Member Managed Limited Liability Company Operating Agreement

Overview of this form

The Member Managed Limited Liability Company Operating Agreement is a crucial legal document that establishes the internal rules and regulations for an LLC managed by its members. This agreement outlines the management structure, profit-sharing arrangements, and member responsibilities, distinguishing it from other business agreements that may delegate management to outside managers. By implementing this operating agreement, members can ensure clarity in governance and decision-making processes, which can help prevent disputes and misunderstandings in the future.

What’s included in this form

- Definitions of key terms relevant to the LLC's operations.

- Formation details, including the name and duration of the company.

- Management structure, outlining how decisions will be made by the members.

- Capital contributions and how profits and losses will be allocated among members.

- Procedures for admitting additional members and transferring ownership interests.

- Dissolution procedures of the LLC, including how to wound up its affairs.

When this form is needed

This operating agreement should be used when forming a member-managed LLC to clearly define the roles, responsibilities, and rights of all members. It is essential to have this document in place before commencing business activities, particularly if the members intend to share profits, manage operations collectively, or have future plans for additional members joining the LLC.

Who needs this form

- Individuals forming a new limited liability company.

- Existing LLCs wishing to formalize their management structure among members.

- Business partners who want clear guidelines on operating procedures and profit sharing.

Steps to complete this form

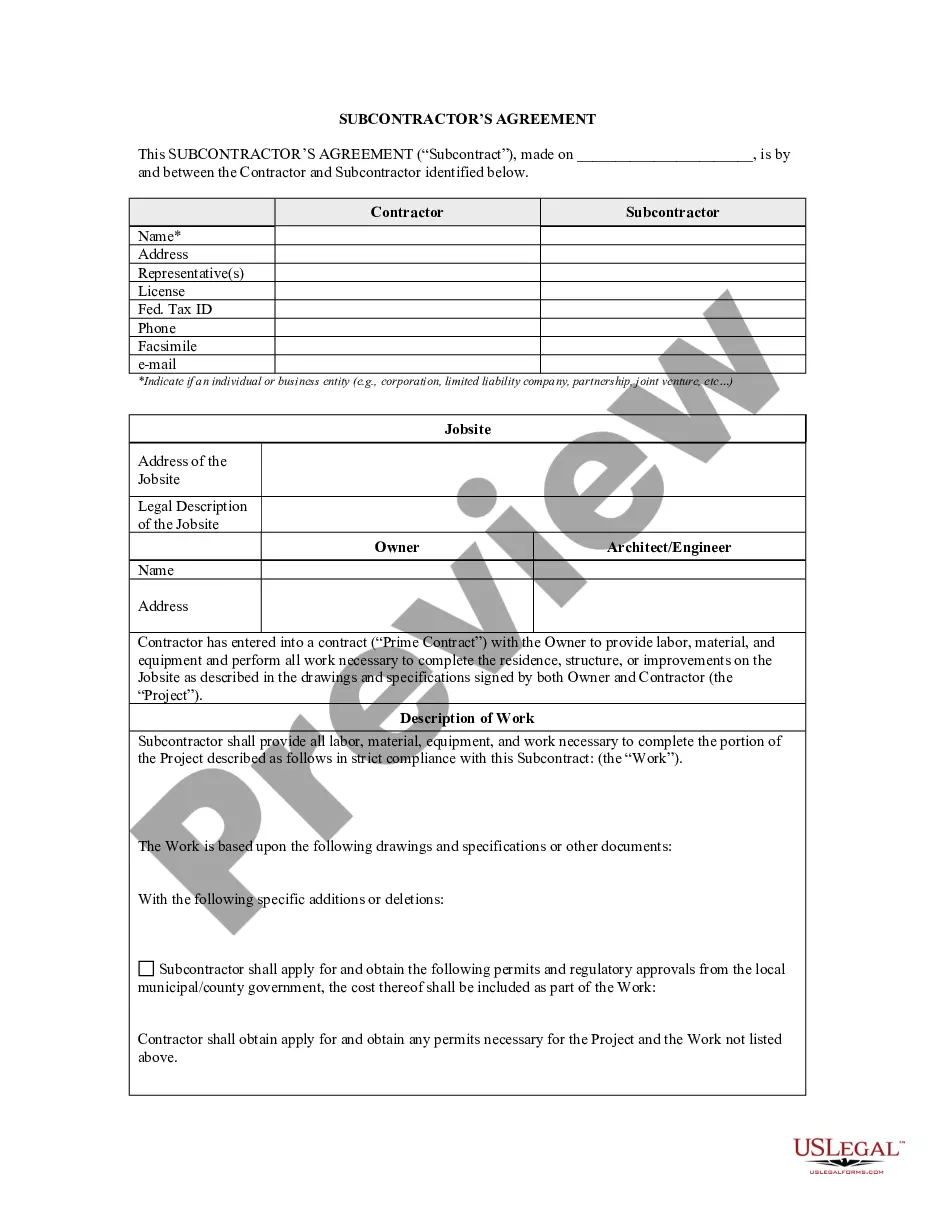

- Identify the members of the LLC and their contributions, including names, addresses, and the state of formation.

- Define the management structure, specifying the decision-making authority among the members.

- Allocate how profits and losses will be shared among members, typically based on their capital contributions.

- Detail the procedures for admitting additional members and defining their rights.

- Include provisions for the dissolution of the LLC, outlining how assets will be liquidated and distributed.

Notarization requirements for this form

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Mistakes to watch out for

- Failing to include all members in the agreement, which can lead to disputes later.

- Not specifying the details of capital contributions, leaving room for confusion.

- Neglecting to outline procedures for amending the agreement, making future changes difficult.

Why use this form online

- Quick access to professionally drafted templates, ensuring legal compliance.

- Editable format allows users to customize the agreement according to their specific needs.

- Convenient downloads that save time and reduce the need for in-person consultations.

Form popularity

FAQ

Every member of the LLC and the manager or managers (if there are any) need to sign the operating agreement. Each signatory should sign a separate signature page.Learn how to properly sign business documents on your state's LLC formation page.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.However, a written operating agreement defines in writing how the LLC is run.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

There is no requirement that the operating agreement is notarized. Even without being notarized, the document is still considered legally enforceable among the parties.

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on