Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral

Description What Is A Funeral Home Assignment

How to fill out Assignment Funeral Complete?

Aren't you tired of choosing from countless samples every time you require to create a Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral? US Legal Forms eliminates the lost time an incredible number of American citizens spend browsing the internet for perfect tax and legal forms. Our expert group of lawyers is constantly modernizing the state-specific Templates library, so that it always provides the right documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have an active subscription should complete a few simple steps before having the ability to get access to their Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral:

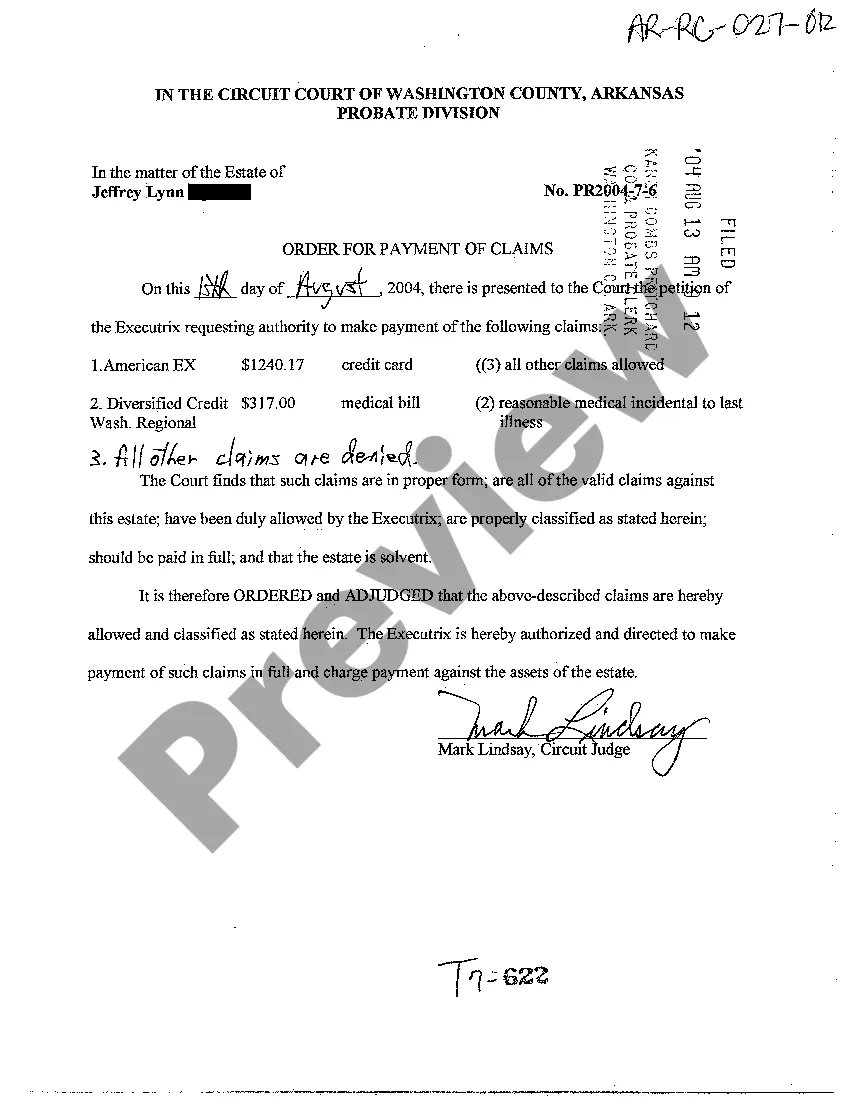

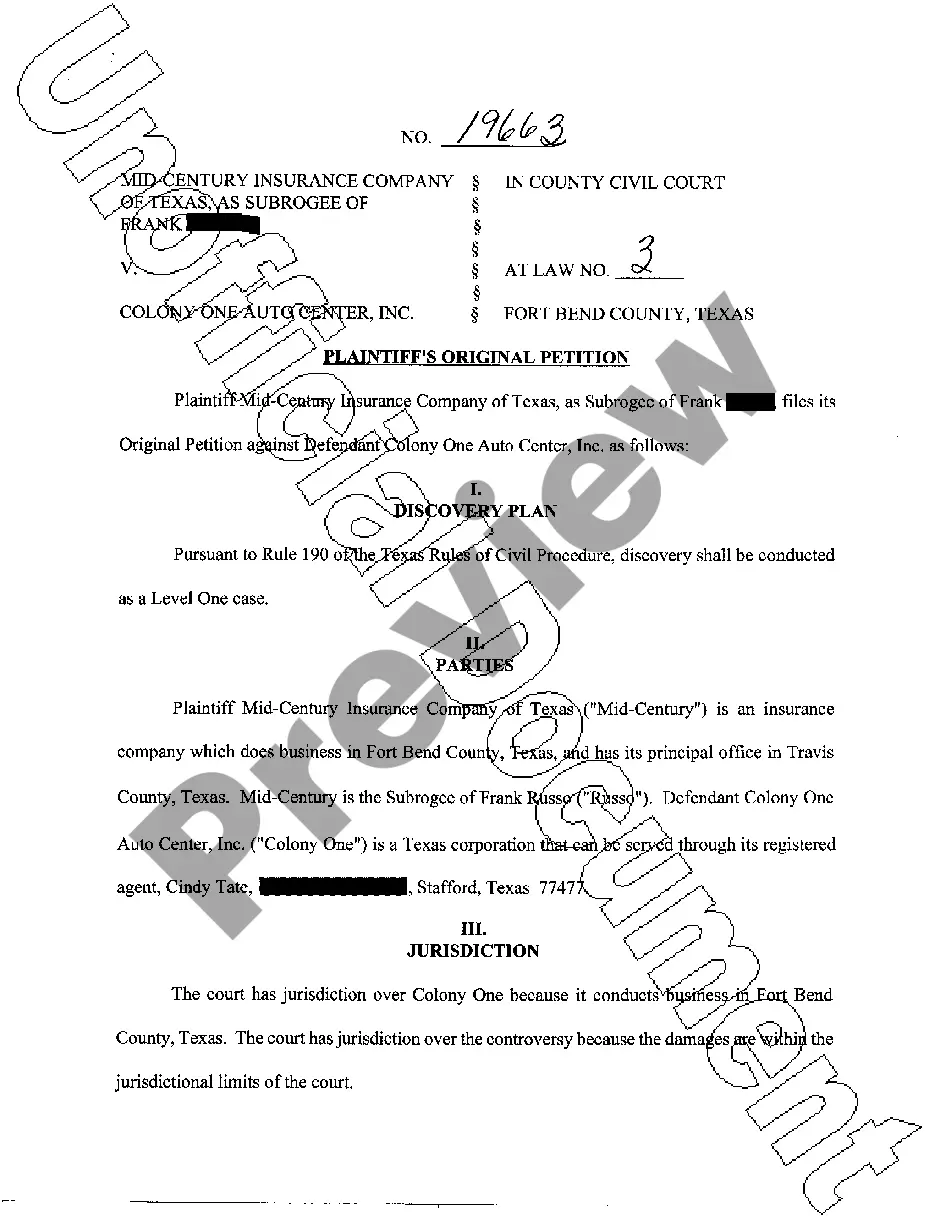

- Make use of the Preview function and read the form description (if available) to ensure that it’s the proper document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the correct example for your state and situation.

- Use the Search field at the top of the web page if you have to look for another file.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your sample in a convenient format to complete, print, and sign the document.

Once you’ve followed the step-by-step recommendations above, you'll always have the ability to log in and download whatever document you require for whatever state you want it in. With US Legal Forms, completing Assignment of Life Insurance Proceeds to a Funeral Director for the Purpose of Arranging a Funeral templates or other legal paperwork is easy. Get going now, and don't forget to examine your examples with accredited attorneys!

Assignment Funeral Printable Form popularity

Assignment To Funeral Other Form Names

Assignment Funeral Agreement FAQ

With life insurance, your family is required to pay the funeral home upfront at the time of the funeral.It's important to note that some life insurance policies offer burial insurance (called a final expense plan). This additional purchase offers funds to help your beneficiary pay for funeral expenses.

Can you be forced to pay for a funeral?It is rare for relatives to be forced to pay for any burial or cremation costs and provided that they have not signed for a coffin, embalming fees or any funeral expenses, relatives are not legally obliged to pay for them.

Pre-Paying With Life InsuranceYou can't pre-pay for your funeral with a life insurance policy that is still in place.The death benefit and earmark can be used to cover funeral services. The family simply makes the funeral home the beneficiary of the policy.

A beneficiary of a life insurance policy can fill out an assignment form at the funeral home, which will allow payment of the settlement to go directly to the funeral home. Again, any money left over is given back to the beneficiaries named once the funeral expenses are settled.

A Funeral Assignment is an agreement that is signed by a beneficiary of a life insurance policy. The beneficiary assigns all or a portion of the life insurance benefits at the Funeral Home which allows payment for funeral expenses to be made directly to the funeral home.

Next of Kin who are unable or unwilling to meet funeral costs.If they are unable to afford this, the hospital could pay for the funeral. If the next of kin can afford to pay for the funeral, they must do so. If they remain unwilling, the matter should be referred to the local authority.

Types of life insurance for funeral costs Two common types of funeral expense life insurance policies are burial insurance and preneed funeral insurance. Having either one of these types of funeral expense life insurance policies can allow you to plan ahead for the costs associated with your funeral/final expenses.

If the deceased person had a life insurance policy with a named beneficiary, it is not part of the estate. The proceeds pass directly to the beneficiary. The beneficiary has no obligation to pay for the funeral using the life insurance proceeds.