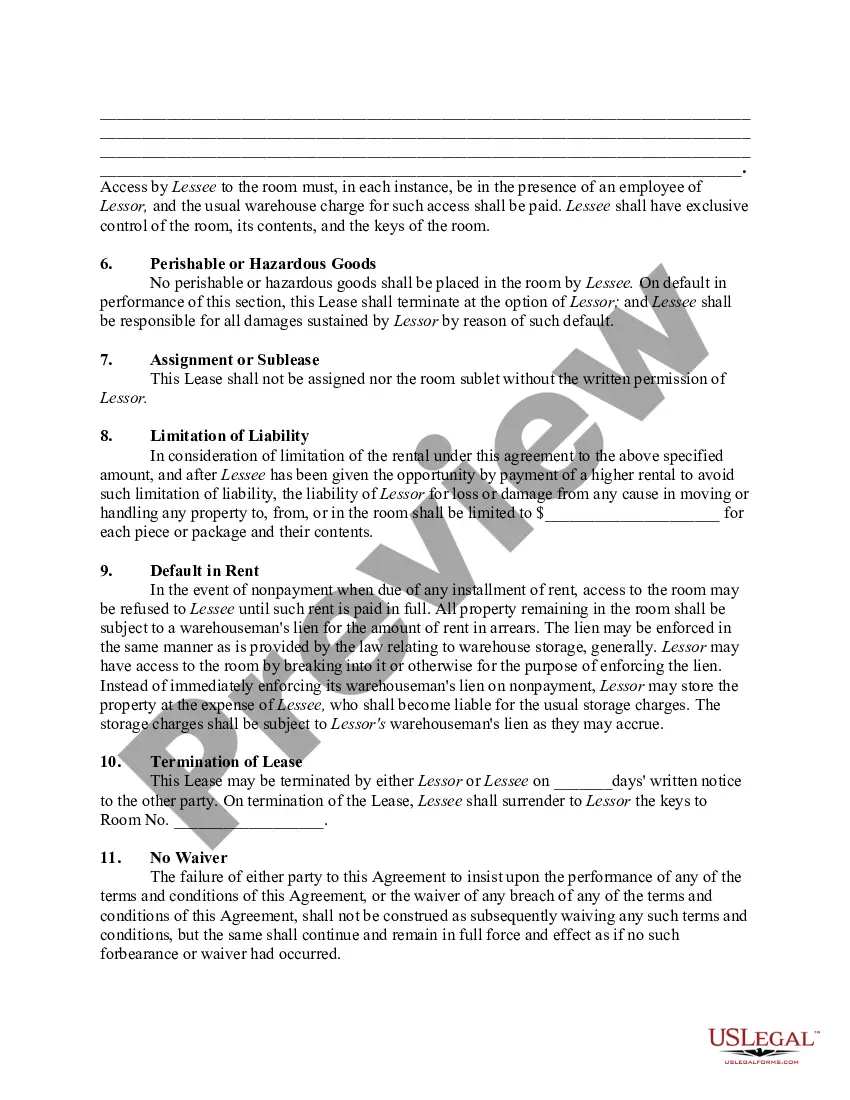

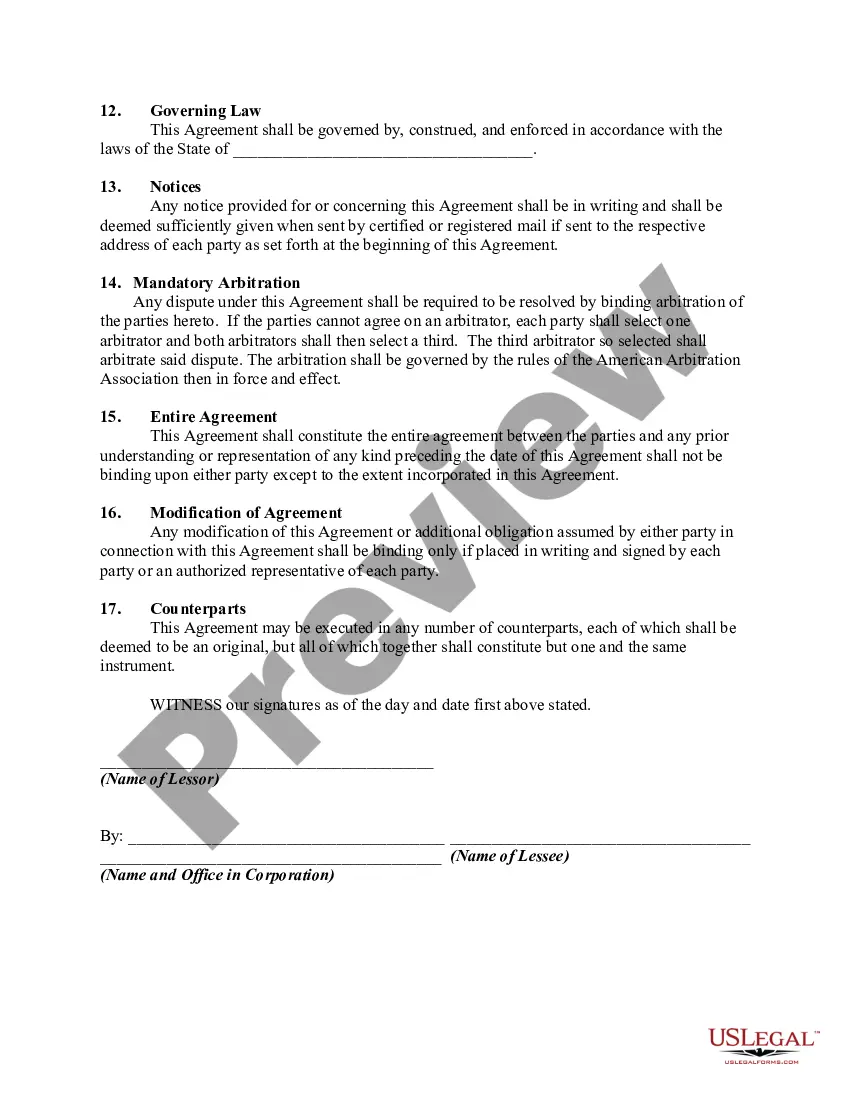

While most warehousing contracts create bailments of the stored goods, other types of agreements may be made covering the subject matter. Of these, the most important are leases of storage space. The essential factor distinguishing a lease of storage space from a bailment of goods is the storer's retaining possession and control over the goods. It cannot be conclusively presumed that a lease rather than a bailment is intended merely because the contract provides for the storing of goods in a certain space in the warehouse. This is true even though the goods are to be placed in a separate room to which the storer is given a key. However, if under the agreement the warehouseman has no control over the storer's access to the premises where the goods are stored, it is generally held that there is a lease of storage space. Of course, the instrument should be drafted to clarify the legal relationship that the parties desire.

Lease of Storage Space for Household Goods

Description

How to fill out Lease Of Storage Space For Household Goods?

Aren't you tired of choosing from hundreds of samples every time you want to create a Lease of Storage Space for Household Goods? US Legal Forms eliminates the wasted time numerous American citizens spend browsing the internet for ideal tax and legal forms. Our professional group of lawyers is constantly changing the state-specific Forms catalogue, so that it always provides the right files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have an active subscription should complete easy actions before being able to download their Lease of Storage Space for Household Goods:

- Make use of the Preview function and read the form description (if available) to ensure that it is the correct document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the proper sample for the state and situation.

- Use the Search field on top of the page if you need to look for another file.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your template in a needed format to finish, create a hard copy, and sign the document.

When you’ve followed the step-by-step recommendations above, you'll always have the ability to sign in and download whatever document you will need for whatever state you want it in. With US Legal Forms, finishing Lease of Storage Space for Household Goods templates or other legal files is not hard. Begin now, and don't forget to look at the samples with accredited attorneys!

Form popularity

FAQ

Instead the storage space actually should be classified as rent. That means the rental charge would be added to any other rental charges you might incur for leased space, such as for an office or factory, and deducted as a business expense as part of the rental category, says Mark H.

If you're looking to save space, try storing belongings in a vertical position. Also, all large and heavy items should be placed on the bottom. If laying your mattress flat, avoid putting it at the very bottom of the storage unit, as belongings on top are sure to put pressure on the padding and springs.

Yes, a storage unit for your business is a tax-deductible expense.

No. Living in a storage unit is prohibited by various local and federal housing laws.In another instance, police had to vacate multiple residents from a storage facility due to health concerns. The authorities further stressed that it's illegal to live in an area not zoned for residential use.

You can deduct the expenses of moving your household goods and personal effects, including expenses for hauling a trailer, packing, crating, in-transit storage, and insurance. You can't deduct expenses for moving furniture or other goods you bought on the way from your old home to your new home.

If you're a cash basis taxpayer, you can't deduct uncollected rents as an expense because you haven't included those rents in income. Repair costs, such as materials, are usually deductible.

General Tax Deduction Rules For businesses, rental expenditures for a storage facility are considered a tax deduction if the expense is ordinary and necessary for the business according to the Internal Revenue Service (IRS) rules.

When you rent a storage unit, you're often offered additional insurance to cover any possible damage to the contents.While renter's insurance cover fire, they don't often cover water damage. You could be left on the hook. The storage unit insurance usually caps the total value of the items in the unit.

It doesn't matter if you're renting a storage unit for a short or longer period of time. You will have to sign a contract with the company you're renting from. And since it's not that uncommon that people don't understand the papyrology, signing this contract can be stressful.