Agreement Between Chiropractic Physician as Self-Employed Independent Contractor and Professional Corporation

What this document covers

The Agreement Between Chiropractic Physician as Self-Employed Independent Contractor and Professional Corporation is a legal document that outlines the terms of engagement between a chiropractic physician and a professional corporation. This form establishes the independent contractor relationship, clarifying the rights, responsibilities, and compensation of the chiropractor while ensuring that both parties understand their obligations. Unlike employment agreements, this contract emphasizes the contractor's self-employed status, which affects tax and benefit considerations.

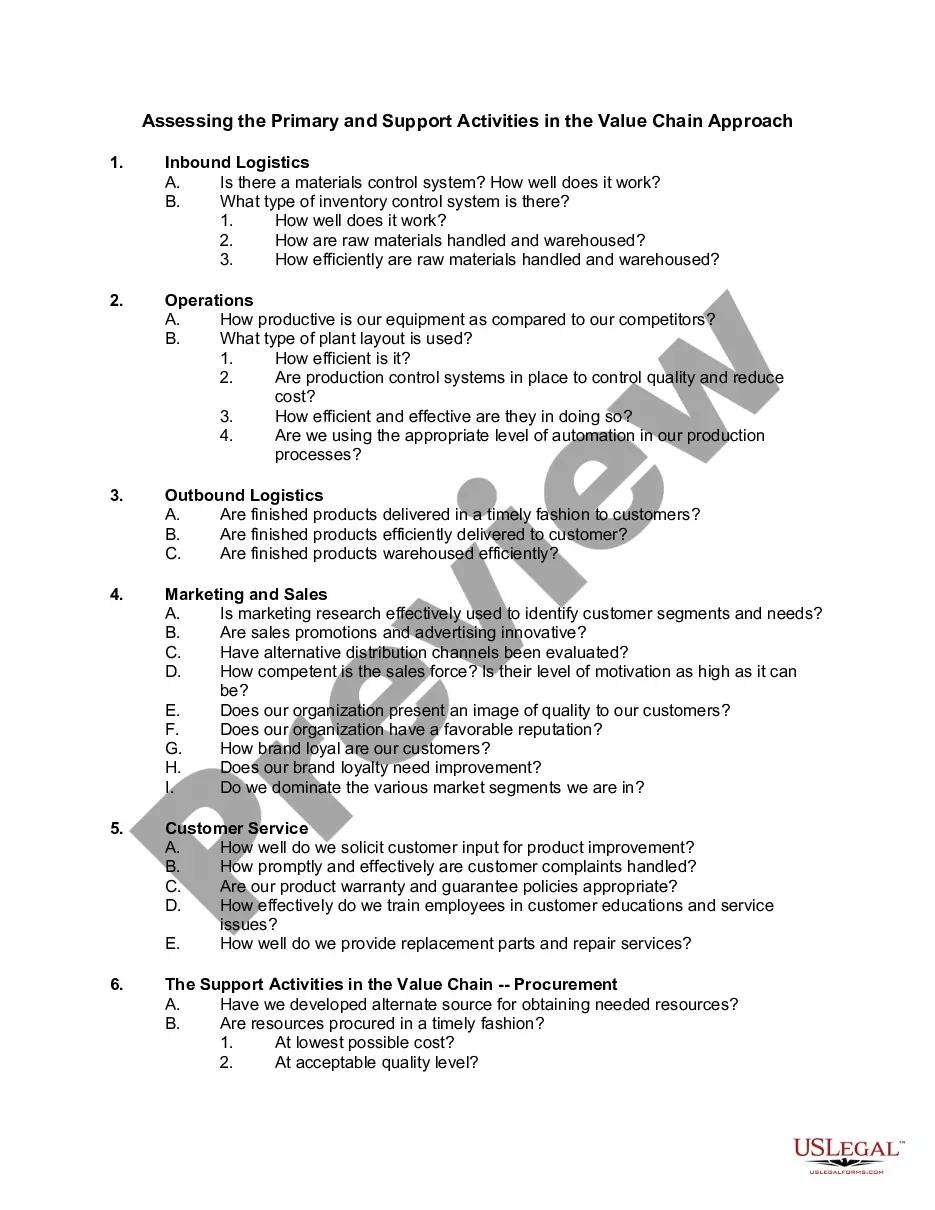

Key components of this form

- Identification of the chiropractor and the professional corporation.

- Details of the services to be rendered by the chiropractic physician.

- Provisions regarding compensation structure and pay schedule.

- Termination terms allowing either party to terminate the agreement at will.

- Stipulations on maintaining professional licenses and compliance with corporate policies.

- Clarification of the independent contractor status and liability for taxes.

When to use this document

This form is essential when a chiropractic physician enters into an agreement to provide services as an independent contractor rather than an employee of a professional corporation. Use this form to formalize the relationship when the corporation requires chiropractic services, and clear terms on compensation, responsibilities, and expectations are necessary to prevent misunderstandings.

Who this form is for

- Chiropractors who plan to work as independent contractors for a professional corporation.

- Professional corporations seeking to engage a chiropractic physician for services.

- Legal representatives drafting independent contractor agreements in the healthcare sector.

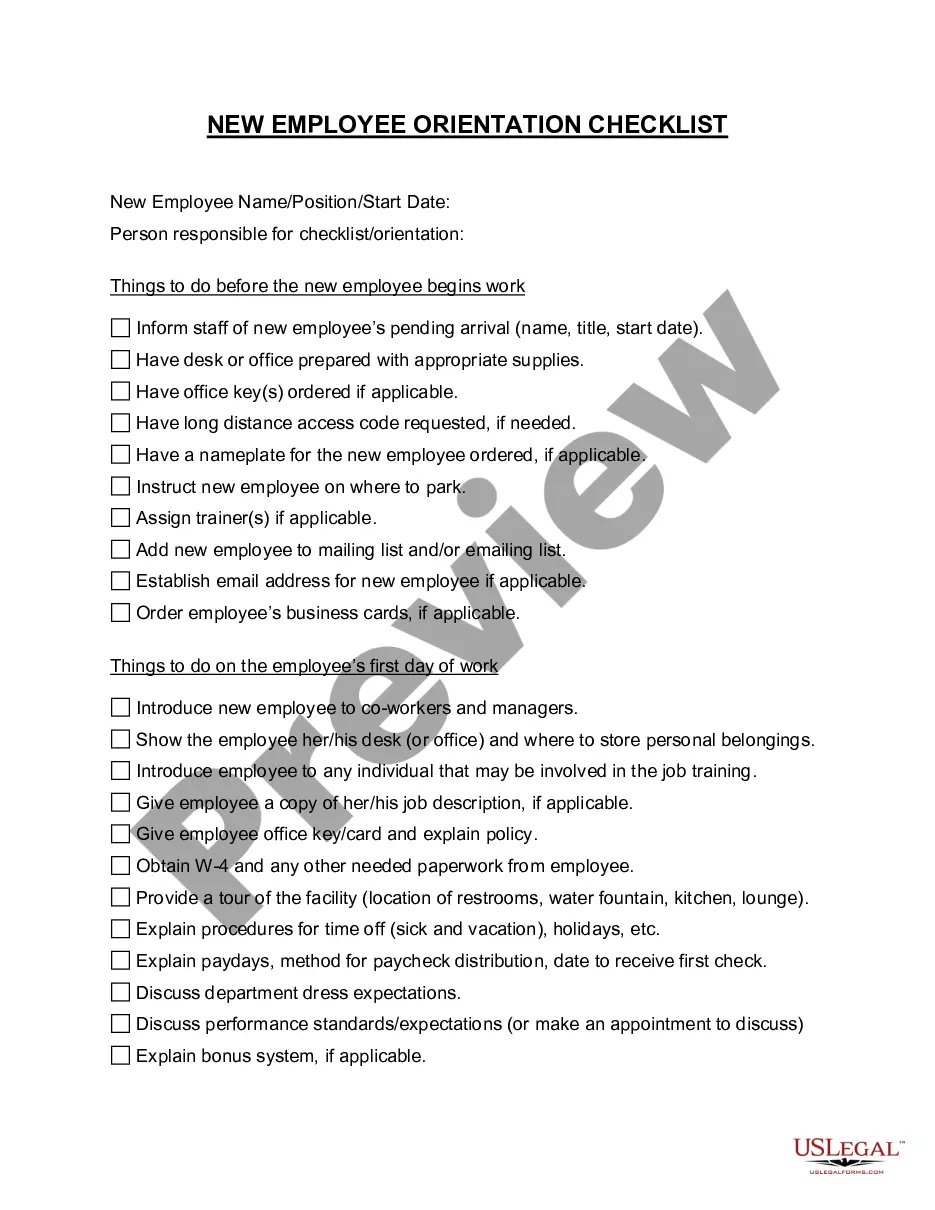

Completing this form step by step

- Identify the parties involved: Name the chiropractic physician and the professional corporation, including addresses.

- Specify the services to be rendered by the chiropractor, detailing any specific duties and expectations.

- Outline the compensation structure clearly, including payment frequency and any bonus arrangements.

- Include termination terms, ensuring both parties understand their rights to terminate the agreement.

- Make sure both parties sign and date the document to finalize the agreement.

Does this document require notarization?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Common mistakes to avoid

- Not specifying the compensation structure clearly, leading to potential disputes.

- Failing to keep a signed copy of the agreement for both parties.

- Not ensuring the chiropractic physician maintains their license throughout the contract period.

- Neglecting to review local laws that may require additional provisions in the contract.

Benefits of completing this form online

- Convenience of downloading and editing the form to suit your specific needs.

- Access to attorney-drafted templates that help ensure legal compliance.

- The ability to save and store completed forms securely online, making them easily retrievable.

- Quick turnaround for creating a legally binding agreement without requiring legal representation for basic drafting.

Form popularity

FAQ

Grey was an officer of his professional corporation, he was by law an employee. The U.S. Tax Court agreed with the IRS.The bottom line is simple and basic if you form a small California corporation and treat yourself as a corporate officer, you can not legally be an independent contractor.

If you own a small business, you are generally self-employed unless you have formed a corporation. You may be called a sole proprietor, a partner in a partnership, an independent contractor, or a consultant.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

5 (2002). The bottom line is simple and basic if you form a small California corporation and treat yourself as a corporate officer, you can not legally be an independent contractor.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

A very common business structure for independent contractors is the limited liability company (LLC). The main benefit is that the LLC offers limited liability for all of the owners.The LLC must pay filing fees, and in some states, additional state taxes.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

The law codifies and expands on an April 2018 California Supreme Court decision that set a strict new test for employers. Independent contractors must be free to perform their work as they wish, must be in a different line of work from the company contracting with them and must operate their own business.