New Certificate of Transaction of Business Under

Description

How to fill out New Certificate Of Transaction Of Business Under?

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state regulations and are examined by our experts. So if you need to complete New Certificate of Transaction of Business Under, our service is the best place to download it.

Obtaining your New Certificate of Transaction of Business Under from our library is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they locate the correct template. Afterwards, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

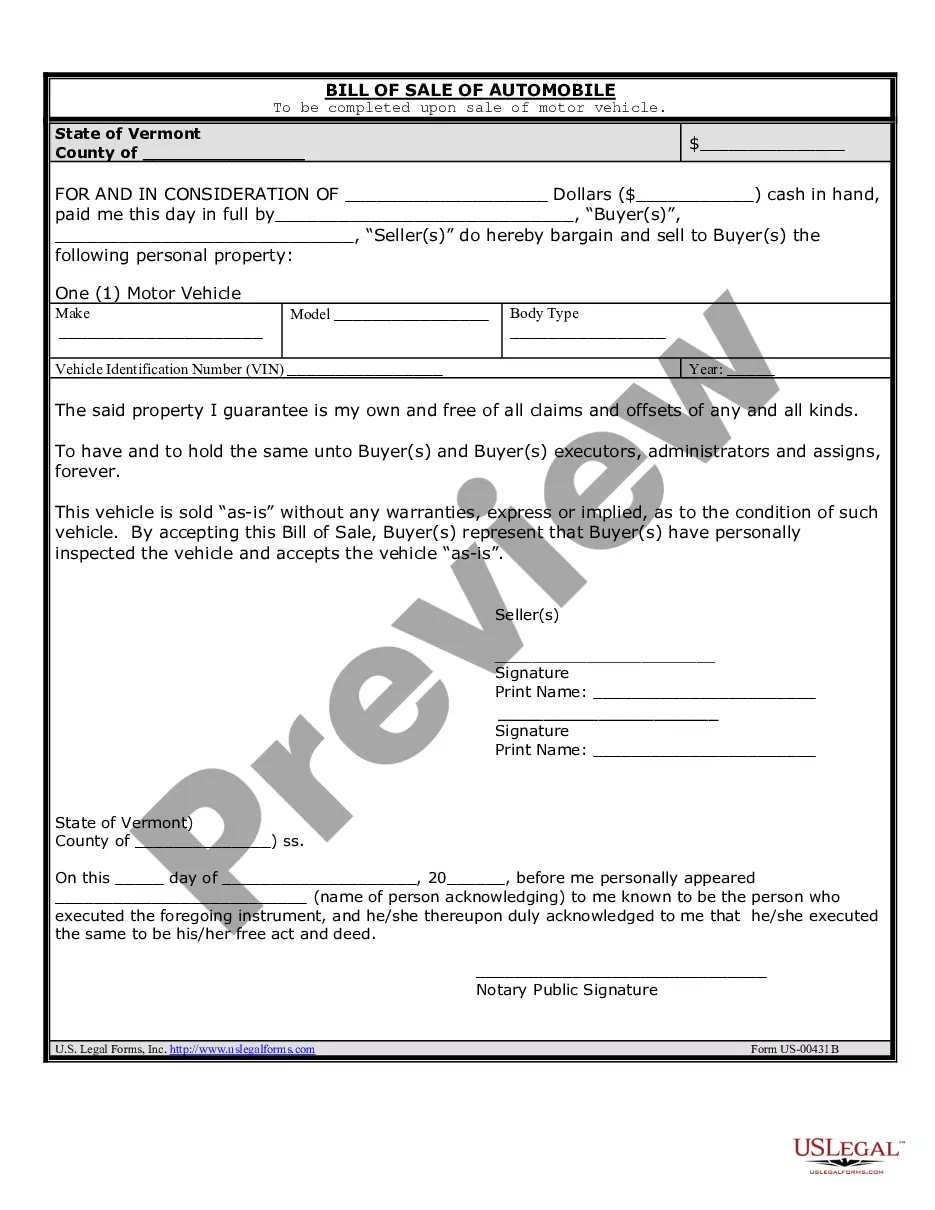

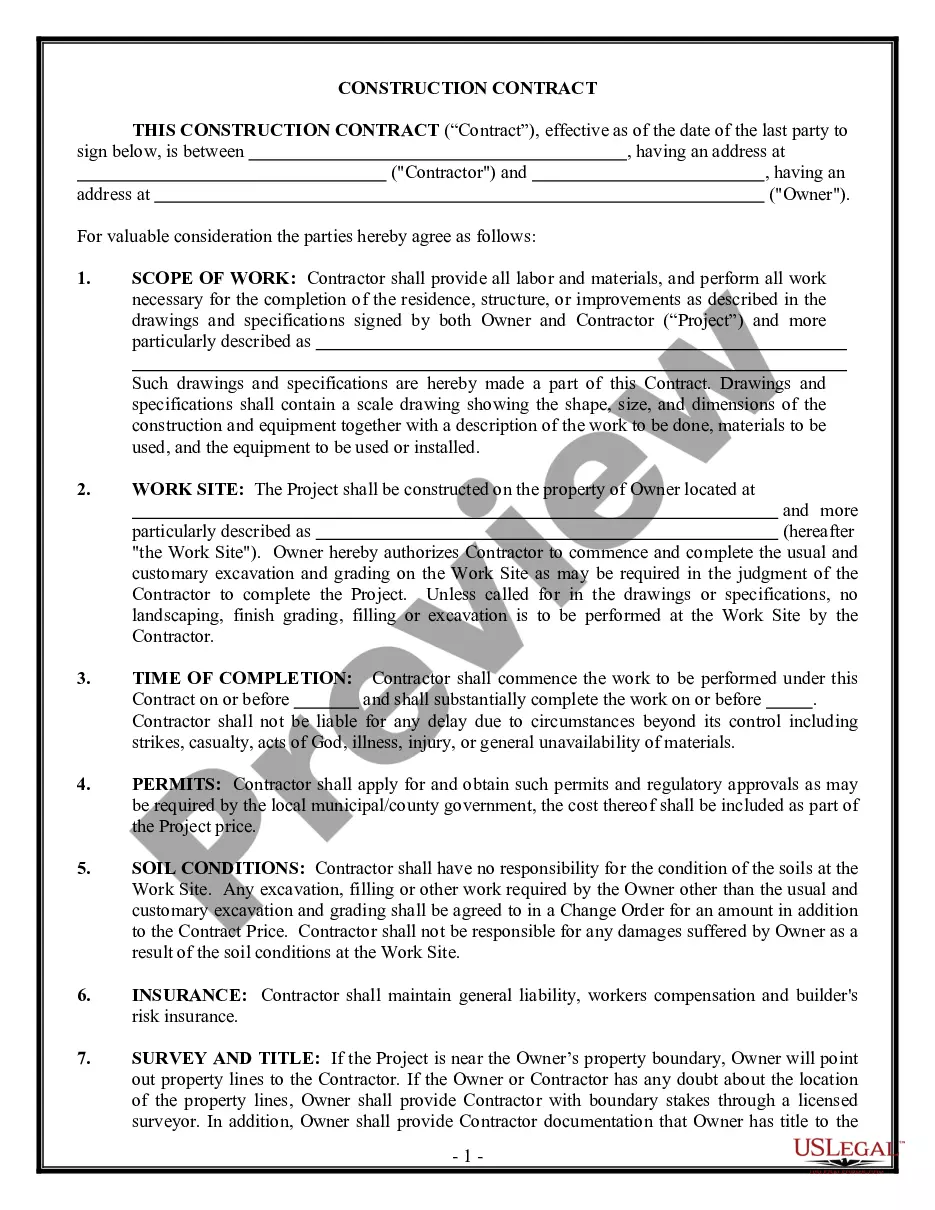

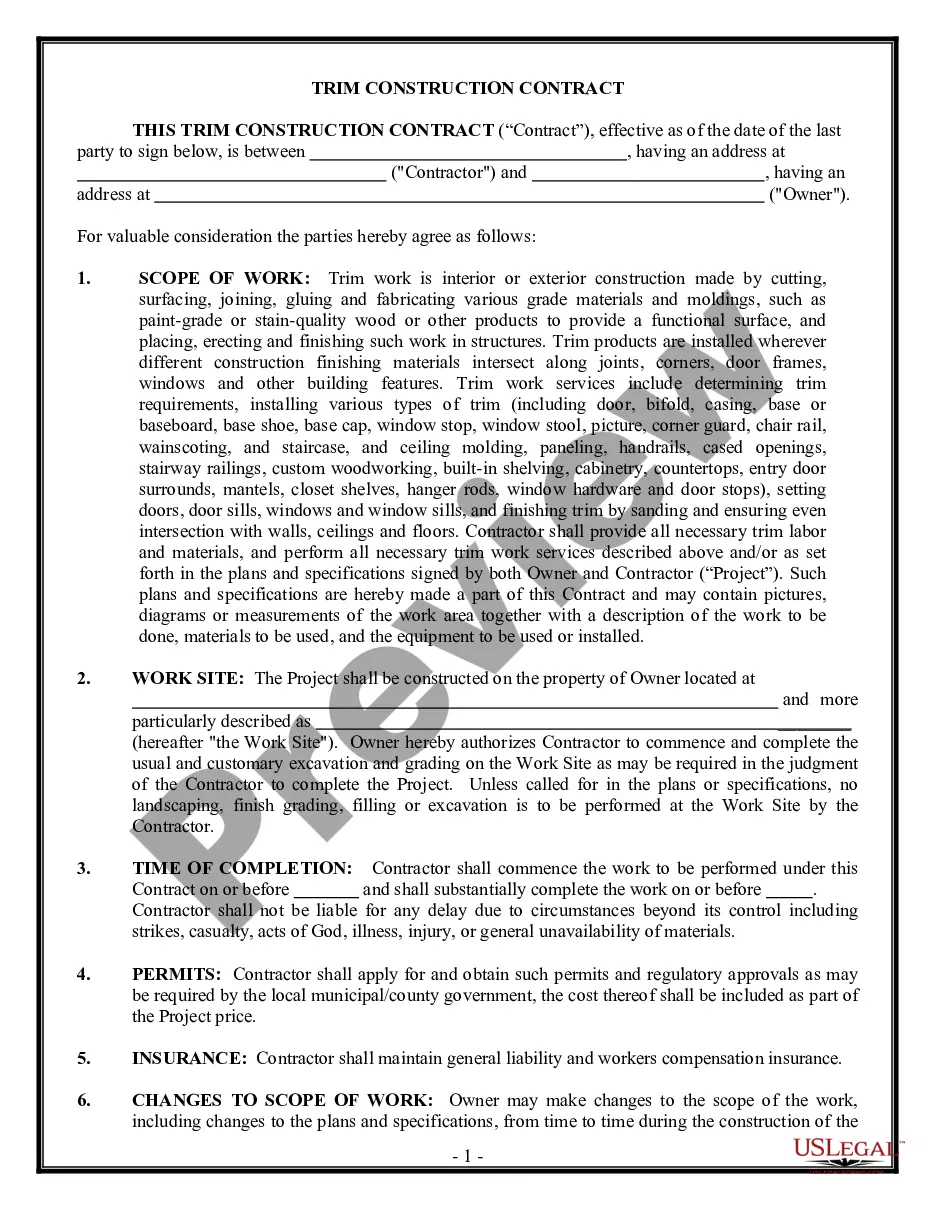

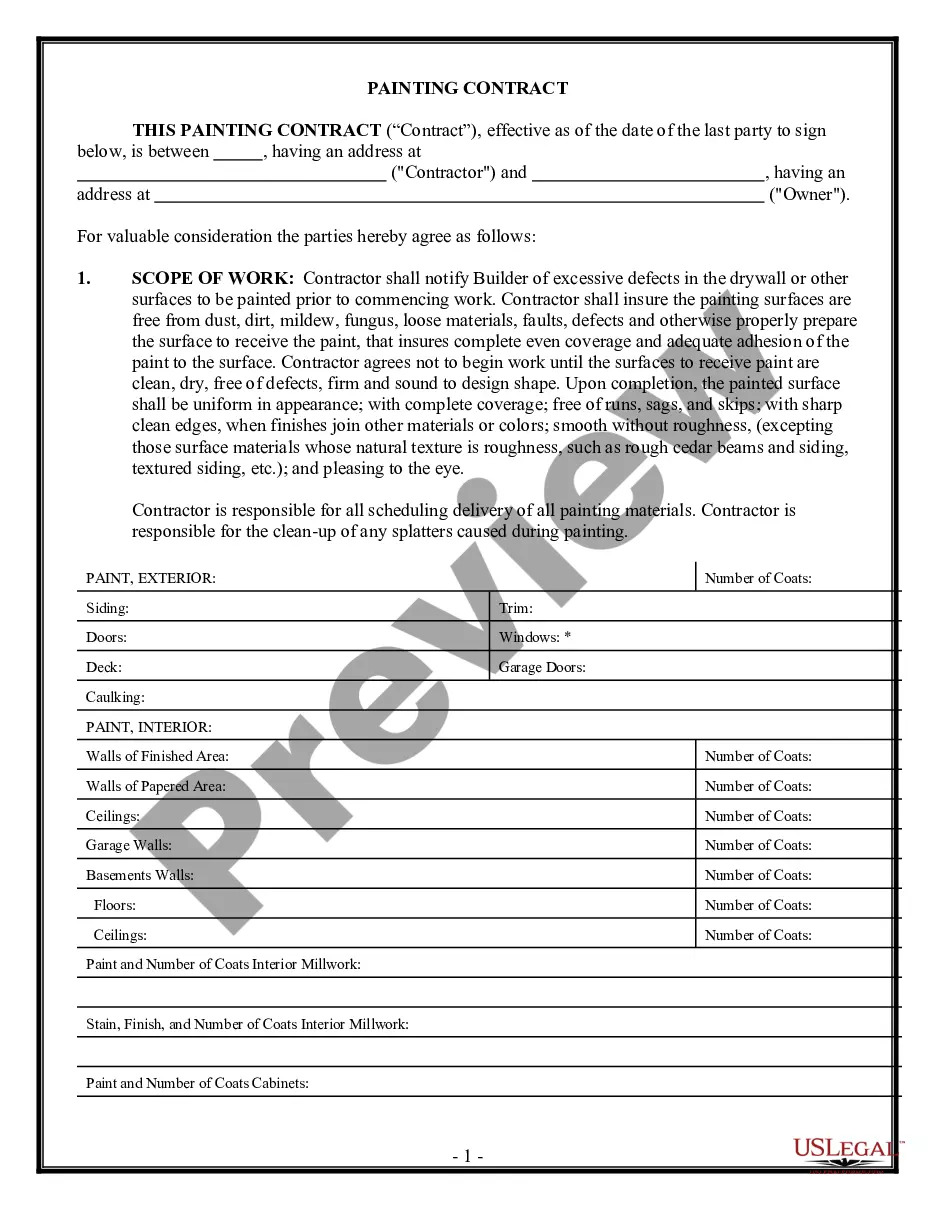

- Document compliance verification. You should attentively review the content of the form you want and check whether it satisfies your needs and fulfills your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab above until you find a suitable blank, and click Buy Now once you see the one you need.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your New Certificate of Transaction of Business Under and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

For example, Pennsylvania regulations state that sales tax exemption certificates ?should? be renewed every four years.

Resale certificates in Iowa are valid for up to three years from the original issue.

Certificates must be retained by the seller for four years from the date of the last sale covered by the certificate.

A Nontaxable Transaction Certificate (NTTC) obtained from the Taxation and Revenue Department allows you as a seller or lessor to deduct the receipts from qualified transactions from your gross receipts. You need only one NTTC from a customer to cover all transactions of the same type with that customer.

It is not necessary to give the seller a new certificate every time a purchase is made because the certificates do not expire. Although certificates of exemption do not actually expire, New Jersey recommends that it would be good business practice for a seller to request a new form at least every few years.

How To Fill Out ST-120 New York State Resale Certificate - YouTube YouTube Start of suggested clip End of suggested clip Number is blank. So if you're a new york state vendor. You click that one. And then you put in yourMoreNumber is blank. So if you're a new york state vendor. You click that one. And then you put in your certificate of authority number right here.

New Jersey Sales and Use Tax Act Under certain conditions, exemptions are provided for otherwise taxable transactions. Sellers are required to collect the tax imposed by the Act, unless the seller obtains a fully completed exemption certificate from the purchaser.

Is an EIN the same as a NYS vendor ID number? An employer identification number (EIN) or federal tax identification number is different than a NYS vendor ID number. An EIN is issued by the IRS and is used to identify a business entity and federal business tax returns.