utilizing our service the first time, follow the tips listed below to get your Sample Letter for Request for Free Credit Report Based on Denial of Credit easily:

- Ensure that the file you find is valid where you live.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another example utilizing the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

As soon as you have signed up and bought your subscription, you can utilize your Sample Letter for Request for Free Credit Report Based on Denial of Credit as many times as you need or for as long as it stays valid where you live. Revise it with your preferred online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Sample Denial Print Form popularity

Letter Denial Purchase Other Form Names

Letter Request Credit Sample FAQ

Why Can't I Get My Report Online? The most common reasons for being unable to access your credit reports online is being unable to remember key pieces of information. The other issue may be that the address you entered when requesting the report does not match the address the credit bureau has on file.

Credit report with the account in question circled and/or highlighted. Birth certificate. Social Security card. Passport (if you have one) the page showing your photo and the number.

If your credit dispute is rejected, the Fair Credit Reporting Act gives you the right to add a 100-word consumer statement to your report explaining your position.

Tell the credit reporting company, in writing, what information you think is inaccurate. Tell the information provider (that is, the person, company, or organization that provides information about you to a credit reporting company), in writing, that you dispute an item in your credit report.

Equifax. Experian or call 1-866-200-6020. TransUnion.

Does a 609 Letter Really Improve My Credit? There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit reportit's just another method of doing so. If the dispute is valid, the credit bureaus will remove the negative item.

The credit report you get when you're denied credit is in addition to the annual credit report that you can order once a year from the three credit bureaus through AnnualCreditReport.com.

How long information is kept by credit reference agencies. Information about you is usually held on your file for six years. Some information may be held for longer, for example, where a court has ordered that a bankruptcy restrictions order should last more than six years.

The name 623 dispute method refers to section 623 of the Fair Credit Reporting Act (FCRA). The method allows you to dispute a debt directly with the creditor in question as long as you have already filed your complaint with the credit bureau and completed their process.