Subordination to Stated Amount

Description

How to fill out Subordination To Stated Amount?

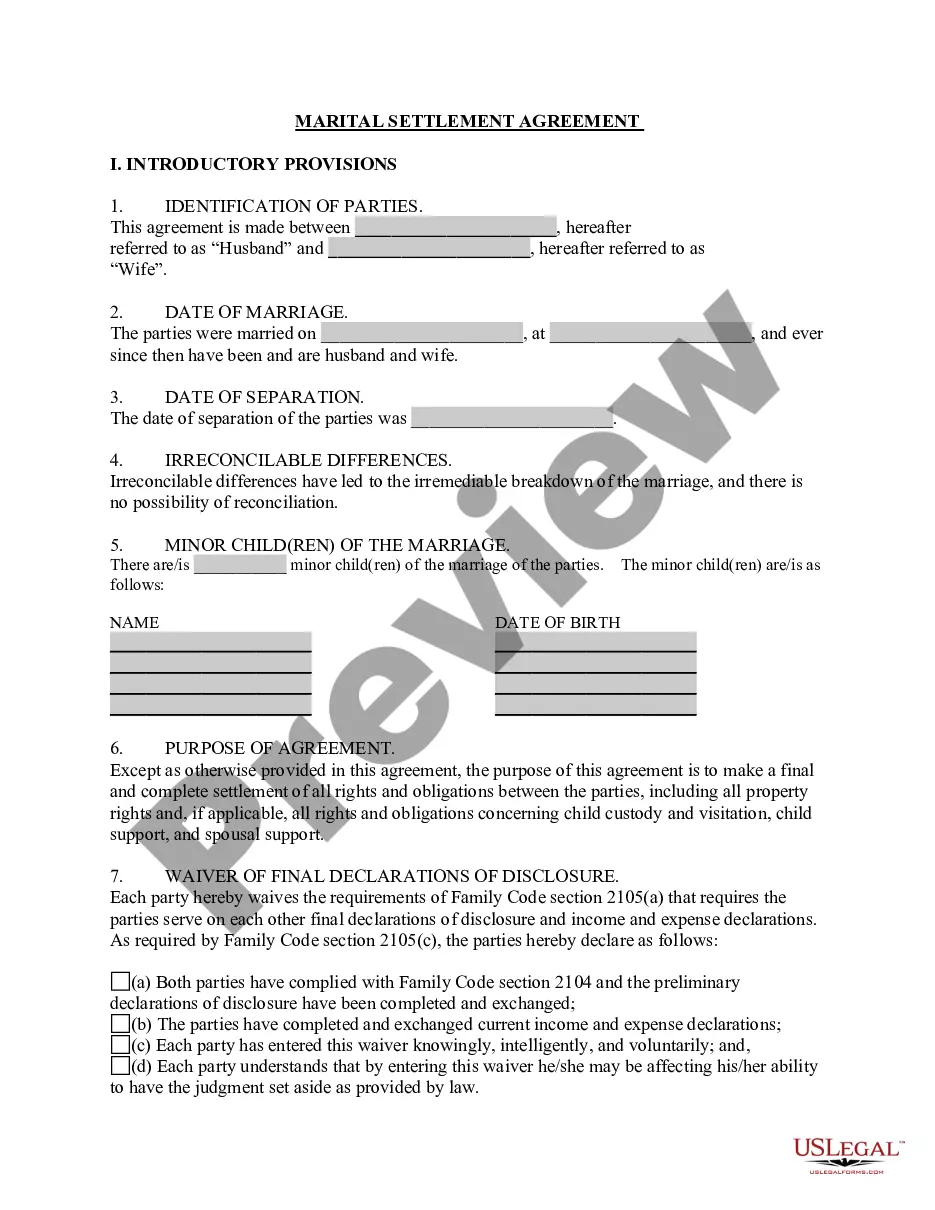

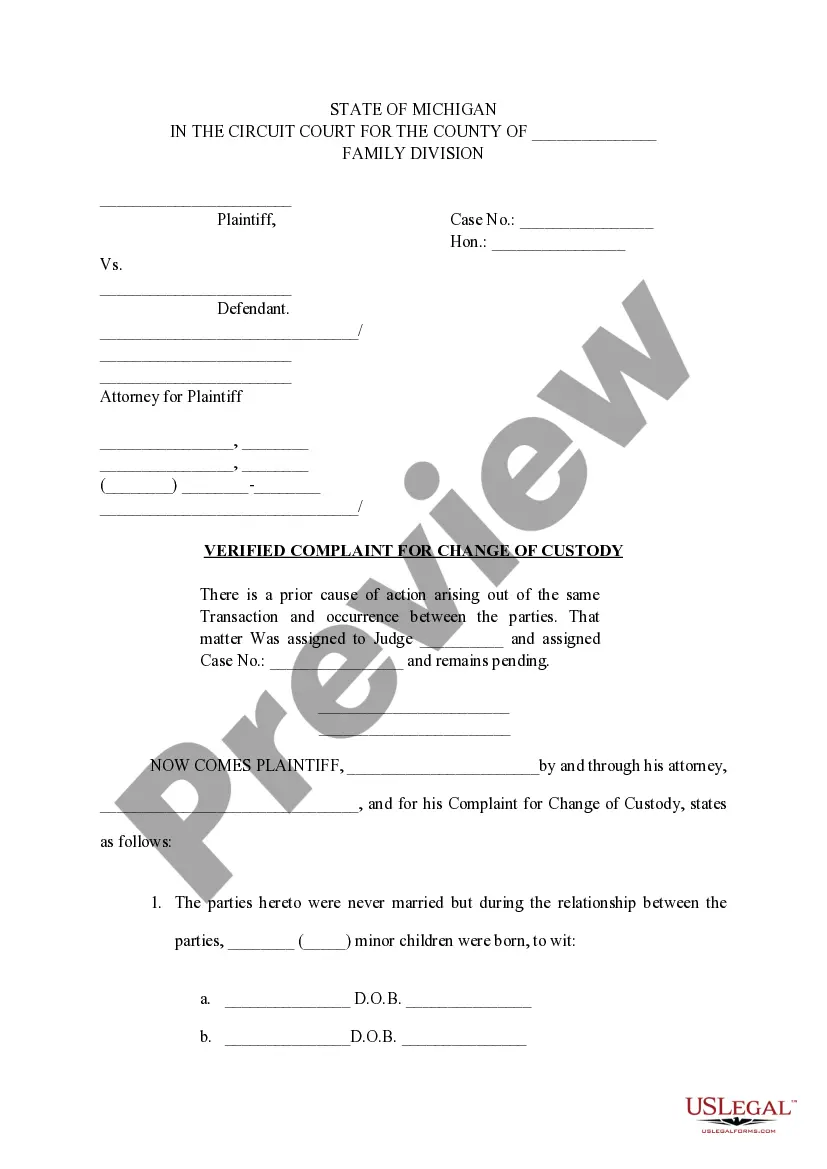

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state laws and are checked by our experts. So if you need to fill out Subordination to Stated Amount, our service is the perfect place to download it.

Obtaining your Subordination to Stated Amount from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they locate the correct template. Later, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a brief guideline for you:

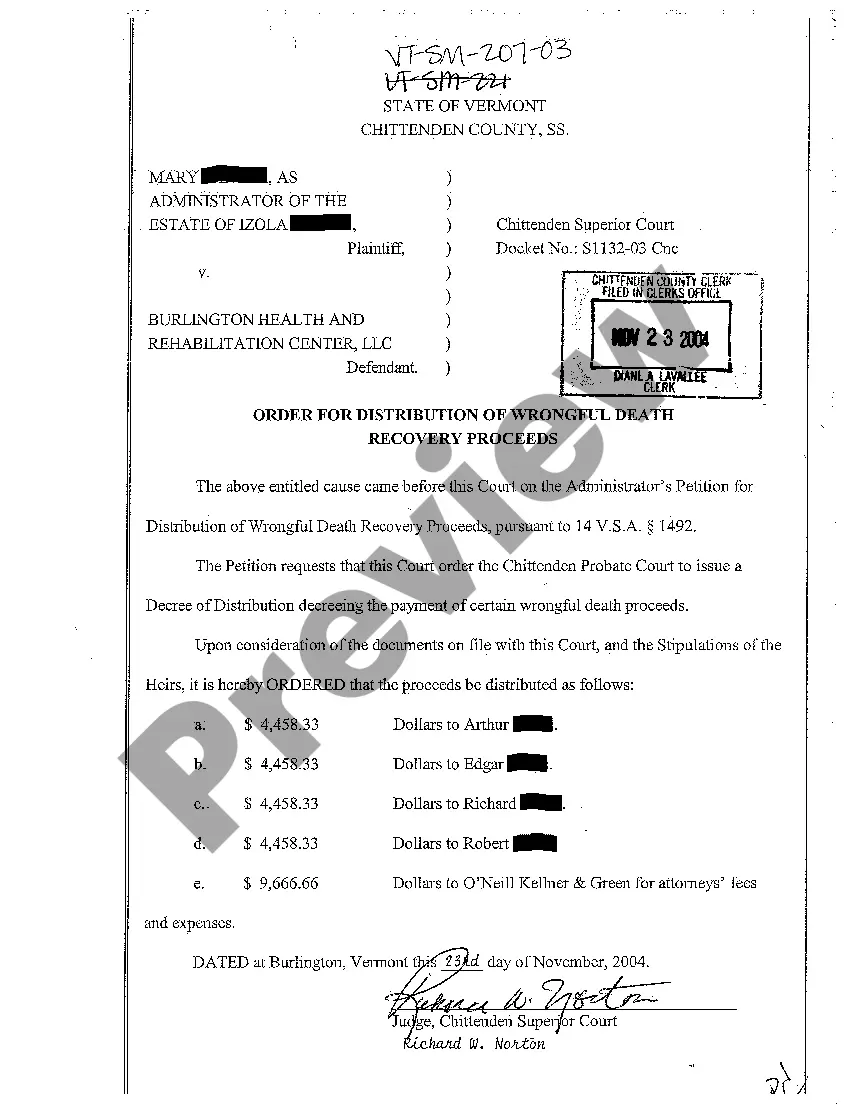

- Document compliance check. You should carefully examine the content of the form you want and make sure whether it satisfies your needs and meets your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab on the top of the page until you find an appropriate blank, and click Buy Now once you see the one you want.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Subordination to Stated Amount and click Download to save it on your device. Print it to complete your paperwork manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any formal document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Subordination Statement means a statement from the relevant creditor to the Bond Trustee (in form and substance satisfactory to the Bond Trustee) to be entered into in respect of any Subordinated Loan and any intra-group loan granted by any Group Company to an Obligor.

Subordinate financing is debt financing that is ranked behind that held by secured lenders in terms of the order in which the debt is repaid. "Subordinate" financing implies that the debt ranks behind the first secured lender, and means that the secured lenders will be paid back before subordinate debt holders.

Example of a Subordination Agreement A standard subordination agreement covers property owners that take a second mortgage against a property. One loan becomes the subordinated debt, and the other becomes (or remains) the senior debt. Senior debt has higher claim priority than junior debt.

What is subordination? Subordination is the process of ranking home loans (mortgage, HELOC or home equity loan) by order of importance. When you have a home equity line of credit, for example, you actually have two loans ? your mortgage and HELOC. Both are secured by the collateral in your home at the same time.

Payment subordination is where the subordinated lender agrees (subject to carve-outs noted in the agreement) to fully subordinate the payment of the subordinated obligations to the prior repayment in full of the senior obligations.

Subordination in itself is the act of placing something in a lower-ranking position. Mortgage subordination boils down to a ranking system on the liens secured by your home. A lien is a legal agreement that grants the lender a right to repossess the property if you default on the loan.

A mortgage subordination refers to the order the outstanding liens on your property get repaid if you stop making your mortgage payments. For example, your first home loan (primary mortgage) is repaid first, with any remaining funds paying off additional liens, including second mortgages, HELOCs and home equity loans.

A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.