An agreement that creates an interest in real property as security for an obligation, such as the payment of a note, and that is to cease upon the performance of the obligation, is called a mortgage. The person whose interest in the property is given as security is the mortgagor. The person who receives the security is the mortgagee (e.g., lender). A release, deed of reconveyance, deed of release, or authority to cancel is used by a mortgagee to renounce a claim upon a person's real property subject to the mortgage.

Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises

Description

Key Concepts & Definitions

Letter Tendering Final Payment of Amount Due: A formal correspondence indicating the fulfillment of payment obligations towards a secured loan, promissory note, or contractor project. This might involve a mortgaged premised or other financial trusts.

Secured Loan: A loan backed by collateral. Defaulting on such a loan typically allows the lender to seize the asset used as collateral.

Promissory Note: A financial instrument that contains a written promise by one party to pay another party a definite sum of money either on demand or at a specified future date.

Step-by-Step Guide: Writing a Letter Tendering Final Payment

- Identify the appropriate letter template. Online services often provide downloadable templates to suit various scenarios.

- Include all relevant details such as the account number, mortgaged premises if applicable, and the final payment amount.

- State the purpose of the letter clearly to tender the final payment of the amount due.

- Attach any supporting documents such as a copy of the promissory note or the initial agreement.

- Close the letter formally and send it to the correct party, ensuring you keep a copy for your records.

Risk Analysis

Neglecting to ensure that the letter includes all necessary details can lead to disputes over whether obligations have been fully met, especially concerning secured loans or contractor projects. Incomplete or incorrect documentation may result in legal complications or delays in the release of financial liens or other security interests.

Best Practices

- Always use a letter template tailored to the specifics of your agreement and financial arrangement.

- Clarify any legal or financial terms in the letter to prevent misunderstandings.

- Ensure all calculations are accurate to avoid underpayment or overpayment scenarios.

- Use secure methods when sending the letter, especially if including sensitive information like account details.

Common Mistakes & How to Avoid Them

- Failing to verify account statuses: Always confirm the outstanding balance before sending final payments.

- Ignoring specified terms: Adhere to the terms outlined in any promissory notes or contractual documents.

- Lack of record-keeping: Keep copies of all correspondence related to the payment, including the sending of the final payment letter.

FAQ

- What should I include in a final payment letter? Details such as your account number, payment amount, and references to relevant documents (contract, promissory note) should be included.

- Can I email the final payment letter? Yes, emailing is permissible, but ensure it's sent to a verified address and consider using encrypted email for security.

- How soon after sending the letter will my payment obligation be considered settled? This depends on the terms of your agreement but generally after the recipient acknowledges receipt and processing of the payment.

Summary

Writing a letter tendering final payment is a critical step in fulfilling financial obligations. This document serves as formal proof of payment and helps in clearing any secured liabilities. Accuracy, clarity, and secure transmission are key to ensuring the process is completed without issues.

How to fill out Letter Tendering Final Payment Of Amount Due Pursuant To A Promissory Note Secured By A Mortgage In Order To Obtain A Release Of The Mortgaged Premises?

Aren't you sick and tired of choosing from numerous templates each time you want to create a Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises? US Legal Forms eliminates the lost time an incredible number of American citizens spend surfing around the internet for perfect tax and legal forms. Our expert team of lawyers is constantly updating the state-specific Forms catalogue, to ensure that it always offers the right files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Users who don't have a subscription should complete easy actions before having the capability to get access to their Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises:

- Use the Preview function and read the form description (if available) to make certain that it is the best document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the correct example to your state and situation.

- Use the Search field at the top of the web page if you have to look for another file.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your file in a convenient format to complete, create a hard copy, and sign the document.

After you’ve followed the step-by-step instructions above, you'll always have the capacity to log in and download whatever document you will need for whatever state you need it in. With US Legal Forms, finishing Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises samples or other official paperwork is not difficult. Begin now, and don't forget to examine your examples with accredited lawyers!

Form popularity

FAQ

Name of Claimant. This is the name the party to be paid, and the party who will be signing the lien waiver document. Name of Customer. Job Location. Owner. Exceptions. Claimant's Signature. Claimant's Title. Date of Signature.

An "Unconditional Waiver and Release Upon Final Payment" extinguishes all claimant rights upon receipt of the payment. A "Conditional Waiver and Release Upon Final Payment" extinguishes all claimant rights upon receipt of the final payment with certain provisions.

An unconditional release means that there are no restrictions on the release of the lien. This type of lien release is often used in final project documents to confirm that the project is complete, payment has occurred, and you release all future rights to file liens on the project.

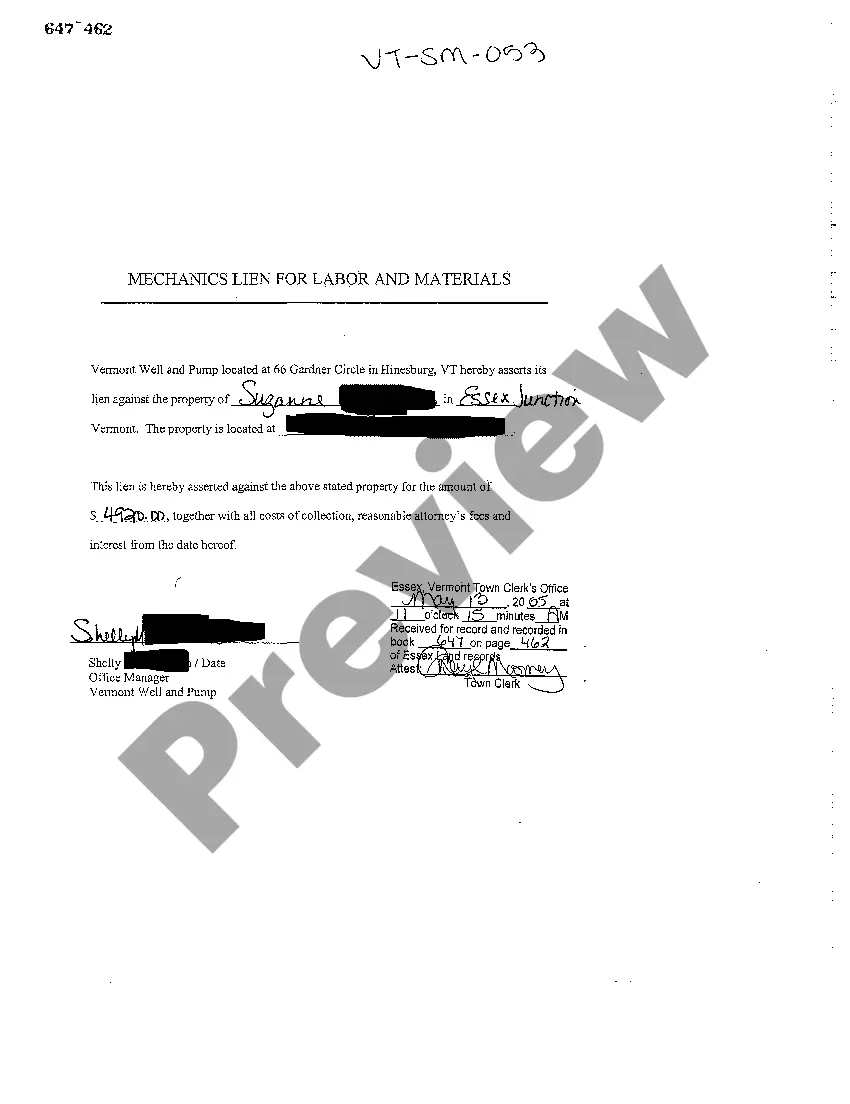

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.