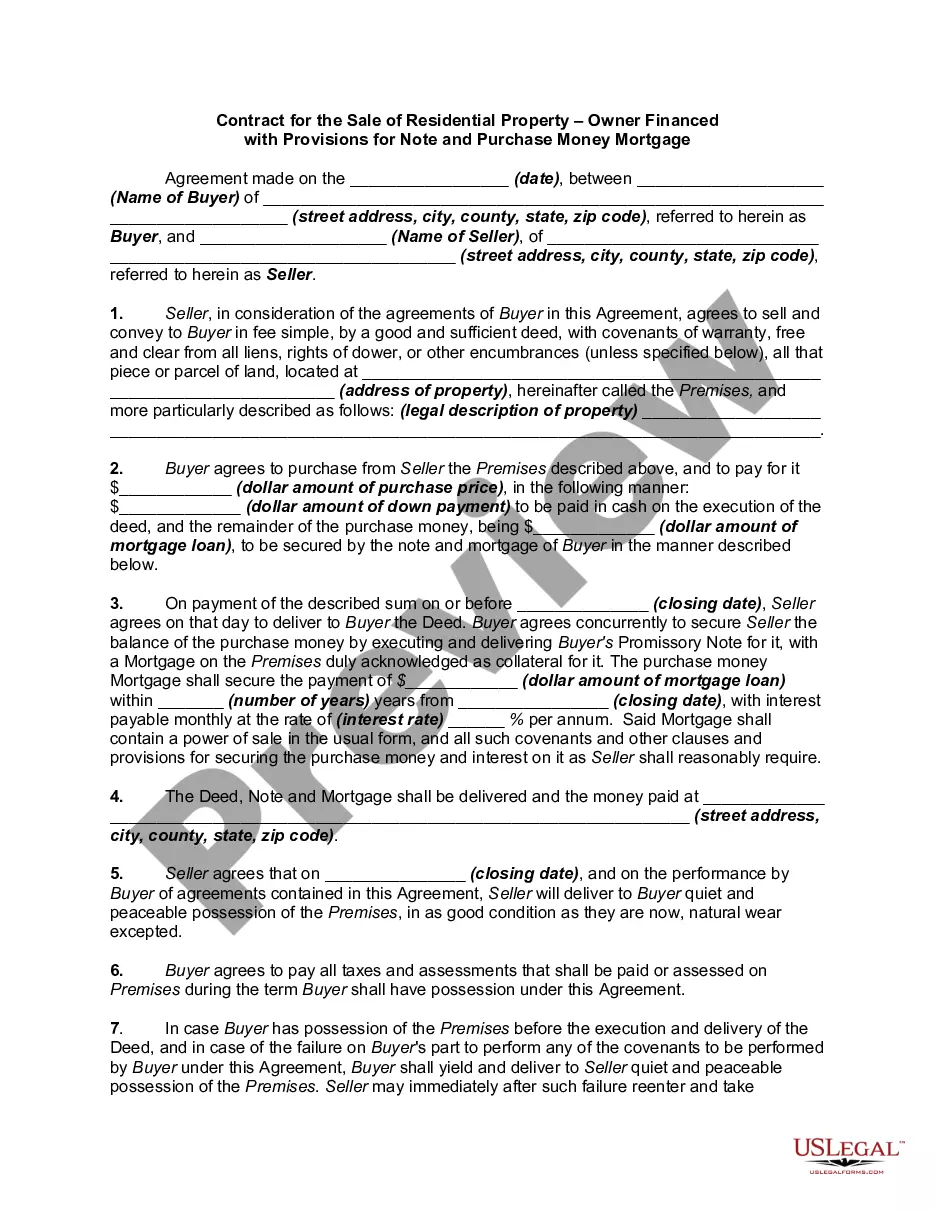

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Contract for the Sale of Residential Property - Owner Financed with Provisions for Note and Purchase Money Mortgage

Description

How to fill out Contract For The Sale Of Residential Property - Owner Financed With Provisions For Note And Purchase Money Mortgage?

Aren't you sick and tired of choosing from countless templates every time you need to create a Contract for the Sale of Residential Property - Owner Financed with Provisions for Note and Purchase Money Mortgage? US Legal Forms eliminates the wasted time numerous American citizens spend searching the internet for appropriate tax and legal forms. Our expert team of lawyers is constantly changing the state-specific Forms library, to ensure that it always provides the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have an active subscription need to complete easy actions before having the capability to get access to their Contract for the Sale of Residential Property - Owner Financed with Provisions for Note and Purchase Money Mortgage:

- Utilize the Preview function and read the form description (if available) to be sure that it’s the right document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right template for your state and situation.

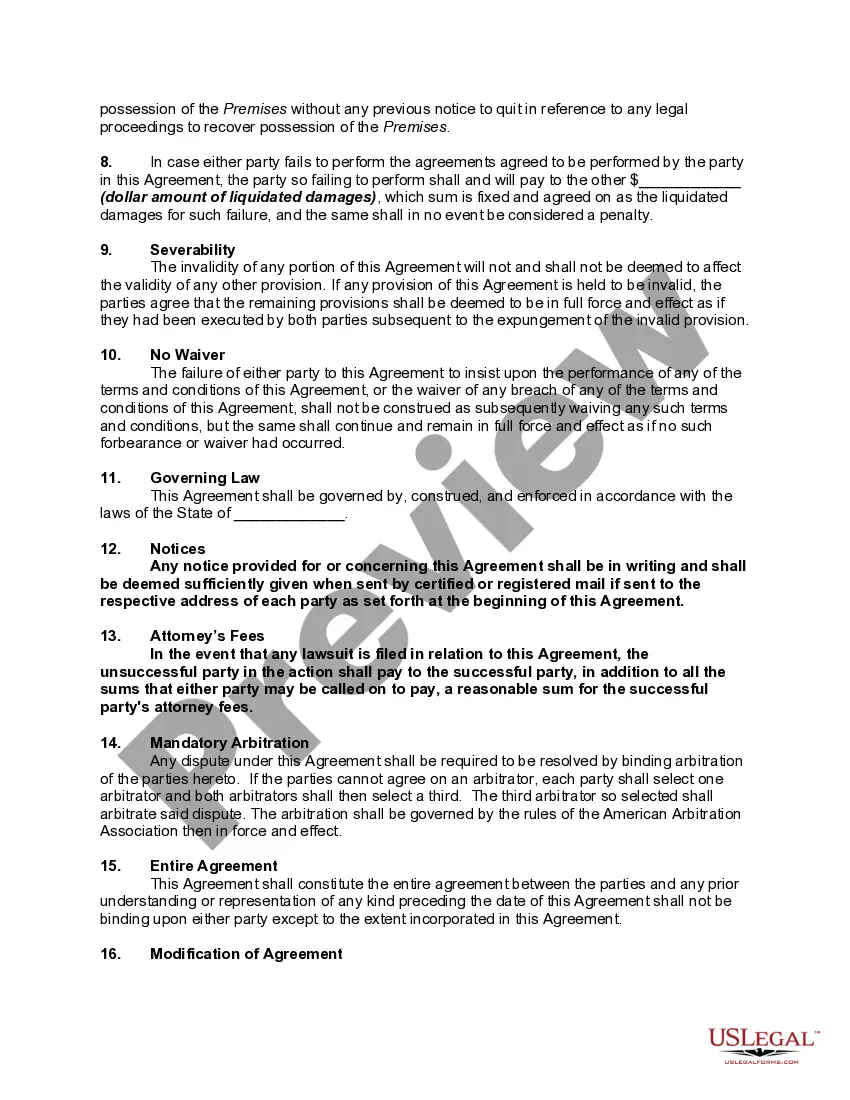

- Use the Search field at the top of the web page if you want to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your sample in a required format to complete, print, and sign the document.

When you have followed the step-by-step instructions above, you'll always be able to sign in and download whatever file you will need for whatever state you want it in. With US Legal Forms, completing Contract for the Sale of Residential Property - Owner Financed with Provisions for Note and Purchase Money Mortgage templates or any other legal paperwork is easy. Get going now, and don't forget to double-check your samples with accredited lawyers!

Form popularity

FAQ

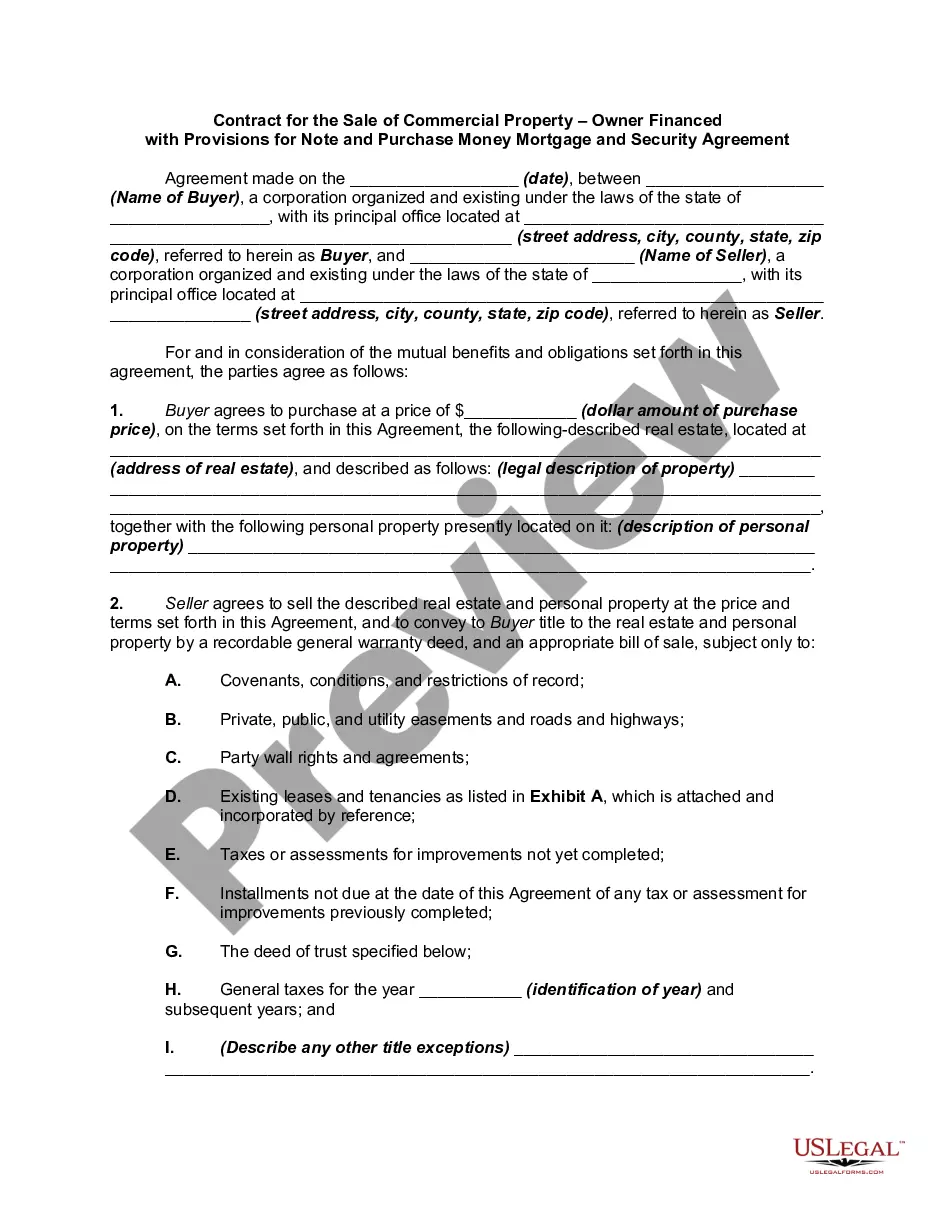

In seller financing, the seller takes on the role of the lender. Instead of giving cash to the buyer, the seller extends enough credit to the buyer for the purchase price of the home, minus any down payment. The buyer and seller sign a promissory note (which contains the terms of the loan).

What's a Seller Addendum? It's an addition to the normal sale and purchase agreement that severely limits Seller's liability during and after the sale process. For example, the Seller Addendum might limit damages to which Buyer is entitled in the event Seller fails to disclose some problem with the property.

Complete the addendum, including your name, the purchaser's name and a description of the property. Include the type of financing that you are providing, such as first mortgage, second mortgage or deed of trust. List the terms of the loan.

The best way to find seller financing is to ask for it in every offer you make. Eventually you'll find a seller that would prefer the fixed payments to a taxable lump sum at closing.

Step 1 Get the Original Purchase Agreement. The buyer and seller should get a copy of the original purchase agreement. Step 2 Write the Addendum. Complete a blank addendum (Adobe PDF, Microsoft Word (. Step 3 Parties Agree and Sign. Step 4 Add to the Purchase Agreement.

Negotiate the basic terms. State the purpose of the contract and the identity of the parties on the first page. Identify the property using its legal description. State the amount of the down payment if any. List the purchase prince, the interest rate, and the total purchase price (purchase prince plus total interest.)

Most owner-financing deals are short term. A typical arrangement is to amortize the loan over 30 years (which keeps the monthly payments low), with a final balloon payment due after only five or ten years.

The seller financing addendum outlines the terms at which the seller of the property agrees to loan the money to the buyer in order to purchase their property.Once complete, this addendum should be signed and attached to the purchase agreement made between the parties.

Interest rateInterest rates for seller-financed loans are typically higher than what traditional lenders would offer. The seller takes on some risk by holding financing, and he or she may charge a higher interest rate to offset this risk. It's not uncommon to see interest rates from 4% to 10%.