An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Assignment by Beneficiary of a Percentage of the Income of a Trust

Description Assign Beneficiary Interest

How to fill out Beneficiary Income Printable?

Aren't you sick and tired of choosing from hundreds of templates every time you need to create a Assignment by Beneficiary of a Percentage of the Income of a Trust? US Legal Forms eliminates the lost time millions of American people spend browsing the internet for suitable tax and legal forms. Our skilled group of attorneys is constantly updating the state-specific Forms collection, so that it always provides the right files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have a subscription need to complete quick and easy steps before having the ability to download their Assignment by Beneficiary of a Percentage of the Income of a Trust:

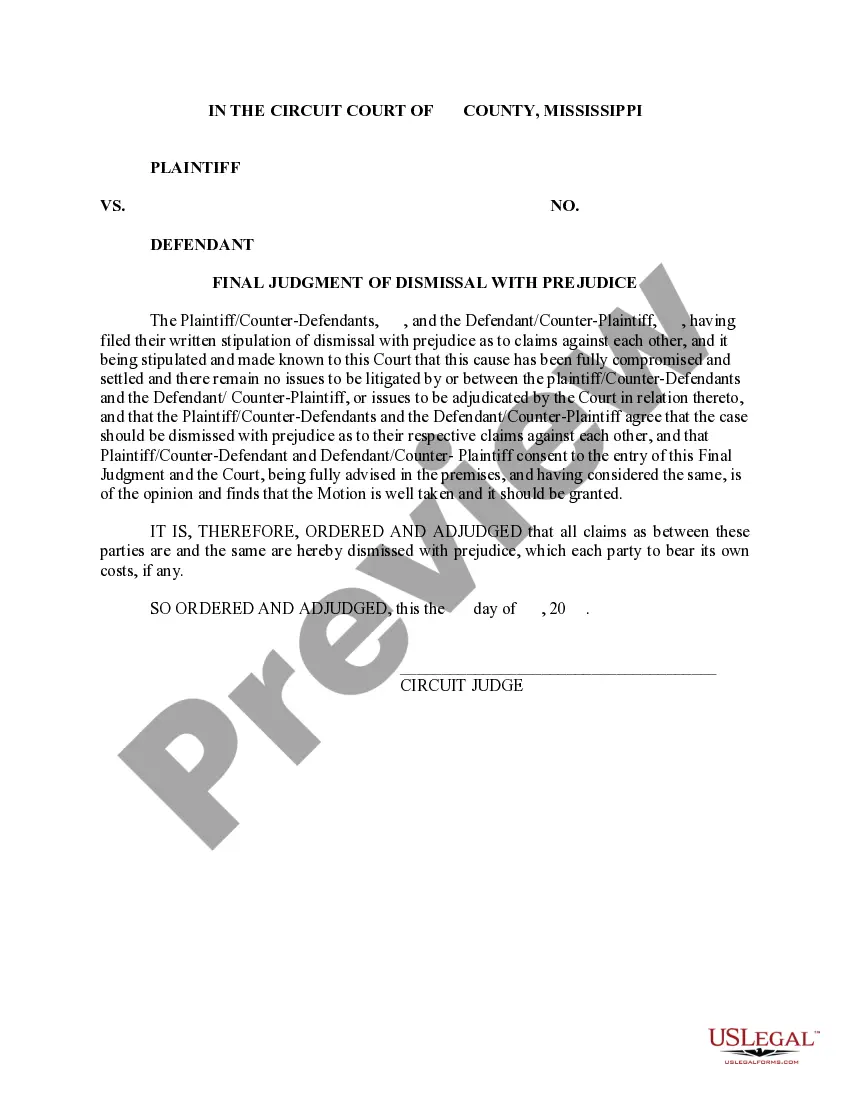

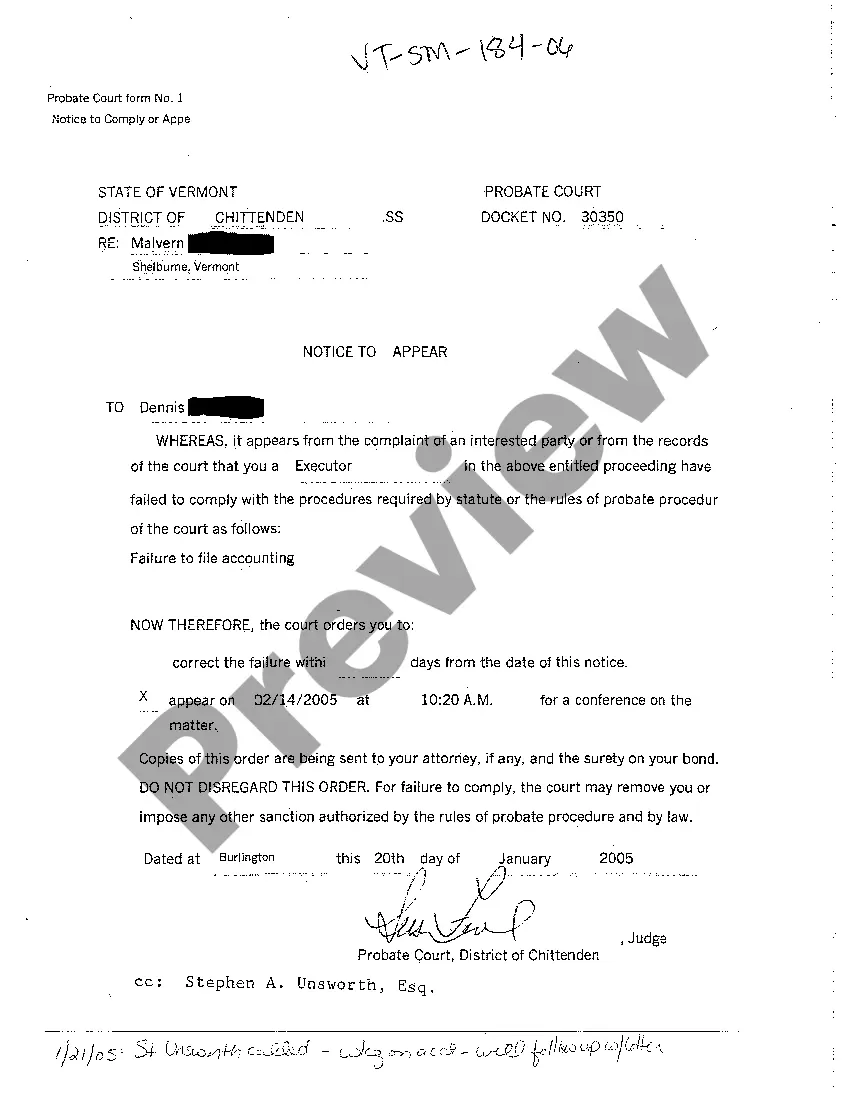

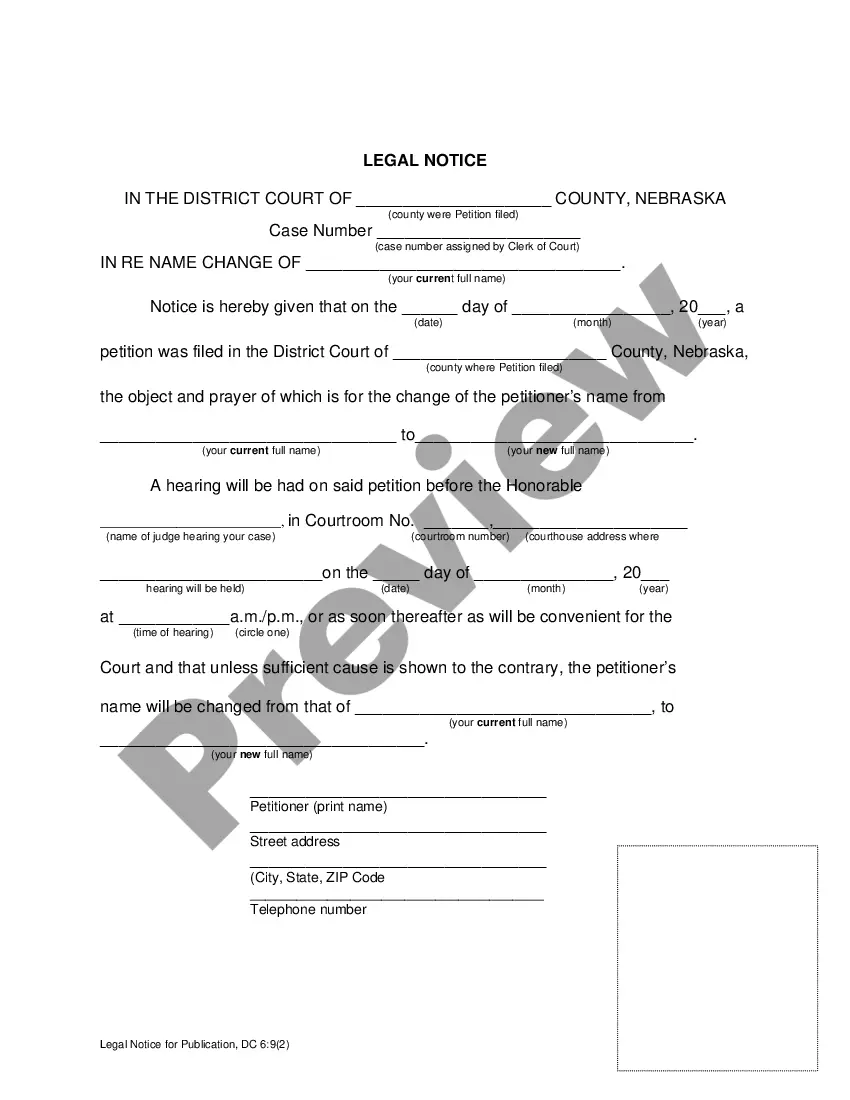

- Make use of the Preview function and look at the form description (if available) to make certain that it’s the right document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the proper example to your state and situation.

- Utilize the Search field at the top of the page if you need to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your sample in a required format to complete, create a hard copy, and sign the document.

When you have followed the step-by-step instructions above, you'll always have the ability to log in and download whatever file you require for whatever state you want it in. With US Legal Forms, finishing Assignment by Beneficiary of a Percentage of the Income of a Trust samples or any other legal files is easy. Get started now, and don't forget to examine your samples with certified attorneys!

Percentage Vary Sue Form popularity

Vary Sue Accruing Other Form Names

Trust Fund Beneficiary Taxes FAQ

An allocation rate is a percentage of an investor's cash or capital outlay that goes toward a final investment. The allocation rate most often refers to the amount of capital invested in a product net of any fees that may be incurred through the investment transaction.

If you have more than one life insurance beneficiary, you can allocate how much each person or entity will receive. These are known as beneficiary allocation rules. For instance, if you have two children, you could state that each will receive 50% of the total amount.

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors.

Your primary beneficiary is first in line to receive your death benefit. If the primary beneficiary dies before you, a secondary or contingent beneficiary is the next in line. Some people also designate a final beneficiary in the event the primary and secondary beneficiaries die before they do.

Each beneficiary is designated a specific percentage of the money, adding up to 100%. A contingent beneficiary receives assets in the same manner stated for the primary beneficiary.

Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write children on one of the lines; instead write the full names of each of your children on separate lines.

In general, most people name one or two primary beneficiaries, and one or two contingent beneficiaries to ensure that their bases are covered.

Yes, you can have multiple primary beneficiaries.Contingent beneficiaries are the people you name as backups should your primary beneficiaries die before or at the same time as you. These backup beneficiaries only receive the money if the primary beneficiaries are unable to.

Your primary beneficiary must survive you or be an existing trust at your death. A contingent beneficiary will inherit your assets only if you have no surviving primary beneficiaries at the time of your death.